The global transition to green infrastructure has reached a critical bottleneck, where traditional lithium-ion technology can no longer meet the escalating demands for range, safety, and rapid charging. As of early 2026, the arrival of solid-state batteries (SSBs) marks a decisive pivot from laboratory curiosity to industrial reality, promising to decouple the electric vehicle (EV) market from its most persistent limitations.

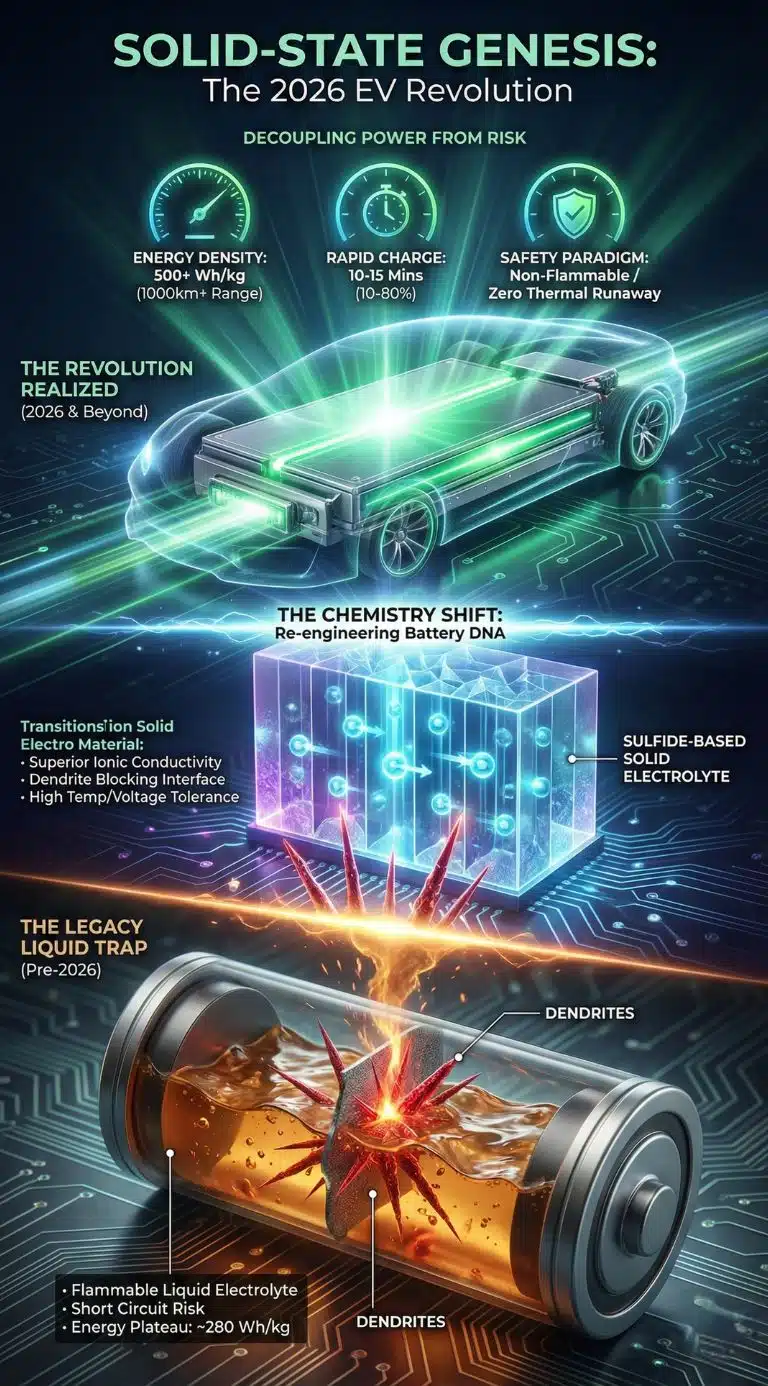

The trajectory of the electric vehicle industry has historically been a story of incrementalism. For over a decade, the liquid-electrolyte lithium-ion battery served as the dependable workhorse of the green revolution. However, by 2024 and 2025, the industry hit a plateau. Energy densities hovered around 250–300 Wh/kg, and charging times remained a friction point for mass-market adoption. More critically, the inherent flammability of organic liquid electrolytes continued to pose safety risks that complicated vehicle design and consumer trust.

