You worry about hackers stealing your bitcoin, right? Many folks lose sleep over cyberattacks and phishing scams that target their crypto assets. It’s like leaving your front door unlocked in a busy city; thieves wait for that chance.

You want safe spots to keep your digital coins, away from harm. Imagine your bitcoin as treasure in a chest; you need the best locks to guard it.

Cold storage stands out as one top way to protect bitcoin. These offline wallets stay disconnected from the internet, so remote hacks can’t touch them. Hardware wallets, like the Ledger Nano X or Trezor Model T, give you full control over private keys.

This post lists 10 safe methods to store your bitcoin in 2025. You’ll learn about non-custodial wallets, seed phrases, and two-factor authentication to boost security. We cover cold wallets for long-term storage and tips to avoid hot wallets on exchanges.

Stick around; your bitcoin’s future depends on it.

Key Takeaways

- Hardware wallets like Ledger Nano X and Trezor Model T keep private keys offline for safe Bitcoin storage in 2025.

- Cold storage methods, such as air-gapped solutions, block remote hacks and suit long-term holding of crypto assets.

- Multi-signature wallets need multiple approvals to boost security, pairing well with devices like Trezor Model T.

- Enable two-factor authentication (2FA) on wallets to add extra protection against phishing scams and theft.

- Non-custodial wallets give full control over private keys, avoiding risks from exchanges in 2025.

Use a Hardware Wallet

Use a Hardware Wallet: Picture your Bitcoin as a treasure chest buried deep underground, and.

Recommended options: Ledger Nano X, Trezor Model T

Pick Ledger Nano X for top-notch security. This hardware wallet keeps your private keys offline, away from hackers. It uses a secure element chip to guard your crypto assets. Many folks love its Bluetooth connectivity for easy mobile use.

Sure, it costs more, but think of it as buying peace of mind, like locking your treasures in a vault.

Go with Trezor Model T if you want open-source trust. This device offers full control over your seed phrase and supports many cryptocurrencies. It features PIN protection and firmware updates to fight threats.

Users praise its touchscreen for simple setup. Hardware wallets like these beat hot wallets for long-term storage, keeping your bitcoin safe from phishing scams.

Air-gapped storage solutions

Air-gapped storage keeps your Bitcoin offline and safe from online threats. This method acts like a vault, locking away your digital assets from hackers who prowl the internet.

- Experts call cold storage one of the safest ways to hold Bitcoin, much like hiding cash under your mattress instead of leaving it out in the open. You create this setup by using devices not connected to the web, ensuring private keys stay secure and out of reach from remote attacks. Think of it as a fortress for your crypto wallet; cold wallets prevent hacks because they lack internet links, making them ideal for long-term storage of cryptocurrency. People often search for offline methods to protect their bitcoins from thieves, and air-gapped solutions fit that bill perfectly, offering peace of mind for your crypto assets.

- Hardware wallets like Ledger Nano X or Trezor Model T enhance air-gapped security by storing private keys on physical devices you can disconnect. These tools give you full control over your digital assets, similar to a personal bank vault for cryptocurrency storage. Avoid custodial wallets on exchanges; opt for non-custodial ones that keep you in charge of seed phrases and recovery phrases. Bitcoin stays safe on a USB drive or hard drive in this setup, but pair it with cold storage for top protection against cryptocurrency theft.

- Imagine your Bitcoin sitting in a cold wallet, untouched by the chaos of decentralized exchanges or phishing scams. This offline storage blocks hackers who target hot wallets connected online. Community-tested applications recommend air-gapped methods for all crypto ownership, steering clear of CEX platforms that risk your funds. You can store bitcoins here indefinitely, with options like microSD cards for backups, ensuring long-term security without the worries of firmware updates or Bluetooth connectivity issues.

