Cryptocurrency trading has taken the financial world by storm, offering a unique blend of high risk and high reward. While it’s an exciting venture, the volatility of the crypto market can lead to costly mistakes for both beginners and experienced traders.

Understanding and avoiding these pitfalls is essential to protect your investments and achieve success in this dynamic market.

In this article, we will discuss the top 10 mistakes to avoid in crypto trading and provide actionable tips to avoid them. By learning from these common errors, you can trade more confidently and effectively.

Understanding the Risks in Crypto Trading

Before diving into the specifics, it’s important to understand that crypto trading is inherently risky. The market is highly volatile, and prices can swing dramatically within minutes. This level of unpredictability means that preparation, research, and discipline are key to minimizing losses and maximizing profits.

Key Risks in Crypto Trading:

- Volatility: Prices can rise or fall sharply without warning.

- Security Threats: Hacking and fraud are prevalent.

- Regulatory Changes: Sudden policy shifts can impact markets.

- Lack of Knowledge: Entering the market without adequate research leads to poor decisions.

Top 10 Mistakes to Avoid in Crypto Trading

Navigating the crypto market can be challenging, but understanding common mistakes can help you trade more effectively. Below, we outline the top 10 mistakes to avoid in crypto trading and provide strategies to avoid them.

Whether you’re a beginner or a seasoned trader, these tips will help you stay ahead and make informed decisions.

1. Jumping in Without Research

One of the biggest mistakes traders make is diving into crypto trading without understanding the basics. Cryptocurrencies like Bitcoin, Ethereum, and others operate on blockchain technology, which can be complex for beginners.

How to Avoid This Mistake:

- Read reputable guides and articles to understand how cryptocurrencies work.

- Follow industry news to stay updated on market trends.

- Use demo trading accounts to practice without risking real money.

Additional Tips:

- Join online forums and communities to gain insights from experienced traders.

- Subscribe to newsletters from trusted crypto experts.

- Watch educational videos for visual learning.

| Research Resources | Details |

| Whitepapers | Detailed info on crypto projects |

| Online Courses | Platforms like Coursera or Udemy |

| News Platforms | CoinDesk, CryptoSlate |

2. Ignoring Risk Management

Risk management is critical in any financial market. Without a clear plan, you risk losing more than you can afford.

How to Avoid This Mistake:

- Use stop-loss orders to minimize potential losses.

- Diversify your portfolio across multiple cryptocurrencies.

- Only trade with money you can afford to lose.

Additional Tips:

- Use risk/reward ratios to evaluate potential trades.

- Regularly review and adjust your risk management strategies.

- Maintain a trading journal to track and learn from past decisions.

