For seniors relying on Social Security income, making ends meet on an already limited budget may be challenging. A personal loan may offset some of the financial burden if you’re in this situation and need to pay for unexpected big-ticket items such as medical treatments or home repairs. So, if you’re wondering whether you can get a personal loan when on Social Security, read on to learn more.

Do personal loans affect SSI benefits?

The short answer is no: personal loans do not directly affect Social Security Income [SSI] benefits. That said, personal loans may indirectly impact your eligibility for SSI if they put you over the income limit set by the Social Security Administration [SSA]. For 2024, that threshold is $943 per month for an individual and $1,415 for a couple in countable earned income. That figure is dynamic, so be sure to check the SSA’s website for up-to-date information about personal loan eligibility requirements.

Can you qualify for a personal loan with social security?

You can get a personal loan while receiving Social Security income, but it largely depends on the lender’s policies.

Some banks offer personal loans specifically for retired individuals or receiving Social Security benefits. These loans generally have lower interest rates and fewer fees than traditional personal loans and don’t always require a credit check. However, they typically have limits regarding the amount borrowed and the repayment period.

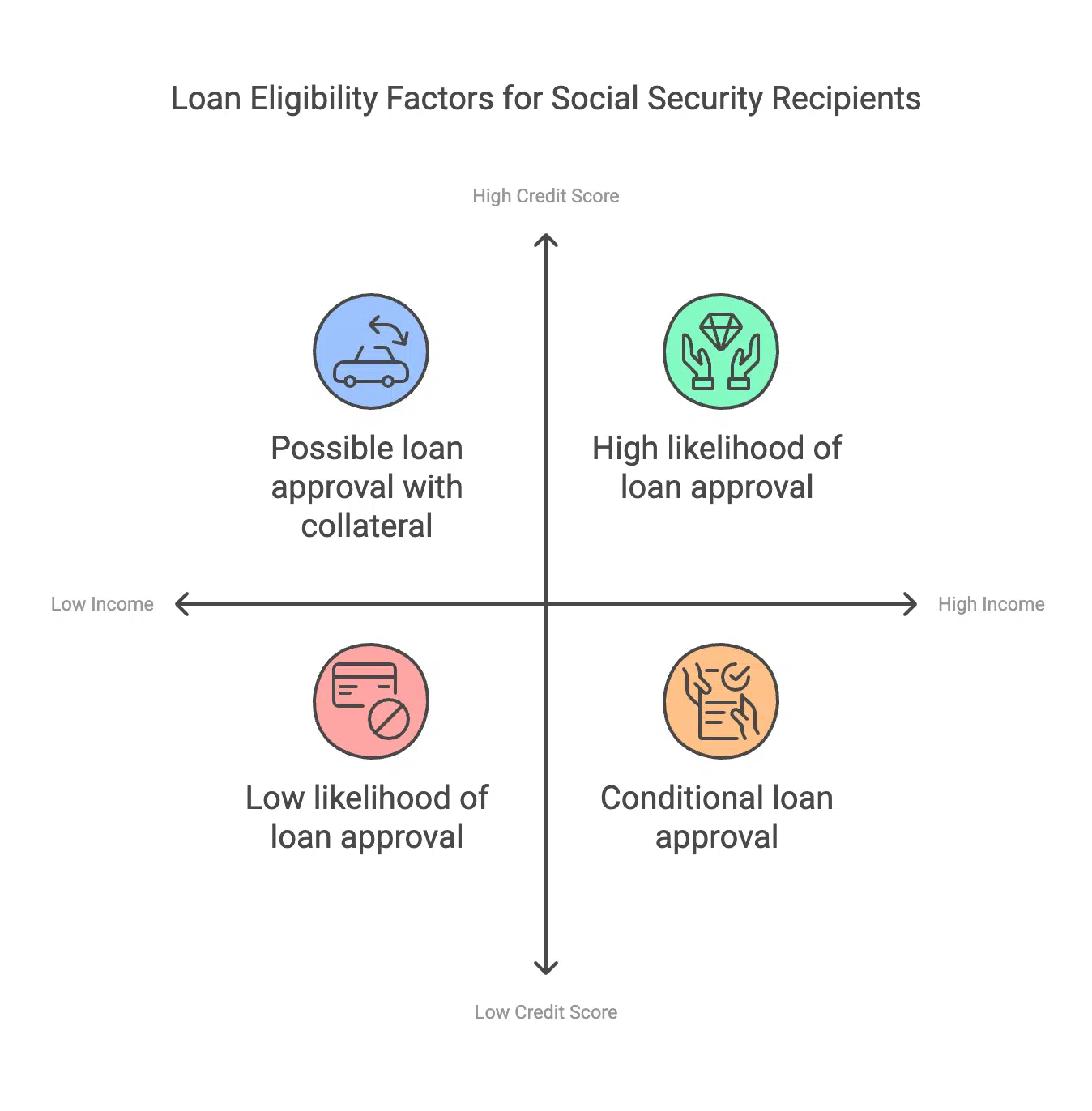

Lenders will typically consider your income level and credit score to decide if you’re eligible. You’ll likely be approved if you have a good credit score since the lender can trust that you’ll pay back the loan. On the other hand, if your credit score is less than ideal, the lender may require additional forms of collateral, such as a car or home, to approve your application.

Lenders will also look at how much money you currently receive through Social Security. Most lenders generally require borrowers to have an income that meets or exceeds the minimum requirements to qualify for a loan. Therefore, if you cannot show evidence of a regular source of income that meets these requirements, the lender may not approve your loan application.

Alternatives of personal loans for people on Social Security

If you don’t qualify for a personal loan, several other options may be available.

For example, if you own a home, you can consider applying for a Home Equity Loan or Line of Credit [HELOC]. With this type of loan, the funds are secured by your house and typically have lower interest rates than personal loans.

You may also want to consider borrowing from family and friends or seeking assistance from nonprofit organizations. Charitable organizations such as The Salvation Army may be able to provide short-term financial help for those in need.

Additionally, government programs like Supplemental Security Income [SSI] can offer additional resources for seniors living on Social Security alone.

Takeaways

Getting a personal loan on Social Security can be challenging, but it is possible. Be sure to research lenders and alternatives carefully and understand the eligibility requirements before applying. This way, you’ll have the best chance of getting approved for a personal loan that meets your financial needs.

Notice: Information provided in this article is for information purposes only and does not necessarily reflect the views of editorialge.com or its employees. Please be sure to consult your financial advisor about your financial circumstances and options. This site may receive compensation from advertisers for links to third-party websites.