- Security pros stress that air-gapped solutions shield against emerging threats in blockchain technology. Use them for NFTs or Dogecoin too, as they work like a secure element chip guarding your crypto portfolio. Forget about public Wi-Fi risks; these setups need no net at all, cutting out vulnerabilities in mobile wallets or desktop wallets. Storing on a hard drive beats exchange-traded funds for safety, giving you true control over public keys and private keys.

- Folks often ask how to store cryptocurrency offline, and air-gapped answers that with ironclad protection. It mimics a paper wallet but goes further by isolating your wallet address from any network. Pair it with two-factor authentication for entry, though the real power lies in zero internet exposure. This method handles decentralized finance tasks safely, letting you manage transactions via QR codes without online dangers lurking.

Use a Multi-Signature Wallet

Picture your crypto assets as a locked vault that demands nods from several trusted pals before opening, yeah, that’s the magic of a multi-signature setup boosting your security game.

You control private keys across devices, slashing risks from solo hacks, so dive deeper into options like those with multiple approvals for your peace of mind.

Enhanced security through multiple approvals

You need extra protection for your bitcoin. Think of a multi-signature wallet as a vault that demands several keys to open. This setup requires multiple approvals before any transaction happens.

Hackers face a tough wall, since one stolen private key won’t cut it. Hardware wallets like Ledger Nano X or Trezor Model T support this feature well. They keep your crypto assets safe from remote attacks.

People love this for long-term storage, as it mimics a team guarding your treasure.

Set up your multi-sig with trusted devices. Split control among a few, say two or three approvals. This way, even if phishing scams hit one spot, your funds stay secure. Cold storage pairs great here, blocking internet threats.

Avoid custodial wallets on exchanges; they risk hacking and loss. Go for non-custodial options to hold full power over your private keys. It’s like having a secret code that only your group knows, adding that peace of mind.

Create physical and digital backups

Backups keep your Bitcoin safe from loss, like a spare key for your house. They help you recover your crypto wallet if something goes wrong, acting as a safety net for your digital assets.

- Make physical backups by writing your seed phrase on paper or metal plates, store them in fireproof safes away from water and thieves, because this offline storage guards against digital hacks and lets you rebuild your cryptocurrency wallet anytime.

- Create digital backups on encrypted USB drives or external hard drives, disconnect them from the internet to mimic cold storage, as experts recommend this for long-term security of private keys and recovery phrases.

- Split your backups across multiple spots, like one at home and another in a bank vault, to avoid losing everything in one disaster, drawing from advice that hardware wallets like Ledger Nano X or Trezor Model T pair well with such methods for full control over crypto assets.

- Test your backups often by practicing recovery on a spare device, which builds confidence and spots errors early, much like rehearsing a fire drill for your cryptocurrency storage.

- Use non-custodial wallets for backups to maintain ownership of private keys, steering clear of custodial wallet risks where others hold your funds, as community-tested apps emphasize this for hacking prevention.

- Add two-factor authentication (2FA) to any digital backup tools, layering protection like a double lock on your door, since this blocks unauthorized access to your backup and recovery processes.

- Encrypt all digital backups with strong passwords or a passphrase, turning them into secure vaults that resist phishing scams and cryptocurrency theft, especially for long-term storage of Bitcoin on devices like smartphones or desktop wallets.

- Avoid public Wi-Fi when handling backups, opt for VPNs on secure networks instead, because this shields your crypto portfolio from remote attacks, aligning with tips for offline storage and cold wallets.

- Include biometric authentication in backup apps if possible, like fingerprint scans on mobile wallets, adding an extra shield for ease of use while protecting NFTs and other cryptocurrency tokens.

- Update your backup methods with firmware updates from official sources, keeping pace with emerging threats in decentralized finance (DeFi), as this ensures your crypto ownership stays safe without relying on exchanges like Coinbase Wallet.

Store offline in a secure location

You keep your seed phrase safe by storing it offline. Think of it like hiding a treasure map in a locked box, away from prying eyes. Cold storage keeps your private keys out of reach from hackers.

