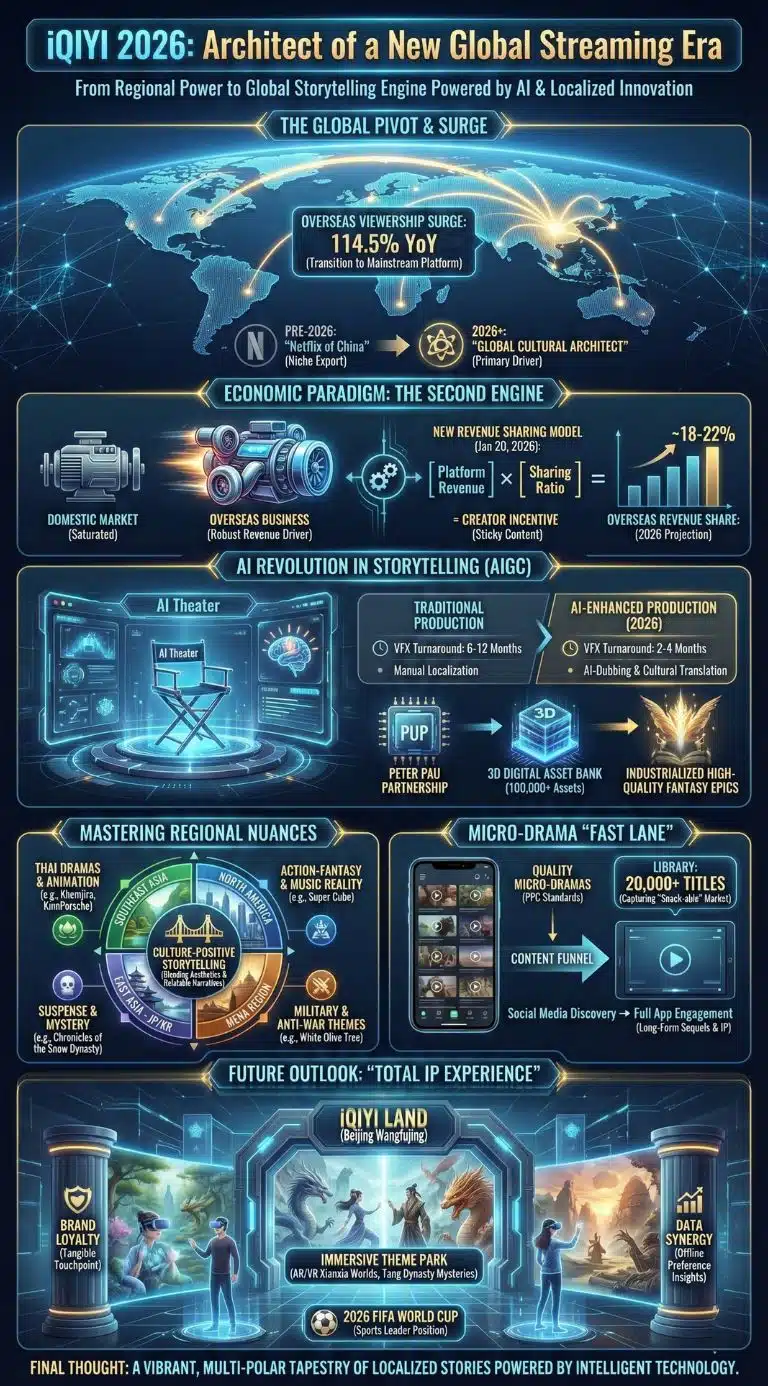

iQIYI’s unveiling of its 2026 content roadmap marks a definitive pivot in the global streaming wars, signaling that Asian storytelling has transitioned from a niche export to a primary driver of international subscriber growth. With a 114.5% surge in overseas viewership, the platform is no longer just “the Netflix of China” but a standalone cultural architect. The iQIYI 2026 Content lineup promises a slate of ambitious originals and co-productions designed to consolidate its global influence and redefine what audiences expect from Asian streaming entertainment.

The landscape of digital entertainment in early 2026 is unrecognizable compared to the pre-pandemic era. What began as a strategic expansion into Southeast Asia has blossomed into a multi-continental offensive. On January 20, 2026, iQIYI International released its landmark “Global Trending Content” report and 2026 outlook, revealing a staggering year-on-year viewership increase that underscores a fundamental shift in consumer behavior. The platform’s success is not merely a byproduct of high-volume production but a result of a sophisticated “Localized Original” strategy that blends traditional Chinese aesthetics with regional storytelling nuances.

