Buying or selling real estate can feel stressful. Prices keep changing, laws shift, and managing properties eats up time. It’s no wonder many real estate agents struggle with staying organized while keeping clients happy.

Did you know that market trends and technology can help solve these problems? Tools like property management software or data analytics make it easier to manage tasks, track property values, or improve client relationships.

This blog gives you 12 smart strategies to tackle tough real estate challenges. From improving financing options to boosting communication, we’ve got tips for success. Ready to learn more? Keep reading!

Understand Market Trends

Study market shifts like a detective following clues. Use smart tools, such as predictive analytics, to make savvy decisions.

Stay informed about local and global market dynamics

Track economic indicators like inflation, unemployment, and interest rates. These factors influence property demand and prices. Pay attention to local policies affecting real estate tax or zoning laws.

Use tools like predictive analytics for market trends. Platforms with data-driven insights help spot investment opportunities faster. Keep an eye on global shifts, as they can ripple into your local market too.

Stay sharp; knowledge fuels smart decisions!

Leverage data-driven insights for decision-making

Use data to guide your choices. Tools like CRM systems and artificial intelligence can help real estate agents spot trends. Analyze property valuations, cash flow, and economic indicators to find strong investment opportunities.

Numbers don’t lie—use them wisely.

For example, track returns on investment or energy-efficient upgrades for better profits. Technologies like IoT devices provide real-time stats on homes, helping with faster decisions during real estate transactions.

This turns raw numbers into smart strategies.

Improve Financing Options

Finding money for real estate isn’t always easy, but there are ways to make it work. Build strong ties with lenders and explore creative funding options to keep cash flowing.

Explore alternative funding sources

Finding money for real estate can be tricky. Exploring new funding options can make a huge difference.

- Use private lenders to secure cash quickly. They often have fewer rules than banks.

- Try crowdfunding platforms to pool funds from many investors. This works well for large projects.

- Partner with others to share costs and risks. Joint ventures can speed up deals.

- Research local grants or programs that support real estate investing. Many cities offer help for buyers.

- Strengthen your credit score before applying for loans. A better score brings better rates.

- Reach out to mortgage brokers who can connect you with multiple loan options at once.

- Tap into hard money loans for short-term needs, like flipping homes or quick purchases.

- Negotiate with banks for lower interest rates on traditional loans by showing strong cash flow plans.

- Save time by building relationships with private equity firms interested in real estate projects.

- Look into seller financing where the property owner becomes your lender.

- Explore online lending platforms offering flexible terms and faster approvals than banks.

- Consider using retirement accounts, like a self-directed IRA, to invest in properties without penalties or taxes upfront.

Strengthen relationships with financial institutions

Building strong ties with financial institutions can open more doors in real estate. Trust and communication are key to lasting partnerships.

- Visit local banks often to build face-to-face connections. Personal relationships make a big impact.

- Share clear details about your investment goals with lenders. This shows you are serious and prepared.

- Offer consistent updates on property performance or cash flow. Transparency boosts trustworthiness.

- Pay loans on time to keep a spotless credit record. A good track record helps secure future funding faster.

- Work with multiple financial groups to diversify options for funding needs like escrow or property tax payments.

- Attend local business events where lenders participate, increasing touchpoints for better networking opportunities.

- Learn about economic indicators and how they affect loan rates or terms from trusted banks or industry professionals.

- Ask potential lenders about special programs like 1031 exchanges or green building project funds.

- Strengthen negotiation skills when discussing interest rates or loan premiums to save money long-term.

- Research private insurance companies partnered with banks for better deals on insured properties.

Always keep these steps in mind while fostering stronger bonds with financial partners in the real estate market!