Hardware wallets like the Ledger Nano X or Trezor Model T offer top protection. They act as a secure vault for your crypto assets. These devices stay disconnected from the internet, making remote attacks impossible.

People often worry about cryptocurrency theft, but offline methods cut that risk. I once heard a story from a friend who lost coins on an exchange; he switched to cold wallets and slept better at night.

Choose a spot that’s hard to find, like a safe or a hidden drawer. Avoid digital copies on your computer; they invite trouble. Paper wallets work well for this too, printed and tucked away.

Your recovery phrase is the key to your bitcoin, so guard it like a secret recipe. Use a metal plate for extra durability against fire or water. Cold wallets shine for long-term storage, keeping your digital assets secure.

Experts say hardware wallets are the safest way in 2025, even with their cost. This approach beats hot wallets connected online, hands down.

Enable Two-Factor Authentication (2FA)

Picture a burglar trying to crack your safe, but you slap on an extra lock that needs a special code from your phone. Add this shield to your crypto wallet, and hackers face a tough wall, keeping your Bitcoin snug and safe from sneaky phishing attacks.

Add an extra layer of protection

You need extra security for your Bitcoin. Turn on two-factor authentication, or 2FA, right away. This step acts like a sturdy lock on your door. It stops hackers in their tracks. Imagine someone tries to sneak into your crypto wallet.

2FA demands a second check, like a code from your phone. Hardware wallets, such as Ledger Nano X or Trezor Model T, often support this feature. They keep your private keys safe offline.

Cold storage adds even more power here, since it blocks remote attacks.

Folks worry about cryptocurrency theft all the time. 2FA helps ease that fear. Pair it with non-custodial wallets for full control. Avoid custodial wallets on exchanges; they risk hacks.

Think of 2FA as your trusty sidekick in the fight against phishing scams. For long-term storage, combine it with seed phrase protection. Hardware wallets use secure element chips and PIN protection too.

Stay sharp, and update your wallet software often. This keeps vulnerabilities at bay.

Use Non-Custodial Wallets

Picture your Bitcoin as a treasure chest, you hold the only key. Grab a non-custodial wallet like Coinbase Wallet, keep those private keys in your grip, no one else touches them.

Maintain full control of your private keys

You own your bitcoin, so keep full control of your private keys. Non-custodial wallets let you do that. They act like a personal safe for your digital assets. Think of them as your own bank vault, not someone else’s.

Hardware wallets, such as Ledger Nano X or Trezor Model T, give you this power. These devices store private keys offline. Hackers can’t touch them remotely. Fact is, experts call hardware wallets the safest for crypto in 2025.

They use secure element chips for top protection. You avoid custodial wallets on exchanges, which hold your keys for you. That risks hacks and losses. Stick to community-tested apps instead.

Picture your private keys as the secret code to your treasure chest. Lose control, and thieves might snatch your crypto assets. Cold storage keeps them safe, away from the internet.

It’s like burying gold in a hidden spot. Use air-gapped solutions for this. Bitcoin stays secure on a hard drive or USB, but hardware options beat them for long-term storage. Ledger and Trezor shine here, even with their price.

They offer pin protection and firmware updates to fight vulnerabilities. Avoid hot wallets connected online; they invite trouble. Go for offline storage to dodge cryptocurrency theft.

This way, you handle your crypto portfolio with confidence.

Generate and store private keys offline

Paper wallets offer a simple way to keep your Bitcoin safe. You create them by generating private keys on a computer that’s not online. Print those keys and your public key onto paper.

Store that paper in a secure spot, like a safe or bank vault. This method acts like a vault for your digital assets, keeping everything offline. Hackers can’t touch it remotely since there’s no internet link.

Think of it as burying treasure where no one can dig it up without your map.

Many folks worry about cryptocurrency theft, so they turn to this offline storage for peace of mind. Cold storage, including paper wallets, ranks as one of the safest options for long-term holding.

