Rising energy bills can hit your wallet like a leaky faucet that never stops, and old buildings keep tenants away. The residential and commercial sectors use 27.6% of all U.S. end-use energy, so costs and carbon footprints stay high.

We share 10 smart investments, from green buildings and solar panels to net-zero carbon offices. You can cut energy waste, earn passive income, and grow property value with LEED certification and water conservation systems.

Read on.

Key Takeaways

- US homes and offices used 27.6% of all energy (20.6 quadrillion BTUs) in 2023. Green roofs, solar panels, and thick insulation can cut bills by up to 30%, and LED upgrades drive a 16% rental premium.

- Fundrise backs LEED-certified projects from $10, CrowdStreet lists net-zero carbon offices, and Yieldstreet plus Hines Global REIT own carbon-neutral towers for steady passive income.

- Alexandria Real Estate Equities Inc. fits solar panels and geothermal systems on 42 million sq ft of lab space. BXP hit net-zero on a 106,000 sq ft tower in 2021 using solar, geothermal heat pumps, and smart controls.

- Argentina grants a 10% VAT exclusion on energy-efficient homes. Developers add low-flow taps, rain barrels, and cellulose insulation to cut water and heat costs, earn LEED badges, and boost local health.

- Smart meters, IoT sensors, and building-management systems track energy use, drive efficiency, support ESG goals, and help tap a $24.7 trillion green real estate market by 2030.

Key Features of a Sustainable Real Estate Investment

Homes with Leadership in Energy and Environmental Design badges carry LEED certification. They offer better energy efficiency and lower utility bills. Renewable power systems supply energy without carbon emissions.

ESG disclosure shows real carbon footprint reduction. Investors track these metrics for steady rental income.

Real estate investment in affordable housing boosts social impact. Simple water conservation systems and rain gardens cut water waste. International standards like BREEAM and LEED guide climate resilience.

Smart meters and energy-efficient appliances slash energy consumption. Such sustainable real estate investments lock in value and attract green living tenants.

10 Smart Investments for a Sustainable Real Estate Portfolio

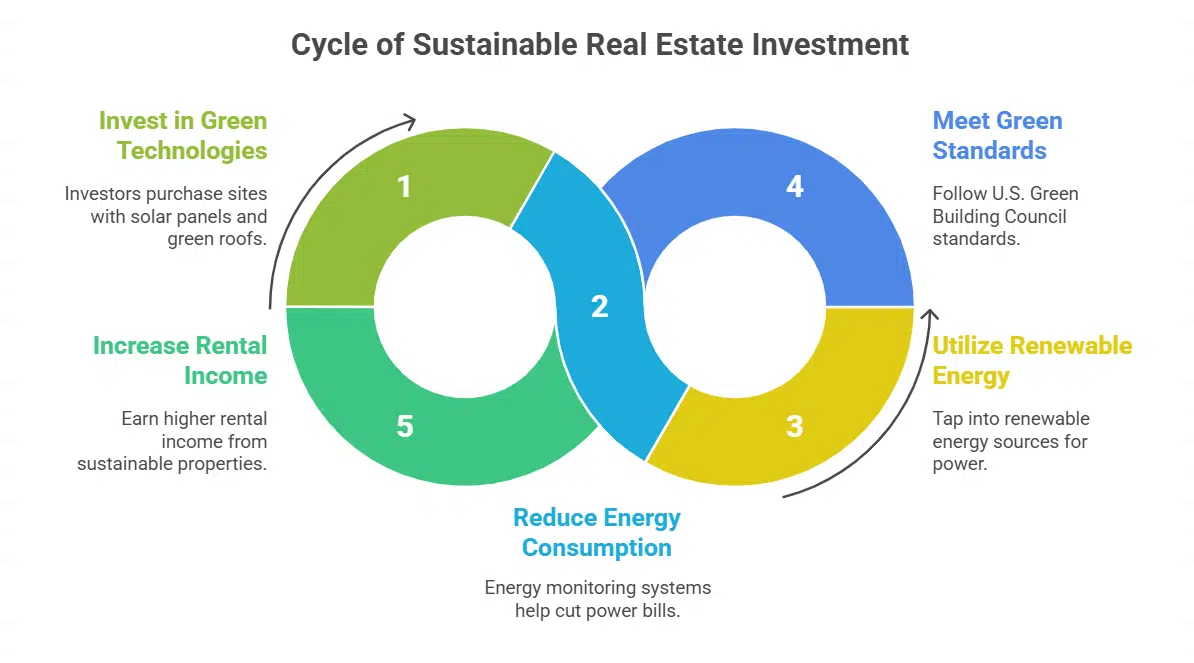

Investors buy sites with solar panels, green roofs, and energy monitoring systems to slash power bills. They tap renewable energy sources, follow U.S. Green Building Council standards, and earn higher rental income.

