You may fear a big tax bite when you tap your retirement plan. It can feel like a maze of rules on social security benefits, tax-deferred accounts, and taxable accounts. One fact: most withdrawals from a traditional IRA or 401(k) count as ordinary income.

That extra cash can push you into a higher tax bracket.

This guide shows ten simple strategies, from smart Roth IRA moves to timing required minimum distributions. You can learn tax-loss harvesting tips, roll old 401(k)s into IRAs, and curb your capital gains tax.

A financial advisor or tax professional can help, but you will find value here. Read on.

Key Takeaways

- Joe split savings across taxable, tax-deferred, and Roth accounts. He cut taxes by $35,000 (40%) and extended his portfolio 24 years.

- Mary used a Roth conversion in a low-income year. She cut $1,500 using IRS Form 8606.

- Jamie kept income at $11,600 in 2024 and saved $1,160 on capital gains. David had $47,025 income, paid $6,161 tax and $750 on gains at 15%. Mix withdrawals from Roth and traditional accounts to avoid higher brackets.

- Delay Social Security past full retirement age. You gain about 8% more per year and face lower tax rates on IRA withdrawals.

- Take RMDs at age 73 or face a 25% penalty on any shortfall. Use the Still Working Exception if you work past 73. Roll old 401(k)s into IRAs to avoid 20% withholding.

Understand How Retirement Accounts Are Taxed

Think of taxes like tolls on a highway, they chip away at each tax-deferred account or employer plan withdrawal. Check RMD dates in your investment account, or call a financial advisor to dodge big fines.

Traditional IRAs and 401(k)s

Traditional IRAs and 401(k)s hold tax-deferred savings, contributions lower taxable income today. Uncle Sam taxes distributions as ordinary income, at your marginal tax rate. Withdraw before age 59½ and the IRS hits you with a 10% penalty, unless you qualify for an exception like disability or certain medical costs.

RMDs (required minimum distributions) kick in at age 73, so you must start taking money then or face a stiff 50% excise tax.

A 401(k) ties to your employer plan, while an IRA sits at a brokerage firm, think Vanguard or Fidelity, or at your bank. Both let you pick stocks, bonds, or a target date fund. They differ in contribution limits, 401(k)s often top out higher, and may offer a match, like free money.

You shape your tax planning around these vehicles, blending them to smooth out your taxable income in retirement.

Roth IRAs and Roth 401(k)s

Roth IRAs hide a secret perk: tax-free growth. You pay no ordinary income tax on qualified distributions. You pull out contributions at any time, penalty free. Savvy savers use this move to shrink taxable income in retirement.

A Roth conversion in a low-income year can slash future tax rates.

Roth 401(k)s follow the same playbook, but they live in your employer plan. You still wait five years and age 59½ for tax-free cash. Employer matches flow into a tax-deferred bucket, so you juggle pretax and after-tax accounts.

A chat with an investment adviser or tax professional can power up your tax planning. This mix can become a core tax-efficient withdrawal strategy for your retirement savings.

Strategy 1: Use a Proportional Withdrawal Approach

Joe splits his retirement savings across taxable accounts, tax-deferred accounts, and retirement savings accounts. He uses a Monte Carlo simulation to test a proportional withdrawal method.

This tactic cuts his ordinary income tax bill by about $35,000, nearly a 40 percent drop. It also lets his portfolio last almost 24 years under sequence of return risk checks.

A proportional plan keeps each tax bracket in check and limits spikes in taxable income. It works well with required minimum distributions, pension income, and capital gains taxes.

Joe meets his financial goals, while his adviser fine-tunes the plan. This tax-efficient withdrawal strategy blends retirement income, brokerage services, and wealth management.

Strategy 2: Consider Roth IRA Conversions

Low-income years offer a chance to convert traditional IRA funds into Roth accounts at a lower ordinary income tax rate. This move snatches savings on future RMDs, shields gains in taxable accounts from higher brackets, and plants a seed for tax-free growth and penalty-free withdrawals after age 59½, like finding a golden ticket for your portfolio.

Consult a tax professional or a registered investment adviser before you file IRS Form 8606, to lock in that benefit.

A simple tax software program or tax planning platform can guide you through a conversion, punching numbers for your tax-deferred accounts. Retirees who align conversions with modest pension income or social security benefits often end up with less taxable income.