Avoid exchanges; they face hacking risks. Instead, use community-tested tools like these for your crypto assets. Ledger Nano X or Trezor Model T hardware wallets pair well if you want extra layers, but paper keeps things basic and secure.

Just back up that printout, folks, in case life throws you a curveball.

Avoid Storing Bitcoin on Exchanges

Hey, picture your Bitcoin sitting on an exchange like a juicy steak left out for thieves, wide open to hacks and sudden shutdowns that

Mitigate risks of hacking and loss

Exchanges face big risks from hackers. They hold your bitcoin like a shared vault, but thieves often break in. Think of it as leaving your cash in a busy street market, easy for pickpockets to grab.

Cold storage keeps your crypto offline, away from online threats. This method blocks remote hacks completely. Experts say hardware wallets like Ledger Nano X or Trezor Model T offer the best shield for 2025.

These devices give you full control over private keys. No more worries about exchange failures or theft.

Skip custodial wallets on platforms; they don’t let you own your keys. Opt for non-custodial options instead, like a secure hard drive setup. It’s like hiding your treasure in a personal safe, not a bank’s.

Community-tested apps boost safety for all crypto assets. Cold wallets shine for long-term storage, far safer than hot wallets connected online. Protect against phishing scams by verifying every transaction.

Use two-factor authentication to add that extra lock. Your bitcoin stays secure from loss this way.

Dedicated devices or operating systems for crypto transactions

You know, using dedicated devices for your crypto transactions feels like having a trusty sidekick in a wild west showdown. Think of hardware wallets like the Ledger Nano X or Trezor Model T, those physical gadgets that keep your private keys under lock and key.

They act as cold storage champs, staying offline to dodge remote hacks, much like a vault buried deep underground. Folks often worry about long-term security, and these tools give you full control over your digital assets, no middleman needed.

Imagine this: you plug in your device only when needed, keeping your bitcoin safe from prying eyes on the internet.

Switch to a secure operating system on a dedicated machine, and it’s like arming your fortress with extra moats. Avoid public Wi-Fi pitfalls by using these setups for cryptocurrency transactions, steering clear of hot wallets that invite trouble.

Cold wallets shine here, especially for storing crypto assets offline, far from hacking risks. I get it, the price tag on hardware wallets stings a bit, but they beat storing bitcoin on a simple USB or hard drive hands down.

Stay sharp, update that firmware, and your crypto portfolio rests easy, protected by secure element chips and PIN protection.

Regularly Update Wallet Software

Regularly Update Wallet Software: Keep your crypto wallet safe by installing the latest firmware updates right away, since they patch up those sneaky vulnerabilities that hackers love to exploit, like fixing a leaky roof before the storm hits, and hey, if you want to dodge more crypto pitfalls, stick around for the next tips.

Stay protected from vulnerabilities

Keep your wallet software fresh. Hackers love old flaws in code. Update it often to block those weak spots. Think of it like patching a leaky boat before you sail. Hardware wallets, such as Ledger Nano X or Trezor Model T, need firmware updates for top safety.

These devices hold your private keys offline, away from online threats. Cold storage shines here, since it stays disconnected from the internet and dodges remote hacks.

Imagine skipping an update and losing your crypto portfolio to a sneaky bug. Don’t let that happen. Regular checks for new wallet software versions guard against cryptocurrency theft.

Use tools like blockchain explorers to spot issues early. For long-term storage, pair this with non-custodial wallets. You control your seed phrase and recovery phrase fully. This way, your digital assets stay safe from phishing scams and other risks in 2025.