The push toward solid-state technology became an existential necessity for automakers. Unlike their predecessors, solid-state batteries replace the volatile liquid electrolyte with a solid conductive material—ceramic, glass, or polymer. This shift is not merely a component swap; it is a fundamental re-engineering of the battery’s “DNA.” By 2026, we are witnessing the first fruits of this transition as pilot production lines from Tokyo to Sacramento begin delivering the first “A-sample” cells for fleet testing. This analysis explores why this moment is the true starting gun for the next EV revolution.

Key Takeaways: The 2026 Solid-State Landscape

- Commercial Inflection: 2026 is the year of “pilot-to-protocol,” where manufacturers like Nissan and Toyota transition from lab prototypes to high-volume pilot lines.

- Safety Paradigms: The elimination of liquid electrolytes effectively removes the risk of thermal runaway, allowing for simplified, lighter battery pack cooling systems.

- Range Breakthroughs: New 2026 benchmarks show energy densities exceeding 500 Wh/kg, theoretically pushing EV ranges beyond 1,000 kilometers on a single charge.

- Geopolitical Reordering: The shift to sulfide-based electrolytes is creating new supply chain dependencies, shifting focus from traditional cobalt to high-purity lithium sulfide.

- Cost Realities: While performance is revolutionary, 2026 costs remain 3x to 5x higher than LFP (Lithium Iron Phosphate) alternatives, keeping initial adoption in the luxury and high-performance segments.

The Chemistry of Disruption: Beyond the Liquid Horizon

To understand why solid-state batteries are the cornerstone of 2026’s green infrastructure, one must look at the interface. In a standard lithium-ion cell, the liquid electrolyte acts as a medium for ions but also as a liability—it is flammable and prone to “dendrites,” microscopic needle-like structures that can cause short circuits.

In 2026, the industry has largely converged on sulfide-based electrolytes for automotive applications due to their superior ionic conductivity. Companies like Samsung SDI and Toyota have leveraged these materials to create batteries that can function at higher voltages and temperatures without the degradation seen in 20th-century chemistries.

Comparative Analysis: Energy and Safety Metrics (2026 Data)

| Feature | Conventional Lithium-Ion (2026) | Solid-State Battery (ASSB – 2026 Pilot) |

| Energy Density | 240–290 Wh/kg | 450–600 Wh/kg |

| Charging Time (10-80%) | 25–45 Minutes | 10–15 Minutes |

| Electrolyte State | Flammable Organic Liquid | Non-flammable Solid (Sulfide/Oxide) |

| Cycle Life (80% SoH) | 1,000–2,000 Cycles | 5,000–10,000+ Cycles |

| Operating Temp Range | -20°C to 50°C | -40°C to 100°C |

| Current Market Cost | ~$80–$100 / kWh | ~$350–$600 / kWh |

The data above underscores the “trusted advisor” perspective: while the performance metrics of SSBs are vastly superior, the economic barrier remains the primary hurdle for 2026. The 50% drop in traditional battery prices predicted by Goldman Sachs in 2024 has largely materialized, making the “premium” of solid-state technology even more pronounced for the average consumer.

