Hey there, are you tired of feeling locked out of real estate investment? Maybe you’ve dreamed of owning property in a stunning place like Switzerland, but the high costs and complicated steps keep you on the sidelines.

It’s a common struggle, and trust me, you’re not alone in this.

Here’s a cool fact to chew on. Switzerland is a hot spot for blockchain technology, often called Crypto Valley, and it’s home to companies like MANTRA Chain in Zug, pushing the boundaries with real estate tokenization.

This means breaking down big investments into smaller, digital tokens that anyone can buy.

Now, imagine a way to jump into this market with just a few clicks, thanks to smart contracts and fractional ownership. That’s what this blog is all about. I’m gonna walk you through 10 awesome real estate projects in Switzerland using tokenization, showing how they make investing easier and open to more folks like you and me.

Stick around, it’s gonna be neat!

Key Takeaways

- Switzerland, known as Crypto Valley, hosts innovative real estate tokenization with companies like MANTRA Chain in Zug.

- Sygnum Shares tokenized their shares in 2020 using Desygnate and partnered with Artemundi for Picasso’s artwork worth 4 million CHF.

- Mt Pelerin in Zug offers fractional ownership with 100% tokenized share equity on the Ethereum blockchain.

- BrickMark focuses on high-value commercial properties, turning them into digital tokens for easy investment.

- Fasanara Capital, with Sygnum Bank, offers a tokenized debt portfolio with a 14% annual return over 18 months.

Sygnum Shares: Pioneering tokenized real estate ownership

Sygnum Shares is pioneering innovation in real estate tokenization. Back in 2020, they tokenized their company shares using their own Desygnate platform, a sophisticated tool for converting assets into digital tokens.

This step made it simpler for people like you and me to own a portion without needing deep pockets. With blockchain technology as the foundation, they’re transforming our perspective on digital assets and fractional ownership.

Envision owning a share of a luxurious building with just a few clicks, similar to buying a candy bar, but far more impressive.

They’ve also collaborated with prominent partners to expand possibilities. Consider their project with Artemundi to tokenize Picasso’s “Fillette au Beren,” valued at an impressive 4 million CHF, divided into 4,000 NFTs.

Or take their tokenization of Cryptopunk 6808 for collective NFT ownership, and their partnership with Fine Wine Capital AG to make premium wines accessible for trading. Additionally, their agreement with Fasanara Capital converted a debt portfolio into security tokens, offering an attractive 14% annual return over 18 months.

Want to learn more? Let’s explore Mt Pelerin and discover how they’re making property investment straightforward with blockchain.

Mt Pelerin: Simplifying property investment with blockchain

Hey there, readers, let’s talk about something exciting happening in Zug, Switzerland. Mt Pelerin is creating a buzz by using blockchain technology to transform real estate investment.

Envision owning a portion of property without the massive initial expense. This company allows you to acquire fractional ownership through digital tokens. It’s like getting a slice of the pie instead of the entire bakery!

Now, consider this arrangement at the core of Crypto Valley. Mt Pelerin employs smart contracts on the Ethereum blockchain to ensure security and transparency. They’ve tokenized 100% of their share equity, meaning token holders gain genuine shareholder rights.

Interested in property opportunities? Their tokenization platform simplifies the investor onboarding process. It’s an innovative approach to expanding your real estate portfolio with just a few clicks!

Blockimmo: A decentralized marketplace for real estate assets

Let me tell you about Blockimmo, a cool player in the real estate game. Based in Zug, Switzerland, often called the Crypto Valley, this platform shakes things up with blockchain technology.

They’ve built a decentralized marketplace where you can buy and sell tokenized real estate assets. Think of it as chopping up big properties into small digital tokens, making fractional ownership a breeze for everyday folks like us.

Now, imagine snagging a piece of a commercial property in Zurich without needing a huge pile of cash. Blockimmo has already tokenized such a property, showing how digital securities can open doors.

Their setup on the Ethereum blockchain keeps things transparent and safe with smart contracts. Pretty neat, right? Let’s roll into the next topic, BrickMark, to see how they’re changing commercial real estate investments.

BrickMark: Revolutionizing commercial real estate investments

Moving from Blockimmo’s open marketplace for real estate assets, let’s shift focus to another innovator in Switzerland. BrickMark is transforming the landscape with a new approach to commercial real estate investments.

