Financial inclusion has long been a challenge, especially for the unbanked and underbanked populations. Traditional banking systems often fail to reach remote communities due to high operational costs, stringent requirements, and a lack of physical infrastructure.

However, the rise of digital banking has changed the landscape, making financial services more accessible, affordable, and efficient for people across the globe.

Digital banking leverages technology such as mobile apps, artificial intelligence (AI), and blockchain to offer seamless financial solutions to those previously excluded. It bridges the financial gap by eliminating geographical and economic barriers, empowering individuals with better financial opportunities.

This article explores the 7 Reasons Why Digital Banking Is Redefining Financial Inclusion and how emerging technologies are revolutionizing the financial industry. Whether it’s mobile banking, AI-driven credit scoring, or blockchain innovations, digital banking is bridging the financial gap and empowering millions with economic opportunities.

Understanding Financial Inclusion in the Digital Age

Financial inclusion refers to providing individuals and businesses with access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit, and insurance—delivered in a responsible and sustainable way. The World Bank estimates that around 1.4 billion adults globally remain unbanked, with most residing in developing economies.

Traditional Banking Barriers vs. Digital Banking Solutions:

| Traditional Banking Barriers | Digital Banking Solutions |

| High operational costs | Low-cost digital services |

| Limited physical infrastructure | Mobile and online banking accessibility |

| Strict documentation requirements | AI-powered alternative credit scoring |

| Exclusion of low-income individuals | Affordable microfinance and digital lending |

7 Reasons Why Digital Banking Is Redefining Financial Inclusion

Digital banking has become a game-changer in the financial sector, addressing long-standing barriers to financial inclusion.

By leveraging advanced technologies and innovative solutions, it enables people worldwide to access banking services with ease, regardless of location or income level. The following key reasons illustrate how digital banking is transforming financial accessibility and creating a more inclusive economy.

1. Accessibility to Banking Services for the Unbanked

One of the primary reasons why digital banking is redefining financial inclusion is its ability to reach populations previously excluded from traditional banking systems. Mobile banking apps, fintech startups, and digital wallets have transformed how people access and manage their finances.

Digital banking eliminates the need for physical bank branches, allowing individuals to open accounts, send and receive money, and apply for loans using their smartphones.

Key Benefits:

- Digital banking enables remote account openings with minimal documentation.

- Mobile banking allows access to financial services from anywhere.

- E-wallets like PayPal, Venmo, and M-Pesa offer alternative banking solutions.

- Access to banking services in rural and underserved areas.

Case Study: M-Pesa, a mobile money transfer service in Kenya, has successfully enabled millions of unbanked individuals to participate in the financial ecosystem. By providing easy access to banking services through mobile phones, M-Pesa has significantly boosted financial inclusion in Africa.

2. Lower Transaction Costs and Fees

Traditional banks often charge high fees for transactions, account maintenance, and remittances. In contrast, digital banking solutions significantly reduce costs, making financial services more affordable. By leveraging digital technology, banks and fintech companies can operate with minimal overhead and pass these savings on to customers.

How Digital Banking Lowers Costs:

| Cost Factor | Traditional Banking | Digital Banking |

| Account Maintenance | High monthly fees | Low or zero fees |

| Money Transfers | Expensive wire transfers | Instant, low-cost P2P payments |

| Loan Processing | Lengthy approval process with fees | AI-driven instant approvals |

Example: Neobanks like Revolut and N26 offer fee-free international transactions, making banking affordable for users who frequently transfer money across borders.

3. Enhanced Security and Fraud Prevention

Security has been a concern in banking, but digital banking has integrated advanced security measures to protect users from fraud and cyber threats. By using cutting-edge technology such as AI and blockchain, financial institutions can detect and prevent fraudulent activities in real time.

Security Features of Digital Banking:

| Security Measure | Description |

| AI-driven fraud detection | Real-time monitoring of transactions to detect anomalies |

| Blockchain encryption | Secure, tamper-proof transaction records |

| Biometric authentication | Fingerprint, facial recognition, and voice verification |

| Multi-factor authentication (MFA) | Enhances account security with OTPs and authentication apps |

Case Study: Many banks now use AI-driven fraud detection systems to analyze transaction patterns and flag suspicious activities, reducing fraud rates significantly.

4. Faster and More Convenient Transactions

Speed and convenience are among the top reasons why digital banking is redefining financial inclusion. With just a few taps, users can transfer money, pay bills, or apply for loans without visiting a physical bank.

Examples of Convenience in Digital Banking:

| Feature | Benefit |

| Instant transfers | Enables real-time payments and remittances |

| Automated bill payments | Ensures timely utility and subscription payments |

| 24/7 banking access | Allows transactions outside traditional banking hours |

Example: Services like Zelle and PayPal enable instant money transfers, making transactions faster and more accessible.

