Scammers are everywhere, even in Web3. Many new investors get fooled by crypto ponzi schemes promising big profits fast. These scams are sneaky and can make people lose their hard-earned money.

A Ponzi scheme works by paying early investors with cash from new ones. It crashes when no more people join. In this blog, you’ll learn how to spot these traps and protect your crypto assets.

Keep reading for simple tips to stay safe!

Key Characteristics of Web3 Ponzi Schemes

Scam projects often lure new investors with flashy promises. Fraudsters use tricks like vague plans or fake crypto wallets to confuse people.

Guaranteed High Returns with No Risk

Promises of high returns with no risk are red flags. Fraudsters lure new investors with sweet offers that seem too good to be true. In Web3 scams, such claims often hide ponzi schemes or rug pulls.

Early investors may get paid using funds from later ones. This setup collapses when fewer people invest, leaving victims unable to withdraw funds. Always question these guarantees and verify through trusted sources and regulators like the SEC.

Unclear or Vague Business Model

A confusing or unclear business model is a red flag. Scammers often hide behind fancy words like “decentralized finance” or “blockchain technology.” They give no explanation about how they make money.

If you ask hard questions, their answers stay vague. Real Web3 projects explain how they operate and generate value clearly.

Some crypto scams claim to offer high returns through fake crypto mining or trading bots. These platforms may have no working product at all. Fraudulent schemes prey on new investors by keeping details fuzzy, so people cannot verify if the project is real.

Always check for a whitepaper and roadmap that make sense before investing in any digital assets.

Referral-Based Rewards Structure

Scammers often trick new investors with referral-based rewards. They promise bonuses or free cryptocurrency for bringing others on board. Early investors profit from the money of fresh recruits, not actual revenue.

Web3 scams like these grow through FOMO [fear of missing out]. The more people join, the bigger it seems. But when no one else invests, it collapses. Always avoid projects that focus heavily on referrals instead of building useful products or services.

Lack of a Legitimate Product or Utility

Many Web3 Ponzi schemes lack a real product or service. They often sell overvalued crypto tokens with no actual use. These scams focus on recruiting new investors to pay earlier ones.

For example, some projects promise profits from virtual currency mining but do not own any mining rigs.

A legitimate project must have clear goals and a working model. If a company cannot explain its purpose or relies solely on vague terms like “blockchain technology,” it’s probably fake.

Always ask what value the crypto token brings before investing your money in it.

Common Types of Web3 Ponzi Schemes

Scammers use fake platforms, shady coins, and flashy promises to trap new investors—stay sharp to avoid falling into these traps.

Fake Yield Farming and Staking Platforms

Fake yield farming and staking platforms trick people into thinking they can earn big rewards. Many of these platforms are scams that steal money.

- They offer unrealistically high returns. For example, a new project may promise 200% returns in just a week. This is a red flag.

- These platforms often lack legitimate smart contracts. A real platform uses blockchain technology for transparency and security.

- Scammers create fake websites or phishing sites. They trick you into entering your private keys or seed phrase to steal your funds.

- Victims face difficulty withdrawing funds. Once you invest, the scammer may make excuses or disappear completely.

- Fraudulent yield farms use fancy terms to confuse new investors. Words like “cloud mining” or “decentralized exchange” sound legit but are often traps.

- Scams spread through Telegram, Twitter accounts, or scam emails with urgent investment offers to exploit FOMO.

- Many fake staking apps show false data about cryptocurrency mining performance to keep victims hooked longer.

- Phishing scams might involve malicious software on mobile apps from Google Play Store or Apple Appstore.

- Some fraudsters promote their scams using pumped-up tweets from hacked social media accounts to attract attention quickly.

- The SEC warns against illegal high-yield investment programs [HYIPs]. Always check if projects have clear regulatory compliance before trusting them.

Multi-Level Marketing [MLM] Coins

Multi-Level Marketing [MLM] Coins are a tricky trap in crypto scams. These coins usually rely on recruiting new investors to keep the system running.

- Offer high returns for early investors, while late ones lose money. Early participants get paid from funds brought in by new members, not real profits.

- Focus heavily on referrals. Investors are told to bring more people into the scheme to earn bonuses or rewards.

- Lack any real product or utility. The coin often has no purpose beyond recruiting others.

- Use pressure tactics like “act fast” deals, making people fear missing out [FOMO].

- Promise guaranteed gains with little to no risk but provide vague details about how profits are made.

- Often collapse when no new members join, leaving most investors with losses.

- Rarely comply with regulations and lack transparency about their operations or leadership team.

- Exploit social media platforms like Instagram and Facebook to lure victims and spread misinformation quickly.

- Sometimes connect MLM models with fake decentralized exchanges or yield farming projects to appear legitimate while scamming users’ digital assets.

- Avoid legal tools like initial coin offerings [ICOs], which require disclosures, instead sticking to under-the-radar methods of raising capital from unsuspecting consumers without protections in place.

Cloud Mining Scams

Cloud mining scams trick people who want to mine cryptocurrency. These scams promise easy profits but often steal your money instead.

- Scammers offer fake mining platforms that claim to use blockchain technology to mine coins for you. They advertise high returns with little effort.

- Victims usually pay upfront fees or buy digital assets for access. After payment, they face difficulty withdrawing funds or see no returns at all.