Historically, Chinese streaming platforms (OTTs) struggled with “cultural discount”—the idea that media products lose value when crossing borders due to unfamiliar cultural codes. However, iQIYI has spent the last three years systematically dismantling this barrier. By investing heavily in Thai dramas, Malaysian originals, and high-budget C-dramas with universal themes (such as the “Sweet On” and “Light On” franchises), the platform has managed to secure a foothold in over 190 countries. This momentum sets the stage for 2026, a year where iQIYI aims to solidify its “Second Growth Engine” by leveraging Generative AI and a massive slate of 400+ new titles.

The Economic Paradigm: Overseas as the Second Growth Engine

For years, iQIYI’s financial narrative was dominated by the saturation of the domestic Chinese market. In 2026, the story has shifted. The international business has evolved from an experimental cost center into a robust revenue driver. According to the company’s recent financial reports, overseas membership revenue has seen consistent double-digit growth, often outstripping domestic growth rates. This economic shift is facilitated by a “Revenue Sharing” model that was updated on January 20, 2026, to include eight distinct sectors, from micro-series to documentaries.

The new model moves away from simple licensing toward a “platform revenue × sharing ratio” formula. This ensures that creators are directly incentivized to produce “sticky” content that retains subscribers. By 2026, the company expects revenue-sharing content to account for a significant portion of its total library, reducing the capital risk associated with massive in-house productions while maintaining high quality through rigorous platform gatekeeping.

| Indicator | 2024 Performance | 2025/2026 Projections | Strategic Implication |

| Global Viewership Growth | ~40% YoY | 114.5% YoY | Transition to a global mainstream platform. |

| Overseas Revenue Share | < 10% of total | ~18-22% of total | Diversification of risk away from domestic regulation. |

| Original Content Ratio | 65% | 85%+ | Increased IP ownership and licensing potential. |

| Micro-Drama Library | 5,000 titles | 20,000+ titles | Capturing the “snack-able” content market. |

The transition to this model is essential because it addresses the “subscription fatigue” observed in mature markets like North America. By offering a diverse range of price points—including ad-supported tiers (AVOD) and premium tiers (SVOD)—iQIYI is capturing the “Value-Conscious” segment of the global population.

Technological Frontier: The AIGC Revolution in Storytelling

One of the most significant revelations in the iQIYI 2026 content strategy is the depth of AI integration. The platform is no longer just using AI for recommendations; it is using it for creation. The partnership with Oscar-winning cinematographer Peter Pau to launch the “AI Theater” is a signal to the industry: the “Next Dimension” of filmmaking is algorithmic.

Generative AI (AIGC) is being used to streamline post-production, particularly in the “Wuxia” and “Xianxia” (fantasy) genres, which typically require expensive VFX. By utilizing Global Mofy AI’s 3D digital asset bank—containing over 100,000 high-precision assets—iQIYI can now produce high-quality fantasy epics in half the traditional time. This “Industrialization of Content” allows for a consistent release schedule, which is the lifeblood of OTT retention.

| Feature | Traditional Production | AI-Enhanced Production (2026) |

| VFX Turnaround | 6–12 Months | 2–4 Months |

| Localization (Dubbing/Subs) | Manual, High Cost | AI-Dubbing with Voice Preservation |

| Background Generation | Physical Sets/Green Screen | Virtual LED Stages & AI-Generated Environments |

| Cost per Episode | $1M – $3M (Premium) | 30% – 40% Reduction via AI Efficiency |

Beyond production, AI is the engine behind iQIYI’s localization success. In 2025, Thai-dubbed versions of Chinese animations dominated local charts. The 2026 roadmap includes a massive expansion of AI-driven “Cultural Translation,” where scripts are not just translated but localized—adjusting idioms, cultural references, and even background music to suit local tastes without losing the original IP’s soul.

Regional Nuances: Decoding Global Viewing Preferences

The 2026 strategy relies on a “Multi-Speed” approach to different markets. iQIYI’s data analytics have identified distinct “Genre Clusters” that dictate content allocation. For example, while the “Sweet On” romance brand remains a global staple, there is a burgeoning interest in “Eastern Mystery” (suspense) in East Asia and “Military Romance” in the MENA region.

