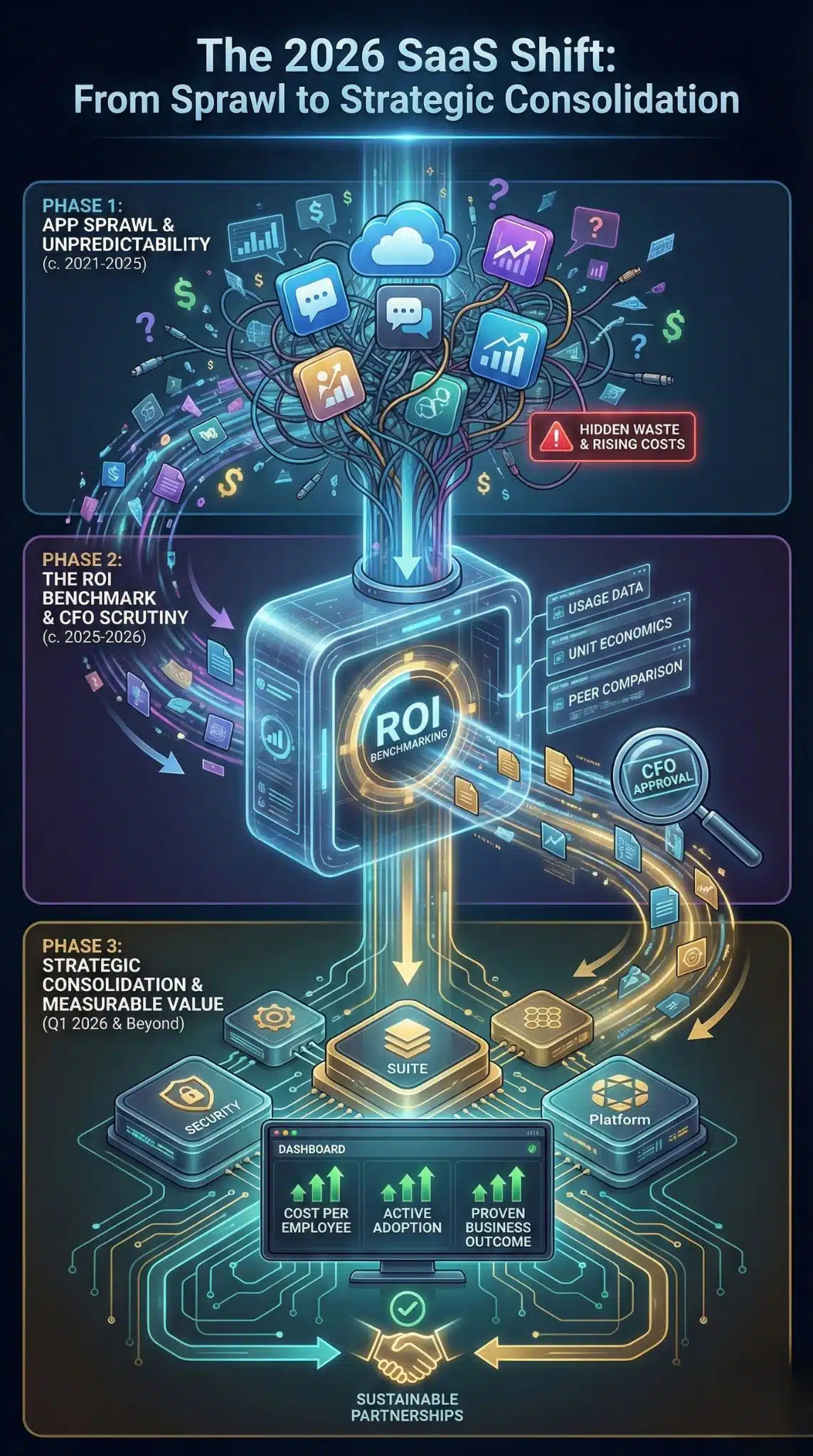

In Q1 2026, SaaS buying is shifting from “Which tool has the most features?” to “Which tool proves measurable ROI versus peers?” With software costs rising and AI add-ons reshaping pricing, CFO-grade benchmarking is accelerating vendor rationalization, and pushing weaker vendors into mergers, roll-ups, or exits.

