Many people wonder about the riches of famous money experts. They face their own money troubles, like piles of debt or slim savings. This sparks curiosity about folks who teach wealth.

Is Dave Ramsey a millionaire? Readers often search for answers to see if his tips really work in real life. His story draws them in, full of ups and downs that mirror everyday struggles.

Dave Ramsey hit big success early on. At age 26, he earned a quarter of a million dollars each year and ran a $4 million real estate setup. This post breaks down his path to wealth, from smart moves to key income sources.

You will learn his seven steps to freedom and see how they build real riches. Keep reading to find your own path.

How Did Dave Ramsey Build His Wealth?

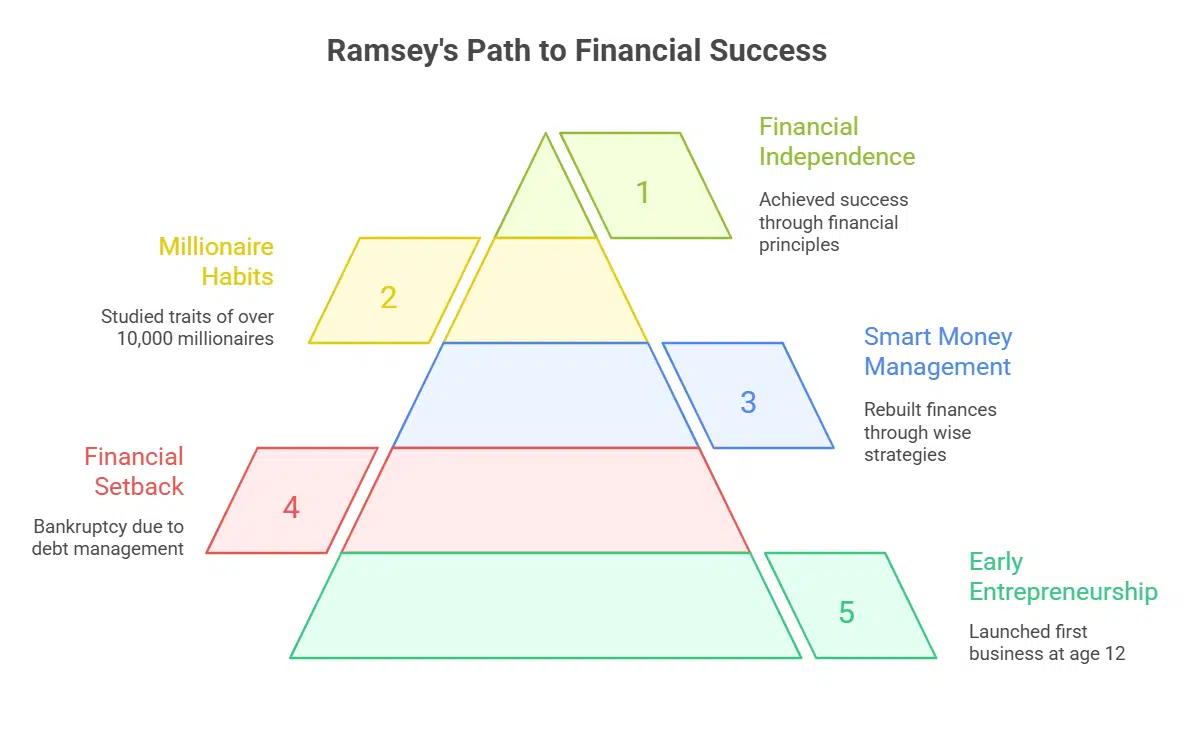

Dave Ramsey started young, getting involved in real estate deals that built his first fortune, until a tough bankruptcy in his twenties flipped everything upside down. He bounced back strong, sharing hard-learned lessons through financial counseling, books, and his hit radio show, turning personal setbacks into a thriving empire that inspires millions to chase debt-free lives.

Early real estate investments

Dave Ramsey started his path to wealth with smart moves in real estate. He launched his first business at age 12, which lit a fire for his entrepreneurial drive. That early spark pushed him into bigger ventures.

By age 26, he earned a quarter of a million dollars each year. He also managed a $4 million real estate portfolio. These steps built his base in personal finance and wealth management.

Yet, Dave piled up that wealth on debt, which led to bankruptcy. He rebuilt everything from scratch. His story shows how understanding investment principles and income strategies can lead to financial independence.

Ramsey Solutions later studied over 10,000 millionaires. The research highlights habits like debt reduction and budgeting techniques. Top careers for economic success often tie back to real estate, just like Dave’s start.

His journey inspires many to chase financial literacy and millionaire habits.

Transition to financial counseling and media career

Ramsey hit rock bottom after building his early wealth on debt. He faced bankruptcy, which wiped out his $4 million real estate portfolio. That tough time changed everything. He turned his pain into purpose.

