You may feel lost about buying your first Bitcoin. Many people worry about digital currency and the blockchain technology behind it. They wonder how to start and keep funds safe. They do not want to waste u.s.

dollar on fees or fall for a scam.

One fact is that a Bitcoin ATM can charge high fees for small buys. This post will show you how to pick a reliable cryptocurrency exchange and set up a crypto wallet. You will learn about two-factor authentication, hardware wallets, and proof of work.

You will also get tips on taxes and legal tender rules. Ready?

Key Takeaways

- Bitcoin basics matter: it can swing 5% to 10% in one day, fell from $20,000 to $3,000 in 2018–19, plunged 65% in 2022, runs on proof of work, and faces over 19,000 rival coins.

- Pick a top exchange like Coinbase or Binance (they verify your ID, follow SEC rules). Bitcoin ATMs charge 5%–10% fees. Mt. Gox lost 850,000 BTC in 2014. P2P options like Bisq need tech know-how.

- Hot wallets trade fast online but risk hacks. Cold wallets (Trezor, Ledger) stay offline and use a 24-word recovery phrase. Lose the phrase, lose the coins.

- Start small (try $50–$100) and set up two-factor authentication (cuts risk by 90%). Do a test trade, then learn blockchain basics, proof of stake, and mining pools.

- Mind the rules: U.S. taxes crypto on Form 8949 and Schedule D. China bans trading. El Salvador treats Bitcoin as legal tender. Never share your private key or recovery phrase.

Understand the Basics of Bitcoin

Bitcoin works as a digital currency that runs on a peer-to-peer network using cryptographic hash. Nodes in the chain ledger record each transaction in blocks. Miners power the network with work that secures and verifies payments.

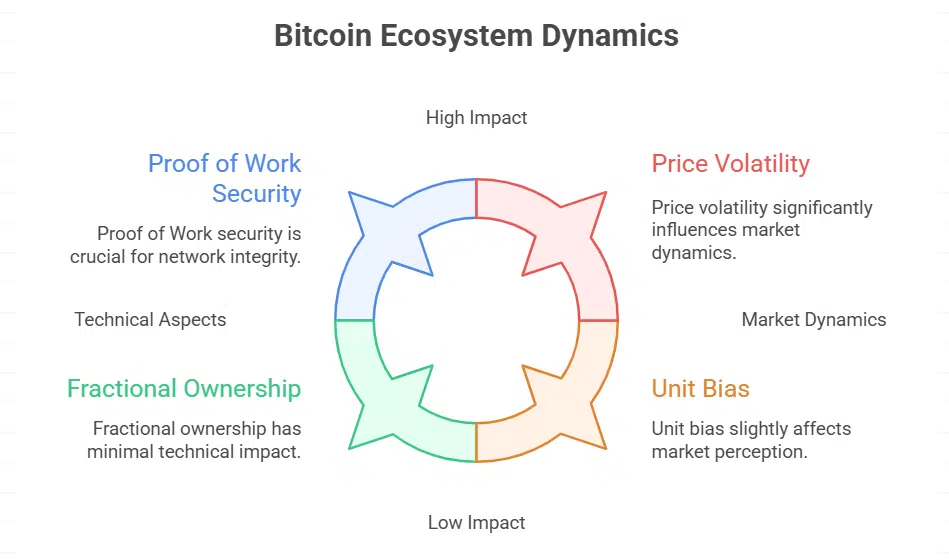

Traders spot 5–10 percent swings in a single day and chase digital assets on crypto exchanges. Price crashed from $20,000 to $3,000 between 2018 and 2019 and tumbled 65 percent in 2022.

Fractional ownership lets people buy a slice of a coin, not just a full unit. Unit bias tricks some into thinking a $1 token ranks lower than a $50,000 token. Miners group up in a miner pool to boost chances of earning new coins.

Bitcoin uses proof of work to guard against double spend. Investors should vet more than 19,000 digital currencies; most lack a solid future.

