Hey there, are you curious about how money moves in today’s fast world, but feel lost with all the tech talk? It’s like trying to solve a puzzle with missing pieces, right?

Well, here’s a cool fact to chew on: Swiss banks are leading the charge in blockchain technology, backing big projects in 2025 to change how financial markets work. These efforts, supported by giants like the Swiss National Bank, aim to make cross-border payments and digital assets smoother than ever.

Stick with me, and I’ll break it down for you. This blog will spotlight five amazing blockchain projects, from Fnality International to Canton Network, showing how they’re shaking up the Swiss banking sector.

Ready for the ride? Let’s go!

Key Takeaways

- Swiss banks are leading blockchain projects in 2025, backed by the Swiss National Bank.

- Fnality International uses Utility Settlement Coins (USCs) for fast cross-border payments with support from UBS and HSBC.

- Canton Network, created by SIX and Goldman Sachs, connects over 40 firms and 7 central banks via Project Agorá.

- Project Agorá innovates a $5 trillion trade finance industry with HSBC, tokenizing assets for speed.

- Versana Platform transforms a $4 trillion syndicated loan market, led by J.P. Morgan and CEO Cynthia Sachs.

Fnality International: Revolutionizing Cross-Border Payments

Fnality International is transforming cross-border payments, everyone. Picture sending money overseas as simple as texting a friend. This blockchain-based system uses tokenized central bank money to make it possible.

Supported by major players like Santander, HSBC, Barclays, and UBS, they’re creating a fresh approach to transferring cash across borders. Their unique advantage? Utility Settlement Coins, or USCs for short.

These coins are connected to central bank reserves, ensuring exceptional stability. Fnality also integrates with existing real-time gross settlement systems. This leads to seamless transactions for financial institutions globally.

Yet, they face some hurdles to overcome, like regulatory obstacles and encouraging widespread adoption of this digital shift. Stay tuned, because this has the potential to revolutionize how we manage money worldwide!

Canton Network: Synchronizing Financial Markets for Seamless Transactions

Hey there, readers, let’s talk about something exciting in the finance sector. The Canton Network is creating a buzz by aligning financial markets for incredibly seamless transactions.

Created by major names like SIX, Deutsche Börse, and Goldman Sachs, this platform focuses on speed and connectivity. It employs a unique tool called Digital Asset Modeling Language, or DAML, to ensure everything runs smoothly.

Think of a bustling marketplace where everyone communicates effortlessly, with no misunderstandings. That’s exactly what Canton offers financial institutions, connecting them for straightforward data sharing across blockchain networks.

Now, imagine a secure community with top-tier protection. Canton prioritizes privacy with smart cryptographic methods, keeping your information secure. It handles significant operations like security issuance and asset servicing, simplifying processes for banks.

Swiss leaders like UBS and SIX Digital Exchange, along with Sygnum Bank, Banque Cantonale Vaudoise, Basler Kantonalbank, and Amina Bank, are all part of this initiative. Plus, it connects to Project Agorá, which involves over 40 financial firms and seven central banks, including the Swiss National Bank.

This framework is transforming the movement of digital assets and tokenized assets in financial markets, setting the stage for a smoother digital evolution.

Project Agorá: Advancing Trade Finance with Blockchain Innovation

Check this out, folks, Project Agorá is making waves in the trade finance world, and it’s a game-changer for a $5 trillion industry. Led by big names like HSBC and BNP Paribas, this blockchain project is all about speed and trust.

It builds a shared digital ledger that tracks trade transactions in real time, cutting down on delays. Plus, it tokenizes assets like invoices and letters of credit, turning paper into secure digital assets.

Imagine slashing fraud risks and boosting cash flow for businesses, all with a few clicks. That’s the magic of blockchain technology at work, folks.

Now, let’s chat about how this ties into the bigger picture of financial markets. Project Agorá isn’t just a tool; it’s a step forward for financial institutions aiming for digital transformation.

It tackles pain points in cross-border payments and trade, making things smoother for everyone involved. Curious about other cool ideas? Let’s move on to the Versana Platform and see how it’s shaking up syndicated loans with tech.

