In today’s rapidly evolving financial landscape, regulatory compliance is becoming increasingly complex and resource-intensive. Financial institutions are tasked with managing an ever-growing range of regulatory requirements, from Anti-Money Laundering (AML) and Know Your Customer (KYC) to data privacy laws like the General Data Protection Regulation (GDPR).

Traditional compliance methods often involve manual processes, extensive paperwork, and costly penalties for non-compliance. Thankfully, RegTech Solutions Transforming Compliance are stepping in to change the game.

RegTech—short for Regulatory Technology—refers to the application of technology to streamline and automate the compliance process. Using cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), blockchain, and cloud computing, RegTech solutions are helping financial institutions reduce compliance costs, improve efficiency, and minimize risk. As more institutions adopt these solutions, it’s clear that RegTech is playing an essential role in shaping the future of financial compliance.

This article delves into 10 powerful RegTech Solutions Transforming Compliance for financial institutions, offering a comprehensive overview of each, their features, benefits, challenges, and real-world examples. By the end, you’ll have a deep understanding of how these solutions are reshaping the financial services industry.

Introduction to RegTech in Financial Compliance

At its core, RegTech Solutions Transforming Compliance involve the use of technology to facilitate regulatory compliance in a more efficient, cost-effective, and automated manner. Instead of relying on traditional manual processes, RegTech utilizes advanced tools such as artificial intelligence (AI), big data, cloud computing, and blockchain to simplify complex compliance tasks.

These solutions allow financial institutions to automate regulatory reporting, monitor transactions in real-time, assess risks, and manage data privacy—all while ensuring strict adherence to regulations like AML, KYC, and GDPR. By reducing human error and increasing transparency, RegTech helps institutions meet regulatory obligations more effectively and at a lower cost.

Why Financial Institutions Need RegTech

The financial industry is no stranger to evolving regulations. Every year, new rules are introduced, and existing ones are updated, making it challenging for institutions to stay compliant. RegTech Solutions Transforming Compliance are essential for overcoming these challenges. Here’s why:

- Reducing Operational Costs: RegTech automates manual processes, saving both time and money. Institutions no longer need to employ large teams to handle repetitive compliance tasks like transaction monitoring and regulatory reporting.

- Improved Risk Management: With the help of AI and machine learning, RegTech solutions offer deeper insights into financial transactions, helping institutions spot potential risks before they escalate.

- Faster Adaptation to Regulatory Changes: As regulatory landscapes evolve, RegTech ensures that financial institutions stay compliant by updating compliance frameworks in real time.

Key RegTech Solutions Enhancing Compliance

As financial institutions face growing pressures to adhere to evolving regulatory standards, RegTech Solutions Transforming Compliance are becoming integral to their operations. These technologies streamline complex regulatory processes, allowing financial institutions to manage compliance risks more effectively and efficiently.

By adopting these innovative tools, institutions can improve accuracy, reduce operational costs, and stay ahead of regulatory changes. Let’s explore the key RegTech Solutions Transforming Compliance that are currently reshaping the industry.

1. Anti-Money Laundering (AML) Software

Anti-money laundering (AML) compliance is one of the most pressing concerns for financial institutions. Traditional AML processes often rely heavily on manual checks and investigations, which are both time-consuming and error-prone. RegTech Solutions Transforming Compliance have significantly streamlined AML procedures, automating the monitoring, detection, and reporting of suspicious activities.

AML software is powered by AI and machine learning algorithms that analyze financial transactions in real-time, flagging any unusual behavior that might indicate money laundering or fraud. This provides financial institutions with faster and more accurate detection, reducing the risk of costly fines for non-compliance.

| Key Features | Description |

| Real-Time Monitoring | AML systems monitor transactions in real-time, identifying suspicious patterns. |

| Risk Profiling | AI creates risk profiles for customers based on transaction history and behavior. |

| Automated Alerts | Flags suspicious transactions automatically, reducing human error. |

Example:

One notable example is the use of AML software by HSBC, which implemented AI-powered tools to monitor transactions across global markets. As a result, the bank reduced its detection time for suspicious activities, significantly lowering its exposure to financial crime.

2. KYC (Know Your Customer) Automation

KYC regulations require financial institutions to verify the identities of their customers before establishing a business relationship. Traditional KYC processes often involve long onboarding procedures, manual document checks, and a high potential for errors. With RegTech Solutions Transforming Compliance, institutions can automate the entire KYC process, reducing the time and effort involved.