He started sharing lessons from his mistakes. People needed help with personal finance and debt reduction. Ramsey began offering financial counseling. His entrepreneurial drive, sparked by his first business at age 12, pushed him forward.

He rebuilt his life step by step.

Soon, Ramsey expanded into media. He launched a radio show to teach financial literacy. Listeners loved his straight talk on wealth management and budgeting techniques. He became a personal finance guru and media personality.

Ramsey Solutions grew from this shift. They conducted a study with over 10,000 participants on millionaire habits. “Most millionaires only invest in what they understand,” Ramsey says.

He stresses that income absolutely matters in building wealth. Top career choices for economic success include fields like his own. His understanding of investment strategies and financial independence drew millions.

Readers, you can learn from his journey too.

Key Sources of Dave Ramsey’s Income

Dave Ramsey once faced bankruptcy in his twenties, but he turned that setback into a thriving empire through smart income streams that inspire millions today. As he often says, “We learn from failure, success not so much,” and his ventures like Ramsey Solutions, best-selling books, and popular radio show prove how diverse earnings can build real wealth.

Ramsey Solutions

Dave Ramsey founded Ramsey Solutions to help people with personal finance and wealth management. This company grew from his own story of debt and recovery. He turned his experiences into tools for financial literacy and debt reduction.

Ramsey Solutions offers classes, books, and apps that teach budgeting techniques and investment principles. People learn millionaire habits through these resources. The firm conducted a huge study with over 10,000 participants.

It looked at traits and jobs of millionaires. Dave Ramsey says, “Income absolutely matters in building wealth.” He stresses that most millionaires invest only in what they understand.

His entrepreneurial drive powers the company. Ramsey Solutions boosts income strategies and financial freedom for many. It shares top career choices for economic success. Users gain skills for wealth accumulation and financial independence.

Dave’s team inspires change with simple advice. They focus on real steps to build wealth.

Book sales and publishing success

Dave Ramsey turned his money troubles into bestselling books that changed lives. He filed for bankruptcy after building wealth on debt, then shared his comeback story in hits like “The Total Money Makeover.” Millions bought his guides on personal finance and debt reduction.

These books teach financial literacy and budgeting techniques. Readers learn investment strategies and wealth accumulation from his real experiences.

His publishing success boosts Ramsey Solutions and fuels income generation. Dave says, “Income absolutely matters in building wealth.” A study by his team surveyed over 10,000 millionaires.

It shows top habits for economic success. People gain financial independence through his words. His entrepreneurial drive shines in every page, inspiring wealth management for everyday folks.

The Ramsey Show and other media ventures

Dave Ramsey hosts The Ramsey Show as a key media venture. He shares personal finance tips on this popular radio program. Millions tune in for advice on debt reduction and wealth management.

His show reaches people across the country. Ramsey built this platform after his own financial struggles. He turned bankruptcy into a story of comeback. Now, he inspires listeners to chase financial independence.

His media work extends beyond the show. Ramsey appears on TV and podcasts too. He promotes financial literacy through these outlets. Fans learn about budgeting techniques and investment strategies.

Ramsey Solutions runs a study with over 10,000 millionaires. It reveals habits like smart income generation. He stresses that income matters in wealth accumulation. Listeners get motivated by his entrepreneurial drive.

They apply these economic principles daily.

Is Dave Ramsey a Millionaire or a Billionaire?

People often wonder about Dave Ramsey’s net worth, especially as a personal finance guru and media personality. His story starts early; he launched his first business at 12, which sparked his entrepreneurial drive.

By age 26, he earned a quarter of a million dollars a year and managed a $4 million real estate portfolio. Yet, that wealth rested on debt, and he hit bankruptcy before he rebuilt his finances through smart money management.

Today, his financial success comes from deep understanding of personal finance and strong entrepreneurial drive. Ramsey Solutions conducted a study on millionaire habits and traits with over 10,000 participants.

It shows top career choices for achieving wealth, like those in financial literacy and debt reduction fields.

Ramsey stresses that income absolutely matters in building wealth. He says most millionaires only invest in what they understand. These investment principles guide his own path to financial independence.

His story inspires readers to focus on budgeting techniques and income strategies for economic success. Occupations of millionaires often tie to wealth accumulation through proven habits.

Ramsey’s journey from debt to riches highlights millionaire habits in action. You can see how personal finance and financial freedom play key roles in his life.

Real estate holdings

Dave Ramsey started young in real estate. He built a strong portfolio early on. At age 26, he earned a quarter of a million dollars each year. He also managed a $4 million real estate portfolio.

This success came from smart investments, but it relied on debt. That choice led to bankruptcy. He learned hard lessons from it.

