Loan defaulting is a drain on the finances and emotionally. Late EMIs, phone calls when you are being pursued on credit repayment, and deteriorating CIB also leave you hanging in a financial maze. However, the positive news is that you can redeem yourself after a loan default. Following the proper attitude and good strategy, you can take control of your future finances and restore your creditworthiness.

Personal loans in India have grown by over 30 percent in the past two years, and following the pandemic, financial instability, even defaults, have increased marginally. The default can happen through loss of jobs, medical emergency, or unforeseen expenses, and the reaction to rebound is clearly defined.

In this blog, we will take you through the nitty-gritty process of how to get a loan out of default, tips you must keep in mind, legal awareness regarding issues of loan default, and how online lending platforms can come to the rescue of borrowers facing financial hardships.

What is Loan Default?

A loan default occurs when a borrower fails to repay the EMIs as per the agreed schedule for an extended period, typically 90 days or more. After this period, the lender may classify the loan as a Non-Performing Asset (NPA), report it to credit bureaus, and initiate recovery or legal proceedings.

- Defaulting has long-term consequences:

- Negative impact on credit score (can drop by 100–150 points or more)

- Difficulty in obtaining future loans or credit cards

- Higher interest rates due to low creditworthiness

- Possible legal action or asset seizure (in case of secured loans)

Step-by-Step Guide to Get a Loan Out of Default

Here’s a structured approach to get the loan out of default and restore your financial credibility:

Step 1: Know Your Loan Status

Start by checking:

- The total overdue amount (including penalties and interest)

- The number of EMIs missed

- Your current credit score on CIBIL, Experian, or CRIF

Tip: If your loan was from an NBFC like Stashfin, the details will also reflect in your email/app or loan statement.

Step 2: Communicate Proactively with the Lender

Ignoring collection calls or notices can worsen the situation. Instead, reach out to your lender and explain your financial hardship. Genuine communication can help you explore:

- Revised EMI plans

- Temporary moratoriums

- Debt restructuring

Lenders, especially digital ones like Stashfin, often have borrower assistance programs to help you catch up on payments without damaging your credit further.

Step 3: Request a Loan Restructuring or Settlement

If you’re unable to repay the full loan due to job loss, medical issues, or other challenges, you can request one of the following:

- Loan Restructuring

- Tenure is extended

- EMI is reduced

- The interest rate may be revised

- Loan Settlement

- You pay a negotiated lump sum, typically less than the total due

- The account is closed, but it is marked as “Settled” in your credit report (which is negative)

- Important: Always get written confirmation from the lender before making a settlement payment.

Step 4: Start Paying EMIs Again (or Partial Payments)

- If full repayment isn’t possible, start small:

- Pay whatever you can afford regularly

- Even partial payments improve your credit standing

Stashfin, for example, offers flexible repayment schedules that adapt to your income

Making consistent payments can eventually help get your loan status reclassified from “default” to “regular”.

Step 5: Consider a Balance Transfer (If Credit Score Allows)

If your default is recent and your credit score is still recoverable (650+), consider doing a loan balance transfer to another lender with:

- Lower interest rate

- Longer tenure

- Better repayment flexibility

Note: Balance transfers are typically allowed only when you’re not already in deep default, but some lenders may still consider you if your income is stable.

Step 6: Rebuild Your Credit Score

- Once your loan is out of default:

- Always pay EMIs on time

- Avoid taking new loans unless necessary

- Use credit-building tools, such as secured credit cards or small personal loans from platforms like Stashfin.

Check your credit report every quarter to track progress

Indian Statistics on Loan Defaults

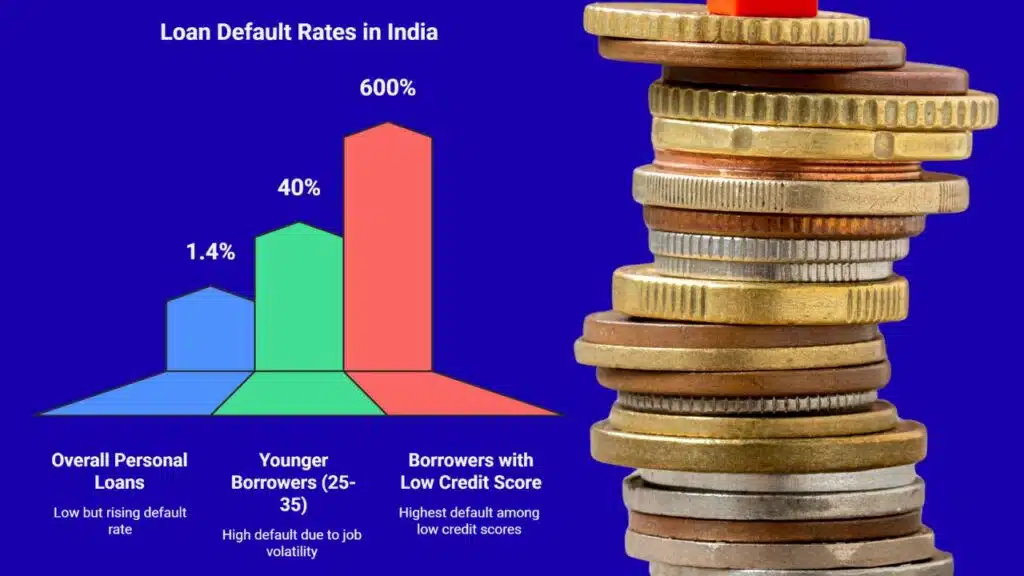

As per the RBI’s Financial Stability Report (Dec 2023), gross NPAs in personal loans are at 1.4%, relatively low but rising.

Default rates are highest among borrowers with a credit score below 600.

Younger borrowers (aged 25–35) form nearly 40% of the defaulting group, mostly due to job volatility and lack of planning.

These numbers highlight the importance of financial literacy, prompt action, and responsible borrowing, especially for first-time borrowers.

What Happens If You Don’t Act?

Loan defaults in India are not taken lightly. If you ignore them, the consequences include:

- Legal notices under the SARFAESI Act (for secured loans)

- Visits from collection agents

- Asset seizures (in secured loans)

A credit score dropping below 600, impacting your eligibility for credit cards, housing loans, or even mobile EMIs

As per RBI guidelines, NBFCs and digital lenders like Stashfin must follow fair practices while collecting dues, but that doesn’t mean you can delay action.

Tips to Avoid Falling Into Default Again

- Once you’ve recovered from a default, follow these practices to avoid repeating the cycle:

- Borrow only what you can repay

- Maintain a repayment reminder calendar

- Avoid multiple loans at the same time

- Keep an emergency fund worth 3–6 months of expenses

- Review your credit report twice a year

Use online lending platforms like Stashfin that offer personal credit lines rather than lump-sum loans, so you only pay interest on what you use.

Reclaim Your Financial Health

Loan default is not the end of your financial journey—it’s a temporary setback that can be fixed with the right knowledge and discipline. By understanding your rights, communicating with lenders, exploring restructuring or settlement options, and using trusted fintech platforms like Stashfin, you can regain control of your finances.

The sooner you act, the better the outcome. Whether it’s rebuilding your credit score or avoiding legal hassles, remember: every financial mistake is a learning opportunity.

Take your first step toward recovery today, and let platforms like Stashfin support you on your journey to financial stability.