Starting a business is challenging, especially when managing money. Many startup founders face difficulties in finding financial solutions that effectively address their needs. That’s where Mercury steps in—a fintech company created specifically for startups.

Immad Akhund, the co-founder and CEO of Mercury, has developed a platform that transforms how startups manage finances. From his early days growing up in Pakistan to selling his previous company Heyzap for $45 million, Akhund’s journey is remarkable.

This blog examines Immad Akhund net worth and his influence on the fintech industry.

Continue reading to learn how he became one of Silicon Valley’s leading entrepreneurs!

Who Is Immad Akhund

Immad Akhund is a well-known entrepreneur and the co-founder of Mercury. He has built a strong career with innovative ideas and successful ventures.

Background and Early Achievements

Born in Pakistan, he moved to the UK at age 9. His early life shaped his drive and vision for success. As a teenager, coding sparked his interest in technology. This passion led him to explore more about software development.

He started working at Bloomberg as a developer after college. During this time, he gained valuable skills in finance and technology. He also co-founded four companies, including Clickpass before Heyzap’s big break.

These early efforts highlighted his ability to build things that lasted.

Academic Life at the University of Cambridge

Immad Akhund studied Computer Science at the University of Cambridge from 2002 to 2006. He earned a Master of Arts degree during this time. The program helped him build strong technical skills and problem-solving abilities.

The university’s environment encouraged innovation and creativity. Immad gained exposure to advanced technology and cutting-edge research. These experiences shaped his future as an entrepreneur in the tech industry.

The Entrepreneurial Path of Immad Akhund

Immad Akhund has built a strong reputation as an entrepreneur with bold ventures. His journey includes creating successful startups and delivering impressive exits.

Launching Heyzap and Its $45M Sale

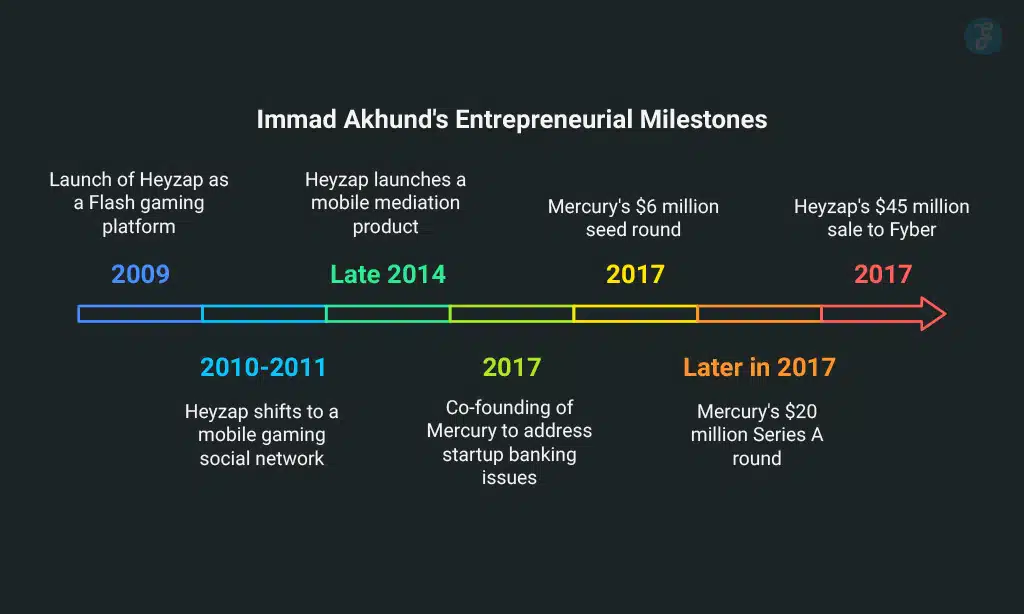

Heyzap started in 2009 as a Flash gaming platform. It soon shifted into a mobile gaming social network by 2010-2011. Later, the company moved to Adtech and launched a mobile mediation product in late 2014.