How We Got Here: From App Sprawl To CFO-Legible Value

For most of the 2010s and early 2020s, SaaS expanded under a simple deal logic: sell seats, land in a team, expand across the org. That model fit an era where growth and speed mattered more than precision, and where “time-to-adoption” often stood in for true business outcomes.

Then the bill came due. As portfolios ballooned, visibility did not keep pace. Recent IT asset management and SaaS management reporting has emphasized a familiar pattern: organizations underestimate what they own, overbuy licenses to avoid shortfalls, and then discover that a meaningful share of spend delivers little ongoing usage. Once waste becomes measurable, it becomes governable, and once it becomes governable, it becomes negotiable.

By late 2025, the macro story was no longer “tech budgets are collapsing.” It was “tech budgets are being reallocated.” Market forecasts for 2026 point to continued growth in overall IT spending and particularly strong software growth, even as enterprise buyers tighten scrutiny on how software translates into outcomes. The underlying driver is that “software” is no longer a stable category: GenAI features are being embedded across products, often shifting price structures and renewing debates about value capture.

The result is the 2026 “ROI Benchmarking Shift”: a new default where renewal and expansion decisions increasingly hinge on comparative ROI proof, not narrative.

| Period | What Buyers Rewarded Most | What Changed In The Buying System | Why It Matters Now |

| 2021–2022 | Expansion, fast deployment | Seat-based growth, tool sprawl tolerated | “More tools” looked like “more productivity” |

| 2023–2024 | Efficiency, consolidation | Finance scrutiny rises, usage data becomes negotiating leverage | Waste becomes visible, renewals get harder |

| 2025 | Governance + predictable value | Usage tracking and right-sizing become normal | ROI becomes continuous, not annual |

| Q1 2026 | Benchmarkable ROI vs peers | AI pricing volatility and suite bundling accelerate rationalization | Consolidation becomes the market’s pressure valve |

Why ROI Benchmarking Is Becoming The Default Procurement Language

ROI benchmarking is not one metric. It is a procurement posture: buyers compare outcomes, adoption, and total cost against internal baselines and external norms, then force vendors to justify renewal with evidence.

Three forces are driving this.

First, buyers now have better “instrumentation.” SaaS management and ITAM practices increasingly track actual usage and force license cleanup. That matters because the old renewal model relied on inertia: once a tool was “standard,” it stayed standard. Usage tracking breaks inertia. When renewal discussions start with a dashboard rather than a stakeholder’s memory, the burden of proof shifts from the buyer to the vendor.

Second, cost is rising even when usage is flat. Forecasts for 2026 highlight that software spend growth is being propelled partly by higher costs and the expanding footprint of AI functionality. When the unit price rises, buyers naturally demand unit-level proof. They want to see value per employee, per workflow, per department, and per revenue dollar influenced.

Third, purchasing is more decentralized, which increases duplication and makes “portfolio ROI” measurable. When lines of business buy their own tools, duplication creeps in: multiple project trackers, overlapping analytics products, parallel communications stacks, and redundant security add-ons. Benchmarking becomes the neutral arbiter across departments because it offers a shared scoreboard that can survive internal politics.

| Benchmark Buyers Use In 2026 | What It Measures | What Vendors Must Prove | The Consolidation Implication |

| Cost per employee / department | Unit economics of software | Value per user, not feature depth | Point tools with weak usage get cut |

| Active usage and license utilization | Adoption and realized value | “Used” equals “renewed” | Products that are “nice-to-have” lose seats |

| Time-to-value | Speed from purchase to outcome | Onboarding ROI, fast activation | Suites win if they reduce integration work |

| ROI vs peers (internal or market norms) | Comparative performance | Measurable KPIs and proof points | Only leaders survive as “category standards” |

| Predictability of spend | Budget stability | Pricing clarity, bill control | Unpredictable AI or usage pricing triggers churn |

Pricing Is The Flashpoint: AI Add-Ons, Usage Metering, And The “Unpredictable Bill” Problem

The biggest reason ROI benchmarking is intensifying in early 2026 is that pricing has become harder to forecast.