These solutions use AI and facial recognition technology to verify identity documents and ensure that customer information is accurate. They also integrate with global databases to check for blacklisted individuals or entities.

| Key Features | Description |

| Automated Identity Verification | AI tools verify customer identities using biometric data and documents. |

| Global Database Integration | Cross-checks customer data with international sanction lists and PEP databases. |

| Frictionless Onboarding | Reduces onboarding time by automating identity verification and data collection. |

Example:

A great example is Onfido, a leading KYC automation company that helps organizations like Revolut and Monzo quickly onboard customers. By utilizing AI and machine learning, Onfido automates identity verification and enhances the customer experience, reducing friction during the KYC process.

3. Regulatory Reporting Platforms

Regulatory reporting is often a daunting task for financial institutions due to the complexity and frequency of required filings. With multiple regulators, each with their own specific requirements, meeting deadlines and maintaining accuracy can be a challenge. RegTech Solutions Transforming Compliance simplify this process by automating data collection, validation, and submission.

These platforms aggregate data from various sources, ensuring that financial institutions can generate accurate reports quickly. They also help institutions stay compliant by automatically adjusting to changes in reporting requirements and regulatory frameworks.

| Key Features | Description |

| Automated Data Collection | Pulls relevant data from internal systems to create reports efficiently. |

| Real-Time Reporting | Generates reports in real-time, ensuring timely submission. |

| Compliance Frameworks | Adapts to changing regulatory requirements, ensuring accurate reporting. |

Example:

For instance, AxiomSL provides a regulatory reporting platform that supports financial institutions in over 40 jurisdictions. Their platform helps firms comply with requirements for multiple regulators by automating the entire reporting process, ensuring accuracy and efficiency.

4. Risk Management Tools

Managing risk is a fundamental aspect of financial compliance. RegTech Solutions Transforming Compliance equip financial institutions with advanced risk management tools, using AI and data analytics to identify and assess potential risks in real-time. By automating risk assessments, these tools allow institutions to focus on high-risk areas and make data-driven decisions.

| Key Features | Description |

| Real-Time Risk Assessment | Identifies and assesses potential risks as they occur, enabling faster mitigation. |

| Predictive Analytics | Uses historical data to predict future risks, helping institutions plan accordingly. |

| Fraud Detection | AI detects fraud patterns and alerts compliance teams in real-time. |

Example:

FIS offers risk management solutions that use AI and machine learning to predict potential credit and market risks. Their tools help institutions improve decision-making by analyzing large volumes of data quickly and accurately.

5. Transaction Monitoring Systems

Transaction monitoring is a critical element of financial compliance, particularly in detecting fraudulent activities. Traditional systems often rely on rule-based logic, which can lead to a high volume of false positives. RegTech Solutions Transforming Compliance use AI and machine learning to monitor transactions more accurately, reducing false positives and improving detection capabilities.

| Key Features | Description |

| Real-Time Monitoring | Monitors transactions as they occur, providing real-time alerts. |

| AI and Machine Learning | Continuously learns from new data, improving fraud detection over time. |

| Customizable Risk Settings | Institutions can tailor monitoring thresholds based on their risk profile. |

Example:

One key player in this space is Actimize, a provider of AI-powered transaction monitoring solutions. Their platform uses machine learning to analyze transactions and detect suspicious activities, enabling financial institutions to act faster and with more accuracy.

6. Data Privacy and Protection Solutions

With the rise of data privacy regulations like GDPR and CCPA, ensuring that sensitive customer data is protected has never been more important. RegTech Solutions Transforming Compliance assist financial institutions in safeguarding personal data by automating compliance with these regulations.

From data encryption and secure storage to access control and audit logging, these tools provide a comprehensive solution for managing and protecting sensitive information.

| Key Features | Description |

| Data Encryption | Ensures sensitive data is encrypted both in transit and at rest. |

| Access Control | Limits access to sensitive data to authorized personnel only. |

| Audit Logging | Keeps detailed records of data access for auditing and compliance purposes. |

Example:

OneTrust offers a data privacy and protection platform that helps organizations comply with GDPR, CCPA, and other privacy laws. The platform automates data mapping, risk assessments, and breach notifications, ensuring institutions remain compliant with data protection laws.