After nine months of negotiations, Heyzap was sold to Fyber for $45 million. This acquisition marked a significant step in the journey of its co-founders. The deal showed how startups can grow with innovation and timely pivots within competitive markets like technology companies.

Establishing Mercury

Immad Akhund co-founded Mercury in 2017 to fix startup banking issues. He and his team wanted to build a better bank for startups. They raised $6 million in a seed round that year, followed by a $20 million Series A round later on.

Five of the eight founding members came from Akhund’s previous company, Heyzap.

Over 60 lawyers were involved to handle strict fintech laws. Mercury operates with partner banks and is FDIC-insured, making it safe for deposits. The platform focuses on offering simple financial services like payments, credit cards, savings accounts, and treasury tools.

Mercury: Revolutionizing Banking for Startups

Mercury offers smart banking solutions for startups. It focuses on making financial management simple and efficient for growing businesses.

Overview of Mercury

Based in San Francisco, Mercury offers a digital banking platform for startups. It provides no-fee checking and savings accounts, debit cards, cash management options, and FDIC insurance.

The service has handled transactions worth up to $156 billion as of 2024.

As of July 2021, Mercury reached a market valuation of $1.6 billion. Its user-friendly system is trusted by many startup companies. Entrepreneurs rely on its smooth cash flow management tools to grow their businesses efficiently.

Key Features of Mercury’s Banking Platform

Mercury provides banking services built specifically for startups. Its platform combines innovation and simplicity with modern financial tools.

- Mercury offers no-fee checking and savings accounts, making it budget-friendly for startups. Users also get free debit cards for everyday transactions.

- Cash management accounts include FDIC insurance of up to $5 million. This protects large deposits and ensures financial stability for businesses.

- Venture debt financing helps startups raise money without giving up equity shares. Mercury supports growth while keeping ownership intact.

- Treasury investments allow companies to manage liquidity efficiently. Startups can maximize returns on idle cash through strategic investing options.

- Upcoming features in 2024 will include bill payments, payment collection, and advanced financial management tools. These updates aim to simplify daily operations for growing businesses.

- The platform is easy to use, supporting seamless banking experiences across devices. Startups save time with its user-friendly approach.

- Mercury provides customer-focused support designed for entrepreneurs’ needs. It ensures banking remains hassle-free for startup founders and teams alike.

Mercury’s Market Valuation and Growth

The startup bank Mercury has achieved a valuation of over $1.62 billion. It raised $120 million in a Series B funding round, showcasing rapid investor interest. This funding reflects strong confidence from venture capital firms and key investors.

More than 200,000 clients trust Mercury’s platform for their banking needs. Notable companies like Surge AI and 11x use its services. Recognition came when Forbes included it in the Fintech 50 list for 2025—a testament to its growing impact in the fintech world.

Analyzing Immad Akhund Net Worth

Immad Akhund net worth and wealth stems from his successful ventures and investments. His journey showcases smart business moves that have boosted his financial growth.

Primary Sources of Wealth

The $45 million sale of Heyzap played a big role in building his wealth. As the CEO of Mercury, he earns from the startup’s revenue streams. Mercury serves over 100,000 businesses and has become profitable by offering diverse banking services.

Investing in startups also boosts his net worth. He has funded over 300 companies as an angel investor. Some of these have grown significantly, increasing his financial gains. His career reflects smart decisions in entrepreneurship and venture capital growth.

Current Estimated Net Worth

Immad Akhund net worth is linked to his role as CEO of Mercury and other ventures. He gained wealth from selling Heyzap for $45M in 2016. His startup, Mercury, now holds a valuation of over $1 billion.

As an angel investor, Immad has backed more than 300 startups. This portfolio adds significantly to his wealth. Though exact figures remain unclear, experts estimate his net worth to be tens of millions or higher. Right now, Immad Akhund net worth is estimated at $45 million.