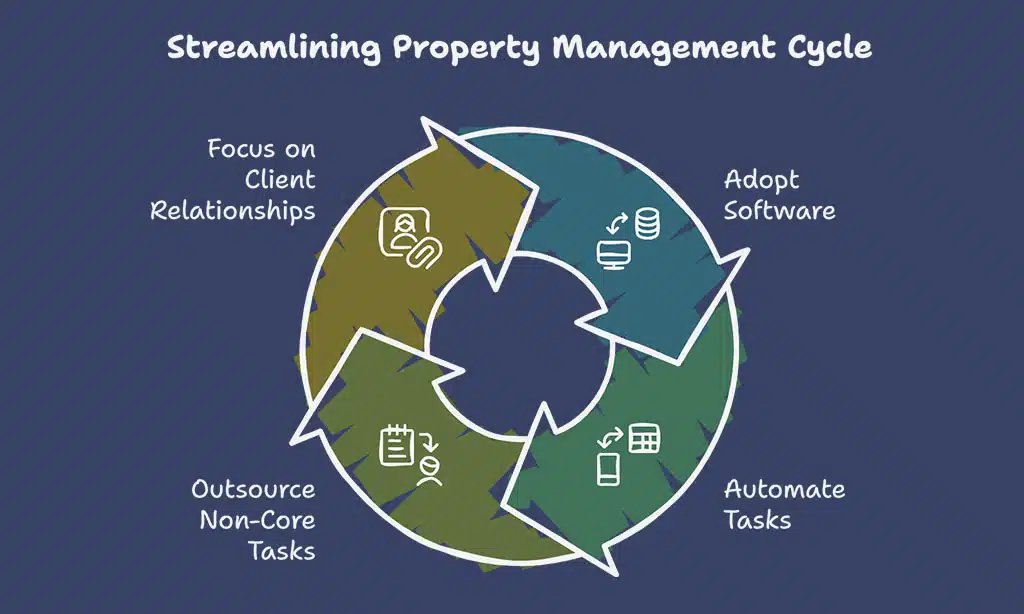

Streamline Property Management

Managing properties can feel like herding cats without the right tools. Save time and energy by simplifying tasks with smart solutions.

Adopt property management software

Property management software saves time and reduces mistakes. It helps track rent payments, schedule maintenance, and manage tenant details in one place. This boosts time management for real estate agents handling multiple properties.

Automated systems improve cash flow by sending reminders to tenants about due dates. Tools like AppFolio or Buildium simplify communication with clients through instant updates. Agents can focus on client relationships while the software handles daily tasks.

Outsource non-core tasks

Free up time by letting someone else handle routine work. Tasks like home inspections, marketing reports, or tenant screenings can be outsourced. This boosts productivity and reduces stress.

Use property management services or hire virtual assistants for admin jobs. These tools keep operations smooth while you focus on real estate transactions and client relationships.

Enhance Client Communication

Good communication builds trust fast. Use smart tools like email and social media to keep clients happy and informed.

Build trust through transparency

Share clear details about real estate transactions. Show clients all costs, timelines, and risks upfront. Explain complex terms in plain language to avoid confusion. Trust grows when people feel informed.

Use technology like augmented reality (AR) or property management tools to give honest views of properties. For example, AR can show true layouts without hidden flaws. Reliable information makes clients feel secure and valued.

Use technology to improve responsiveness

Use property management software to answer client questions faster. Automate tasks like scheduling, email replies, and reminders. This saves time and keeps clients happy. Tools like chatbots can help too.

They offer instant answers 24/7.

Social media boosts response speed as well. Platforms like Instagram allow real estate agents to reply quickly and build trust with audiences. Getting alerts for direct messages ensures no lead slips through the cracks.

Customers value quick replies, so staying connected is key!

Adapt to Economic and Policy Changes

Markets can flip like a coin. Stay sharp, adjust fast, and don’t let policy tweaks throw you off track.

Stay updated on housing policies and regulations

Laws change quickly, and they affect real estate investing. For example, new zoning rules or tax policies can impact cash flow. Stay informed about local housing regulations to avoid fines or delays in real estate transactions.

Join professional associations to get updates on policy changes. Build connections with other real estate agents who share tips about upcoming laws. Staying ahead helps you protect your investment property and grow your real estate career.

Prepare for economic fluctuations

Build a safety net by focusing on properties that bring positive cash flow. This gives steady income, even if the real estate market slows down. Use economic indicators like job growth and housing demand to pick locations with strong potential.

Diversify your portfolio to spread risk. Mix residential, commercial, and rental properties. Keep an eye on policy changes or shifts in the economy. Adjust strategies quickly based on interest rates or new regulations affecting real estate transactions.

Takeaways

Overcoming real estate challenges takes focus and smart choices. Use tools like property software and strong financial plans to simplify tasks. Keep learning about market trends, policies, and client needs for better results.

Small changes can make a big impact in this industry. Take action today, because success starts with one step!

FAQs

1. What are common challenges in the real estate industry?

Real estate agents often face issues like time management, understanding market trends, building client relationships, and maintaining cash flow during slow periods.

2. How can real estate agents improve their negotiation skills?

Agents can practice role-playing scenarios, attend continuing education courses, and join professional associations to learn from experienced salespeople.

3. What strategies help balance work-life demands in a real estate career?

Time management is key. Set clear boundaries for personal time, use digital marketing tools to save effort, and focus on mental health by taking breaks when needed.

4. How does sustainability impact the real estate market?

Sustainability influences property management decisions as buyers increasingly seek energy-efficient homes that align with economic growth and environmental goals.

5. Why is personal branding important for success in real estate investing?

A strong personal brand builds trust with target audiences and helps stand out online through social media or email marketing campaigns tailored to customer experiences.

6. Can learning about economic indicators help navigate market trends?

Yes! Understanding economics helps predict labor market shifts, regulatory compliance needs, and how broader changes affect local property values or appraisals.