Owning pricey digital assets like CryptoPunks or Bored Ape NFTs feels out of reach for most people. With some selling for over $100,000, these high-value tokens are often reserved for the super-rich or early adopters.

This leaves everyday investors wondering if they’ll ever get a slice of this booming market.

Here’s the good news: fractionalized NFTs are changing that. By splitting one NFT into smaller portions, they make it affordable to own pieces of expensive art, real estate, and even virtual items.

In this blog post, you’ll learn how fractional ownership works and why it’s breaking down barriers in investing.

Ready to find out how? Keep reading!

The Concept of Fractional Ownership in NFTs

Fractional ownership in NFTs breaks high-value assets into smaller, affordable pieces. Blockchain and smart contracts make this process simple and secure.

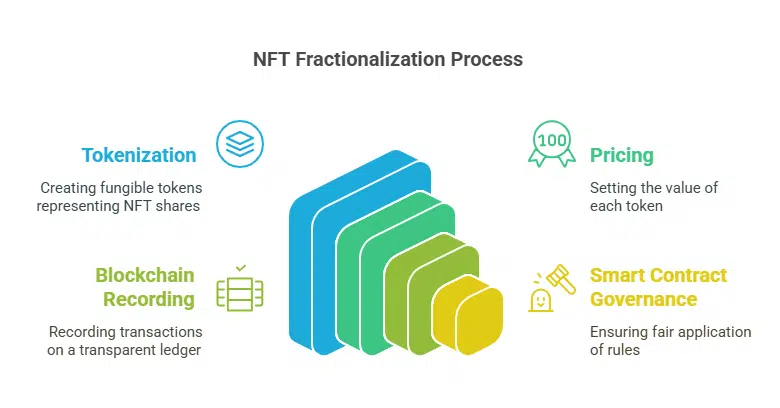

How fractionalization works in NFTs

NFT fractionalization breaks a digital asset into smaller portions called fungible tokens. These tokens, often compliant with ERC-20 standards, represent shares in the NFT’s ownership.

Owners can set the total number of tokens and their price during tokenization. For example, a $1 million artwork can be split into 1,000 pieces worth $1,000 each.

Blockchain technology guarantees transparency by recording all transactions on distributed ledgers. Smart contracts govern the process automatically, ensuring rules like voting rights or profit sharing are applied fairly among stakeholders.

This system transforms illiquid assets into more tradable ones, opening doors for smaller investors to claim stakes in high-value NFTs without buying them outright.

Key technologies enabling fractionalized NFTs

Smart contracts play a key role in fractionalized NFTs. They automate splitting ownership into smaller shares, often using Ethereum’s ERC-20 tokens. These contracts handle transactions, manage royalty payments, and allow secure transfers without middlemen.

Everything runs efficiently on blockchain networks.

Blockchain technology keeps records transparent and tamper-proof. It tracks every share of the digital token so owners can verify their holdings anytime. Decentralized exchanges (DEXs) enable trading these fractions with ease, boosting NFT liquidity across markets like art or gaming assets.

Benefits of Fractionalized NFTs

Fractionalized NFTs let everyday people invest in assets once reserved for the wealthiest. They also breathe new life into markets, making trading faster and smoother.

Accessibility to high-value assets

A $100,000 NFT can be split into 1,000 shares at $100 each. This allows more people to invest without needing huge amounts of money. Fractional ownership turns rare digital assets, like high-value NFTs or even real estate tokens, into something everyone can afford.

Physical assets like diamonds and property also benefit from this approach. Digital tokens let investors own a share of these expensive items through fractionalized platforms. Blockchain technology tracks ownership securely, boosting trust in shared investments.

Enhanced market liquidity

Fractionalized NFTs help owners sell their digital assets faster. Instead of waiting for one buyer to purchase a $1 million NFT, they can sell smaller fractions to multiple investors.

This reduces long holding periods and makes trading quicker.