Green Buildings and Developments

Green buildings use solar panels and thick insulation to cut energy costs. They add green roofs and rainwater harvesting to shrink a carbon footprint. Buildings earn badges for energy efficiency and lower emissions.

Some real estate investing sites let you start for just $10.

Fundrise backs LEED-certified projects with stakes from ten dollars. Yieldstreet picks eco offices that aim for high returns under ESG rules. CrowdStreet funds commercial towers designed for net-zero carbon use.

Hines Global REIT owns carbon-neutral sites that deliver steady passive income.

Renewable Energy-Powered Properties

Alexandria Real Estate Equities Inc. installs solar panels and geothermal systems on its campuses. These renewable energy sources cut energy bills and shrink carbon footprints. Investors gain passive income and strong returns in sustainable buildings.

Lendlease shapes urban developments with integrated wind turbines and rooftop photovoltaic modules. Digital Realty Trust uses Apollo AI to boost energy efficiency in data center properties.

Hannon Armstrong Sustainable Infrastructure Capital funds projects tied to smart grids and clean power for lasting ESG impact.

Mixed-Use Sustainable Communities

Developers blend housing, shops, and offices in one site. They add green roofs, solar panels, and rain gardens to cut water waste. JBG Smith Properties, with 14 million rentable sq ft in D.C., offers apartments and offices near bus and rail lines.

This mix shrinks commutes, lowers carbon footprints, and boosts energy efficiency.

Nuveen Real Estate funds these projects to create climate-positive spaces and earn passive income. AcreTrader links farmland and these zones, so fresh produce appears steps from front doors.

Tishman Speyer builds green-certified towers with bike lanes plus solar arrays. Sites show up to 30 percent lower energy bills and steady rental income, which grows wealth and backs sustainable investing.

Affordable Housing with Eco-Friendly Designs

Affordable homes can trim bills, shrink carbon footprints, and lift local health. Argentina grants a 10% VAT exclusion on energy-efficient residences. A team tucks in rooftop photovoltaics, links rain barrels to gutters, fits low-flow taps.

They wrap walls in cellulose insulation and anchor structures with cross-laminated timber, like a snug jacket in winter.

Investors earn passive income from rentals that cut utility costs. Cities cheer projects that score LEED certification and boost property values. These builds hit social responsibility goals and drive sustainable urban development.

Net-Zero Carbon Properties

BXP revamped a 106,000 sq. ft. tower in 2021. The team cut fuel use and hit net-zero carbon. They added solar panels, geothermal heat pumps, and a smart building system. The project won LEED certification and an Energy Star rating.

Investors eye the site for lower costs and passive income. CrowdStreet lists office assets with a net-zero carbon focus. Each property runs on renewable energy sources and tracks carbon cuts.

Hines Global REIT owns carbon-neutral towers in big markets. It tracks emissions data in a cloud platform. It also taps rental income from eco-minded tenants. Renters praise the green buildings and lower bills.

The fund links to long-term ESG impact and real estate market trends. It shows green buildings can cut bills and grow returns.

Smart and Energy-Efficient Buildings

Smart buildings talk to you through sensors, as if they read your mind. Internet of things networks and a building management system drive energy efficiency and carbon footprint reduction.

U.S. homes and offices ate up 27.6% of total power in 2023, about 20.6 quadrillion BTUs. Owners who fit led retrofits saw a 16% rental premium bump.

Alexandria Real Estate Equities Inc owns 42 million square feet of lab space, plus 5.3 million under construction. They chase leed certification and renewable energy sources to boost passive income.

Landlords add 3D modeling software and energy dashboards to manage consumption and show tenants lower expenses. Investors like such green buildings for long term value.

Properties Utilizing Sustainable Building Materials

Property investors install Tesla solar tiles on rooftops to tap renewable energy sources and boost energy efficiency. Developers pour self-healing concrete in foundations to cut maintenance and carbon footprint.

Smog-eating tiles coat exterior walls and scrub pollution from city air.

Large firms like Prologis Inc, with a market cap near $103 billion, finance LEED-certified complexes. Landlords see higher rental income and passive income from eco-friendly designs.

These smart components shape sustainable real estate investments and fuel demand for green buildings.

Real Estate Projects with Water Conservation Systems

Developers install rainwater harvesting systems on residential and commercial sites. They cut water waste and boost energy efficiency. These systems link to soil moisture sensors and smart meters.

Buyers pay higher premiums for these features. They lower utility bills and drive carbon footprint reduction.

Host Hotels & Resorts Inc fits water conservation technology across parts of its 77 properties and 42,000 rooms. The firm projects $5.8 billion revenue in 2025. Investors gain passive income and tax benefits from lower water costs.

