The phrase private credit bubble has moved from niche chatter to mainstream market anxiety. A recent Deutsche Bank client poll pointing to private credit as a standout risk for 2026 did not create the fear, but it helped quantify it. Investors are not only asking whether defaults will rise. They are also asking whether the structure of private lending could magnify stress when the cycle turns.

Private credit has grown into a central funding pipeline for middle market and sponsor backed companies. It promises speed, flexibility, and bespoke terms. It also operates with less visible pricing, lighter public disclosure, and a different set of liquidity expectations than public credit. Those features can look like strengths in calm markets, then become friction points in volatile ones.

This analysis breaks down what the poll signal means, why private credit looks vulnerable into 2026, and what indicators will matter most if sentiment shifts from concern to forced repricing.

Executive Summary

Private credit has expanded quickly, taking share from banks and public bond markets in many corporate segments. That expansion has not been inherently reckless, but it has coincided with intense competition among lenders and a long period where capital was eager to deploy.

The Deutsche Bank poll matters because it reflects the mood of large allocators and market professionals heading into 2026. When institutions start to cluster around the same worry, liquidity often becomes more selective even before fundamentals break.

The core risks sit in four areas: valuation opacity, borrower cash flow pressure from high debt costs, refinancing uncertainty, and liquidity or leverage dynamics inside fund structures. None of those guarantees a crash. Together, they create a setup where problems can stay hidden, then show up fast.

The best way to treat the private credit bubble debate is as a scenario analysis. Focus less on labels and more on how stress would travel through borrowers, lenders, and investor behavior.

| What This Is | Why It Matters | What To Watch In 2026 |

|---|---|---|

| A fast-growing non-bank lending market facing rising skepticism | Private credit now finances a meaningful share of sponsor and mid-market borrowing | Default trends, refinancing access, secondary pricing, NAV markdowns |

| Deutsche Bank poll flags private credit as a top 2026 risk | Big allocators may tighten underwriting and reduce new commitments | Spread widening, covenant tightening, gating/tender reductions |

| “Bubble” concern is about structure, not just losses | Opacity + liquidity expectations can turn small cracks into fast repricing | Fund leverage lines, redemption pressure, clustered restructurings |

The Deutsche Bank Poll: What It Signals For 2026

Polls do not predict timing, but they reveal positioning and narrative dominance. When a major bank’s client survey elevates private credit risk, it often means investors see a gap between perceived stability and underlying vulnerability.

Three implications follow.

First, risk committees and allocators may tighten underwriting standards for new private loans. They may also demand more reporting, stronger covenants, or better downside protections.

Second, fundraising and recycling dynamics may change. Private credit funds depend on steady inflows and the ability to redeploy repayments. If investor appetite cools, even strong managers can face slower deployment or more cautious deal selection.

Third, the secondary market can become more important. When sentiment turns, investors who want liquidity may accept steeper discounts. That can reset marks and trigger broader repricing pressure across vehicles that hold similar loans.

In other words, the poll is not a forecast of collapse. It is a sign that the market’s tolerance for hidden risk may be falling as 2026 approaches.

| Poll Signal | What It Suggests | Likely Market Effect |

|---|---|---|

| Private credit shows up as a major perceived risk | Investor confidence is less automatic heading into 2026 | Tougher due diligence, more conservative allocations |

| Concern is shared across large market participants | Narrative risk is rising, even before data breaks | Slower fundraising and deal flow selectivity |

| Worry centers on “stress” rather than “growth” | Focus shifts from yield chasing to downside protection | Wider spreads, stronger covenants on new loans |

Private Credit 101: What It Is And Why It Grew So Fast

Private credit usually refers to non bank lending, often directly negotiated between a lender group and a corporate borrower. Most deals are senior secured loans, unitranche structures, or bespoke financing packages. Private lenders often step in where banks hesitate due to regulation, balance sheet limits, or speed constraints.

Private credit grew because it solved real problems.

Borrowers gained faster execution and fewer public market dependencies. Sponsors gained certainty for acquisitions and refinancings. Investors gained higher yields than many public alternatives, plus the perception of stability from infrequent pricing.