This tactic helps manage required minimum distributions later, so you keep more cash in your hands. Mary, a former teacher, cut her retirement tax bill by $1,500 in one year; you might do the same.

Strategy 3: Plan Withdrawals to Stay Within Lower Tax Brackets

Planning withdrawals across tax-deferred accounts and taxable accounts helps you stay in a low tax bracket. You can pull from a Roth IRA or a traditional IRA (individual retirement account), a 401(k) or a standard brokerage account.

Use the 0% long-term capital gains tax rate when taxable income stays at $11,600 or below. Jamie’s taxable income met that mark in 2024, so she saved $1,160 on capital gains. This tactic cuts ordinary income tax and capital gains tax.

Shifting funds near a new bracket makes sense. David clocks $47,025 in taxable income, so he pays $6,161 in total tax. He also faces a $750 capital-gains bill at 15%. Pulling less or mixing Roth withdrawals can trim his tax bracket load.

Tax planning can bump up net retirement income.

Strategy 4: Delay Social Security Benefits

Delaying social security benefits can boost monthly checks. Each year of delay after full retirement age adds about 8 percent. The Social Security Administration pays higher amounts for delays.

You cut early retirement taxable income. A benefit estimator can show exact gains.

This move eases tax planning and lowers ordinary income tax rates. Your IRA or 401(k) withdrawals face lower tax brackets. Many retirees ask a financial advisor about this strategy.

Next, we explore harvesting tax losses.

Strategy 5: Harvest Tax Losses

Even after you delay Social Security benefits, other tax charges can still bite. This strategy uses tax-loss harvesting to wipe out gains in taxable accounts. You sell dips in your brokerage services account, then use those losses to slice away tax liability on withdrawals.

A move like this can tame ordinary income tax from IRA or 401(k) distributions.

Many member SIPC firms, like Bank of America and Merrill Lynch, list tax-loss tools on their platforms. A tax professional can check your limits on tax brackets and capital-gains tax offsets and file the right IRS form.

Think of it as turning portfolio misses into tax wins.

Strategy 6: Take Advantage of the “Still Working” Exception

After you harvest tax losses, you can use the Still Working Exception to hold off required minimum distributions on your active 401(k). You face no RMDs on that plan if you keep working past age 73.

This tactic keeps tax-deferred accounts growing free from federal income tax until you need them. You use this for tax planning and gain room in lower tax brackets, which helps fund Roth IRA conversions or taxable account withdrawals later.

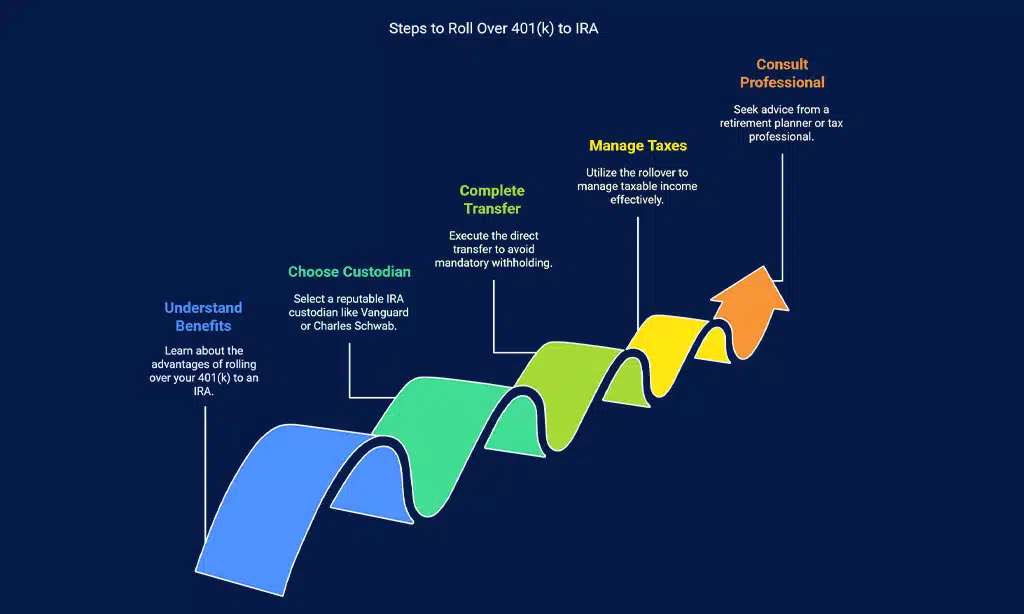

Strategy 7: Roll Over Old 401(k)s Into IRAs

Shifting gears from Strategy 6 leads us to roll an old 401(k) into an IRA. Direct transfers dodge 20% mandatory withholding. You keep tax-deferred growth in your individual retirement account.

