After more than a decade of being a familiar face on primetime television, billionaire entrepreneur Mark Cuban is stepping away from Shark Tank, the hit ABC show that brought startup investing into mainstream culture.

Cuban confirmed that Friday’s season finale in May 2025 would mark his final appearance on the show. He originally joined the cast of “Shark Tank” in its second season in 2011, becoming a fan favorite for his direct, high-energy investment style and sharp business insight.

While speaking about his departure, Cuban explained his reasoning simply: he wants to spend more time with his teenage children. “Shark Tank” is filmed over the summer months, which overlaps with the only time his kids are free from school. He said previously, “I just want to enjoy those summer moments with them while I still can.”

During his tenure on Shark Tank, Cuban invested in over 85 companies, many of which have become notable success stories. Startups like BeatBox Beverages, Simple Sugars, and Dude Wipes all gained Cuban’s backing and scaled significantly thanks to the exposure and funding from the show.

In a touching moment during his farewell episode, fellow sharks—including Barbara Corcoran, Lori Greiner, and Kevin O’Leary—paid tribute to Cuban’s impact on the show, recognizing his role in shaping the lives of young entrepreneurs and driving public enthusiasm for venture capital.

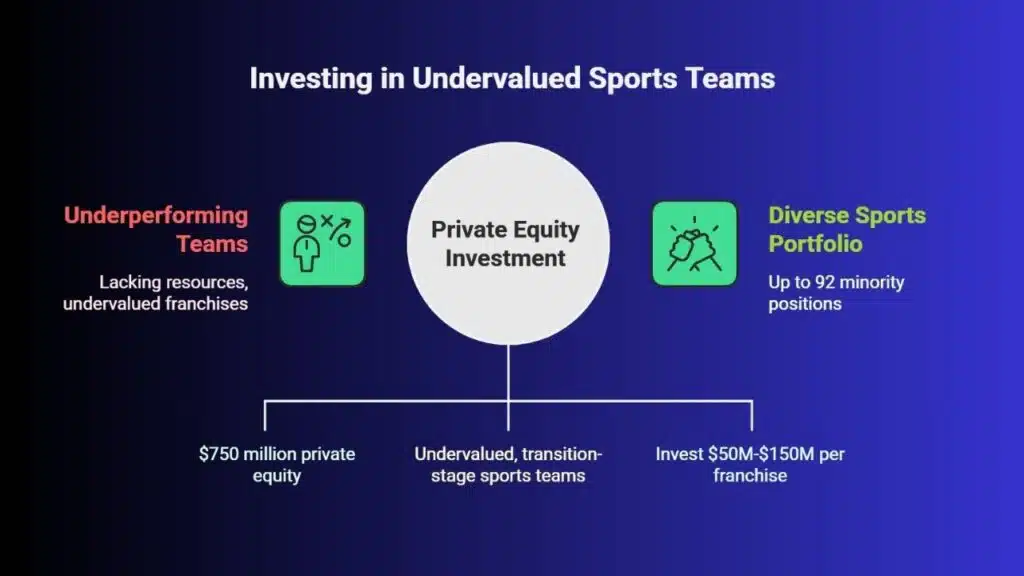

Cuban’s New Focus: Launching a $750 Million Private Equity Sports Fund

As Cuban closes the door on his television career (for now), he’s opening another in the business world—one that brings him back to his roots: professional sports.

On the same day as the Shark Tank finale, Cuban officially announced the launch of a $750 million private equity fund named Harbinger Sports Partners. The fund will target minority ownership stakes in franchises across the NBA, NFL, and MLB—three of North America’s most valuable and iconic sports leagues.

Cuban has a long history with sports, most notably as the owner of the Dallas Mavericks, a team he bought in 2000 and helped transform from one of the league’s worst teams into a championship-winning franchise. Although he sold his majority stake in the Mavericks in 2023 to Miriam Adelson—widow of casino magnate Sheldon Adelson—he still retains a minority share and continues to be involved in the team’s basketball operations.

