Mary never envisioned being a widow at 35. Yet here she was, just months after burying her husband, facing a second gut punch. The life insurance policy, meant to provide a lifeline for her and her two young children, was denied. The company cited a clause about non-disclosure of pre-existing conditions: her husband’s slightly elevated blood pressure. He’d taken medication for it, but viewed it as a minor issue, not something that would jeopardize the very policy he’d bought to safeguard his family’s future. The denial letter felt like a cruel twist of fate on top of an already unbearable loss.

What is Bad Faith?

The word “denied” might seem like the final, unchangeable verdict on your life insurance claim. However, it’s important to understand that insurance companies don’t hold absolute power. When a denial goes beyond a simple error or differing interpretation of the policy’s terms, it might cross the line into what’s known as “bad faith”.

Bad faith, in the context of insurance, means more than just a disagreement. It occurs when an insurance company knowingly acts in a way that is unreasonable, misleading, or downright malicious in order to avoid paying a legitimate claim. They might twist the wording of the policy, exploit loopholes, or even purposely delay investigations, hoping the beneficiary will become desperate and give up. This isn’t simply a legal technicality – it’s about an insurance company knowingly doing the wrong thing, prioritizing their profits over their policyholder’s needs.

Life Insurance Companies: Tactics for Dodging Payouts

Life insurance companies, unfortunately, have an arsenal of tactics designed to get them off the hook for paying out claims. Some of these are frustratingly petty, while others are downright insidious:

- Nitpicking Applications: Years after a policy was issued, they might comb back through the original application with a fine-tooth comb. Finding even the tiniest inaccuracy, like a misstated middle initial or an old address, can be their excuse to try and invalidate the entire policy. Never assume that because you paid premiums in good faith for years, that the company won’t play these games.

- Exploiting “Lapses”: Did a payment get delayed in the mail, even by a day or two? Even if the check is postmarked before the due date, some companies will seize upon this technicality to claim the policy “lapsed” and they owe you nothing.

- Obscure Exclusions: Buried deep in the fine print of life insurance policies, you’ll often find clauses about pre-existing conditions. These might be so broad, it would exclude large swaths of the population. The insurer might then deny a claim, alleging the deceased MUST have known about an issue, even if it was undiagnosed or considered minor by the policyholder.

The Devastating Impact

The devastating impact of a wrongful life insurance denial extends far beyond the immediate financial loss. It strikes at the very heart of why people purchase these policies in the first place. For Mary, the mother we imagined earlier, the denial meant the very real possibility of losing her home – the place where her children felt a lingering connection to the dad they’d lost. It

meant the potential upheaval of switching schools mid-year, adding further instability to their already shattered world. The constant stress of fighting the insurance company was an emotional burden on top of her grief, hindering her ability to heal.

Life insurance is often sold on the promise of peace of mind, a safety net for loved ones. When that promise is broken through a bad faith denial, it’s more than just money lost. It’s a deep betrayal of trust. People diligently pay their premiums, believing that should the worst happen, their family will be protected. To have that protection yanked away at the most vulnerable time feels like an act of cruelty. At this point, consulting a specialized life insurance attorney becomes vital. They can not only help untangle the legal complexities but may offer an option for restoring that shattered trust in obtaining the benefits you and your family deserve.