You hold it with an IRA custodian, like Vanguard or Charles Schwab. A rollover also helps manage taxable income and lowers your ordinary income tax.

Your investment broker or an Enrolled Agent guides you through IRS Form 1099-R and trustee-to-trustee transfer. This tactic prevents surprises in taxable accounts and builds a clean path for future withdrawals.

Chat with a retirement planner or a tax professional before you pull the trigger.

Strategy 8: Monitor Required Minimum Distributions (RMDs)

Your tax-deferred accounts need required minimum distributions (RMDs) at age 73. Missing the mark draws a 25 percent penalty on the shortfall. Those withdrawals count as ordinary income tax.

That may push taxable income into a higher tax bracket. Smart tax planning for RMDs helps you avoid big bills and odd surprises. You may want to consult a tax professional for guidance.

Set a calendar alert long before your deadline. Use your IRA custodian or brokerage services to process distributions automatically. You can split RMDs across several taxable accounts to smooth income and curb sudden spikes.

A registered investment advisor can help refine your strategy. Strategy 9 shows ways to qualify for tax relief.

Strategy 9: Watch for Opportunities to Qualify for Tax Relief

IRS rules let you tap into tax-deferred accounts without penalty under certain events. You can withdraw up to 1,000 dollars for emergencies each year, fund a first-time home purchase up to 10,000 dollars, cover higher education expenses and pay unreimbursed medical bills.

Storm damage qualifies under federally declared disaster distributions, based on IRS relief.

A tax professional or retirement counselor helps you spot these relief windows and lower taxable income. Use a broker’s tax calculator or an IRS worksheet to time moves before required minimum distributions kick in.

These steps pave the way to minimizing the 20% withholding on 401(k) distributions.

Strategy 10: Avoid 20% Mandatory Withholding on 401(k) Distributions

Rolling over an old 401(k) into an IRA (individual retirement arrangement) stops the 20 percent mandatory withholding rule. You sidestep Form 1099-R withholding and keep money in tax-deferred accounts, not in a taxable account.

Many investors tap Charles Schwab or Fidelity investment platforms for the rollover. A swift transfer can shrink your tax bill for the year and help you stay in a lower bracket.

Speak to a tax professional or financial advisor first. They explain brokerage services and rollover rules, and guide you through the IRS rollover process. A seasoned pro can tune withdrawals to meet your retirement income goals.

Next, we move to minimize taxes on capital gains.

Minimize Taxes on Capital Gains

Shift assets to your investment account, and hold them for over a year to tap lower long-term capital gains rates. Talk with a tax professional to match sales to your tax brackets and curb capital gains tax.

Plan for large long-term capital gains strategically

Plan a large sale in a low tax bracket year. Jamie sold stock in 2022 when she reported $35,000 in taxable income. Her long-term capital gains rate came in at zero percent. David waited until he climbed into a 15% bracket.

He paid more capital gains tax.

Talk to a tax professional or CPA. Use your brokerage services and portfolio management team to pick dates. Match gains to years with lower taxable income. This moves capital gains into 0% or 15% brackets.

You can cut tax bills with this move.

Avoiding Early Withdrawal Penalties

You can dodge the 10% fee on retirement account withdrawals if you meet certain rules, like big medical bills or first-time home purchases. See IRS guide or talk with a tax pro to learn how to keep more of your own money.

Exceptions that help reduce penalties

Early withdrawal penalties can cut your nest egg. Certain exceptions shrink that 10% fee.

- Claim up to $1,000 for emergency expenses from an IRA, skip the 10% early withdrawal penalty.

- Tap funds from an individual retirement account to cover higher education costs, and avoid the penalty on early distribution.

- Waive the fee on distributions if you face total and permanent disability, and file Form 5329 with the IRS.

- Distribute assets after the account owner’s death to a beneficiary, and the usual early withdrawal penalty disappears.

- Access up to $10,000 from a qualified retirement plan in cases of domestic abuse, and lower your taxable income without that penalty.

