Do you feel stressed every month looking at your credit card balances? You’re not alone. Many people struggle with keeping their credit usage low, and it can hurt their credit scores over time.

Experts agree that sticking to certain habits can help. Keeping your credit utilization under 30% is key for a healthy credit profile. This guide will share 9 simple rules to manage your usage and boost your score.

Stick around; the tips are easy to follow!

What Is Credit Utilization?

Credit utilization shows how much of your total credit limit you are using. It’s a percentage based on your credit card balances compared to all your available credit. For example, if your total limit is $10,000 and you use $2,000, your rate is 20%.

Experts recommend keeping this under 30% for good credit scores. Staying below 10% can help even more. High usage tells lenders you might rely too much on credit, which could hurt your FICO score or reports from major bureaus like Experian or TransUnion.

Low usage means better financial habits and stability to creditors.

Why Is Keeping Credit Utilization Under 30% Important?

Using more than 30% of your available credit makes you look risky to lenders. It can lower your credit score fast. Credit scoring models, like FICO, give high importance to low usage of revolving accounts.

For example, a $1,000 limit means spending no more than $300 keeps you within the safe zone. Going over this percentage signals higher borrowing risk to credit bureaus.

Experts say staying under 10% can build excellent credit profiles over time. A good habit is paying off balances fully during each billing cycle. This lowers interest rates and boosts financial confidence with banks and card issuers like Capital One or American Express.

Keeping utilization low opens doors for better financial products with perks like cashback or lower annual fees.

Low credit utilization shows you’re smart about money management and thoughtful with your spending.

9 Rules for Maintaining Low Credit Utilization

Keeping your credit usage low takes effort, but with smart habits, it’s easier than you think—read on to learn the best tips.

Pay down your balance early

Clear your credit card balances before the billing cycle ends. This reduces your credit utilization rate quickly. If you wait until the due date, issuers may report a higher balance to credit bureaus.

For better results, aim for under 10% usage of your total credit limit.

Paying early also saves money on interest if you carry balances over time. Lower balances help boost your FICO score, which benefits loan approvals or better terms with lenders like Capital One or mortgage companies.

Pay off your balances more than once a month

Paying off your credit card balances more than once a month can help keep your credit utilization low. A lower utilization rate protects your credit score from dropping. For example, if you have a $3,000 credit limit and spend $900 in two weeks, paying it off early before using the card again reduces the reported balance on your billing cycle.

“Keeping balances under 30% can save you from unnecessary drops in FICO scores.”

This habit gives you more available credit throughout the month. Credit bureaus often see low usage as responsible money management. It’s also easier to avoid late fees or high revolving debt this way.

Frequent payments mean fewer surprises when checking monthly statements!

Decrease your spending

Spending less helps keep your credit utilization low. Use a debit card instead of your credit card for daily purchases. This keeps your credit card balances from growing too fast.

Stick to a budget that matches your income and bills. Avoid impulse buying or overspending on non-essentials. Small changes, like cooking at home or skipping fancy coffee runs, can add up quickly over time!

Request a higher credit limit

Ask your credit card issuer for a credit limit increase. A higher limit gives more available credit and lowers your credit utilization ratio. For example, if your current limit is $5,000 and you spend $1,500, that’s 30%.

But with a new limit of $8,000, the same spending drops to 19%.

Keep in mind some lenders may perform a hard inquiry on your credit report. This might slightly lower your score temporarily. Update your income before requesting an increase to show better repayment ability.

Many issuers like Capital One or Mastercard International allow you to request increases online or in their app without fees.

Open a new credit card

Opening a new credit card can help boost your available credit. This increases your total credit limit, which lowers your credit utilization ratio. For example, if you have $3,000 in balances but increase your total limit to $10,000 by opening another card, your utilization drops from 50% to 30%.

Pick a card with no annual fee or perks like cash back rewards. But keep an eye on hard inquiries since too many can lower scores temporarily. Use the new line of credit wisely and avoid overspending to maintain good financial habits.

Avoid closing unused credit cards

Unused credit cards assist with your credit utilization. Keeping them open increases your total credit limit, reducing your usage ratio. For instance, if you have $10,000 in available credit but only use $2,500, your usage stands at 25%.

Closing a card with a $5,000 limit would raise that usage to 50%.

Older accounts also contribute positively to your credit history length. Credit scoring models prioritize long-standing accounts. Closing older cards could shorten this timeline and negatively impact your scores.

Be mindful of annual fees that may not be worthwhile on unused cards!

Consolidate debt with a personal loan

A personal loan can combine all your debts into one payment. This can lower stress and help build better financial habits. Paying off credit cards with a personal loan changes revolving credit to installment debt, which improves your credit profile.

It may also reduce your interest rate compared to high-interest credit card balances. Keep in mind, applying for a loan might trigger a hard inquiry on your credit report. Still, the long-term benefits of easier money management often outweigh this short-term effect.