Choose a Reliable Cryptocurrency Exchange

Coinbase and Binance lead top crypto exchanges. The platforms require you to verify your ID. You can buy digital currency in dollars, euros, and other options. Each trade records on blockchain technology to stop double-spend.

Those sites follow SEC rules and global regulations. Strong security guards your crypto assets, and a fast help desk answers your questions.

Mt. Gox collapsed in 2014 and cost users 850,000 bitcoins. Bitcoin ATMs charge fees from 5 percent to 10 percent or more. Peach and Bisq offer peer-to-peer trades with more privacy, but they demand tech skills and careful partner checks.

Fidelity, Robinhood and JP Morgan let you buy bitcoins, yet they lock coins in their wallets. Most brokerages tack on higher fees and list few tokens. Exchanges must register with each country’s regulators before opening shop.

Watch fees and trading pairs if you aim for passive income or a speculative investment.

Learn About Bitcoin Wallets

Compare a hot wallet app to a cold wallet device, then read on to learn more.

Hot Wallets vs. Cold Wallets

Here is a quick look at hot and cold wallets.

| Wallet Type | Advantages | Disadvantages |

|---|---|---|

| Online Wallets |

|

|

| Offline Devices |

|

|

Start with a Small Investment

Invest a small amount you can lose. Aim for fifty or one hundred USD, not your rent or mortgage, to buy a Bitcoin fraction. Sign up on Coinbase or Binance and set up two-factor authentication for crypto security.

Pick a bank transfer or a credit card to purchase digital currency. Send coins to a hardware crypto wallet like Ledger Nano S and do a test transaction to avoid irreversible errors.

Spend the first month on tech, not on price charts. Study blockchain technology and proof of stake and read about mining cryptocurrency in a mining pool. Try MetaMask as a cryptocurrency wallet.

Use small trades on decentralized exchanges to learn trading tools and build a strategy.

Be Aware of Volatility and Risks

Bitcoin can swing by 5–10% in one day. 2022 saw a 65% tumble in price. 2018 dropped from 20,000 to 3,000 in months. Extreme dips can hit your digital assets hard. Media hype stokes fear and greed in the cryptocurrency market.

Price spikes up to 30% lure new investors into risky bets.

More than 19,000 digital currencies float in cryptocurrency trading. Most lack value and long term promise. Scams slip by despite blockchain security. The exchange platform can lock you out on a crash.

Breaches can hit a crypto wallet without two-factor authentication (2fa). A hardware wallet can secure your Bitcoins better. A blockchain explorer and market data API can check live trades.

Talk to a financial advisor for smart cryptocurrency investment.

Research Tax Implications and Legal Considerations

Countries set different rules for digital currency. China bans crypto trading. Blockchain technology still draws legal scrutiny. Japan’s financial regulator asks crypto exchanges to register.

El Salvador treats Bitcoin as legal tender. U.S. agencies like the IRS and SEC tax crypto trades on Form 8949 and Schedule D. These local laws can cut into potential returns on digital assets.

Skipping research can land you in tax court or trigger audits.

Taxable events start when you sell, swap, or spend Bitcoin. You must report capital gains and losses. Some brokerages even let you mix Bitcoin with retirement accounts, from IRAs to 401(k)s.

Passive income from bitcoin mining also triggers tax duties. Those investment vehicles still face federal rules on monetary transfers. Unreported trades can trigger steep fines or criminal charges.

Keep logs of each trade date, cost basis, and sale price.

Prioritize Security Measures

Lock down your crypto wallet with two-factor authentication and a strong passphrase, then move most coins to an offline storage unit. Read our guide on adding an authenticator app, a password manager, and a security token to raise your walls.

Enable Two-Factor Authentication

Adding two-factor authentication feels like building a second wall around your digital currency vault. You enter a fresh code from an authenticator app each time you sign in or move digital assets.

Many crypto exchanges and crypto wallets let you use 2FA for logins and withdrawals. SMS methods can get stolen via SIM swapping, so stick with apps such as Google Authenticator or Authy.

