India’s rapid digital payment revolution has been built on two pillars: Aadhaar, the biometric national ID system, and UPI (Unified Payments Interface), the real-time bank-to-bank transfer network. Now, IoT startup Proxgy is combining these platforms into a new product called ThumbPay—a biometric payment device that allows users to complete transactions simply by pressing their thumb on a scanner.

The launch is designed to address gaps in financial inclusion. While smartphone-based UPI apps like PhonePe, Google Pay, and Paytm dominate urban India, millions of people in rural areas or older demographics either do not use smartphones, do not carry wallets regularly, or struggle with QR code–based payments. ThumbPay promises to remove these barriers by enabling people to pay directly from Aadhaar-linked bank accounts using only their fingerprint.

How ThumbPay Works

The device functions by merging two systems:

-

Biometric Identity Verification: When a customer places their thumb on the scanner, the Aadhaar Enabled Payment System (AEPS) confirms their identity using India’s central biometric database.

-

Bank Transfer via UPI: Once identity is confirmed, UPI processes the payment instantly from the user’s Aadhaar-linked bank account to the merchant’s account.

This seamless integration removes the need for QR codes, smartphones, debit cards, or physical wallets. Payments can be done instantly at a shop counter or in an outdoor market with no extra steps beyond the thumb scan.

Advanced Features Designed for Daily Use

ThumbPay has been built not only for ease of use but also with multiple technical features that make it versatile across different environments:

-

Certified Fingerprint Scanner: A high-quality scanner ensures accurate biometric authentication, reducing the risk of fraud or mismatched fingerprints.

-

Built-in Camera for Verification: The device also includes a small camera that can be used for additional identity verification when needed.

-

UV Sterilization: Recognizing that hundreds of people may touch the same scanner daily, Proxgy added UV sterilization technology to disinfect the scanner surface automatically and maintain hygiene.

-

Multiple Payment Modes: In addition to biometric authentication, the device supports QR and NFC (Near Field Communication) payments, giving users and merchants flexibility.

-

Connectivity Options: To function in India’s diverse terrain, ThumbPay supports 4G, Wi-Fi, and LoRaWAN networks, ensuring it works even in areas with weak mobile connectivity.

-

UPI Soundbox Feature: Like popular merchant soundboxes, ThumbPay provides voice confirmations of payments, reassuring both customers and shopkeepers that the transfer has gone through successfully.

These features make ThumbPay not just a biometric payment scanner, but a multi-functional digital payment hub tailored for Indian markets.