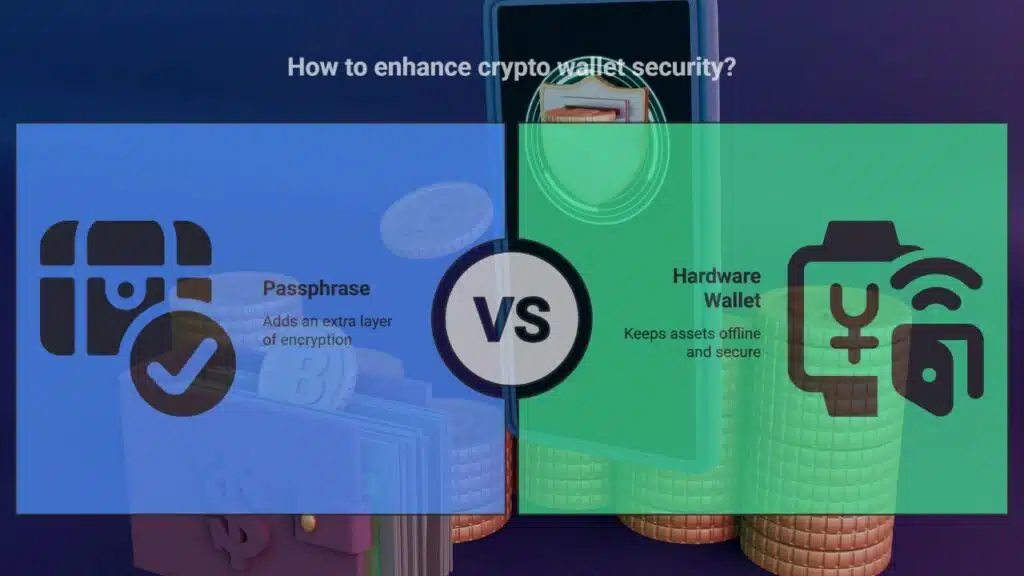

Use a Passphrase for Extra Security

Picture your seed phrase as a locked treasure chest, and a passphrase acts like an extra hidden key that thieves can’t guess. Add this layer to your hardware wallet, say a Ledger Nano X or Trezor Model T, and you beef up protection against sneaky attacks on your private keys.

Add an additional encryption layer

You know that feeling when you lock your front door, but then add a deadbolt just to sleep better at night? That’s what a passphrase does for your crypto wallet. It acts like an extra shield, layering on more encryption to guard your seed phrase and private keys.

Hardware wallets, such as the Ledger Nano X or Trezor Model T, let you set this up easily. These devices keep your digital assets offline in cold storage, making them tough for hackers to touch.

Think of it as burying treasure with a secret map only you know.

Folks often worry about long-term security for their bitcoin, especially from phishing scams or cryptocurrency theft. A passphrase boosts that protection, much like a hidden code on a safe.

Pair it with non-custodial wallets for full control over your crypto assets. Cold wallets shine here, staying air-gapped and safe from online threats. Hardware options like the Trezor Safe 3 add features such as PIN protection and firmware updates to fend off vulnerabilities.

This setup ensures your holdings stay secure for the long haul, no matter what.

Diversify Storage Methods

Don’t put all your eggs in one basket, folks,

Split holdings across different secure options

You can spread your Bitcoin across various safe spots. This cuts down on risks if one method fails.

- Split your crypto assets into parts and store some in a hardware wallet like Ledger Nano X or Trezor Model T, which keeps private keys offline and safe from hackers, just like hiding cash in different drawers at home.

- Put another chunk in cold storage, an offline wallet not connected to the internet, making it super hard for remote hacks, and experts call this one of the safest ways for long-term security in 2025.

- Use a non-custodial wallet for part of your holdings, where you control the private keys fully, avoiding the dangers of custodial wallets on exchanges that might get hit by cryptocurrency theft.

- Store a portion on a paper wallet, generated offline with your seed phrase kept in a secure spot, like a fireproof safe, to dodge online threats and ensure you own your digital assets without middlemen.

- Mix in a multi-signature wallet for extra layers, needing multiple approvals for transactions, which boosts crypto security and protects against phishing scams that target single-key setups.