| Risk Management Tools | Benefits |

| Stop-Loss Orders | Automatic loss limitation |

| Portfolio Diversification | Reduces overall risk |

| Position Sizing | Controls exposure |

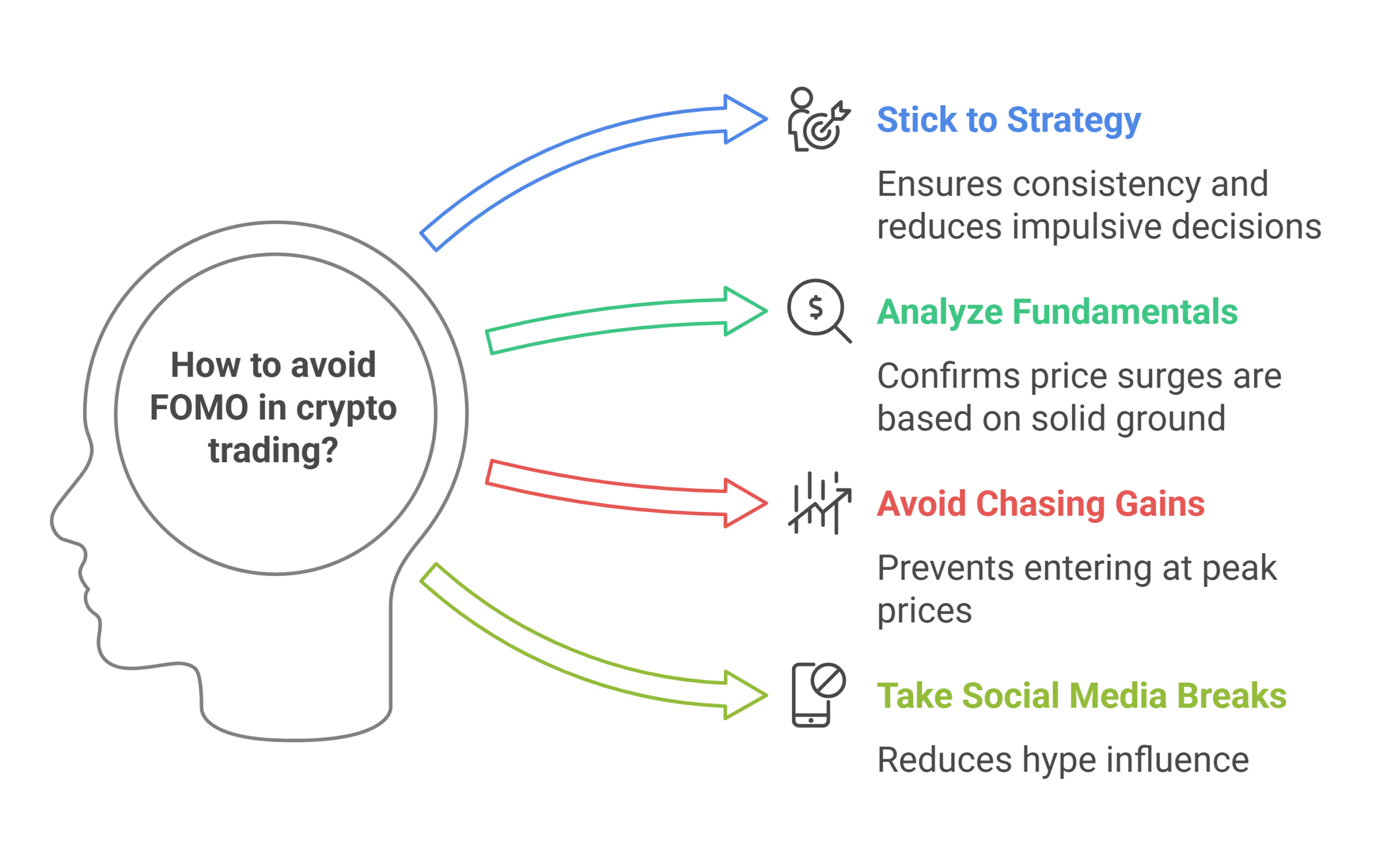

3. Following FOMO (Fear of Missing Out)

FOMO is a common emotional trap in crypto trading. Seeing a coin’s price surge can lead to impulsive decisions without considering the risks.

How to Avoid This Mistake:

- Stick to your trading strategy, regardless of market hype.

- Analyze whether the price surge is backed by solid fundamentals.

- Avoid chasing coins that have already seen massive gains.

Additional Tips:

- Take breaks from social media to avoid being influenced by hype.

- Use technical indicators to validate market trends.

- Remember that opportunities are always present in the market.

| FOMO Triggers | Mitigation Strategies |

| Sudden Price Surges | Research before acting |

| Social Media Hype | Verify claims from reliable sources |

| Peer Pressure | Trust your own analysis |

4. Overleveraging

Leverage allows you to trade with borrowed funds, amplifying both potential gains and losses. Many traders misuse leverage, leading to significant losses.

How to Avoid This Mistake:

- Start with low leverage or avoid it entirely if you’re a beginner.

- Understand the risks associated with margin trading.

- Monitor your positions closely to avoid margin calls.

Additional Tips:

- Use leverage calculators to understand your risk exposure.

- Begin with smaller trade sizes to minimize risks.

- Avoid emotional trading when using leverage.

| Leverage Ratio | Risk Level |

| 1:1 | Low Risk |

| 1:10 | Moderate Risk |

| 1:100 | High Risk |

5. Not Keeping Track of Market Trends

Ignoring market trends can result in poorly timed trades. The crypto market often follows patterns influenced by news, technology updates, and macroeconomic factors.

How to Avoid This Mistake:

- Use tools like trading charts and indicators.