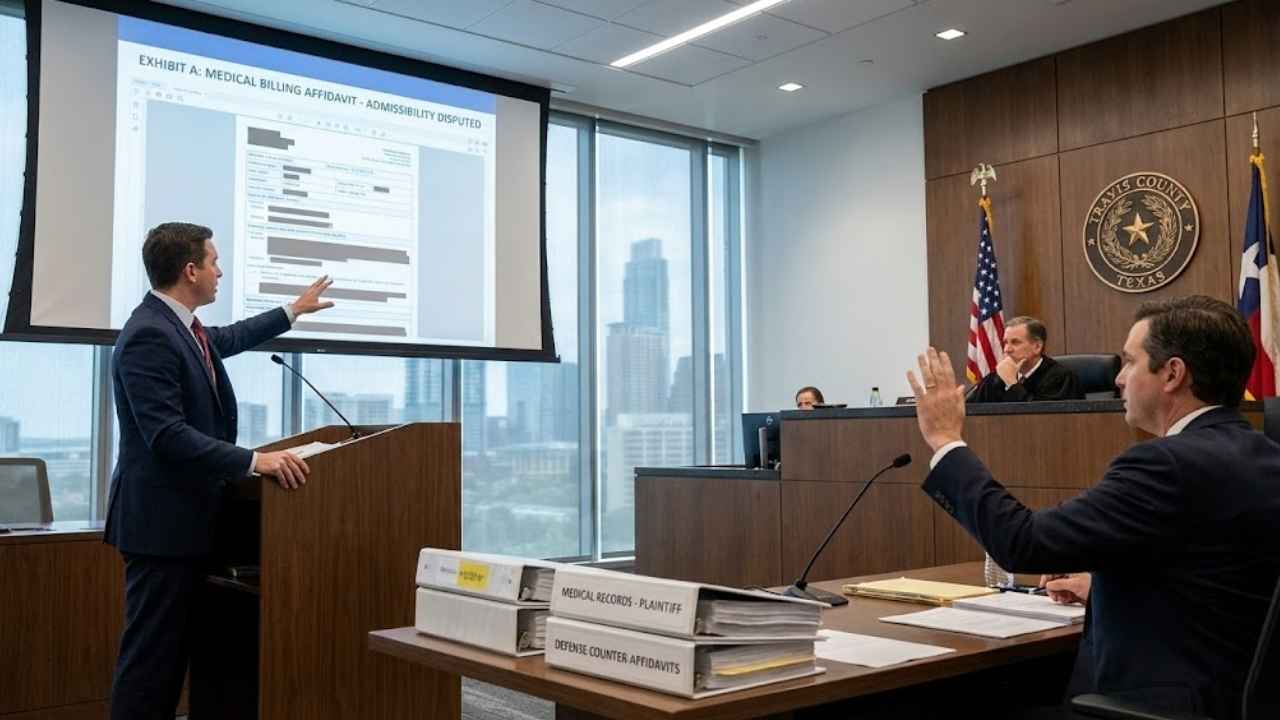

Bad Faith Attorneys: Warriors for the Wronged

Facing down a massive insurance company after a wrongful denial can feel like an impossible fight. This is where bad faith attorneys become invaluable allies. These specialized lawyers have the experience and deep understanding of insurance law to combat the shady tactics insurers often employ.

They go beyond simply refuting the initial reason for the denial. Bad faith attorneys act as investigators. They dig deep, examining whether the company has a history of similar denials using the same excuse. They meticulously review communications with the beneficiary, looking for evidence that the insurer purposely misled or stalled in hopes the person would give up. It’s this tireless work of uncovering the larger pattern of deceptive practices that allows them to build the strongest possible cases against the insurance company.

In situations where bad faith appears to be a widespread practice within a specific company, there’s even greater power in numbers. A bad faith insurance lawyer can spearhead class action lawsuits, uniting multiple wronged policyholders. This amplifies the voices of those harmed, and makes it far more difficult for an insurance company to brush off the accusations as isolated incidents.

Conclusion

It’s important to understand that laws surrounding insurance bad faith differ significantly between states. What qualifies as a wrongful denial in one state might not be enough to build a solid case in another. This is why seeking out a Texas insurance lawyers within your specific state is crucial. They’ll have an in-depth knowledge of the local legal landscape and what’s required to prove that the insurance company acted in bad faith.

If you feel your life insurance claim has been wrongfully denied, don’t simply resign yourself to defeat. The National Association of Insurance Commissioners (NAIC) (https://content.naic.org/) is an essential resource. Their website provides information about your rights as a policyholder, allows you to search for reputable bad faith insurance attorneys in your area, and importantly, empowers you to file a formal complaint with your state’s insurance regulator. This complaint can trigger an official investigation into the company’s practices.

Remember, while the road to justice might feel long and daunting, you don’t have to walk it alone. By seeking legal guidance, understanding your rights, and taking action to hold insurance companies accountable, you fight back not just for yourself, but for all those who might be wrongly denied the benefits of the policies they’ve faithfully paid for.