That growth also created an ecosystem. Funds raised capital from pensions, insurers, family offices, and wealth platforms. Managers built origination teams and relationships with private equity sponsors. Deal flow increased, and competition intensified.

Competition can be healthy. It can also compress spreads and weaken protections. That is where the private credit bubble debate begins.

| Term | Meaning | Why Borrowers Like It | Why Investors Like It |

|---|---|---|---|

| Private Credit | Loans made by non-bank lenders to companies | Faster execution, bespoke terms, certainty | Higher yields, negotiated structures, diversification |

| Direct Lending | Fund lends directly to a borrower | Less market risk than bonds | Steady income and control rights |

| Unitranche | Single blended loan replacing senior + junior layers | Simpler capital stack | Higher yield than senior-only lending |

| Sponsor-Backed | Borrowers owned by private equity | Funding for acquisitions and refinancings | Deal flow pipeline, perceived sponsor support |

How Big Private Credit Is And Why Size Changes The Risk Profile

Scale changes everything. When private credit was smaller, stress would mostly stay inside a subset of funds and borrowers. With larger scale, private credit becomes a core component of corporate financing.

Size also reshapes correlations. The industry leans heavily on sponsor backed deals, recurring refinance activity, and leveraged capital structures. If refinancing becomes harder across the board, many borrowers face the same challenge at the same time. That raises the chance of clustered distress.

Another scale issue is benchmarking. In public credit, prices adjust minute by minute. In private credit, marks often adjust quarterly, sometimes with manager discretion and model based assumptions. The larger the market, the larger the impact when marks finally reprice.

| Size Factor | What Expands With It | Why That Changes Risk |

|---|---|---|

| More AUM | More borrowers depend on private lenders | Stress affects a larger corporate footprint |

| More managers | Competition increases | Pricing compresses, terms loosen |

| More retail/wealth access | Liquidity expectations rise | Gating risk becomes more sensitive |

| More interconnected finance | Bank lines + co-lending grow | Spillovers become more plausible |