Monitor your credit utilization regularly

Check your credit card usage often. Use online tools or apps from your bank to track spending. Keeping tabs helps spot if you’re nearing the 30% limit. For example, using $900 of a $3,000 credit limit puts your credit utilization ratio at 30%.

Lower numbers, like under 10%, are better for credit scores.

Credit bureaus see rising balances quickly. Banks report changes during each billing cycle to them. Watching your available credit regularly lets you act fast before hitting risky levels.

This habit can keep your financial profile strong and help avoid surprise drops in scores.

Keep your reported income updated

Tell your credit card issuers if your income increases. A higher reported income can lead to a credit limit increase. More available credit means lower credit utilization, helping your FICO score.

Lenders use this data to assess risk. If you don’t update it, they might see outdated figures. Stay honest with reporting for better financial services and products.

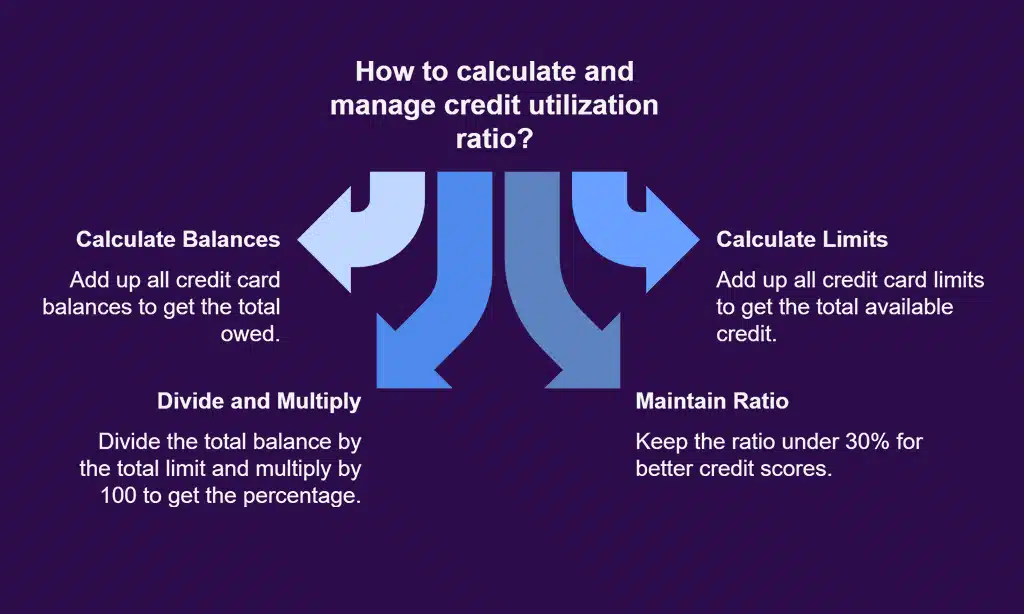

How to Calculate Your Credit Utilization Ratio

Add up all your credit card balances. Check how much you owe on each account. For example, if one card has $500 and another has $300, your total balance is $800.

Next, add all your total credit limits. If one card has a limit of $1,000 and the other has $2,000, that gives you $3,000 in available credit. Divide the balance by the total limit ($800 ÷ $3,000).

Then multiply by 100 to get a percentage. In this case, your ratio is 26.7%. Keep it under 30% for better scores!

Takeaways

Keeping credit utilization low is key to a good credit score. Pay your balances often, spend less, and track your usage. Ask for higher limits and avoid closing old cards. These steps are simple but can make a big difference over time.

Low usage shows lenders you’re smart with money. Start today—small changes lead to big wins! Take control of your finances now!

FAQs

1. What is credit utilization, and why does it matter?

Credit utilization is the percentage of your available credit that you use. It matters because it impacts your credit scores, as most credit scoring models consider a low credit utilization ratio a sign of good financial habits.

2. How can I keep my credit card balances under 30% of my total credit limit?

You can lower your balances by making more frequent payments during the billing cycle or setting up automatic card payments to avoid carrying too much debt on revolving credit accounts.

3. Will increasing my total credit limit help reduce my credit utilization rate?

Yes, requesting a higher limit from your card issuers increases available credit, which lowers your utilization ratio if spending stays the same. Just watch out for hard inquiries when asking for an increase.

4. Can personal loans or installment loans help with managing high revolving debt?

Yes, using personal loans to pay off high-interest revolving debts like those on a gold card or other cards can reduce overall usage while keeping payment history intact on your report.

5. Do late payments affect my ability to maintain low utilization rates?

Late payments don’t directly impact this rate but hurt payment history and FICO scores reported to consumer reporting agencies like Experian or Equifax—important factors in lending decisions.

6. Should I close unused lines of credit if I’m not using them often?

No, closing old accounts reduces total limits and raises the utilization ratio unless balances drop proportionally—keeping open lines active helps maintain strong profiles with mortgage lenders and fintech services alike!