- Stay informed through crypto news platforms.

- Join online communities to learn from other traders.

Additional Tips:

- Set up alerts for key market changes.

- Learn to identify trend reversal patterns.

- Use historical data to understand market behavior.

| Tracking Tools | Purpose |

| TradingView | Technical analysis |

| Crypto News Websites | Market updates and trends |

| Social Media (e.g., Twitter) | Real-time insights |

6. Misjudging Transaction Costs

Transaction fees can significantly impact your profits, especially if you’re trading frequently.

How to Avoid This Mistake:

- Compare fees across exchanges before choosing a platform.

- Factor in both trading fees and withdrawal fees.

- Use exchanges with transparent fee structures.

Additional Tips:

- Opt for trading during periods of lower network congestion.

- Consider long-term holding strategies to minimize fees.

- Use fee calculators to estimate costs before trading.

| Platform | Trading Fee | Withdrawal Fee |

| Binance | 0.10% | Varies by asset |

| Coinbase | 0.50% | Fixed fee |

| Kraken | 0.26% | Varies by asset |

7. Using Unsecured Platforms

Choosing an unsecure trading platform can expose your funds to hacks and fraud.

How to Avoid This Mistake:

- Select exchanges with strong security measures (e.g., 2FA, cold storage).

- Research the platform’s reputation and history.

- Avoid sharing sensitive information online.

Additional Tips:

- Regularly update your passwords and enable 2FA.

- Store long-term holdings in hardware wallets.

- Verify the authenticity of URLs before logging in.

| Security Features | Importance |

| Two-Factor Authentication (2FA) | Prevents unauthorized access |

| Cold Wallet Storage | Protects funds from hackers |

| SSL Encryption | Secures data transfers |

8. Falling for Scams and Fraud

Scams are rampant in the crypto space. From phishing emails to fake investment schemes, the risks are high.

How to Avoid This Mistake:

- Verify the legitimacy of projects before investing.

- Avoid clicking on suspicious links or emails.

- Use hardware wallets for secure storage.

Additional Tips:

- Double-check URLs to avoid phishing sites.

- Avoid offers that seem too good to be true.

- Conduct background checks on team members of new projects.

| Common Scams | Warning Signs |

| Phishing Emails | Misspellings, urgency claims |

| Pump-and-Dump Schemes | Rapid, unverified price surges |

| Fake ICOs | Lack of credible whitepapers |

9. Trading Without a Plan

Trading without a strategy is akin to gambling. A lack of direction can lead to inconsistent results.

How to Avoid This Mistake:

- Set clear goals for your trades.

- Define entry and exit points.

- Regularly evaluate and adjust your strategy.

Additional Tips:

- Use trading journals to refine your strategies.

- Backtest your plan using historical data.

- Incorporate both technical and fundamental analysis.

| Plan Components | Details |

| Entry Point Criteria | When to buy |

| Exit Point Criteria | When to sell |

| Risk/Reward Ratio | Acceptable losses vs. gains |

10. Neglecting Tax Obligations

Crypto gains are taxable in most jurisdictions. Neglecting tax compliance can lead to penalties.

How to Avoid This Mistake:

- Use tools to track your trades and calculate taxes.

- Stay informed about your local tax laws.

- Consult a tax professional for guidance.

Additional Tips:

- Keep detailed records of all transactions.

- Use tax loss harvesting strategies to offset gains.

- Stay updated on changes in crypto tax regulations.

| Tax Tools | Features |

| CoinTracking | Tracks trades and generates reports |

| Koinly | Simplifies tax calculations |

| CryptoTrader.Tax | Integrates with exchanges |

How to Trade Smartly and Avoid Mistakes

By avoiding these mistakes, you can improve your trading performance and reduce unnecessary losses. Remember to:

- Keep learning and stay updated on market trends.

- Trade with a clear strategy.

- Protect your assets with strong security practices.

Takeaways

Trading cryptocurrencies can be profitable, but it’s not without risks. By understanding and avoiding the common mistakes to avoid in crypto trading outlined in this guide, you can trade smarter and build a more secure and successful investment portfolio.

Start your trading journey today, armed with knowledge and confidence. Remember, patience and discipline are key to long-term success in the crypto market.