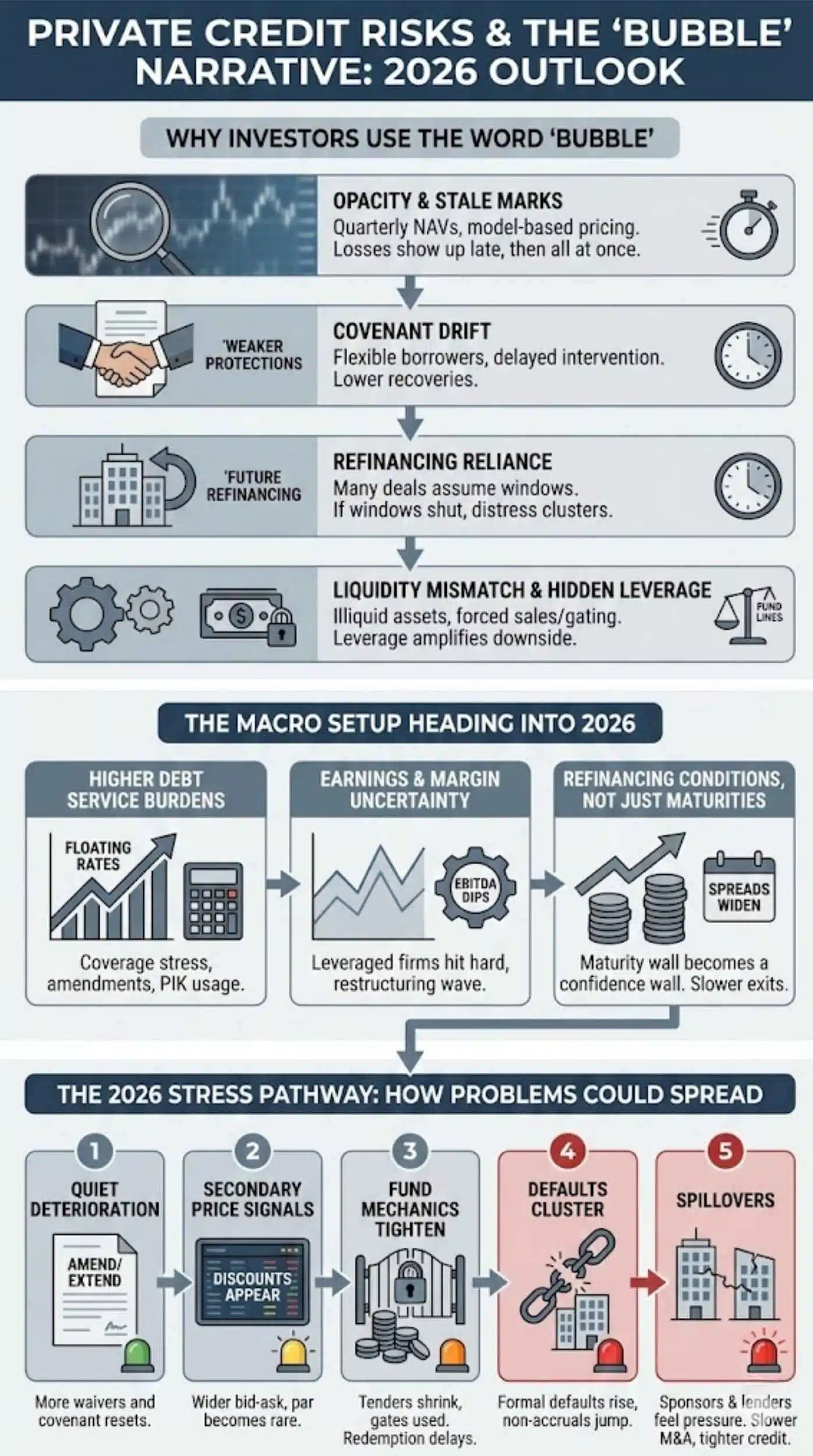

Why Investors Use The Word “Bubble”

Calling it a bubble can be sloppy. Still, investors use the term because it captures a pattern: rapid growth, confidence in stability, and a belief that the structure reduces volatility.

Here are the most common reasons the label appears.

Opacity And Stale Marks

Private loans do not trade on exchanges. Many do not have active daily secondary pricing. That can make reported returns look smoother than the true underlying risk.

Smoother does not automatically mean safer. It often means the market has not been forced to discover price in real time. When stress hits, pricing can jump from stable to sharply discounted, not because the loans changed overnight, but because reality becomes undeniable.

Covenant And Documentation Drift

In competitive environments, lenders can accept weaker covenants. Some deals rely more on sponsor relationships than on strict contractual tripwires. That can delay intervention, allowing leverage or cash burn to worsen before lenders can act.

Weaker protections can also reduce recovery values. If lenders cannot step in early, more value can leak out through fees, asset transfers, or delayed restructurings.

Refinancing Reliance

Many private credit borrowers expect to refinance. They assume some mix of growth, stable rates, and continued lender appetite. If that cycle breaks, companies can face a maturity wall without a clean exit.

Liquidity Expectations Versus Illiquid Assets

Most private loans are illiquid. Some investors still expect periodic liquidity through fund terms, tender offers, or wealth platform structures. In a stress environment, managers may need to gate, slow redemptions, or raise cash at discounted secondary prices.

Leverage Inside The System

Some private credit vehicles use financing lines or other leverage to enhance returns or bridge capital calls. Leverage can be modest and well managed, but it can also amplify forced selling if lenders tighten terms.

This is the core of the private credit bubble concern. The risk is not just borrower defaults. The risk is how the structure reacts when the market wants cash and transparency at the same time.

| “Bubble” Driver | What It Looks Like | Why It Can Hurt In Stress |

|---|---|---|

| Opacity and stale marks | Quarterly NAVs, model-based pricing | Losses show up late, then all at once |

| Covenant drift | Weaker protections, more flexibility for borrowers | Delayed intervention, lower recoveries |

| Refinancing reliance | Many deals assume future refinancing windows | If windows shut, distress clusters |

| Liquidity mismatch | Illiquid loans inside vehicles offering liquidity | Forced sales or gating can shock sentiment |

| Hidden leverage | Fund lines or structured leverage | Amplifies downside when lenders tighten |

The Macro Setup Heading Into 2026

Private credit performance depends on borrower cash flows and credit conditions. Heading into 2026, several macro pressures matter.