- Back up parts of your Bitcoin on a dedicated USB or hard drive in cold wallet style, but pair it with PIN protection and firmware updates to stay ahead of vulnerabilities, as Bitcoin can sit safely there for years.

- Diversify with a mobile wallet like Coinbase Wallet for quick access, but only for small amounts, and always enable two-factor authentication (2FA) to add that extra shield against unauthorized access.

- Keep some in a desktop wallet on a secure operating system, isolated from public Wi-Fi, using VPNs for any cryptocurrency transactions to prevent hacking prevention slip-ups.

- Add biometric authentication features, like fingerprint scans on advanced hardware wallets, for portions of your crypto portfolio, making it feel like a high-tech vault only you can open.

- Check blockchain explorer tools regularly to monitor balances across these options, staying updated on emerging threats and ensuring your long-term storage setup guards against cryptocurrency and security risks.

Use VPNs or secure networks

Public Wi-Fi can expose your crypto transactions to hackers, like leaving your front door wide open. Switch to a VPN instead, it hides your online moves and keeps snoopers at bay. This step guards your private keys and digital assets, much like a sturdy lock on a safe.

Folks often worry about cryptocurrency theft on open networks, so pick secure connections for peace of mind. Cold storage shines here too, since it stays offline and dodges those risks altogether.

Think of VPNs as your invisible shield during cryptocurrency transactions. They encrypt data and block prying eyes, especially when you handle Bitcoin or NFTs. Hardware wallets like Ledger Nano X or Trezor Model T pair well with this, offering extra layers against hacks.

Avoid exchanges for storage, as facts show cold wallets prevent remote attacks. Secure networks make long-term security a breeze, keeping your crypto portfolio safe from phishing scams and unauthorized access.

Consider a Biometric Wallet

Consider a Biometric Wallet: Picture your crypto stash locked behind a quick face scan or thumb press, like a secret vault that only you can open. These gadgets use fingerprint checks or facial ID to block thieves, adding that extra shield to your digital coins and keeping your peace of mind intact.

Advanced security with fingerprint or facial recognition

Biometric wallets add fingerprint or facial recognition to lock down your crypto assets. They use this tech on hardware wallets like Ledger Nano X or Trezor Model T. You scan your finger or face to access private keys.

This beats simple PIN protection against sneaky thieves. Imagine your face as the key to a vault, no one else gets in. Cold storage gets even safer with these features. Hackers can’t fake your biometrics from afar.

Such wallets blend secure element chips with biometric authentication for top defense. Think of it as a bodyguard for your digital assets. You keep full control, just like with non-custodial wallets.

Offline storage shines here, blocking remote attacks. Trezor Safe 3 offers this edge too. Your seed phrase stays hidden behind your unique scan. Crypto security feels personal and tough to crack.

Verify the Wallet’s Source

Always grab your wallet software straight from the maker’s main site,

Download software from official websites only

You know that feeling when you grab a snack from a shady vendor and regret it later? Don’t let that happen with your crypto. Download wallet software only from official websites, like those for Ledger Nano X or Trezor Model T.

These hardware wallets keep your private keys safe on a secure element chip. Hackers love to fake sites and slip in malware, aiming for your digital assets. Stick to the real deal to dodge phishing scams and cryptocurrency theft.

Imagine you’re building a fortress for your bitcoin, but one wrong download cracks the wall. Opt for verified sources to get that firmware update or desktop wallet. This simple step guards against vulnerabilities in hot wallets or mobile wallets.

Cold storage shines here too, since official downloads ensure offline storage stays pure. By doing this, you maintain full control over your seed phrase and crypto portfolio, no funny business from outsiders.

Regularly check activity logs and balances

Stay alert with your crypto holdings, folks. Check those activity logs often in your wallet software. Spot any odd moves right away. This habit acts like a watchdog for your digital assets.

Imagine catching a thief before they slip away, that’s the power here. Use a blockchain explorer to double-check transactions. It keeps hackers at bay and protects your bitcoin from cryptocurrency theft.

