Hey there, are you feeling the pinch of property taxes on your home? It’s a common headache for many homeowners, especially when those bills seem to creep up year after year, even after you’ve paid off your mortgage.

Let me share a quick fact: property taxes are based on the value of your place, and they often go up over time. That’s right, the more your home is worth, the more you might owe.

In this blog, we’ll break down 8 key things about real estate taxes, including how they’re figured out and tips to possibly lower your bill. We’ll even touch on related costs like sales tax and income taxes.

Stick around!

Key Takeaways

- Property taxes are based on your home’s value and can increase up to 2% each year in California under Proposition 13 from 1978.

- In California, tax payments are due on November 1 and February 1, with late penalties after December 10 and April 10.

- Seniors over 55 in California can save with Proposition 60 (1986), Proposition 90 (1988), and Proposition 19 by transferring their tax base.

- Missing tax payments in California gives you up to 5 years to catch up before a tax sale, with extended deadlines to April 10, 2026, for fire-affected areas per Governor Gavin Newsom.

- Local governments in California collected $43 billion from a 1% property tax rate in 2010-11, showing the impact of local rules.

How Property Taxes Are Calculated

Got a property tax bill that’s got you puzzled? Let’s simplify it, step by step. Property taxes are ad valorem taxes, which means they’re based on the value of your home. The local government calculates your bill by multiplying their effective tax rate by the assessed value of your place.

Think of it like a math problem with a costly result.

Now, imagine this system at work. If your home’s assessed value is high, that bill rises quickly. Local rules, much like a game of chess, determine that rate. In some areas, like California, you pay twice a year, so keep track of the dates.

Stay aware of terms like withholding tax as well; they might come up in related discussions. Stay with me, and this mystery becomes easier to understand!

What Is Included on a Property Tax Bill

Let’s break down what shows up on your property tax bill, folks. It’s not just a random number slapped on a piece of paper. You’ll see a 1% general tax levy based on your home’s assessed value.

That’s the big chunk right there. Then, toss in about 0.1% more for voter-approved debt rates. It adds up quick, doesn’t it?

On top of that, your bill might list extras like parcel taxes, Mello-Roos taxes, and other assessments. Ever notice those sneaky additions? They’re often tied to local projects or services.

Some areas might even slip in a transaction privilege tax if it applies. So, keep a sharp eye on every line. Your wallet will thank you for catching any odd fees!

Understanding Tax Assessments

Hey, figuring out tax assessments can feel like cracking a tricky puzzle, but it’s just the way your property’s value gets sized up for taxes. Stick with us to dig deeper into how this works!

How Often Are Properties Assessed?

Let me break this down for you, folks. Property assessments, which decide the value of your home for tax purposes, don’t happen on a fixed schedule everywhere. Some places do it every year, while others stretch it out to once every five years.

It all depends on the state laws where you live.

Now, think of it like a checkup for your house’s worth. In California, for instance, assessments reset to the latest purchase price when a home is sold. After that, the value can creep up by as much as 2% each year.

So, keep an eye on local rules, maybe even peek into statutes like A.R.S. if you’re curious, because knowing the timing can help with planning your budget.

What Factors Affect the Assessed Value?

Hey there, let’s chat about what can change the assessed value of your home. Things like structural upgrades, think adding a pool or an extra room, often bump up your property tax bill.

It’s a bit like dressing up for a party; the fancier you get, the more attention you draw.

Curb appeal plays a big part too. If your house looks sharp and inviting, assessors might peg its value higher. Even small tweaks to your yard or paint job can shift the numbers. Oh, and don’t forget, local rules or an occupational license tied to your property could nudge the assessment as well.

Ain’t that a kicker?

Key Exemptions to Reduce Your Property Tax

Hey there, did you know some special breaks, like tax relief programs, can slash your property tax bill big time? Stick around to dig into more ways to save!

Homestead Tax Exemption

Let’s chat about a sweet deal for homeowners like you. The can cut down the assessed value of your main home. That means a smaller tax bill in your mailbox. It’s like getting a discount just for living in your own place, and who doesn’t love saving some cash?

This break isn’t tied to things like corporate income taxes, but it directly helps your wallet. Many states offer this perk to ease the load on primary residences. So, if you’re settled in your forever home, check if you qualify.

It could shave off a nice chunk from what you owe each year.