Versana Platform: Transforming Syndicated Loans Through Technology

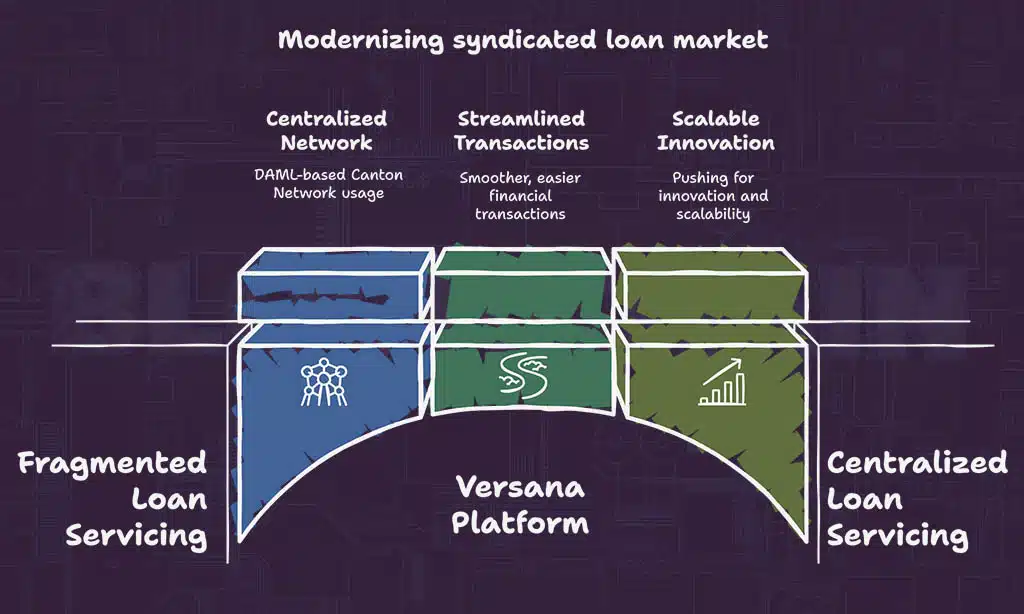

Moving from the innovative strides of Project Agorá in trade finance, let’s shift our gaze to another game-changer in the financial world. The Versana Platform is shaking things up by modernizing the massive $4 trillion syndicated loan market.

Backed by heavyweights like J.P. Morgan, Bank of America, Citi, Credit Suisse, Barclays, Deutsche Bank, and Wells Fargo, this platform is a big deal. It uses the DAML-based Canton Network for centralized loan servicing, making transactions smoother than a hot knife through butter.

Now, imagine a tool that cuts through the mess of financial markets with ease. That’s Versana for you, and its founding CEO, Cynthia Sachs, is all about pushing for innovation and scalability in this space.

With over 400 financial institutions already part of JPMorgan’s Liink Network, the reach is huge. This platform isn’t just a drop in the bucket; it’s a major step for banking in Switzerland and beyond, tackling data privacy and risk management head-on.

Got a stake in digital transformation? Then, folks, this is one to watch!

Tokenization Initiatives by Swiss Banks: Enhancing Digital Asset Management

Hey there, readers, let’s chat about how Swiss banks are shaking things up with tokenization. They’re turning traditional assets into digital assets using blockchain technology.

Think of it like transforming a paper dollar into a digital coin you can use online. One big player in this game is the Swiss National Bank, often called the SNB. They’ve rolled out the “Deposit Token” or DT concept, a kind of programmable money.

This acts as a solid alternative to stablecoins, making payments and digital asset transactions faster and smoother. Imagine settling trades automatically or paying for stuff with a quick wallet tap, all in a secure CHF-based system.

Pretty neat, right?

Now, let’s dig a bit deeper into why this matters to you. The DT idea isn’t just a tech trick; it’s built to boost efficiency across financial institutions. It’s got potential for everything from retail payments to supporting a full digital ecosystem.

Plus, it sticks to strict legal and privacy rules, keeping your data safe. Swiss banks are also eyeing tokenized assets to push digital transformation forward. While I can’t spill all the stats, know that private capital activity in the DACH region has jumped a whopping 140% in AUM since 2018.

That shows serious growth in this space. So, stick around as we jump into our final thoughts in the conclusion.

Takeaways

Well, folks, we’ve journeyed through some amazing blockchain projects backed by Swiss banks in 2025. Isn’t it wild how fast tech like Fnality International and Canton Network is changing finance? These ideas are shaking up cross-border payments and syncing up financial markets.

So, stick around, keep curious, and watch how digital assets grow with these bold steps!

FAQs

1. What’s the big deal with blockchain technology and Swiss banks in 2025?

Hey, let me tell you, blockchain technology is shaking up financial markets like a storm hitting a quiet lake. Swiss banks, including heavyweights like LGT, are backing projects that push digital transformation with tokenized assets and cross-border payments. It’s all about making things faster and safer for folks like us.

2. Which Swiss bank projects are diving into decentralized finance?

Well, the Swiss National Bank (SNB) is throwing its weight behind some cool decentralized finance (DeFi) ideas. They’re teaming up with fintechs to explore crypto assets and build permissioned blockchain systems.

3. How are these blockchain projects helping small and medium-sized enterprises?

Listen up, small and medium-sized enterprises are getting a real boost from these Swiss bank ventures. With support from European wealthtech and insurtech startups, they’re tapping into digital assets for better funding through venture capital (VC). It’s like giving a little fish a big pond to swim in, with advanced risk management to boot.

4. Are these projects tackling data privacy or anti-money laundering rules?

You bet they are, my friend. Swiss banks are weaving data privacy and anti-money laundering measures into their blockchain setups, especially with tools like Know Your Customer checks. They’re working across platforms like LinkedIn and X (Twitter) to keep user profiles secure while meeting strict financial institution standards.

5. What’s the connection between sustainable finance and these blockchain efforts?

Picture this, sustainable finance is like the cherry on top of a tech sundae for Swiss banks. They’re focusing on environmental, social, and governance (ESG) goals, using blockchain to fund sustainable infrastructure with tokenized assets. It’s a win for the planet and for financial markets, all backed by institutions like HSG.

6. How do these projects link to stock exchanges or the internet?

Alright, let’s chat about this wild web of connections. These blockchain projects, supported by Swiss banks, are hooking up with stock exchanges to trade crypto assets online, right over the internet. It’s like building a digital bridge between old-school finance and new-age tech, with display ads on platforms like Instagram and Facebook spreading the word.