His new venture, Harbinger Sports Partners, aims to identify undervalued or transition-stage sports teams and invest between $50 million to $150 million per franchise, capping each investment at a 5% stake. The goal is to assemble a diverse portfolio of up to 92 minority positions across the NFL, NBA, and MLB.

Why Now? The Changing Landscape of Sports Ownership

The timing of Harbinger’s launch isn’t random—it follows a major shift in how professional sports leagues view private investment.

Traditionally, owning a stake in a sports franchise was reserved for ultra-wealthy individuals or families, with tightly regulated ownership rules. However, in the past few years, these leagues have begun to loosen restrictions to allow private equity firms to purchase minority stakes. This move was largely driven by rising team valuations, which have made it harder for individuals to buy entire teams on their own.

Here’s how the leagues have evolved:

- NBA: Allowed private equity investments starting in 2020.

- MLB: Followed suit in 2019, permitting up to 15% of a team to be owned by private equity.

- NFL: The last to join, approved private equity investments in August 2023, with a limit of 10% per team.

This policy change opens the door for firms like Harbinger to play a more central role in sports ownership by providing liquidity to owners who want to exit or reduce their stake, without forcing a full team sale.

Who’s Behind Harbinger Sports Partners?

Mark Cuban isn’t going it alone in this venture. He has partnered with two experienced sports business professionals:

- Rashaun Williams: A venture capitalist who is also a limited partner in the Atlanta Falcons (NFL). Williams has years of experience in tech, media, and sports investments and brings a deep understanding of how to structure deals within league rules.

- Steve Cannon: The former CEO of AMB Sports and Entertainment, the parent company of the Atlanta Falcons and Atlanta United FC. Cannon was also vice chairman of the Falcons and helped develop Mercedes-Benz Stadium, one of the most advanced sports venues in the world.

Together, the trio aims to structure Harbinger to meet league compliance requirements while also offering something different from traditional ownership: institutional-grade capital, long-term operational strategy, and responsible governance.

In a public statement, Williams said,

“The professional sports sector is maturing into an institutional-quality asset class. Harbinger will be structured to operate within league frameworks while offering long-term capital, operational fluency, and a responsible ownership mindset.”

Sports Franchises: The New Gold Standard in Alternative Investments

Cuban’s bet on sports as an asset class isn’t just sentimental—it’s backed by data. Sports franchises in the U.S. have seen explosive growth in value over the past decade. For example:

- In 2000, Cuban purchased the Dallas Mavericks for $285 million. By 2023, the team’s valuation had soared to $3.5 billion, according to Forbes.

- NFL franchises like the Washington Commanders were sold for $6.05 billion in 2023.

- Sportico estimates that there are only about 500 individuals globally who can afford to buy a major-league franchise outright.

These high valuations have made sports teams one of the most attractive—and exclusive—alternative investments. But with leagues now allowing fractional ownership, investors like Cuban can deploy capital in smaller amounts while still gaining access to the prestige, influence, and returns of owning part of a professional team.

What’s Next for Mark Cuban?

While Cuban is stepping away from the Shark Tank cameras, he’s not retreating from the spotlight. Alongside Harbinger Sports Partners, Cuban remains committed to his cost-plus drug venture, which aims to disrupt the U.S. pharmaceutical industry by offering transparent, affordable pricing for prescription medications.

Additionally, he continues to serve as a mentor and investor in a wide range of startups. And though he hasn’t completely ruled out returning to television or politics, Cuban has made it clear that for now, his priority is family and impactful business ventures.

“This is not a retirement,” Cuban told CNBC. “This is a reset.”

Mark Cuban’s departure from “Shark Tank” marks the end of an era for both the show and the broader world of mainstream entrepreneurship. But his next move—a $750 million push into professional sports investment—could redefine how elite investors engage with the world’s most powerful athletic brands.

By combining his deep knowledge of sports operations with his legacy of business innovation, Cuban’s Harbinger Sports Partners could help reshape the future of franchise ownership, offering fresh capital and smart strategy in a rapidly evolving sports economy.

The Information is Collected from Yahoo and MSN.