Senior and Retiree Tax Exemptions

Hey there, folks, if you’re over 55, you might save big on property taxes with some neat exemptions. California’s got your back with rules like Proposition 60 from 1986 and Proposition 90 from 1988.

These let seniors transfer their tax base to a new home. Pretty sweet, right?

Now, check out Proposition 19, a newer gem for those 55 and up. It also helps move your tax base to a replacement house, cutting down your bill. If you’re a retiree looking to downsize, these breaks can feel like finding a golden ticket.

Stick with me to see how they work!

Why Your Property Tax Bill Might Increase

Property values often climb as time passes, and that can bump up your tax bill. Think of it like a balloon slowly filling with air, getting bigger each year. When your home’s worth grows, so does the amount you owe in taxes.

It’s a simple fact that hits many homeowners right in the wallet.

Also, making changes to your place can raise the tab. Adding a shiny new pool, a deck, or even an extra room means more value, and yup, a higher tax bill. Picture it as dressing up your house; the fancier it gets, the more you’ll pay.

Keep an eye on those upgrades, folks, because they add up fast.

Tips for Lowering Your Property Tax Bill

Hey, want to cut down on that hefty property tax bill? Let’s chat about some clever ways to save a few bucks, and keep reading for the full scoop!

Review Your Property Tax Card

Let’s chat about your property tax card, folks. This little document holds key details about your home, like lot size and room dimensions. It also lists structural improvements that could bump up your assessed value.

So, grab a copy from your local assessor’s office and take a close peek.

Checking this card helps you spot errors that might hike your tax bill. Maybe they got your square footage wrong, or listed a fancy addition you never made. If something looks off, don’t sit quiet.

Reach out to the assessor and get it fixed fast.

Research Comparable Properties in Your Area

Dig into the details of nearby homes to spot differences in assessed values. Comparing your property with similar ones in your area, like those with the same size or style, can reveal if your tax bill seems off.

Think of it as playing detective in your own neighborhood. Check public records or online tools like Zillow to see what others pay. If you find big gaps, that’s your clue to file an appeal and possibly lower your property tax.

File an Appeal if Necessary

Filing an appeal for your property tax bill can be a smart move if you think it’s too high. Don’t sit on the fence; act fast because deadlines sneak up like a cat on the prowl.

You’ll need solid proof, like clear photos of your home, to show why the assessment seems off.

Gather your evidence and check if there’s a filing fee to start the process. Sometimes, getting legal help might be worth the extra dime to boost your chances. Stick to the facts, and don’t let the red tape scare you off; you’ve got this in the bag!

What Happens if You Miss a Property Tax Payment

Hey there, missing a property tax payment can feel like dropping the ball at a crucial moment. Don’t sweat it too much, though. In California, you’ve got a safety net of up to five years to catch up on those delinquent taxes before a tax sale kicks in.

That’s a decent window to get things sorted, right?

Now, let’s chat about urgency. Falling behind can pile on penalties and interest, making that bill grow faster than weeds in spring. If you’re in LA and got hit by the recent fires, take a breath.

Governor Gavin Newsom stepped up, extending deadlines for affected ZIP codes to April 10, 2026. So, check if you qualify, grab that extra time, and dodge the extra stress of a looming tax collector.

How Proposition 13 Shapes California Property Taxes

Let’s talk about a transformative policy in California, known as Proposition 13 from 1978. This law limits how much property taxes can increase each year, setting a cap at just 2 percent.

Think about purchasing a home long ago and not facing steep tax rises as property values climb. That’s the benefit here, keeping your tax bill from growing uncontrollably.

Now, consider this law as a safeguard for homeowners. It also establishes payment deadlines you need to remember: the first installment is due on November 1, considered late after December 10, and the second is due on February 1, late after April 10.

Missing these dates leads to quick penalties. So, Proposition 13, together with resources like tax calculators and county assessor offices, supports people in managing their budgets without unexpected shocks.