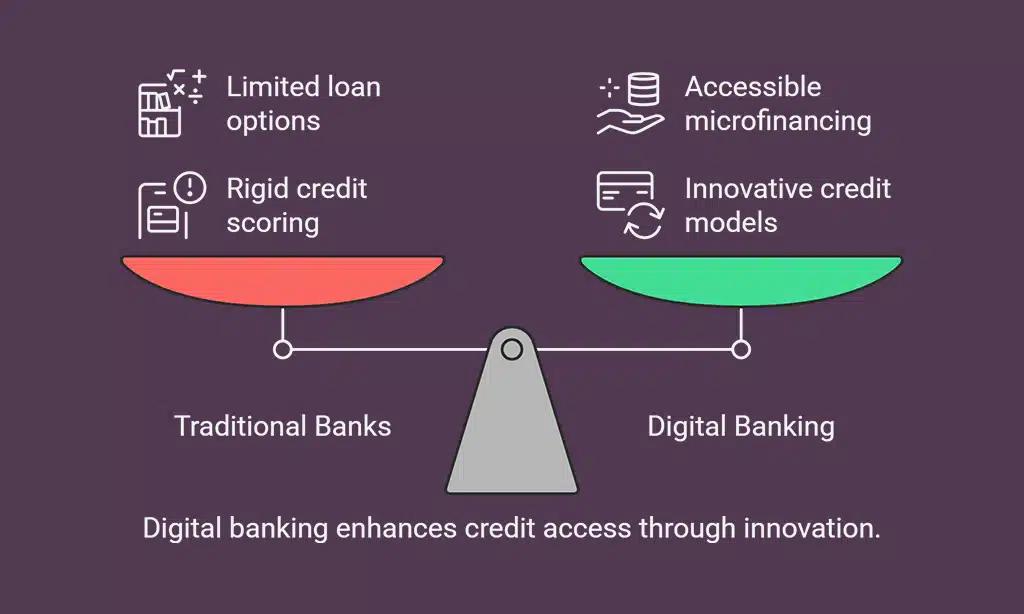

5. Credit Accessibility and Microfinancing Opportunities

Lack of credit history often prevents individuals from securing loans through traditional banks. Digital banking has introduced innovative credit scoring models to solve this issue.

How Digital Banking Expands Credit Access:

| Method | Impact |

| AI-driven credit scoring | Evaluates alternative financial behaviors to determine creditworthiness |

| Microfinance platforms | Provides small loans to individuals with no credit history |

Example: Fintech platforms like Tala use smartphone data to assess creditworthiness, enabling loans for individuals without a traditional credit score.

6. Personalized Financial Management Tools

With AI-powered budgeting tools, digital banking helps users make smarter financial decisions. These tools analyze spending patterns, suggest savings opportunities, and provide real-time financial insights, enabling users to take full control of their money.

Popular Financial Management Features:

| Feature | Benefit |

| Automated Savings Plans | Helps users save money automatically |

| AI-Driven Budgeting | Provides personalized spending insights |

| Investment Guidance | Suggests smart investment strategies |

| Expense Tracking | Categorizes transactions for better financial control |

Example: Digital banking platforms like Mint and YNAB (You Need a Budget) use AI to help users monitor spending, set financial goals, and optimize their savings habits.

7. Integration with Emerging Technologies (AI, Blockchain, Fintech)

The future of financial inclusion is deeply connected to emerging technologies. AI, blockchain, and decentralized finance (DeFi) are playing crucial roles in making banking services more efficient and accessible. These innovations help create a more secure and transparent financial system.

Technology Innovations Driving Financial Inclusion:

| Technology | Impact |

| AI | Automated risk assessment and fraud prevention |

| Blockchain | Secure, decentralized transactions for cross-border payments |

| Fintech Apps | Collaboration with digital banks for inclusive financial solutions |

| DeFi | Decentralized platforms that offer financial services without intermediaries |

Case Study: Companies like Ripple and Stellar are using blockchain to facilitate low-cost cross-border payments, allowing unbanked individuals to participate in global finance.

Takeaways

Digital banking is revolutionizing financial inclusion by providing affordable, accessible, and secure financial services to the unbanked and underbanked.

The 7 Reasons Why Digital Banking Is Redefining Financial Inclusion highlight how technology is reshaping the global financial landscape.

By embracing digital banking, individuals worldwide can achieve greater financial empowerment, stability, and growth—ushering in a new era of global financial inclusion.

The continuous advancement of AI, blockchain, and fintech will further expand opportunities for financial participation.