Manufacturing the Future: From Grams to Gigawatts

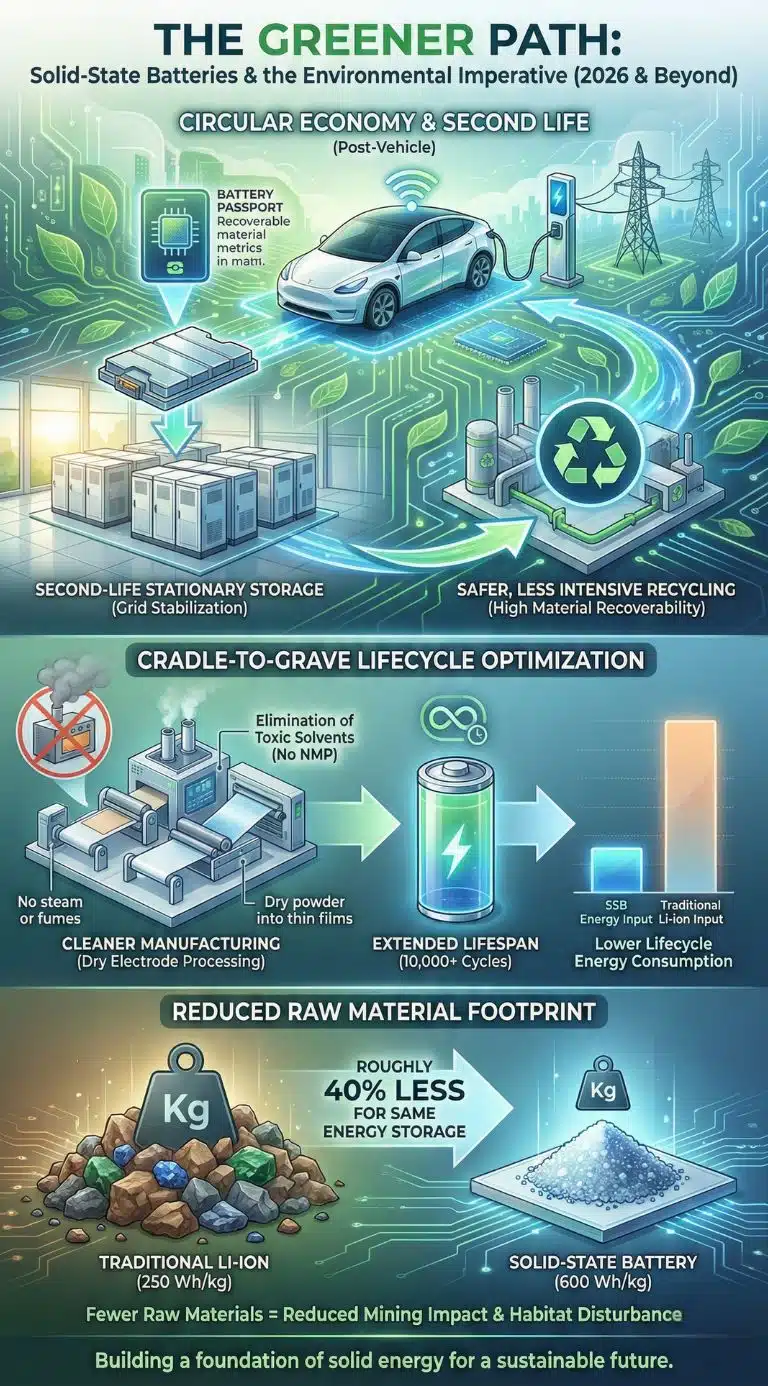

The greatest challenge of 2026 is not the science, but the “scale.” Traditional battery manufacturing relies on “wet” coating processes that involve massive drying ovens—a bottleneck that accounts for nearly 40% of a gigafactory’s energy consumption.

A significant trend in 2026 is the adoption of Dry Electrode Processing (DEP). This technique, championed by startups and now integrated by majors like Volkswagen (via QuantumScape) and Nissan, eliminates solvents entirely. By pressing dry powders directly into films, manufacturers are reducing the factory footprint by 30% and energy use by nearly 50%. This synergy between solid-state chemistry and dry manufacturing is what will eventually bring SSB costs down to parity with liquid-ion tech by the early 2030s.

2026 Global Milestone Timeline

- January 2026: Nissan unveils its first functional all-solid-state prototype vehicle, utilizing a 65nm interface coating to stabilize the lithium-metal anode.

- March 2026: Samsung SDI begins shipping “B-sample” cells to BMW and other European OEMs for winter durability testing.

- June 2026: The US Department of Energy announces a $2.5 billion grant for “Domestic Solid Electrolyte Sourcing” to reduce reliance on East Asian sulfide precursors.

- September 2026: GAC (Guangzhou Automobile Group) enters “small-batch” production for its luxury Aion Hyper brand, marking the first consumer-available SSB-equipped passenger car.

- December 2026: Market analysts confirm that solid-state patent filings have surpassed traditional lithium-ion filings for the third consecutive year.

Geopolitics and the New Mineral Frontier

The solid-state battery EV revolution is reshaping global trade maps. For the last decade, the “Battery Belt” was defined by access to cobalt from the DRC and nickel from Indonesia. However, solid-state designs—particularly those using lithium-metal anodes—are shifting the focus toward ultra-high-purity lithium and specialized phosphorus chemicals.

China currently maintains a lead in sulfide electrolyte production, with companies like Yanyan New Materials reaching “ton-level” output in 2026. However, the US and EU are aggressively pursuing a “security-led ordering.” Under the 2026 updates to the Inflation Reduction Act (IRA), subsidies are now specifically tiered to reward the use of solid electrolytes processed in “friendly” jurisdictions.

“Energy is, once again, a geostrategic domain in which dependence equates to vulnerability,” notes a 2026 report from Slaughter and May.

This fragmentation means that while the technology is global, the supply chains are becoming regional. We are seeing the rise of “Battery Sovereignty,” where nations are willing to trade economic efficiency for supply chain security.