Partner With a Financial Advisor for Tax Planning

Financial advisors watch tax rule updates. They guide your tax planning for retirement income. They help shift funds in tax-deferred accounts and taxable accounts to curb a big tax bite.

They spot moves that spread pension income and social security benefits across lower tax brackets. Roth IRA conversions in your IRA (individual retirement arrangement) catch their eye, and they map required minimum distributions to dodge penalties.

A good planner reviews your tax-efficient withdrawal strategies and your brokerage services statements. They weigh long-term capital gains and your taxable income, then trim ordinary income tax and capital gain tax.

They lean on IRS Publication 590-B and talk to a tax professional. You tap proven wealth management and keep your retirement savings safe from surprise bills.

Regularly Review and Adjust Your Withdrawal Strategy

Taxpayers face changing income tax rules each year. Quarterly reviews find shifts in taxable income and tax brackets. A tax professional uses brokerage services tools from Bank of America to run projections.

Individual retirement arrangements and RMDs need checking, to cut ordinary income tax.

Market dips may change long-term capital gains plans. Pension income and social security benefits start dates can alter your mix. Use tax-efficient withdrawal strategies in Roth accounts and tax-deferred accounts when income changes.

Next, learn why timing matters with major life changes.

Timing Matters: Align Withdrawals With Major Life Changes

Treat your withdrawal plan like a GPS, steering you away from high-tax roads. Align cash pulls with key events, like selling a home or finishing college bills. Sell assets in taxable accounts when your taxable income dips.

Pull from a Roth IRA in a low-income year to dodge steep ordinary income tax. Tap your 401(k) before RMDs start to keep your tax-deferred accounts working more smoothly. Spread withdrawals over time to stay beneath each tax-bracket ceiling.

A chat with a financial advisor at Bank of America can fine-tune your tax planning.

Adjust your plan if salary or pension income changes. A small raise can push you into a new progressive income-tax tier. Talk to a tax professional for personalized adjustments. In the next section, look at using tax-advantaged accounts for growth.

Use Tax-Advantaged Accounts for Growth When Possible

Funding a retirement account with tax advantages lets your savings grow without extra income taxes later. A Roth IRA conversion in a low tax bracket traps lower rates today and shrinks future ordinary income tax.

That move cuts required minimum distributions and buffers retirement income.

Talk with a tax professional or a financial advisor and map your tax planning around your financial goals. This tactic uses tax-free growth in your retirement savings while it limits taxable income, capital gains, and fees in brokerage services.

Takeaways

Retirement costs can shrink when you follow simple tax tactics. Mixing a tax-deferred plan and a Roth gives you more choice. You run a tax calculator to gauge income shifts. Delaying Social Security lifts your savings in low brackets.

Track RMDs to avoid extra fees. A financial advisor or a brokerage tool can sharpen your strategy.

FAQs on Strategies to Minimize Taxes on Retirement Withdrawals

1. What is a tax-efficient withdrawal strategy for retirement savings?

Use taxable accounts and tax-deferred accounts, like an IRA. Move some money each year into a Roth IRA. That cuts ordinary income tax and keeps you in lower tax brackets. Spread out required minimum distributions so you avoid a big tax hit.

2. How can Roth accounts lower my taxable income in retirement?

A Roth IRA or Roth 401(k) lets you pay tax now, then grow your cash tax-free. Think of a Roth IRA like a tax-free treasure chest. You dodge ordinary income tax later. Just avoid an early withdrawal penalty by waiting until you are 59 and a half.

3. When must I take required minimum distributions?

The IRS makes you start RMDs at age 73. It applies to most IRAs, 401(k) plans and tax-deferred accounts. You skip Roth IRAs. You divide your account balance by a life factor. Miss one RMD and you pay a big fine.

4. Should I hire a tax professional or a financial advisor?

Yes, pick a tax professional for deductions, filing status and tax withholding. Add a financial advisor or wealth manager to guide your retirement income, investment services and social security benefits. They team up to meet your financial goals.

5. How do social security benefits and pension income affect my tax bill?

Social security benefits and pension income count toward your taxable income. They can push you into higher progressive income tax brackets. That may raise your ordinary income tax. Smart tax planning can help you avoid a surprise.

6. What role do capital gains and rate of return play in tax planning?

If you use taxable accounts you may owe capital gains tax on long-term capital gains. You compare the rate of return in taxable and tax-deferred accounts to pick the best fit. Good planning boosts your annual return and cuts your tax bill.