GIS mapping and green building design help earn leed certification.

Urban Vertical Farming Spaces

Urban vertical farms boost local harvests and cut transport emissions. Investors treat these green roofs like cash cows for rental income with hydroponic towers inside. Some setups use solar panels to power LED lighting and tap renewable energy sources.

Tax breaks and grants support these projects under LEED standards. Farms on roofs add insulation and boost energy efficiency.

Eco-minded tenants pay more to live near thriving aeroponic gardens. These sites match ESG goals and spark strong market trends in sustainable real estate. Owners report less water waste thanks to rainwater harvesting on site.

Government incentives and carbon footprint reduction measures drive investor interest.

Adaptive Reuse and Redevelopment Projects

Adaptive reuse gives old buildings a second wind. Boston Properties repositioned a 106,000 sq ft office in 2021 into a net-zero space. They won LEED certification and cut carbon footprints.

Investors saw new rental income and passive income. Yieldstreet backs green buildings that promise high returns and strong ESG focus.

Some developers mix brick walls with solar panels to boost energy efficiency. Investors enjoy carbon footprint reduction and fresh rental income, plus capital gains tax perks. Planners rely on modeling tools to track yield.

The properties tap renewable energy sources for sustainable investing and track real estate market trends.

Benefits of Investing in Sustainable Real Estate

Your building can moonlight as a clean power plant, slashing utility bills while you rack up rent checks. Toss in LEED certification and smart controls, and you shrink your carbon footprint while you fatten your dividends.

Environmental Impact

Sustainable real estate cuts carbon footprints, by using energy efficiency, green buildings, and renewable energy sources. U.S. homes and offices used 27.6 percent of all energy in 2023, which added up to 20.6 quadrillion BTUs.

LED retrofitting drove up rental income, by 16 percent, because tenants chase lower bills.

Rainwater reuse systems boost buyer willingness to pay premiums, and they raise sale prices in eco-friendly developments. Investors earn passive income from solar panels, smart meters, and renewable energy sources on rooftops.

Many properties earn LEED certification, aligning with real estate market trends, and cut greenhouse gas emissions.

Financial Returns and Long-Term Value

Tax incentives boost cash flows and lower upfront costs. Green buildings use energy efficiency to cut bills and shrink carbon footprints. Tenants love solar panels and smart sensors in offices.

USGBC’s LEED Platinum office high-rise lifted asset value by 10%. Investors earn solid return on investment from rental income and passive income.

Growth projections point to a $24.7 trillion market by 2030 in emerging cities. Large investors and funds tap ESG investments in real estate investments. Data centers and commercial buildings with reduced energy consumption win tax deductions and subsidies.

Portfolio diversification in green buildings cuts risk and adds long-term value.

Takeaways

Sustainable real estate choices can boost passive income and shrink your carbon footprint. Investors report higher rent yields in LEED-certified buildings than in standard ones. Tools like building information modeling and sun tracker tools help lower energy use.

Green building trends, from mixed-use hubs to eco-friendly homes, still gain traction. Smart moves now can shape a greener, wealthier future.

FAQs on Smart Investments for a Sustainable Real Estate Portfolio

1. What is a sustainable real estate portfolio?

A sustainable real estate portfolio is a group of properties that help the planet and your wallet. They have energy efficient lights and heating. They cut your carbon footprint and run on renewable energy sources like solar. You get rental income and passive income. It is like hitting two birds with one stone, profit and planet care.

2. Why choose LEED-certified buildings?

LEED-certified buildings are green buildings that meet strict eco standards. They cut energy bills, trim carbon footprint, and lower waste management costs. Tenants love them and rent longer. You see steady rental income and value growth. It feels like a green seal of trust.

3. Can I use a home equity line of credit for green upgrades?

Yes, you can tap a home equity line of credit to fund solar panels or better insulation. You pay low rates over time. You see big energy savings. It is a no-brainer for smart investors.

4. What role do alternative investments play?

Alternative investments let you mix funds beyond rental homes. You can buy shares in real estate investment trusts or back green startups with venture capital and private equity. You can also pick hedge funds that meet environmental, social, and governance goals. This adds diversity and helps with risk management.

5. How do renewable energy sources fit real estate market trends?

Adding solar panels or wind turbines cuts energy costs for everyone. It also lines up with real estate market trends for sustainable living and low carbon. Retail investors and big firms both flock to such properties. It shows you build for the future.

6. How can I manage risk in a sustainable real estate portfolio?

Spread your money across commercial real estate, rental homes, and real estate investment trusts. Mind landlord-tenant laws, portfolio allocations, and stock market shifts. Don’t put all your eggs in one basket. Work with investment management pros if you want help. These steps cut risk and can lead to financial freedom.