Investors also benefit from easier exits in secondary markets. Fractional tokens are simpler to trade and attract more buyers, boosting nft liquidity. Platforms like fractional.art allow these trades seamlessly, improving market activity and accessibility.

Democratization of ownership

People can now own a piece of expensive digital artwork or rare NFT collections without needing millions. Fractionalized NFTs break high-value assets into smaller, affordable shares.

This process allows more individuals to invest with minimal funds, making ownership accessible across various income levels. For example, platforms like Fractional.art enable users to buy fractions of an NFT using ERC-20 tokens.

Shared ownership fosters community engagement among investors. Each stakeholder gains a sense of belonging while participating in decision-making through DAOs (decentralized autonomous organizations).

Whether it’s voting rights for asset management or influencing future strategies, fractionalization spreads power evenly instead of concentrating it at the top.

Price discovery for rare assets

Fractionalized NFTs simplify price discovery for rare assets. By allowing multiple investors to trade fractional tokens, the market decides the value collectively. This constant trading activity reveals a more accurate valuation of the original non-fungible token (NFT).

Rare digital artwork or high-value NFTs benefit greatly from this process. Increased NFT liquidity ensures easier buying and selling, making it simple to track demand. Fractional ownership also opens secondary markets, attracting more buyers with smaller budgets.

Applications of Fractionalized NFTs

Fractionalized NFTs are shaking up industries, making digital art, real estate, and gaming assets more accessible—discover how this reshapes ownership next!

Digital art and collectibles

Digital art and collectibles can now be shared, thanks to fractional NFTs. These digital assets let multiple people own shares of high-value artwork or rare items. For example, the Doge meme NFT was divided into 17 billion tokens called $DOG.

This split allowed more buyers to participate in owning a piece of its value.

By splitting ownership, NFT marketplaces create access for small investors. Blockchain technology secures each share, tracking who owns what without confusion. This method also boosts liquidity since smaller pieces are easier to trade than whole digital artworks or collectibles.

Real estate tokenization

Real estate tokenization breaks a property into smaller, tradable digital tokens. These digital assets represent fractional ownership of the property. Developers use blockchain technology to convert property ownership rights into NFTs (non-fungible tokens).

This allows multiple investors to share high-value properties like luxury homes or commercial buildings.

Fractional NFTs lower investment barriers. Instead of needing large capital, investors can buy small portions for as little as $100 in some cases. It attracts diverse participants, from everyday people to institutional players, making the market more inclusive.

Investors gain exposure to physical asset performance while enjoying liquidity through NFT marketplaces or secondary markets built on platforms like Binance Smart Chain.

Gaming and virtual assets

Gaming uses fractionalized NFTs to change how players own digital assets. These NFTs split expensive items, like rare skins or weapons, into smaller shares. This lets more players buy a part of high-value items without spending a fortune.

Platforms such as NFTX and Fractional.art simplify this process, giving gamers easy access to shared ownership.

Fractional investing also boosts the gaming economy’s liquidity. Players can trade their shares on secondary markets or hold them for potential growth. It gives small investors a chance to participate while developers enjoy increased engagement in their games.

Challenges and Limitations of Fractionalized NFTs

Handling legal hurdles can be a thorny issue, often causing delays and confusion. Fraud risks also linger, making security a vital concern for platforms and investors alike.

Legal and regulatory concerns

SEC scrutiny has raised alarms about fractional NFTs being classified as unregistered securities. This could expose platforms and creators to legal risks. U.S. laws demand strict compliance, especially when investments involve shared ownership or governance rights.

Taxation on NFT trading is another gray area. Many countries lack clear rules for digital tokens, leaving investors unsure of their obligations. Regulatory gaps create uncertainties, making caution essential in secondary markets and DAO activities tied to fractionalized NFTs.

Security and fraud risks

Scammers often exploit fractionalized NFTs to dupe buyers. Fake tokens linked to nonexistent digital assets can trick even seasoned investors. In 2021 alone, NFT frauds cost users billions of dollars.