Regional Leadership & Strategic Focus (2026 Analysis)

| Region | Key Players | Strategic Focus | Market Strength |

| Japan | Toyota, Nissan, Panasonic | All-Solid-State (Sulfide), 2027-28 Mass Market | IP Ownership & Precision Mfg |

| South Korea | Samsung SDI, SK On, LGES | High-Conductivity Electrolytes, Pilot Scale | Speed to Market & Integration |

| China | CATL, BYD, Qingtao, GAC | Semi-Solid & Hybrid SSBs, Cost Reduction | Production Volume & Supply Chain |

| North America | QuantumScape, Solid Power, Factorial | Lithium-Metal Anodes, DEP Manufacturing | R&D Innovation & Venture Capital |

| Europe | Northvolt, Blue Solutions, BMW | Industrial Sustainability, Circular Supply | Regulatory Standards & Green Policy |

The Environmental Imperative: A Greener Infrastructure?

The role of solid-state batteries in green infrastructure extends beyond the tailpipe. A nuanced analysis of the 2026 lifecycle data suggests that SSBs offer a significantly better “cradle-to-grave” environmental profile.

Because SSBs are more energy-dense, a vehicle requires fewer raw materials to achieve the same range as a traditional EV. Furthermore, the lack of flammable liquid makes the recycling process safer and less energy-intensive. 2026 has seen the emergence of “Battery Passports” in the EU, which now include specific metrics for the recoverability of solid electrolytes.

Environmental Benefits of the SSB Shift:

- Reduced Mining Footprint: A 600 Wh/kg battery requires roughly 40% less mass than a 250 Wh/kg battery for the same energy storage.

- Extended Lifespan: With cycle lives reaching 10,000 cycles, an SSB can outlast the vehicle itself, creating a robust “second-life” market for stationary grid storage.

- Elimination of Toxic Solvents: Dry manufacturing removes the need for NMP (N-Methyl-2-pyrrolidone), a toxic solvent used in traditional battery production.

Expert Perspectives: The Skeptic’s Corner

While the momentum of the solid-state battery EV revolution is undeniable, expert opinions remain divided on the timeline for mass-market saturation. Neutrality requires us to acknowledge the “Skeptical Path.”

Some analysts argue that the “Semi-Solid” approach—retaining a tiny amount of liquid to ensure interface contact—is the only way to achieve economic viability before 2030. They point to the “Pressure Challenge”: most all-solid-state batteries currently require high external pressure to maintain contact between layers, which adds weight and complexity to the battery pack.

Furthermore, the rapid improvement of “Advanced Li-ion” (such as silicon-anode and high-nickel variants) has created a moving target. If traditional batteries can reach $60/kWh by 2027, the value proposition of a $400/kWh solid-state battery may be confined to supercars and aerospace for longer than expected.

The Road Ahead: What Happens Next?

As we look toward the 2027–2030 window, the milestones are clear. The successful deployment of pilot fleets in late 2026 will determine whether the “Toyota/Nissan timeline” of 2027-2028 mass production holds firm.

We expect to see:

- Premium Parity: By late 2027, the cost of SSBs for luxury vehicles (vehicles over $80,000) will reach a point where the performance gains outweigh the price premium.

- Infrastructure Shift: Charging networks will need to upgrade to “Ultra-Fast” standards (400kW+) to accommodate the 10-minute charging capabilities of these new cells.

- Niche Expansion: Beyond cars, we will see solid-state technology dominate the drone and medical device markets, where safety and weight are non-negotiable.

Winners vs. Losers in the Solid-State Transition

| Category | Winners | Losers |

| Automakers | Early adopters (Toyota, Nissan, BMW) who secured IP and pilot lines. | “Follower” brands still heavily invested in legacy liquid-ion infrastructure. |

| Consumers | High-mileage drivers and those in extreme climates (cold/hot). | Budget-conscious buyers who may be priced out of the first wave. |

| Environment | Global carbon targets, as SSBs enable heavier transport (trucks/planes) to electrify. | Specialized liquid-electrolyte manufacturers without a transition plan. |

| Geopolitics | Nations with “Battery Sovereignty” and high-purity mineral processing. | Countries relying solely on raw mineral export without mid-stream processing. |

Final Thoughts: The End of Range Anxiety

The solid-state battery EV revolution is not just about a better battery; it is about the maturation of the electric vehicle as a superior technology to the internal combustion engine in every metric. In 2026, we have moved past the question of “if” to the logistical challenge of “when.”

While the high costs of 2026 act as a temporary barrier to universal adoption, the technological breakthroughs in interface stability and dry manufacturing have cleared the path. The green infrastructure of the future will be built on a foundation of solid energy—safer, denser, and faster than anything that came before.