Codes reset every 30 seconds, making it tough for thieves to slip in. Data shows accounts without 2FA lost millions in 2021 to hackers.

Blockchain technology drives digital currency, but hackers lurk. Review your 2FA setup each month. Change your backup codes and app settings. Cybercriminals test every gap in cryptocurrency security.

You cut risk by up to 90 percent when you use two-factor authentication (2fa).

Avoid Sharing Private Keys

Scammers ask for private keys under the guise of tech support or account recovery. No legitimate transaction or service will ask for your 24-word recovery phrase. You risk losing all digital assets if someone steals your private key.

Store recovery phrases offline, in a locked safe or on a paper record.

Fake investment advisors target newbies with phishing emails that mimic crypto exchanges. Verifying an email domain can save you from a scam site that looks real. Use a hardware device or USB gadget to guard your secret seed phrase.

Add two-factor authentication (2fa) with an authentication app like Google Authenticator for extra cryptocurrency security.

Avoid Emotional Decisions and Hype

FOMO drives rash trades, and social media stars hype coins to fill pockets. A single tweet can spark a 30% price spike, luring beginners into impulsive buys. Influencers push price predictions and insider tips that suit their own goals.

Treat urgent limited time offers as red flags. Healthy skepticism will shield your crypto wallet.

Media hype can swell like storm clouds, hiding portfolio diversification or core blockchain upgrades. Press headlines rarely reveal true decentralized finance risks or initial coin offerings pitfalls.

You need to evaluate coins independently, not follow a herd mentality. No legit investment needs blind trust or instant action. Step back, log off social feeds, check valuations, and move with care.

Takeaways

Hold your horses, a smart buyer uses a test trade first. You can stash coins in an offline device, it boosts protection. Turn on two-factor authentication, and use a trusted exchange.

Watch price swings, so you dodge nasty surprises. Stay curious about blockchain, digital currency, and new rules, you will trade with more skill.

FAQs on Must-Know Tips Before You Buy Your First Bitcoin

1. What is Bitcoin and how does it differ from other digital currency?

Bitcoin is a virtual currency that runs on blockchains. It uses blockchain technology to record every trade. Cardano and the ethereum blockchain share the same idea, but they run on different rules. As a digital asset, Bitcoin sits in a strategic bitcoin reserve held by some funds. It can serve as a store of value, like digital gold.

2. How do I secure my Bitcoin in a crypto wallet with two-factor authentication?

Pick a reputable crypto wallet that focuses on cryptocurrency security. Store your coins off crypto exchanges when you can. Turn on two-factor authentication, or 2FA, on your account. That way, a thief needs more than a password to steal your keys. Think of 2FA as a second lock on your front door.

3. Should I see Bitcoin as a speculative investment or a path to passive income?

Some buy Bitcoin as a speculative investment in the cryptocurrency market, hoping to buy low and sell high. Others stake coins on certain blockchains for passive income. Remember, swings in bull and bear markets can move prices fast. Do your own research and set clear goals before you invest.

4. Can Bitcoin join bonds, t-bills, and other financial securities in my portfolio?

Yes, you can mix Bitcoin with bonds, t-bills, and stock market shares. Bonds pay interest to a bondholder. T-bills use a set rate, and stocks can reward you with dividends. Diversifying helps spread risk, but don’t let your eggs sit in one basket.

5. What tax and legal rules apply when I buy Bitcoin?

Governments treat Bitcoin as a digital asset, so gains get taxed. You may need to report trades to the department of financial protection and innovation. The rules can affect your mortgage lenders, student loans, or retirement savings. Work with a CFP® or tax pro to stay on track.

6. What about the environmental impact of Bitcoin and its authenticity?

Bitcoin mining can use a lot of energy, so it has an environmental impact. Some coins claim they use green power. Check the authenticity of your coin and use trusted cryptocurrency exchanges for every money transfer. A scam can drain your wallet faster than a leaky bucket.