Make it routine to scan balances too. Log in to your hardware wallet, like the Ledger Nano X or Trezor Model T, every week. See if numbers match what you expect. This simple step guards against sneaky phishing scams.

Cold storage shines here, since offline methods dodge remote hacks. Your private keys stay safe, giving you full control over crypto assets.

Educate Yourself on Emerging Threats

Keep an eye on fresh dangers, like sneaky phishing scams that target your recovery phrase and private keys. Explore tips from blockchain experts on dodging cryptocurrency theft, and you’ll guard your crypto assets like a pro.

Stay updated on the latest security techniques

You hear about new hacking tricks popping up all the time in the crypto world. Stay sharp by reading up on cryptocurrency security trends. Think of it like locking your door against sneaky thieves.

Experts say cold storage beats everything for safety in 2025. It keeps your bitcoin offline, away from remote attacks. Grab a hardware wallet like the Ledger Nano X or Trezor Model T.

These devices guard your private keys with a secure element chip. They offer full control, no sharing with outsiders.

Phishing scams lurk around every corner, ready to snatch your seed phrase. Dodge them by learning the latest crypto security moves. Follow blockchain analysts for tips on hacking prevention.

Use non-custodial wallets to hold your crypto assets tight. Avoid custodial wallets on exchanges; they invite risks. For long-term storage, go with offline methods. Picture your bitcoin safe on a USB or in cold wallet form.

Update your wallet software often to patch holes. This way, you fend off emerging threats like a pro.

Takeaways

You’ve now got ten solid ways to keep your Bitcoin safe, from hardware wallets like Ledger Nano X to cold storage that stays offline. These tips work fast and fit right into your daily routine, no fancy tricks needed.

What steps will you take today to lock down your crypto assets? Strong security stops hackers in their tracks and guards your digital fortune for the long haul. Check out sites like Trezor or blockchain explorers for more tips, and keep learning to stay ahead.

FAQs

1. Hey, what’s the safest way to store my Bitcoin using a hardware wallet in 2025?

You know, a hardware wallet like the Ledger Nano X or Trezor Model T keeps your private keys offline in cold storage, shielding them from hacking attempts. It’s like locking your crypto assets in a vault that only you can open with PIN protection and biometric authentication. Just remember to update the firmware regularly to fend off those sneaky cryptocurrency theft risks.

2. Should I pick a non-custodial wallet over a custodial one for my crypto portfolio?

Absolutely, go for a non-custodial wallet if you want full control over your private keys and digital assets; it’s like being the captain of your own ship. Custodial wallets, think Coinbase Wallet, hold the keys for you, but that means trusting someone else with your crypto ownership.

3. How do I handle my recovery phrase without messing up?

Treat your recovery phrase, or seed phrase, like a secret treasure map; write it down on a paper wallet and store it offline to avoid phishing scams. If you lose access, it lets you regain your cryptocurrency wallets, but never share it, or you’ll invite trouble.

4. What’s the deal with hot wallets versus cold wallets for long-term storage?

Hot wallets, such as mobile wallets with Bluetooth connectivity, stay online for quick cryptocurrency transactions, but they’re riskier for long-term security. Cold wallets, on the other hand, offer offline storage to protect against hacks, making them ideal for safeguarding your NFTs and crypto assets over time. Picture hot wallets as your everyday pocket change, while cold ones are the buried chest.

5. Can two-factor authentication really boost my crypto security?

Yes, enabling two-factor authentication (2FA) on your wallet software adds an extra layer against unauthorized access, much like a double lock on your front door. Combine it with a secure element chip in hardware wallets for even better hacking prevention.

6. How do I use a blockchain explorer to check my crypto transactions safely?

Just hop on a blockchain explorer to verify your public key transactions without exposing private keys; it’s a simple way to keep tabs on your crypto portfolio. For added safety, pair it with desktop wallets that support multi-party computation, and always watch out for those phishing scams lurking around.