Ramsey rebuilt his finances with better habits. He now teaches wealth management through personal finance tips. Dave says, “Most millionaires only invest in what they understand.” His story shows how real estate can boost net worth.

Income matters a lot in building wealth, he believes. His drive turned setbacks into financial independence. Readers can apply these investment strategies for their own debt reduction and wealth accumulation.

Business earnings and investments

Dave Ramsey runs Ramsey Solutions, a company that teaches people about personal finance and debt reduction. This business brings in big earnings through classes, tools, and advice on wealth management.

He started it after his own bankruptcy, turning hard lessons into a media empire. Ramsey Solutions even ran a huge study with over 10,000 millionaires, showing their habits and traits.

That research highlights top careers for building wealth, like engineering or accounting.

Investments play a key role in his net worth too. Ramsey stresses that most millionaires stick to what they know, avoiding risky bets. He says income drives wealth accumulation, no matter what.

His own story proves this; at age 26, he earned $250,000 a year from a $4 million real estate portfolio. But debt sank that early success, so he rebuilt with smarter strategies. Now, his entrepreneurial drive fuels ongoing financial independence through solid investment principles.

Dave Ramsey’s 7 Steps to Financial Freedom

Dave Ramsey, a personal finance guru and media personality, created these seven steps after his own financial ups and downs. He faced bankruptcy from debt-built wealth, then rebuilt everything with smart habits that spark entrepreneurial drive and lead to financial independence.

- Build a starter emergency fund. Save $1,000 fast for unexpected costs. This step acts as your first safety net in personal finance. Ramsey stresses this after his early real estate days, where at 26 he earned a quarter of a million dollars a year and managed a $4 million portfolio, yet debt led to bankruptcy. Start small to gain momentum in wealth management.

- Pay off all debt except your house. Use the debt snowball method; list debts from smallest to largest and tackle them one by one. Ignore interest rates at first. Focus on quick wins to build motivation. Ramsey’s own story shows how debt reduction freed him from past mistakes, like building wealth on borrowed money before his rebuild.

- Save three to six months of expenses. Put this in a separate account for bigger emergencies. It provides peace during job loss or health issues. Based on Ramsey’s teachings, this step ensures stability. He points out that most millionaires, from a Ramsey Solutions study of over 10,000 people, invest only in what they understand to avoid risks.

- Invest 15% of your household income for retirement. Put money into mutual funds or retirement accounts. Do this after securing your base. Ramsey believes income absolutely matters in building wealth. His financial literacy advice highlights how consistent investing leads to millionaire habits, like those in top careers for economic success.

- Save for your children’s college fund. Set aside money for education costs. Use plans like 529s to grow savings tax-free. Ramsey’s entrepreneurial drive started at 12 with his first business, showing early habits matter. This step promotes financial freedom for the next generation, tying into wealth accumulation strategies.

- Pay off your home early. Throw extra money at your mortgage each month. Aim to own your house free and clear. Ramsey’s net worth, a hot topic, grew from understanding investment principles after bankruptcy. He teaches that owning assets without debt boosts budgeting techniques and long-term security.

- Build wealth and give generously. Max out investments and enjoy giving to others. Live like no one else so later you can live and give like no one else. Ramsey’s success comes from personal finance knowledge and drive. The millionaire study reveals traits like discipline in income strategies, leading to true economic principles of independence.

Takeaways

Ramsey turned his financial setbacks into a massive empire through smart choices and hard work. His story shows anyone can achieve wealth with discipline and the right habits. Follow his seven baby steps, and you might build your own path to freedom.

For a detailed breakdown of Dave Ramsey’s path to financial independence, read our guide on the 7 Steps to Financial Freedom.

FAQs

1. Is Dave Ramsey really a millionaire?

Dave Ramsey is indeed a millionaire, with a net worth that tops two hundred million dollars from his financial advice empire. He turned his life around after facing bankruptcy in his twenties, which shows anyone can build wealth with smart choices. This journey motivates people to take control of their money.

2. How did Dave Ramsey build his wealth?

Dave Ramsey built his wealth by sharing simple financial tips through books, radio shows, and classes. He started small after losing everything, but his focus on debt-free living paid off big.

3. What lessons can we learn from Dave Ramsey’s path to riches?

People often wonder about Dave Ramsey’s success story, especially after he hit rock bottom financially. You can learn to avoid debt, save an emergency fund, and invest wisely from his methods. These steps have helped countless folks achieve financial freedom, proving that discipline leads to real wealth.

4. Why do people question if Dave Ramsey is a millionaire?

Some question Dave Ramsey’s millionaire status because his advice stresses frugality and living below your means. Yet, his business in financial education, including popular tools like Financial Peace University, has made him very wealthy. Understanding his wealth reminds us that giving solid advice can create lasting prosperity.