Higher Debt Service Burdens

A large share of private loans carry floating rates. When benchmark rates rose, interest costs rose quickly. Even if rates drift down, spreads can widen, and lenders may demand stronger terms.

Borrowers with thin margins, cyclical revenue, or aggressive acquisition rollups can struggle. That increases amendments, payment relief requests, and restructurings.

Earnings And Margin Uncertainty

Many sponsor backed companies operate with optimization assumptions. They may rely on continued pricing power, stable demand, or synergy capture. In an uneven economy, those assumptions can break.

A small decline in EBITDA can trigger large stress when leverage is high. That is basic math, and it applies regardless of whether the lender is a bank or a private fund.

Refinancing Conditions, Not Just Maturities

The maturity calendar matters, but conditions matter more. If credit spreads widen, refinancing costs rise even if base rates fall. That can trap borrowers in expensive capital or push them into distressed exchanges.

| Macro Pressure | Why It Matters For Private Credit | What It Can Trigger |

|---|---|---|

| High debt service costs | Many loans are floating-rate | Coverage stress, amendments, PIK usage |

| Uneven earnings | Small EBITDA dips hit leveraged firms hard | Restructuring wave in weaker sectors |

| Tighter refinancing | Spreads can widen even if base rates fall | Maturity wall becomes a confidence wall |

| Slower exits | PE needs realizations to recycle capital | Fewer deals, more support capital calls |

The 2026 Stress Pathway: How Problems Could Spread

Stress rarely appears as one dramatic event. It usually moves through stages. Below is a realistic pathway markets watch.

Stage 1: Quiet Deterioration

Early signs include more covenant resets, more add backs in EBITDA definitions, and more deals that rely on optimistic forward projections. Managers may also increase reserves or shift marks, but gradually.

At this stage, many investors still see stable reported returns. That stability can delay risk recognition.

Stage 2: Secondary Prices Start To Speak

If more loans trade in the secondary market at discounts, investors get a real time signal. Discounts can persist even if the borrower is not in default, because buyers demand a margin of safety.

Secondary weakness can also pressure NAVs across similar assets. This is where the private credit bubble narrative can accelerate, because the market finally has a price discovery mechanism.

Stage 3: Fund Terms Tighten

If investors request liquidity, managers may slow redemptions, reduce tender sizes, or impose gates within contractual limits. Some vehicles may borrow or sell assets to meet redemptions.

That is not automatically catastrophic. It can still spook investors, especially those who expected bond like liquidity.

Stage 4: Defaults Cluster

Defaults tend to cluster when refinancing shuts and earnings fall. In private credit, managers may prefer restructurings that avoid formal default while preserving enterprise value. Even then, losses can rise through write downs, lower recoveries, and longer time to resolution.

Stage 5: Spillovers Into Public Markets And Sponsors

Private equity sponsors may face slower exits, lower valuations, and more capital calls to support portfolio companies. That can reduce new deal volume and tighten credit availability further.

Banks can feel pressure through credit lines to funds, co lending arrangements, or exposure to the same borrowers through other instruments. The exact channel varies, but the potential for spillover exists.

This is how a private credit bubble scenario becomes a broader market issue. It is less about a single loan book and more about interconnected behavior.

| Stage | What Happens | Typical Early Sign |

|---|---|---|

| Stage 1: Quiet deterioration | Amend/extend grows, terms soften | More waivers and covenant resets |

| Stage 2: Secondary price signals | Discounts appear, price discovery starts | Wider bid-ask, par becomes rare |

| Stage 3: Fund mechanics tighten | Tenders shrink, gates used | Redemption delays and lower liquidity |

| Stage 4: Defaults cluster | Formal defaults rise after refinancing stalls | Non-accruals and restructurings jump |

| Stage 5: Spillovers | Sponsors and linked lenders feel pressure | Slower M&A, tighter credit overall |

Early Warning Indicators To Track In 2026

If you want a practical dashboard, these indicators matter. They are more useful than headlines.