AI has introduced a subtle but powerful shift: vendors are no longer only selling “software.” They are selling “capability,” often metered, sometimes bundled, and frequently re-tiered. Even when base functionality stays similar, AI features create a new basis for price increases. That forces buyers to ask a pointed question: are we paying for additional measurable outcomes, or are we paying for the promise of future outcomes?

Consumption-based pricing adds another layer of uncertainty. It can be fair when usage scales with value, but it becomes dangerous when the value is ambiguous or when usage spikes are disconnected from business impact. Many IT leaders now report unexpected charges tied to consumption or AI pricing models. In a benchmarking environment, surprises are poison. They weaken trust, accelerate executive escalation, and turn renewals into competitive rebids.

Procurement teams are responding by professionalizing negotiation timing and standardizing ROI asks. Data-driven procurement playbooks emphasize earlier renewals, longer runways for competitive comparisons, and contract structures that reduce variance. This is not just cost control; it is risk control. The CFO’s objection is rarely “this tool costs money.” It is “this tool costs money unpredictably.”

Key Statistics Buyers Are Using As “Benchmark Anchors” In 2026

- Worldwide IT spending forecast for 2026: $6.08T, with software at $1.433T (about +15% year over year).

- SaaS spend per employee has been rising again after a period of tightening, with recent indexes showing strong year-over-year growth.

- Average annual waste from unused SaaS licenses remains large enough to be a board-level issue.

- A meaningful share of organizations report SaaS waste rising year over year, even as governance improves.

- A majority of IT leaders report unexpected charges tied to consumption-based or AI-related pricing.

Those figures matter less as isolated numbers and more as executive ammunition: they provide “permission” for aggressive rationalization and make consolidation a defensible strategy rather than a political battle.

Consolidation Pressure Point: When ROI Is Audited, Platforms Have An Edge

When buyers benchmark ROI, they tend to reward two things: fewer vendors and clearer accountability.

That is where consolidation accelerates. If an enterprise is wasting millions on unused licenses and dealing with unpredictable consumption bills, the simplest path to improvement is vendor reduction and portfolio standardization. Standardization makes governance cheaper. It reduces integration work. It simplifies security reviews. And it turns vendor management into a smaller number of bigger relationships, which usually improves negotiating leverage.

This does not mean “best-of-breed is dead.” It means best-of-breed must clear a higher ROI bar. A point solution that replaces manual work, reduces security risk, or meaningfully lifts revenue can still win. But it has to win in comparative terms, against suites that bundle adjacent capabilities and promise fewer integrations.

Security is a special case because risk reduction is itself an ROI category. In many environments, security tools can justify spend through audit readiness, incident prevention, and reduced blast radius. Yet even here, benchmarking pushes toward consolidation around core primitives (identity, access, device trust, policy enforcement) because fragmentation adds risk and operational overhead.

| Likely “Winners” In A Benchmark-Driven Quarter | Why They Benchmark Well | Likely “Losers” | Why They Fail The Benchmark Test |

| Platforms with provable adoption and broad workflows | Easier to show enterprise-wide ROI | Redundant point tools | Hard to justify vs existing suite modules |

| Vendors with predictable, governable pricing | Low variance, CFO-friendly | AI add-ons with unclear value | Higher bills without KPI lift |

| Security and compliance enablers | ROI includes risk and audit readiness | “Nice-to-have” productivity apps | Usage drops first in rationalization |

| Vendors with strong onboarding + fast time-to-value | Benchmarks improve quickly | Vendors with long, services-heavy deployments | ROI takes too long to materialize |

Expert Perspectives And Counter-Arguments

There is a real risk that ROI benchmarking becomes oversimplified and short-termist. Some tools deliver value that is hard to capture in quarterly metrics: employee experience, long-term data quality, innovation velocity, or strategic flexibility. Benchmarking can also overfit to “what can be measured” rather than “what matters most.”

There is also a credible lock-in argument. When buyers consolidate too aggressively into a single suite, they can lose bargaining power and slow innovation. The suite vendor can raise prices, degrade service, or deprioritize features because switching costs become prohibitive. In that world, best-of-breed becomes a hedge.