They concentrate on high-value commercial property tokenization, particularly for major players like institutional investors. Imagine it as dividing a massive pie into smaller, accessible portions, allowing more people to participate using blockchain technology.

Now, envision this, you don’t need to purchase an entire building to invest. BrickMark employs digital tokens to provide partial ownership in top-tier properties. Their platform, developed on the Ethereum blockchain, converts substantial real estate into easily handled digital assets.

It’s similar to trading baseball cards, but for properties worth millions. Stay with us, there’s more to discover about how they’re reshaping the investment landscape for tokenized real estate assets!

Seba Shares: Bridging finance and tokenized real estate

Shifting from BrickMark’s innovative approach to commercial property deals, let’s talk about another exciting player in Switzerland’s real estate scene. Seba Shares, located in Zug, the core of Crypto Valley, is creating a buzz by connecting traditional finance with tokenized real estate assets.

They’re focused on using blockchain technology to create opportunities for investors. How impressive is that?

Now, imagine this, everyone, Seba Shares has also introduced the SEBA Gold Token, supported by ethically sourced gold. This step highlights their skill in combining digital securities with tangible value.

With features like smart contracts on the Ethereum blockchain, they’re setting the stage for fractional ownership. So, you can own a piece of property without a huge investment. Isn’t that a great opportunity?

Alaïa Sportresort in Crans-Montana: Tokenizing luxury resort ownership

Moving from Seba Shares’ focus on blending finance with digital assets, let’s chat about a cool project in Switzerland’s stunning mountains. The Alaïa Sportresort in Crans-Montana is breaking new ground by tokenizing luxury resort ownership.

Imagine owning a slice of a fancy getaway spot, all thanks to blockchain technology. This isn’t just a dream; it’s real, and it’s happening right now.

Back in 2021, this resort used the Ethereum blockchain to offer tokenized equity, making fractional ownership a breeze for investors. With FINMA-approved infrastructure backing it up, you can feel confident jumping into this digital securities deal.

It’s like getting a VIP pass to a top-notch property in Switzerland, without needing a huge bank account. How neat is that? Stick around to see how this changes the game for real estate tokenization.

La Pradera Ranch: Enabling fractional ownership of premium properties

Shifting gears from the luxury slopes of Alaïa Sportresort, let’s chat about another cool spot in Switzerland. La Pradera Ranch is making waves by letting everyday folks like us own a slice of premium property through real estate tokenization.

Imagine snagging a piece of a fancy ranch without needing a fat wallet. That’s the magic of fractional ownership, and it’s happening right now.

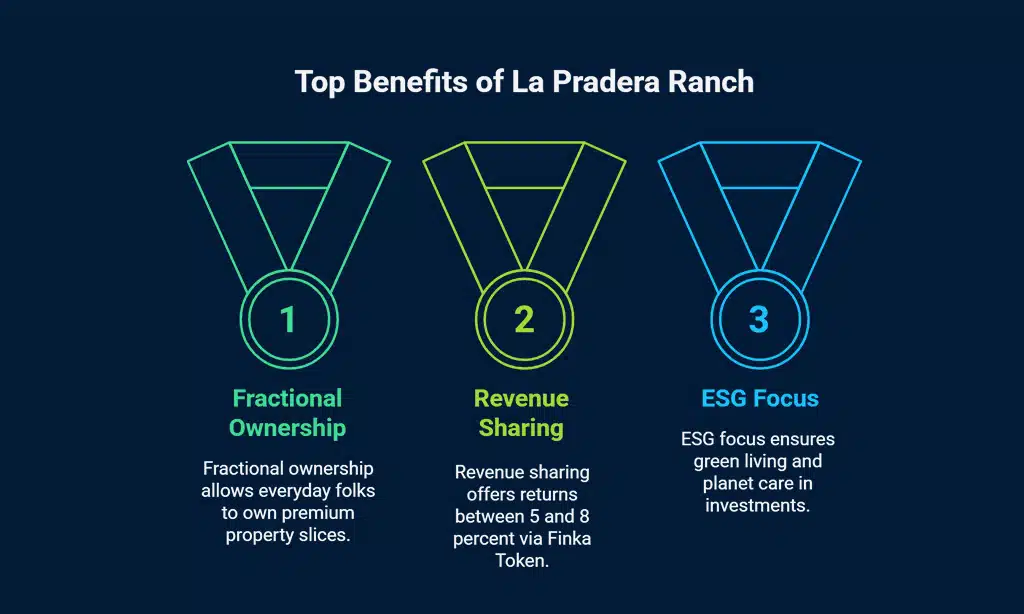

This project uses the Finka Token to share out Net Operating Revenue, promising returns between 5 and 8 percent. Plus, they’re all about green living with a focus on ESG principles, which means they care for the planet while growing your investment.