Borrower Level Indicators

- Rising use of payment in kind interest or interest deferrals

- More frequent amendments and covenant resets

- Higher leverage multiples in new deal terms

- EBITDA add backs growing larger and less credible

- Increased restructurings framed as “extensions”

Portfolio And Fund Indicators

- Rising non accrual rates or internal watchlist counts

- NAV markdowns becoming more frequent and more correlated across funds

- Higher reliance on fund level leverage or financing lines

- Gating activity, reduced tender sizes, or delayed redemptions

- Increased secondary sales and widening discount levels

Market Wide Indicators

- Spread widening in leveraged loans and high yield, especially in lower quality tiers

- Higher default forecasts from rating agencies and credit strategists

- Sharp tightening in underwriting standards reported by lenders

- A drop in private equity deal volume tied to financing uncertainty

If you see several of these at once, the private credit bubble risk moves from theoretical to actionable.

| Indicator | What Rising Levels Mean | Why It’s Important |

|---|---|---|

| PIK interest usage | Borrowers can’t pay cash interest | Often precedes deeper distress |

| Amend/extend volume | Refinancing is hard or expensive | Signals credit tightening |

| Non-accrual rate | Loans stop paying as expected | Direct sign of performance stress |

| NAV markdown frequency | Managers are repricing risk | Reduces “smooth return” illusion |

| Secondary discounts | Buyers demand more risk premium | Forces broader valuation reset |

| Fund leverage tightening | Lenders pull back | Can drive forced selling |

Who Gets Hit First If Stress Builds

Credit stress usually concentrates where leverage is high and cash flows are fragile. In private credit, the most vulnerable pockets often share characteristics.

Highly Levered Sponsor Deals With Thin Coverage

These borrowers can handle normal volatility, but not a combined hit of slower revenue and higher debt costs. They often need refinancing confidence to maintain flexibility.

Cyclical And Consumer Sensitive Businesses

Demand shocks and margin compression show up quickly. If lenders lose confidence, refinancing terms can become punitive.

Aggressive Rollup Strategies

Rollups can create scale, but they can also create integration risk. If synergies lag or costs rise, leverage becomes a trap.

Companies With Limited Asset Coverage

Senior secured loans rely on collateral and enterprise value. If asset coverage is weak, recoveries can fall more than expected.

| Most Exposed Segment | Why It’s Vulnerable | What Breaks First |

|---|---|---|

| Thin interest coverage borrowers | Little cushion vs rate/spread shocks | Covenants, liquidity, then defaults |

| Cyclical and consumer-sensitive | Demand swings hit fast | EBITDA drops, coverage collapses |

| Rollups with integration risk | Synergies can lag projections | Leverage stays high longer |

| Weak asset coverage deals | Collateral is limited | Recoveries disappoint |

| Over-concentrated sponsor themes | Correlation rises across portfolio | Clustered restructurings |

Who May Benefit If The Market Reprices

A repricing does not only create losses. It can create opportunity.

Stronger Private Credit Managers

Managers with disciplined underwriting, real covenants, and conservative leverage can gain share. They can lend at wider spreads with better terms when weaker competitors pull back.

Distressed And Special Situations Capital

If more companies need rescue financing, liability management, or turnaround capital, distressed investors can find attractive setups. The key is patience and expertise.

Secondaries Specialists

As funds sell loans to raise cash, secondary buyers may obtain diversified exposure at discounts. That can produce strong returns if losses do not exceed the discount.

| Potential Winner | Why They Benefit | What They Look For |

|---|---|---|

| Top-tier private credit managers | Better terms and pricing after pullbacks | Strong covenants, senior secured deals |

| Distressed credit funds | More rescue and restructuring needs | Control positions, downside protection |

| Secondaries buyers | Discounts widen in risk-off markets | Diversified pools at attractive entry |

| Opportunistic lenders | Scarcity raises bargaining power | Higher spreads, tighter docs |

Is Private Credit Fundamentally Broken Or Just Cycling

Private credit is not inherently flawed. It filled a gap created by banking regulation, capital requirements, and the need for flexible financing. Many deals are senior secured and structured with risk controls.

The real question is whether the market priced the risk correctly during the growth surge. The private credit bubble concern focuses on underwriting drift, structural liquidity expectations, and the lag between fundamental deterioration and reported returns.