The practical resolution is that benchmarking does not eliminate judgment; it changes where judgment is applied. Benchmarks drive the first pass of rationalization, then exceptions get defended with deeper narratives and stronger evidence. In Q1 2026, many vendors will not survive the first pass.

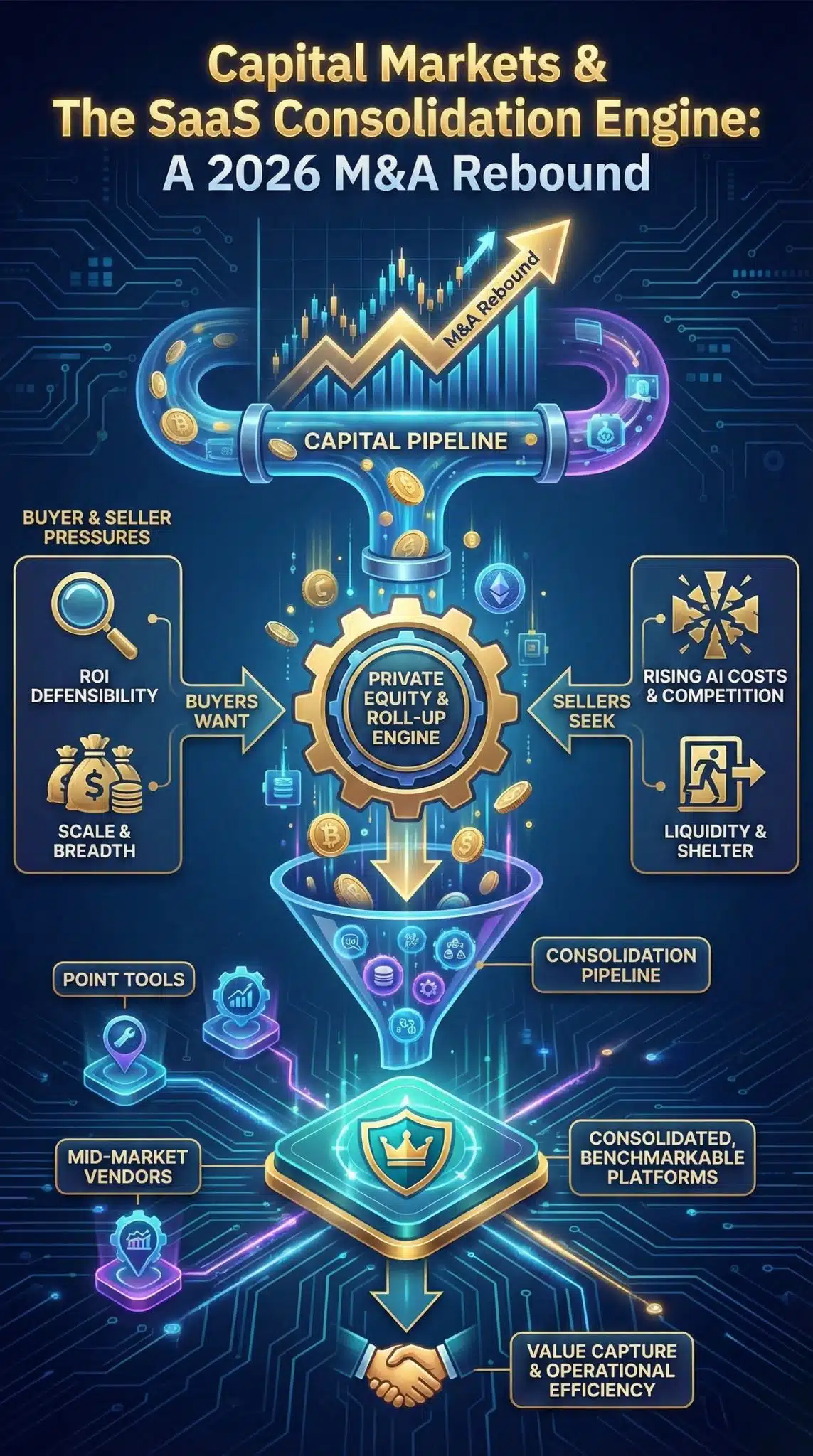

Capital Markets Are Back, And SaaS Consolidation Is The Release Valve

The ROI benchmarking shift would be painful even without active deal markets. But the deal environment heading into 2026 is supportive.