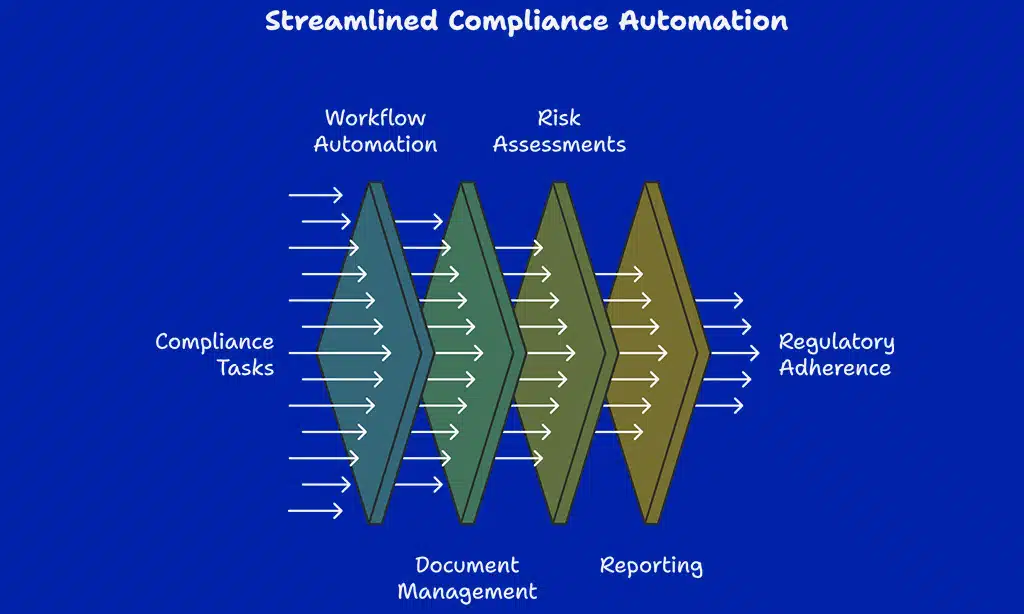

7. Compliance Automation Platforms

Automating compliance tasks can significantly reduce the time and effort needed to ensure regulatory adherence. RegTech Solutions Transforming Compliance use automation to handle repetitive compliance processes such as document management, risk assessments, and reporting.

| Key Features | Description |

| Workflow Automation | Automates the entire compliance workflow, from documentation to risk analysis. |

| Document Management | Automatically collects, verifies, and stores compliance-related documents. |

| Audit Trails | Keeps a detailed record of all compliance actions for future reference. |

Example:

ComplyAdvantage offers an AI-powered platform that automates AML screening, KYC checks, and regulatory reporting. This automation has helped banks and fintechs reduce manual efforts and focus on more strategic compliance activities.

8. Blockchain for Secure Compliance

Blockchain’s ability to create immutable records makes it a powerful tool for enhancing compliance, particularly in areas like transaction tracking and auditing. RegTech Solutions Transforming Compliance leverage blockchain technology to create secure, transparent, and verifiable records that can’t be tampered with.

| Key Features | Description |

| Immutable Records | Ensures that all compliance-related data is tamper-proof and verifiable. |

| Smart Contracts | Automates regulatory processes using pre-set rules executed on the blockchain. |

| Enhanced Transparency | Provides full transparency of all transactions, reducing the risk of fraud. |

Example:

Deloitte has implemented blockchain solutions to enhance compliance in financial institutions. By using blockchain to create an immutable record of transactions, the firm ensures that compliance processes are more secure, transparent, and efficient.

9. Cloud-Based Compliance Management

Cloud technology offers scalable, cost-effective solutions for managing compliance across multiple jurisdictions. RegTech Solutions Transforming Compliance use the cloud to provide real-time access to compliance data and enable cross-team collaboration.

| Key Features | Description |

| Scalability | Cloud-based systems can easily scale to meet the growing needs of financial institutions. |

| Collaboration | Enables teams to collaborate across different locations and devices. |

| Cost Efficiency | Reduces infrastructure and maintenance costs associated with on-premise solutions. |

Example:

Salesforce provides cloud-based compliance tools that enable financial institutions to streamline their compliance processes. Their platform offers scalable solutions that integrate compliance management with other customer relationship management (CRM) systems.

10. AI-Powered Compliance Solutions

AI is transforming every aspect of financial services, and compliance is no exception. RegTech Solutions Transforming Compliance use AI to automate decision-making, analyze large datasets, and predict future risks, helping institutions stay ahead of regulatory challenges.

| Key Features | Description |

| Predictive Analytics | Uses AI to predict future compliance risks based on historical data. |

| Natural Language Processing (NLP) | Analyzes regulatory documents and updates compliance frameworks accordingly. |

| Automated Decision Making | AI makes real-time compliance decisions based on predefined criteria. |

Example:

Darktrace uses AI to monitor and protect organizations against cyber threats, including those related to compliance breaches. The platform uses machine learning to adapt to evolving threats and identify vulnerabilities in real time.

Wrap Up

The RegTech Solutions Transforming Compliance are reshaping the financial services industry by providing automated, efficient, and cost-effective compliance tools. These solutions are helping financial institutions meet regulatory requirements with greater accuracy, reduce operational costs, and enhance risk management strategies.

As regulatory landscapes continue to evolve, the role of RegTech in ensuring compliance will only grow more crucial.

By adopting these cutting-edge technologies, financial institutions can stay ahead of the curve, mitigate risks, and avoid costly fines. The future of financial compliance is here, and it is powered by RegTech.