This granular understanding of the audience allows iQIYI to avoid the “one-size-fits-all” trap that has plagued some Western streamers in Asia. By producing Thai-specific content like Khemjira or KinnPorsche, they are building local loyalty that serves as a gateway to their broader Chinese library.

| Region | Primary Genre Interest | Flagship Title Performance (2025/2026) |

| Southeast Asia | Thai Dramas & Dubbed C-Animation | Khemjira (No. 1 Non-Chinese Drama) |

| North America | Action-Fantasy & Music Reality | Super Cube: Extraordinary Chapter |

| East Asia (JP/KR) | Suspense & Detective Mystery | Chronicles of the Snow Dynasty |

| MENA Region | Military & Anti-War Themes | White Olive Tree / The Flame’s School |

The success of The Best Thing—a drama that integrated Traditional Chinese Medicine (TCM) into a modern romance—is particularly telling. It proved that audiences are willing to engage with deep cultural elements if the core emotional narrative is relatable. This “Culture-Positive” storytelling is a hallmark of the 2026 slate.

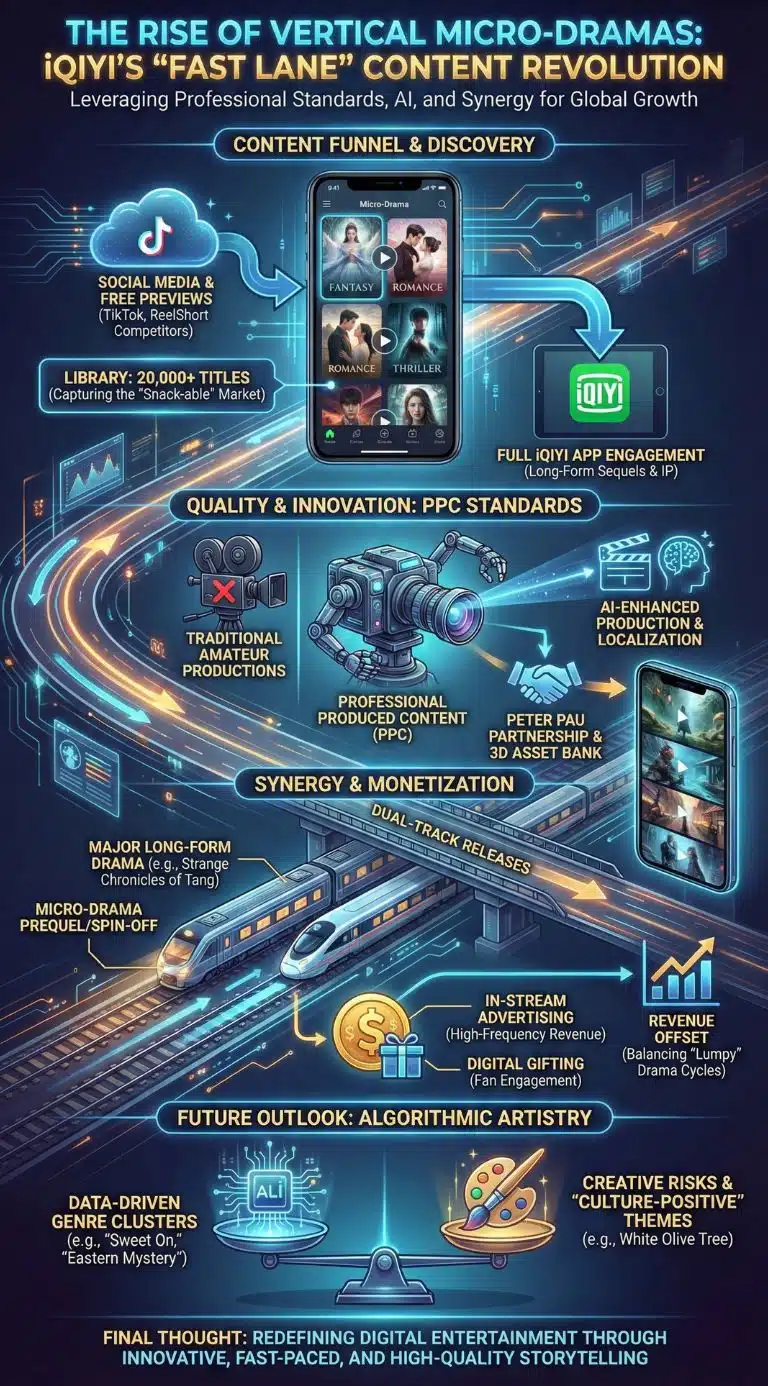

The Rise of Vertical Micro-Dramas: Content in the “Fast” Lane

Perhaps the most disruptive element of the 2026 lineup is the elevation of micro-dramas (episodes ranging from 1 to 5 minutes) to a core strategic pillar. With a library that has grown to 20,000 titles, iQIYI is directly competing with short-form platforms like TikTok and ReelShort.

However, iQIYI’s edge lies in “Quality Micro-Dramas.” Unlike the low-budget, often amateurish productions seen on some platforms, iQIYI is applying Professional Produced Content (PPC) standards to the micro-format. This creates a “content funnel”: users are attracted by free or low-cost micro-dramas on social media, which then leads them to the full iQIYI app for long-form sequels or similar high-budget IP.

- Synergy: 2026 will see “Dual-Track” releases where a major long-form drama (like Strange Chronicles of Tang) is accompanied by a micro-drama prequel or spin-off.

- Monetization: These formats are perfect for “in-stream” advertising and digital gifting, providing a high-frequency revenue stream that offsets the “lumpy” nature of big-budget drama cycles.

Expert Perspectives: The Balance of Algorithm and Artistry

The shift toward AI-driven and data-informed production has sparked a debate among industry analysts. On one hand, Gong Yu, Founder and CEO of iQIYI, argues that the “disruption” caused by AI is imminent and necessary for the survival of long-form content in a short-attention-span world. Analysts from Media Partners Asia (MPA) note that iQIYI’s ability to “industrialize” the creative process is what allows it to compete with the sheer financial muscle of Netflix.