With blockchain technology backing this tokenized real estate asset, buying in feels as easy as pie. So, if you’ve ever dreamed of owning land in a stunning place, La Pradera Ranch on the Ethereum blockchain could be your ticket to ride!

BlueOcean: Leveraging tokenization for sustainable real estate projects

Hey there, readers, let’s talk about BlueOcean, a dynamic company in Switzerland creating a buzz with real estate tokenization. They prioritize sustainable initiatives, transforming eco-friendly buildings into digital assets.

Envision owning a portion of an environmentally conscious property with just a few clicks. That’s the wonder of blockchain technology, dividing large investments into small, accessible digital tokens.

Now, imagine this: BlueOcean employs smart contracts on the Ethereum blockchain to ensure security and transparency. Located in Switzerland, they harness the pioneering vibe of Crypto Valley.

Their platform welcomes international investors to participate, providing shared ownership in exceptional, planet-friendly properties. Isn’t it exciting to consider being part of a sustainable future? Stay tuned to discover how they’re revolutionizing the industry with tokenized real estate assets.

Fasanara Capital: Integrating innovation in real estate tokenization

Fasanara Capital is transforming the landscape of real estate tokenization with innovative concepts. They’ve partnered with Sygnum Bank to provide a tokenized debt portfolio. Envision earning an impressive 14% return annually! Plus, it reaches maturity in only 18 months.

This opportunity simplifies property investment through blockchain technology.

Their emphasis on digital assets and security tokens creates opportunities for many. You don’t need to purchase an entire building, just acquire a portion through fractional ownership.

It’s like sharing a pizza with friends, straightforward and clever. Utilizing the Ethereum blockchain, they ensure safety and transparency. Curious for more? Let’s move to the final insights in our conclusion.

Takeaways

Hey there, readers! Isn’t it wild how Switzerland is leading the charge in real estate tokenization? From Sygnum Shares to BlueOcean, these projects show blockchain tech turning property investment into a whole new game.

Think of it as slicing a pie, everyone gets a piece with digital tokens. Drop a comment if you’re excited to see where this trend heads next!

FAQs on Real Estate Projects in Switzerland Using Tokenization

1. What’s the big deal with real estate tokenization in Switzerland?

Hey, let me tell you, real estate tokenization is shaking things up in places like Crypto Valley. It’s all about turning physical properties into digital assets using blockchain technology, making investment a breeze for folks worldwide. So, imagine owning a slice of a Swiss chalet through tokenized real estate assets, no matter where you’re sipping your coffee.

2. How do smart contracts play into these Swiss projects?

Well, smart contracts are the trusty sidekicks in this blockchain economy. They automate deals on platforms like Ethereum blockchain, cutting out the middleman and keeping things slick.

3. Can anyone jump into fractional ownership with tokenized shares?

Absolutely, my friend, fractional ownership via digital tokens is like splitting a pie; everyone gets a piece. These Swiss projects lower capital requirements, so even small-time investors or foreign investors can join the game through a tokenization platform. Just hop onto a user-friendly interface, complete investor onboarding, and you’re in.

4. What’s the role of security tokens in this real estate gig?

Security tokens are the heavy hitters here, acting as digital securities tied to real estate portfolios. They’re built on blockchain technologies, offering a safe way to trade on a secondary market without the usual headaches.

5. How does blockchain technology boost user experience in these projects?

Listen up, blockchain technology isn’t just tech jargon; it’s a game-changer for user experience, or UX as the cool kids say. With decentralized applications, or dapps, and a solid user interface design, investors on platforms like Binance Smart Chain can track their crypto tokens easily. It’s like having a financial dashboard right at your fingertips, no fuss, no muss.

6. Are there risks with tokenized real estate assets in Switzerland?

Hey, let’s not sugarcoat it; there are bumps like vulnerabilities and regulatory compliance to watch. A blockchain company often runs security audits to hedge against risks, but it’s still a bit of a wild west out there. Stick with projects backed by solid start-ups or VC funds, and keep an eye on the financial market updates through channels like X (Twitter) or LinkedIn for the latest scoop.