Common scams include wash trading, where bad actors inflate prices using fake trades; rug pulls, where projects vanish with funds; and phishing attacks that steal crypto wallet details.

The absence of strict rules makes this space a breeding ground for fraudsters. Without clear regulatory guidance, these risks grow larger daily. Smart contracts, while powerful tools in blockchain technology, can carry vulnerabilities if not coded properly.

A single error could lead to token flaws or open doors for hackers. Investors must stay cautious and triple-check asset authenticity before any purchase or trading activity on NFT marketplaces like OpenSea or Fractional.art.

Potential for market manipulation

The NFT space lacks strict rules, making it easy for bad actors to twist prices. Prices often rise due to hype or FOMO, not real value. This makes fractionalized NFTs risky, as their worth can depend on market sentiment rather than the underlying asset’s value.

Without regulatory oversight, fake bids and insider trading can thrive. Manipulated valuations harm investors looking for fair deals in secondary markets. For example, inflated ERC-20 tokens within fractional NFT platforms could mislead buyers into overpaying.

The Role of Blockchain in Fractionalized NFTs

Blockchain acts as the backbone for fractional NFTs, making processes fast and reliable. It builds a system where transactions are clear and easy to track.

Ensuring transparency and trust

Smart contracts handle fractional NFT ownership with precision. They automate tasks like dividing profits and managing shared rights, leaving no room for confusion. Blockchain technology records every transaction on an unchangeable ledger.

This keeps all deals clear and open for everyone to see.

Digital assets gain trust through this setup. Shared ownership is backed by transparent processes, minimizing fraud risks. Investors can verify details without relying on a central authority or middleman—just the blockchain itself enforcing fairness.

Facilitating secure transactions

Blockchain technology locks in security for fractionalized NFTs. It allows transparent tracking of digital tokens, so ownership stays clear and tamper-proof. Smart contracts handle the buying and selling process, making it almost impossible for fraud to slip through.

Each transaction is verified on the blockchain before approval, keeping shareowners safe.

Fractional investing benefits from this tech by letting multiple people co-own assets without losing their rights. ERC-20 tokens divide high-value NFTs into smaller shares while securing them under decentralized finance (DeFi) systems.

This setup reduces risks like double-spending or data alteration during nft trading or secondary market deals.

Market Trends and Future Predictions

Interest in fractionalized NFTs is growing, with industries exploring their potential. Platforms are expanding features to attract more users and offer better tools for shared ownership.

Growing adoption of fractionalized NFTs in industries

Industries are embracing fractionalized NFTs at a rapid pace. Digital art and gaming lead the charge, making high-value assets more accessible to everyday investors. Platforms like Fractional.art allow users to buy small portions of costly NFTs using blockchain technology.

Even real estate is turning physical properties into digital tokens, opening doors for fractional ownership.

Businesses benefit from enhanced market liquidity and broader investor participation. Smaller investments reduce financial barriers, letting people diversify portfolios without owning entire assets.

This trend also fosters price discovery in secondary markets while promoting community engagement through shared ownership models like DAOs.

Evolution of platforms supporting fractional ownership

Platforms like Fractional.art and NIFTEX are paving the way for fractional NFT ownership. They allow users to split high-value NFTs into smaller, tradable tokens using blockchain technology.

ERC-20 tokens often represent these fractions, making them easy to trade on secondary markets.

New integrations with DeFi tools are boosting this model further. Features such as yield farming and governance rights give users added perks alongside shared ownership. These platforms also promote liquidity, letting investors buy or sell their digital assets faster than before.

Takeaways

Fractionalized NFTs are rewriting the rules of investment. They make expensive digital assets affordable and boost market activity. This shift gives more people access to high-value items once out of reach.

Blockchain technology ensures security, simplicity, and transparency in this process. Start exploring fractional ownership today—it’s a step toward smarter investing!