Major consultancies and financial reporting have described a rebound in M&A in 2025, and surveys point to growing optimism for 2026. The pattern often looks like this: deal value climbs faster than deal volume, signaling that capital is concentrating into scaled assets and platform plays rather than scattering across many small acquisitions.

That matters for SaaS because benchmarking pressure creates both buyers and sellers:

- Buyers want scale, customer concentration, and product breadth that makes ROI defensible.

- Sellers want liquidity and strategic shelter as AI investment requirements rise and customer acquisition becomes more expensive.

The private equity role is also evolving. If “ROI proof” becomes the procurement gate, then professionalization, bundling, and go-to-market efficiency become more important than raw feature velocity. PE firms are structurally suited to that kind of operational consolidation: they can roll up adjacent capabilities, rationalize costs, and position a combined entity as a safer “benchmark winner.”

| Indicator | What The Latest Data Suggests | Why It Accelerates SaaS Consolidation |

| M&A rebound and optimism | Deal markets strengthened in 2025; sentiment improved for 2026 | More buyers and capital available for roll-ups |

| Software economics tightening | AI reshapes product roadmaps and pricing | Mid-market vendors seek exit before margins compress |

| SaaS waste quantified | Waste becomes measurable and governable | Rationalization creates motivated sellers and buyers |

| Pricing volatility | Unexpected charges increase scrutiny | Buyers shift toward fewer, more governable vendors |

What Comes Next In Q1 2026: Three Plausible Paths

Consolidation won’t look identical across categories, but ROI benchmarking pushes the market toward a narrower set of outcomes.

Renewal-Driven Rationalization Forces “Soft Consolidation”

In this path, consolidation happens without formal M&A. Buyers cut duplicate tools at renewal, shrink seat counts, and standardize on suites. Vendors experience churn, and many respond by bundling features, discounting aggressively, or moving to longer terms to stabilize revenue.

This scenario is common when procurement matures quickly. It doesn’t require a headline deal. It requires a spreadsheet, a renewal calendar, and the willingness to say no.

Category Roll-Ups As Mid-Market Vendors Seek Scale

Here, the market makes consolidation explicit. Mid-market vendors recognize they cannot simultaneously fund AI transformation, defend margins, and fight suite bundling with limited distribution. So they seek scale through mergers, acquisitions, or being acquired. Private equity accelerates the process by standardizing operations and packaging combined offerings as more “benchmarkable” (broader functionality, clearer governance, fewer vendors).

A Barbell Market Where Only Platforms And Specialists Thrive

This is the most structurally transformative scenario. Mid-tier “good but not essential” vendors get squeezed. Platforms win broad spend. Specialists survive where they can defend unique outcomes or risk reduction. The defining feature is not company size. It’s defensibility under benchmarking. If the vendor can show unique value that a suite cannot replicate quickly, it stays. If not, it becomes a consolidation target.

Milestones To Watch This Quarter

- Price and packaging updates tied to AI features (especially when add-ons become default tiers).

- Contract structure changes, including longer terms and earlier renewal cycles driven by benchmarking playbooks.

- Software roll-ups and take-private deals, particularly where public market valuation penalizes near-term margins.

- New “proof of value” tooling: outcome dashboards, usage governance, and ROI reporting that compresses proof cycles from quarters to weeks.

Final Thoughts

The 2026 ROI Benchmarking Shift is not just a procurement fad. It is a structural response to three realities: software costs are rising, pricing is becoming less predictable due to AI and consumption models, and portfolios have grown large enough that waste is now measurable at enterprise scale.

That combination turns SaaS selection into something closer to capital allocation. When buyers treat software as a portfolio with unit economics, consolidation becomes the natural outcome. They will keep the vendors that win benchmarks, and they will remove the ones that fail them. Vendors that cannot translate AI features into measurable outcomes, or cannot explain pricing variance in CFO-friendly terms, will face the harshest version of the market. They will merge, get acquired, or fade.

If you want the simplest “what to watch,” it is this: renewal behavior is the leading indicator. In Q1 2026, the biggest consolidation events may happen in procurement spreadsheets before they show up in press releases.