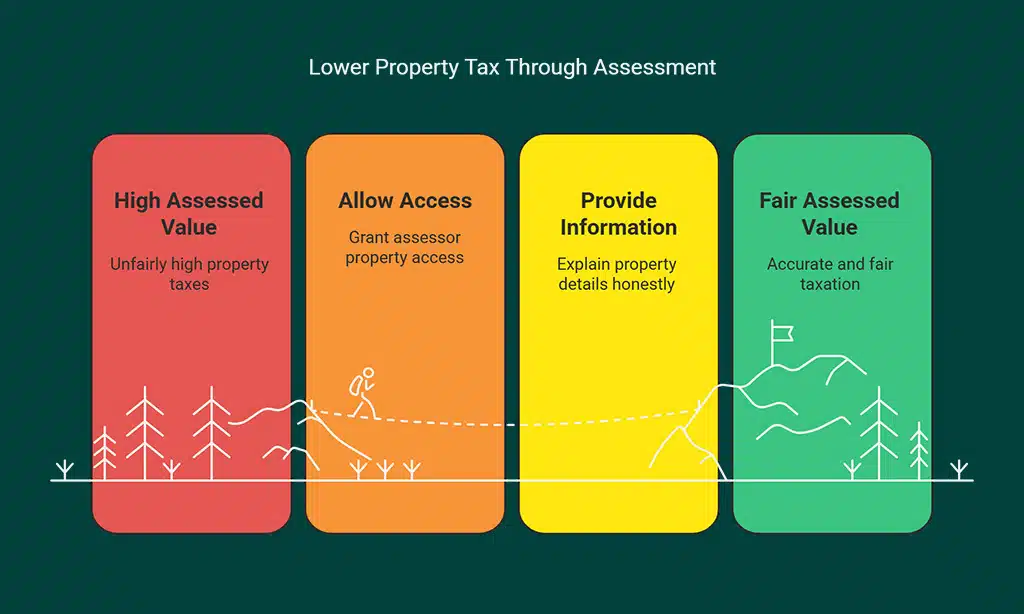

The Importance of Allowing the Assessor Access to Your Home

Hey there, homeowners, let’s chat about something vital. Letting the property assessor into your home might feel like opening your door to a stranger, but it can save you a heap of trouble.

You’re not forced by law to say yes, yet slamming the door shut could lead to a sky-high assessed value on your place. That means a bigger tax bill, and nobody wants that headache.

Walk side by side with the assessor through your house, folks. Point out what’s what, and clear up anything that might bump up the value unfairly. It’s like showing a friend around, only this friend decides how much you owe in taxes.

Keep it friendly, stay honest, and you might just keep those property tax numbers from soaring out of control.

Differences Between Local and State Property Tax Policies

Let’s chat about how property tax rules differ between local and state levels, shall we? It’s a bit like comparing apples to oranges, since each has its own flavor. Local governments, such as counties or cities, often set their own rates and decide how to spend the cash.

They might focus on schools, roads, or parks right in your neighborhood. Meanwhile, state policies act like a big umbrella, setting broader guidelines that locals must follow. Some states, for instance, have sweeter deals with lower rates than others.

That’s a huge deal if you’re picking where to buy a home.

Now, dig into this juicy tidbit about California. Back in 2010-11, local governments there raked in a whopping $43 billion from just a 1% property tax rate. Pretty wild, right? Local rules in California, shaped by state laws like Proposition 13, cap how much taxes can jump each year.

On the flip side, state policies might push for extra fees or limits that affect everyone, no matter the county. So, your tax bill could look different just a few miles down the road, depending on local decisions versus state mandates.

Isn’t that a head-scratcher?

Takeaways

Wrapping up, real estate taxes can seem like a tricky puzzle to solve. Don’t worry, though, with these eight tips, you’re better equipped to handle your property tax bill. Got a question about your assessment? Dig into it, and chat with your local assessor for clarity.

Hey, saving a few bucks on taxes feels like hitting a small jackpot, right?

FAQs on Real Estate Taxes

1. What are real estate taxes, and why do they matter to me?

Hey, let’s break this down quick. Real estate taxes, often called property levies, are fees you pay on the value of your home or land. They hit your wallet yearly, so knowing them helps you plan your budget without nasty surprises.

2. How do they figure out my real estate tax bill?

Well, it’s not just a random guess, my friend. Local officials assess your property’s worth, then slap on a tax rate based on where you live, and that’s your bill.

3. Can real estate taxes change over time?

Oh, you bet they can. These property charges often shift with market values or local rules, so don’t be shocked if your bill creeps up. Keep an eye on town announcements to stay in the loop.

4. Are there ways to lower my real estate tax load?

Listen up, there’s hope yet. Check for exemptions or discounts, like for seniors or veterans, that might trim your property fee. Chat with a local tax office to dig into options tailored for your spot.