Conversely, some cultural critics warn of “Algorithmic Homogenization.” If every script is optimized for “regional preference data,” does the art lose its ability to surprise? The counter-argument, often cited by iQIYI’s Chief Content Officer Wang Xiaohui, is that data identifies the canvas, but the artist still provides the paint. The success of White Olive Tree—a romance with a profound anti-war message—suggests that iQIYI is still willing to take creative risks on “heavy” themes, provided they are packaged within popular genre tropes.

Future Outlook: Beyond the Screen and into “iQIYI Land”

What happens next for iQIYI? The 2026 roadmap points toward a “Total IP Experience.” Following the success of immersive theaters in 58 cities, the opening of iQIYI Land in Beijing’s Wangfujing district represents a move into the theme park space. This mirrors the “Disney Model” but with a Chinese digital twist.

Fans will be able to step into the worlds of their favorite “Xianxia” dramas, utilizing AR and VR to “fly” as immortals or solve mysteries in a reconstructed Tang Dynasty street. This offline expansion serves two purposes:

- Brand Loyalty: It creates a physical touchpoint for a digital brand, making the subscription feel more “tangible.”

- Data Synergy: Offline interactions provide a new stream of data on fan preferences, which in turn informs the next generation of digital content.

As the 2026 FIFA World Cup approaches—a tournament iQIYI will broadcast with original companion programming—the platform is also positioning itself as a sports leader, ensuring it remains the “Home of Entertainment” regardless of the viewer’s interest.

What Happens Next?

- Q2 2026: Launch of the first 15 “AI-Generated” films from the Peter Pau initiative.

- Q3 2026: Opening of the Wangfujing “iQIYI Land,” marking the transition to a lifestyle brand.

- Year-End 2026: Predicted overseas revenue to hit a record 25% of total platform earnings as the “Second Engine” reaches full throttle.

Final Thoughts

iQIYI’s 2026 strategy is more than just a content update; it is a blueprint for the future of globalized digital media. By aggressively integrating Generative AI, diversifying revenue models through professional micro-dramas, and expanding into physical experience centers, iQIYI is effectively bridging the gap between digital consumption and cultural lifestyle. As the platform transitions from a regional player to a global architect of “Asian Storytelling,” it challenges the Western-centric hegemony of the streaming world. The success of this 2026 roadmap will likely determine whether the future of global entertainment is a monolithic global culture or a vibrant, multi-polar tapestry of localized stories powered by intelligent technology.