Immad Akhund’s Impact as an Angel Investor

Immad Akhund has invested in over 300 startups, showing his deep commitment to fostering innovation. His strategic insights and financial backing have helped many companies gain traction and succeed.

Portfolio of Over 300 Startup Investments

He has invested in over 300 startups. These investments highlight his influence as a top angel investor.

- He actively supports early-stage companies through his investments. Many of these startups operate in tech and fintech spaces.

- His portfolio includes companies that went viral, like Rappi, which grew rapidly in delivery services.

- As a part-time partner at Y Combinator, he connects with promising ventures and adds value to the ecosystem.

- His track record proves strong decision-making, with notable successes from his investment choices.

- Startups backed by him often gain traction and attract more VCs for future fundraising rounds.

- Over time, his portfolio has grown into a collection of innovative businesses across industries globally.

- These investments reflect his passion for helping founders scale their ideas and achieve success.

Notable Successes from His Investment History

Immad Akhund has made smart investments in many startups. His portfolio includes over 300 companies, with several major successes.

- Airtable became a huge success and is now widely used for team collaboration and project management.

- Substack grew rapidly, helping writers create paid newsletters and connect directly with readers.

- Rappi expanded as a major on-demand delivery platform in Latin America, raising billions in funding.

- Mercury, the startup he co-founded, continues to innovate in the financial sector for startups.

- His investments supported other fast-growing Silicon Valley businesses that achieved high valuations in a short time.

Insights and Lessons from Immad Akhund’s Ventures

Immad Akhund net worth journey is full of practical lessons for budding entrepreneurs. His focus on solving real problems and adapting to challenges offers valuable insights into building successful startups.

Core Strategies for Startup Success

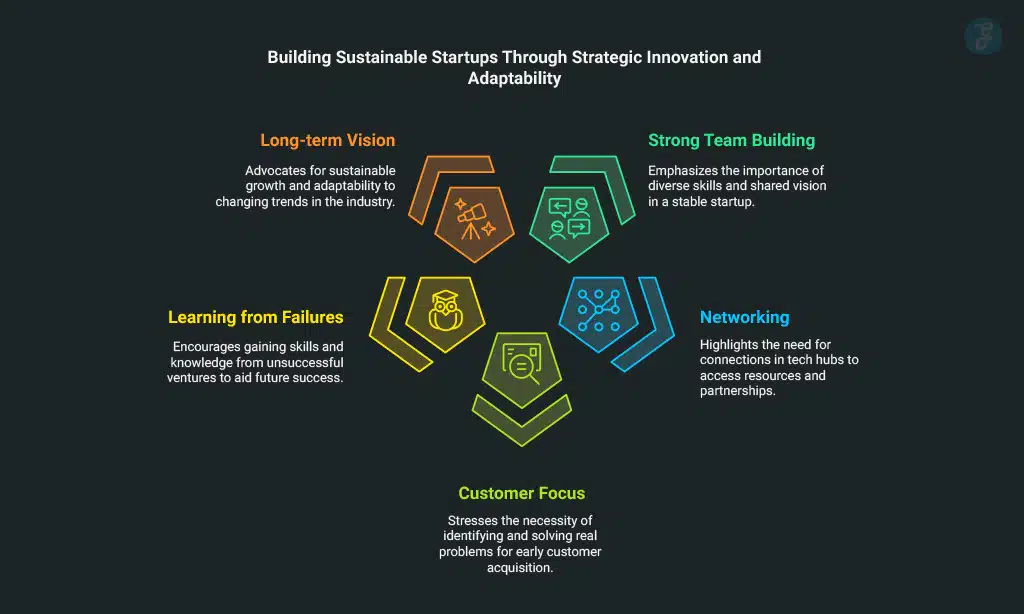

Strong co-founders make a startup stable. A team with diverse skills drives growth faster. Focus on hiring people who share the same vision for the company.

