Many people find real estate out of reach due to high entry costs. In Dubai real estate, fractional ownership starts at AED 5,000. This post shows you how blockchain technology and smart contracts can protect your fractional shares and fuel portfolio diversification.

Keep reading.

Key Takeaways

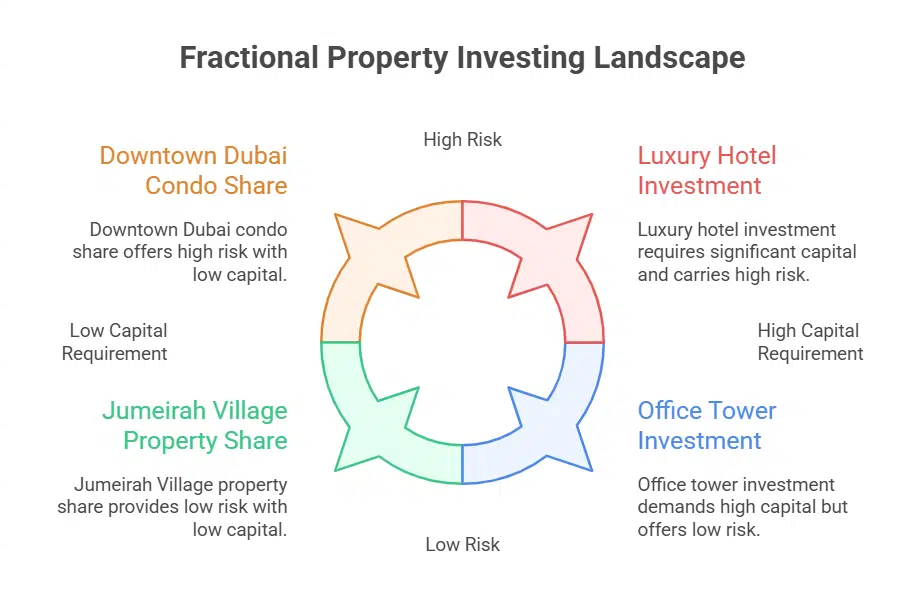

- Investors buy slices of Downtown Dubai condos, Jumeirah Village villas, office towers, or Indian apartments for as little as AED 5,000 on fintech platforms that use blockchain and smart contracts to secure title deeds with the Dubai Land Department.

- Platforms slice a $1 million property into bite-sized shares that anyone can snag for a few hundred dollars, so users mix real estate with stocks, earn rental income, and pay shared maintenance fees via automated smart contracts.

- Blockchain ledgers (Ethereum, Hyperledger Fabric) track each fractional share in real time, automate rent payouts and sale triggers, speed up exits, and cut management fees and delays.

- UAE and U.S. regulators—Dubai Land Department, Jafza, and the SEC—require platform registration, clear fee disclosures, escrow accounts, and digital-ledger records to ensure tax compliance and investor protection.

What Are Fractional Property Investing Platforms?

Fractional property investing platforms slice expensive buildings into small shares. They use blockchain technology and smart contracts to secure title deeds with the Dubai Land Department.

Investors start with as little as AED 5,000 to own a slice of Downtown Dubai condos or Jumeirah Village properties. Fintech platforms let people mix real estate investment with stock market habits, for smoother risk assessment.

These online hubs open doors to high-value properties, from office towers to luxury hotels, without massive capital. Users enjoy shared service charges and rental income, while diversifying a portfolio with alternative assets like private equity or bonds.

Regulators in the UAE add a layer of tax compliance and escrow accounts to shield foreign investors. Fractional ownership shakes up traditional real estate investing, giving beginners and pros alike a new playground.

Key Benefits of Fractional Property Investing

Digital apps use distributed ledger tech and self-executing agreements to slice a $1 million property into bite-sized shares anyone can snag for a few hundred dollars. That move unlocks premium real estate, churns out passive streams, and spreads risk across multiple holdings.

Lower Entry Barriers for Investors

Investors can buy a slice of a high-value tower in Downtown Dubai for just AED 5,000. A fintech platform issues fractional shares, so you own part of a property alongside others. You can snag a piece of that tower without breaking the bank.

Property developers register each deal with the Dubai Land Department to keep things above board. This model cuts capital requirements to match most budgets. Younger investors and private equity firms can tap Dubai real estate with lower risk.

Portfolio diversification grows easier with small stakes in multiple assets.

Platforms use blockchain technology and smart contracts to speed up deals, slash fees, and boost transparency. A user logs into a platform, picks a spot, and signs with an eID. Fintech companies trim management fees and simplify exit strategy steps.

Investors pair real estate investments with mutual funds or stocks to spread risk. Fractional ownership opens doors that once stayed closed.

Portfolio Diversification

Fractional platforms revolutionize how you spread risk across multiple properties. The hybrid model merges residential growth with flexible investing practices. That approach cuts needed capital down to AED 5,000 in Dubai.

It opens doors to high-value commercial assets that were once out of reach. Buyers secure shares alongside others, so you join a larger pool of co-owners. You build a diversified portfolio, gaining exposure to condos, offices, and retail units.

Distributed ledger tech and automated agreements run many sites. Fintech platforms track your fractional shares in real time, with clear dashboards. Younger investors choose this route to blend passive income from rents with capital appreciation.

Real estate investing goes hands-off, like a digital real estate fund. A growing market in India shows rising demand for co-ownership options.

Shared Maintenance Costs

Owners of fractional shares pay small maintenance fees alongside other investors. Even with a minimum AED 5,000 stake in a UAE mixed-use complex, each investor covers a tiny portion of upkeep expenses.

Fintech platforms collect funds, apply them to plumbing fixes, landscaping tasks, or cleaning services. Each co-owner sees clear billing records through a user-friendly dashboard.