In a mild slowdown, private credit can muddle through with amendments and selective restructurings. In a sharper downturn, the same tools can delay recognition and then concentrate losses when they finally surface.

| View | Core Argument | What Would Prove It |

|---|---|---|

| “Just cycling” | Market adapts, losses stay manageable | Gradual markdowns, contained defaults |

| “Bubble risk” | Risk was underpriced and hidden | Sudden NAV drops, gating, clustered defaults |

| Balanced reality | Outcomes depend on rates, earnings, refinancing | Mixed results across managers and vintages |

Practical Risk Management For Investors And Borrowers

This section aims to be actionable, not theoretical.

For Investors Allocating To Private Credit

- Demand transparency that matches the risk: Ask for portfolio level detail on top exposures, leverage, covenant quality, and watchlist trends. Reporting quality often separates durable managers from marketing driven ones.

- Evaluate liquidity terms honestly: If the vehicle offers periodic liquidity, understand what it can do under stress. Know the gating language, redemption mechanics, and historical behavior of the manager.

- Stress test for mark shocks: Model what happens if secondary prices drop and NAVs follow. Treat smooth returns as a feature of pricing frequency, not as proof of low volatility.

- Check sponsor concentration: Sponsor relationships help origination, but concentration can increase correlation. Ask how diversified the deal sources are.

- Focus on downside discipline: In a stressed cycle, covenants, collateral, and restructuring skill matter more than headline yield.

Around this point in the cycle, many investors revisit a single question: is the private credit bubble risk a manager selection problem or a category level problem. In practice, it is both.

For Borrowers And Sponsors

- Extend maturities early when possible: Waiting for perfect conditions can backfire. Refinancing windows close fast in risk off markets.

- Be realistic about covenants and reporting: Lenders will demand more control if uncertainty rises. Provide clarity early to avoid punitive terms later.

- Improve cash flow resilience: Cost controls, pricing discipline, and working capital management can preserve lender confidence.

- Consider capital structure simplification: Complex layers can complicate negotiations in distress. Cleaner structures can reduce friction in amendments or refinancings.

| Audience | Action | Why It Helps |

|---|---|---|

| Investors | Demand transparent reporting | Reduces surprise and stale marks |

| Investors | Stress test NAV and liquidity | Prepares for drawdowns and gating |

| Investors | Review covenant quality | Improves recoveries in downturns |

| Borrowers | Refinance earlier if possible | Avoids closed windows later |

| Borrowers | Improve cash flow resilience | Builds lender confidence |

| Sponsors | Simplify capital structures | Reduces restructuring friction |

What Would Disprove The Bubble Narrative

It helps to define what would make the worry fade.

If rates fall meaningfully, earnings stabilize, and refinancing markets stay open, defaults may rise only modestly. Private credit could continue to generate stable returns, and the bubble label would look overstated.

Also, if more managers adopt better reporting and valuations adjust gradually, the risk of a sudden mark shock decreases. Slow recognition is painful, but it is less destabilizing than abrupt repricing.

The bubble narrative thrives when the market believes risk is building while pricing refuses to reflect it. Transparency reduces that gap.

| Bullish Outcome | What Must Happen | What You’d See |

|---|---|---|

| Softer rates + stable earnings | Coverage improves, refinancing stays open | Lower amend/extend, fewer non-accruals |

| Gradual valuation realism | Marks adjust without panic | Steady markdown cadence, limited gates |

| Stronger underwriting discipline | Better terms become standard | Covenant strength returns, leverage falls |

Bottom Line For 2026

The Deutsche Bank poll highlights a real shift in investor psychology. Private credit is no longer viewed as an obscure corner of finance. It is now seen as a potential fault line in 2026 market risks.

The most important takeaway is not whether the label “bubble” is technically correct. The important takeaway is that private credit combines three ingredients that can turn stress into surprise: opaque pricing, leveraged borrowers, and investor liquidity expectations.

If 2026 delivers softer growth, tighter refinancing, and wider spreads, the private credit bubble debate will move from headlines to performance. If conditions stay supportive, the market may avoid a dramatic reset, but it will still face pressure to prove resilience with better transparency and stronger underwriting.