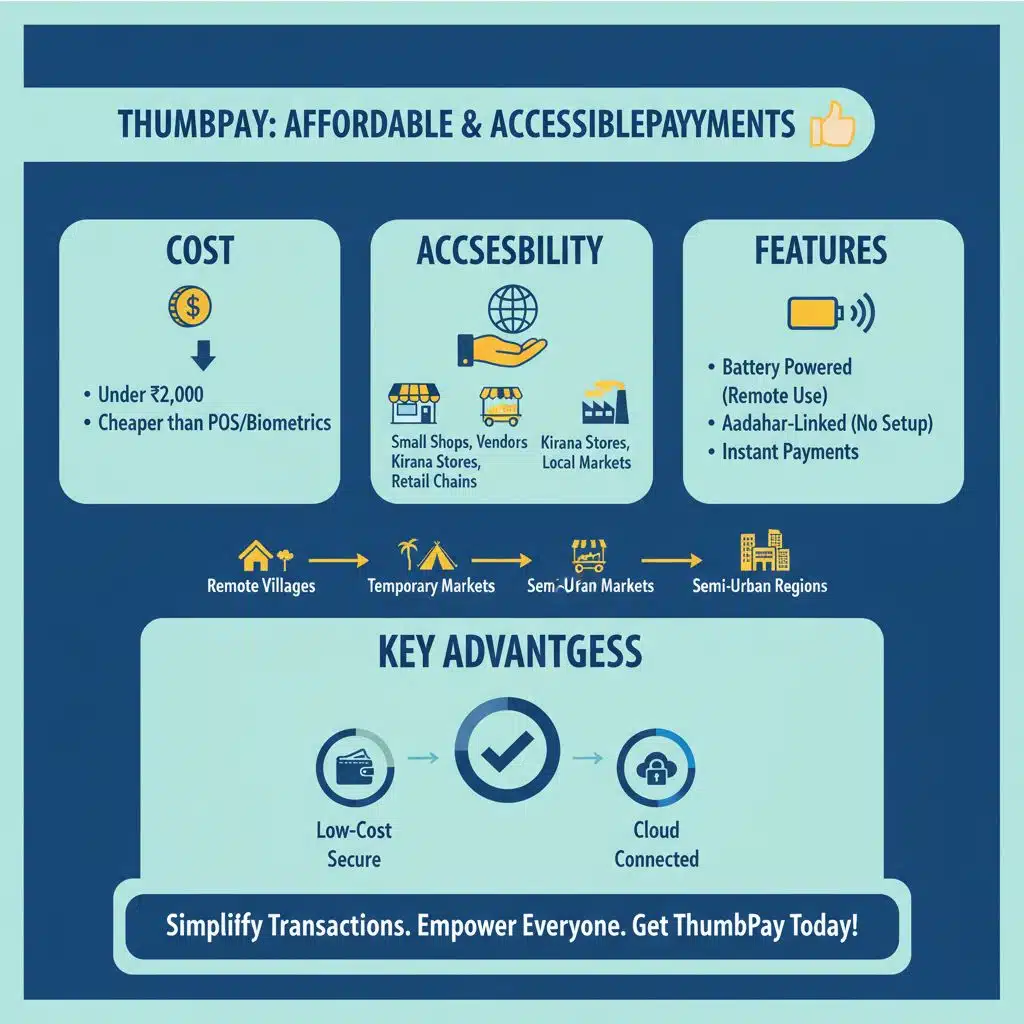

Cost and Accessibility

One of the biggest advantages of ThumbPay is its affordability. Priced under ₹2,000, it is significantly cheaper than many advanced POS systems or biometric devices. This makes it accessible to:

-

Small shops and street vendors.

-

Kirana stores and local markets.

-

Larger retail chains seeking low-cost biometric solutions.

The device also runs on battery power, allowing it to function even in places with unreliable electricity supply. This ensures that it can be used in remote villages, temporary markets, and semi-urban regions.

Because ThumbPay connects directly with Aadhaar-linked bank accounts, anyone with such an account can use it immediately—no need for additional registration or setup.

Who Benefits Most

The target audience for ThumbPay includes people who are often excluded from smartphone-based digital transactions. Key beneficiaries could be:

-

Elderly citizens who may not be comfortable using mobile apps.

-

Daily wage workers who often receive wages in cash but can now directly pay digitally without carrying money.

-

Rural populations with limited access to smartphones or reliable internet connections.

-

Women and first-time bank account holders in financial inclusion programs like Jan Dhan Yojana.

By lowering entry barriers, ThumbPay has the potential to bring millions more Indians into the digital economy, helping reduce reliance on cash and improving transaction transparency.

Trials, Compliance, and Rollout Plans

According to recent reports, ThumbPay has already completed pilot trials in real-world retail environments. These trials tested how well the device performs under high transaction volumes and whether biometric scans remain accurate for diverse users.

The next step is to secure compliance and approvals from two key regulatory bodies:

-

UIDAI (Unique Identification Authority of India): To ensure Aadhaar data is accessed securely and that biometric verification meets official standards.

-

NPCI (National Payments Corporation of India): To ensure that UPI transactions through ThumbPay comply with payment regulations, fraud prevention, and interoperability.

Once the necessary approvals are granted, Proxgy plans to roll out ThumbPay in phases, working with banks and fintech partners to expand its distribution. The device is expected to be marketed to both small-scale merchants and larger retail outlets.

Opportunities and Challenges Ahead

Opportunities

-

Financial Inclusion: ThumbPay could accelerate India’s goal of bringing rural and unbanked populations into the digital economy.

-

Reduced Reliance on Smartphones: With ThumbPay, UPI payments no longer depend on smartphone access, data connectivity, or app literacy.

-

Faster Transactions: Payments take only seconds once the fingerprint is verified, making it convenient for high-volume shops.

-

Hygienic Digital Payment Solution: With UV sterilization, ThumbPay addresses health concerns around shared devices.

Challenges

-

Security Concerns: Fingerprint-based payments must have strong fraud detection to prevent spoofing or unauthorized access.

-

Privacy Risks: Aadhaar’s use in payments has faced criticism over potential misuse of biometric data, so transparency and safeguards will be crucial.

-

Merchant Adoption: Some shopkeepers may be hesitant to invest in new hardware unless it proves consistently reliable and widely accepted.

-

Connectivity in Remote Areas: While ThumbPay supports LoRaWAN and offline modes, ensuring smooth operation in India’s most rural zones will be a technical challenge.

Why ThumbPay Matters

India is already the world’s leader in digital transactions, with UPI crossing 13 billion monthly transactions in August 2025 according to NPCI data. Yet, a large segment of the population remains outside the digital ecosystem due to lack of smartphones, digital literacy, or banking access. ThumbPay represents a practical solution to bridge this gap.

By embedding Aadhaar verification directly into payments and offering an inexpensive, user-friendly device, Proxgy is positioning ThumbPay as a key innovation for the next phase of India’s digital economy. If successful, it could become a standard in small shops and rural markets, just like QR code stands and UPI soundboxes are today.