Smart contracts on a blockchain ledger automate these payments, boosting transparency and cutting delays. Dubai Land Department regulations guide fee structures under regulatory compliance.

Investors track maintenance outlays in real time, thanks to big data analytics and artificial intelligence tools.

Technology Driving the Growth of Fractional Investing

Mobile apps tap Ethereum ledgers and self-executing pacts to open tiny property stakes—read on to see how this tech fuels growth!

Blockchain and Smart Contracts

Blockchain technology logs each share on a distributed ledger. Smart contracts automate rental payments, sale triggers, and dividend payouts without manual oversight. Fractional ownership platforms then store property shares as digital tokens on public chains.

They cut capital needs, turning high value buildings into small tradable slices.

In Dubai, a slice may start at AED 5,000 under DLD rules. Regulators confirm title transfers to meet regulatory compliance. Tokenization on Hyperledger Fabric uses coded agreements to split capital gains and dividends.

It speeds exit strategies, and it broadens portfolio diversification for all investors.

User-Friendly Platforms

A slick mobile app lets novices tap into real estate investments, even high-value commercial property, with just AED 5,000 per fractional share. Clean menus show charts on property valuation, capital appreciation, and maintenance costs, making complex data look simple.

Smart contracts, built on blockchain technology, lock in rules and fees, cutting out middlemen. A built-in ROI calculator uses historical trends, and a digital wallet handles each purchase in seconds.

The interface feels like ordering pizza, only the slices yield rental returns. Chatbots guide you through KYC, linking a digital wallet, and securing fractional ownership in Dubai, Abu Dhabi, or India.

Modern fintech platforms bundle analytics, management fee breakdowns, and performance charts to tame market volatility. Each action writes to a secure ledger, giving full transparency and real-time updates on portfolio diversification.

Risks and Challenges of Fractional Property Investing

Regulatory compliance and wild price swings can trip you up fast, so you need airtight smart contracts and a clear exit plan—read on.

Legal and Regulatory Considerations

Platforms that offer fractional ownership must register shares under securities rules. They file with the Securities and Exchange Commission (SEC) and report trades. Regulators demand clear disclosures on fees, management fees, capital gains tax rules.

Smart contracts on blockchain technology record each fractional share in real time. Investors read offering documents, do due diligence on fintech platforms before they invest.

Dubai real estate regulators require registration with Dubai Land Department (DLD) and Jafza. Platform listings include high-value properties at a minimum investment of AED 5,000 per share.

The United Arab Emirates (UAE) applies no capital gains tax on sold fractions. Fractional share records use digital ledgers to speed up exit strategy steps. Investors check regulatory compliance, note management fees, compare portfolios for diversification.

Market Volatility

Property values hit peaks and valleys like ocean waves. Investors face market volatility as prices swing. Fractional shares let you tap into Dubai real estate with just AED5,000, so you dodge big price shocks.

Blockchain tech and smart contracts power these trades, speeding deals and cutting delays. You build a diversified portfolio across Downtown Dubai offices and Indian apartments. This approach aligns with your risk tolerance, so rough markets feel less brutal.

You also use dollar-cost averaging to snag more asset slices when prices dip. This tactic puts volatility to work for you, not against you.

Future Trends in Fractional Property Investing

Fintech platforms will tap AI to track market volatility and forecast capital appreciation. Blockchain technology will secure smart contracts, link to digital wallets, and speed up exit strategies.

Investors in mobile apps will buy fractional shares, blend asset classes, and aim for portfolio diversification.

Dubai Land Department rolled out plans for AED 5,000 minimum stakes in downtown Dubai projects. India will update rules to boost regulatory compliance and guard investors. Younger investors and venture capital firms will access high-value properties and private equity options with this model.

Takeaways

Fractional ownership has shaken up how people join premium assets. Platforms use distributed ledgers; they run with smart contracts to keep deals clear. Investors pool small sums and chase capital growth without sky-high entry costs.

Dubai real estate tastes this change too, with local registry rules that protect each share. Many younger buyers grab tax-efficient accounts and watch their diversified portfolios grow.

This move shows real estate investing can fit any budget, and the road ahead looks exciting.

FAQs on Rise of Fractional Property Investing Platforms

1. What is fractional property investing?

It lets you buy slices of high-value properties, you get fractional ownership in the underlying asset. Fintech platforms use pools of funds, so you can own a piece of the pie, without a giant down payment. It’s real estate investing on a small scale, like a taste test, before you order the whole cake.

2. How do blockchain technology and smart contracts work on these platforms?

They log each share sale on a chain of blocks, so the record stays clear, and nobody can tamper with it. Smart contracts lock in terms, they run themselves once you meet the rules. That cuts middlemen, speeds up deals, and trims risk.

3. How can I diversify my investments on these platforms?

You can build a diversified portfolio, mix real estate slices, digital coins, non-public capital and property funds. Tools for investment analysis and portfolio management help you balance each part, tame market volatility, and avoid putting all your eggs in one basket.

4. What fees and exit strategy should I watch for?

Look out for management fees, some charge a flat rate, others take a share of your gains. Check if there’s a fee when you cash out. Plan your exit strategy early, you might resell your fractional shares on a secondary market or sell back to the platform.

5. Can younger investors start with small sums and plan their financial future?

Yes, many platforms set low entry limits for younger investors, so you can dip your toe without sinking your whole savings. They link to savings plans, offer tools for financial planning, even guide you step by step.

6. How do I invest in Dubai real estate with full regulatory compliance and gain capital appreciation?

Choose platforms licensed by the land authority, they follow strict rules, they file each deal with the office. You get access to Gulf real estate, from urban core apartments to beachfront plots. As the market grows, you could see capital appreciation, all while staying on the right side of the law.