Building connections in tech hubs like Silicon Valley is vital. Networking opens doors to investors and partnerships. It’s always easier to grow a startup where resources are abundant.

Valuable Lessons from Entrepreneurial Ventures

Entrepreneurial ventures teach valuable lessons. These insights help founders succeed and grow their businesses.

- Focus on finding customers early. Many startups fail because they do not identify their audience or solve real problems.

- Learn from failures. Immad Akhund’s first startups didn’t succeed, but he gained skills and knowledge that helped him later.

- Build a strong network of talent and investors. Access to the right people can open doors for funding and partnerships.

- Use every opportunity to improve your product. Startups must listen to feedback and adjust quickly to stay relevant.

- Keep learning as you grow. The startup journey is a process, and each step teaches something new about the market or team management.

- Seek smart funding options that align with your vision. Mercury launched as a startup-friendly bank to address this specific need.

- Take risks wisely but always plan ahead. Immad Akhund sold Heyzap after scaling it successfully, proving timing matters in business decisions.

- Always look at long-term goals instead of short wins. Sustainable growth builds stronger companies over time than quick gains do.

- Stay adaptable to changing trends or needs in tech, finance, or customer behavior for continued success in competitive markets like Fintech apps.

- Give back as an angel investor while expanding personal wealth, like Immad who has invested in 300+ promising startups globally!

Future Directions Under Immad Akhund’s Leadership

Immad Akhund focuses on pushing innovation in financial technology. His leadership aims to expand Mercury’s offerings for better solutions.

Upcoming Innovations in Fintech

Same-day liquidity is transforming treasury management. Mercury, in partnership with JP Morgan and the U.S. government, now offers this feature in its Treasury service. It helps startups access funds faster without delays.

Automatic receipt matching is simplifying IRS documentation compliance. This new tool scans receipts and matches them for accurate record-keeping. These advancements aim to simplify banking for startup founders while saving time and reducing stress!

Plans for Expanding Mercury’s Services

Mercury aims to introduce personal banking services in April 2024. This move will broaden its current offerings beyond startup banking. Entrepreneurs and small business owners might soon access new financial tools for their personal needs.

The platform also plans to expand support for bill payments, payment collections, and financial management. These updates could help users simplify daily tasks while managing funds more effectively.

Mercury continues to focus on developing smarter options for businesses and individuals alike.

Takeaways

Immad Akhund net worth journey shows hard work and vision can reshape industries. From building startups to leading Mercury, he has left a strong mark on tech and banking. His impact goes beyond business, inspiring startup founders worldwide.

With bold plans for the future, Immad Akhund net worth story is still being written.

Disclaimer: Mercury is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Column, N.A., and Evolve Bank & Trust, Members FDIC.

References

- https://founder-tactics.pilot.com/speakers/immad-akhund

- https://golden.com/wiki/Immad_Akhund-WXZ

- https://mixergy.com/interviews/mercury-with-immad-akhund/ (2020-09-28)

- https://alejandrocremades.com/immad-akhund/

- https://www.forbes.com/companies/mercury/

- https://foundr.com/articles/building-a-business/immad-akhund

- https://mercury.com/

- https://wefunder.com/mercury

- https://www.zenopartners.com/2023/03/29/mercury-is-profitable-and-growing-rapidly/ (2023-03-29)

- https://venture.angellist.com/v/back/immad-akhund

- https://mercury.com/investor-database/immad-akhund

- https://www.zendesk.com/blog/mercury-immad-akhund/ (2023-11-17)

- https://www.linkedin.com/posts/iakhund_the-main-thing-that-kills-startups-by-1st-activity-7262479377265827840-LZJx

- https://svicons.substack.com/p/immad-akhund-ceo-and-founder-of-mercury

- https://www.linkedin.com/posts/iakhund_a-lot-of-entrepreneurship-is-knowing-yourself-activity-7296257358756777984-bbMQ

- https://a16z.com/forecasting-fintechs-future-with-the-ceos-of-bill-and-mercury/