- Many scams feature vague business models. They avoid sharing details, making it hard to prove how the platform works.

- Some schemes rely on referrals, urging investors to bring others in for bonus rewards. This is a key sign of pyramid selling tied to Ponzi schemes.

- Fake reviews and social media hype create FOMO [fear of missing out]. Scammers manipulate emotions to hook new investors quickly.

- Fraudulent cloud mining sites may disappear overnight, taking investments with them in what’s called a “rug pull.”

- Legitimate projects provide transparent whitepapers, team info, and proper regulatory compliance. Scam sites lack these basics.

- The U.S SEC warns about investment scams like these and stresses checking project credibility before investing capital.

- Phishing attempts are also common here—fake websites collect private keys or personal data for more theft later.

- Always protect crypto wallets with tools like hardware wallets and use two-factor authentication for added security against such scams.

High-Yield Investment Programs [HYIPs]

High-Yield Investment Programs [HYIPs] can be traps. They promise unrealistically high returns but often leave investors empty-handed.

- These scams claim guaranteed profits, sometimes over 1% daily or 30% monthly. Such returns are not sustainable.

- Many HYIPs use crypto buzzwords like blockchain technology to sound legitimate. But their operations lack transparency and real value.

- Early investors might get paid, but only with new investors’ money. This is a classic Ponzi scheme structure.

- Withdrawal issues are common in HYIPs. Victims report difficulty withdrawing funds or find accounts frozen without explanation.

- These programs often pressure users to recruit others for bonuses or higher payouts, creating a referral-based scam trap.

- Some HYIPs pose as investment platforms tied to yield farming or staking projects but have no actual business backing them.

- Regulatory bodies like the SEC warn against such schemes and encourage people to question promises of “no-risk” profits.

- Scammers also use fake websites or phishing emails to steal private keys, making it easy for them to drain your wallet.

- Falling prey to cloud mining scams under the guise of an HYIP is common, as fraudsters exploit technical terms to confuse victims.

- Protect yourself by verifying any project’s whitepaper, checking team backgrounds, and avoiding quick decisions driven by fear of missing out [FOMO].

How to Avoid Web3 Ponzi Schemes

Stay sharp and question everything. Scammers thrive on blind trust and rushed decisions.

1. Verify the Project’s Whitepaper and Roadmap

Check the whitepaper for clear goals and details about the project. If it’s vague or filled with buzzwords, treat it as a red flag. Solid projects explain how they’ll use blockchain technology and digital assets to solve real problems.

Review the roadmap too. It should list timelines, milestones, and planned updates. Beware of projects promising overly quick or guaranteed profits—they often hide crypto Ponzi schemes.

2. Assess Team Transparency and Credentials

Check the team’s history and credibility. Look for names, photos, and clear roles on their website or social media. If the team stays hidden or uses fake profiles, that’s a red flag.

Verify past projects linked to them. Scammers reuse fake identities in crypto scams like Ponzi schemes. Honest teams welcome questions from new investors and explain their goals clearly.

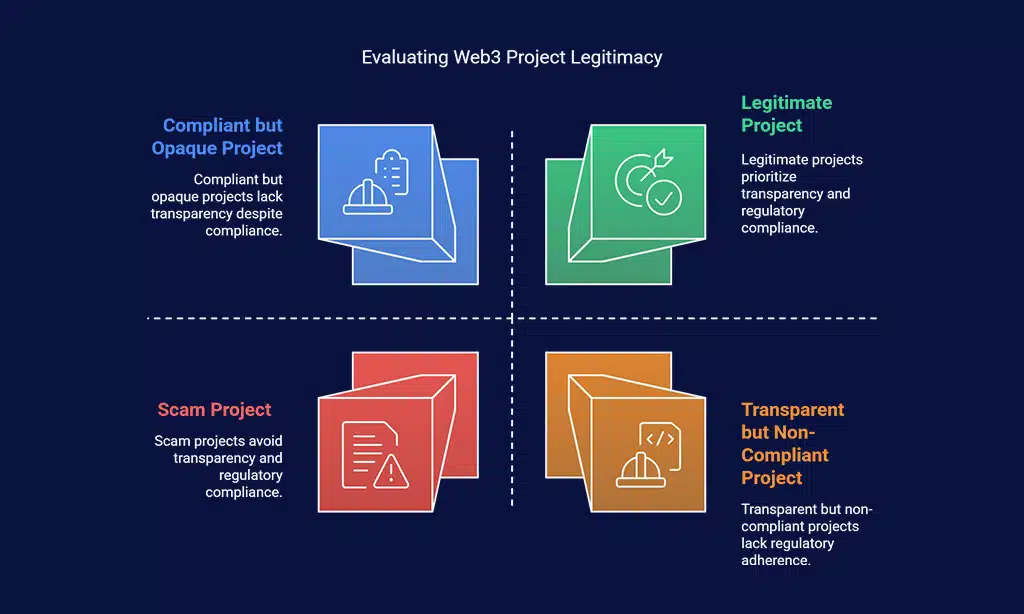

3. Check for Regulatory Compliance

Verify if the project complies with laws. Legitimate Web3 projects follow rules set by groups like the SEC or other financial authorities. Scams, like crypto Ponzi schemes, usually avoid registering or meeting legal standards.

Always check if they mention licenses or regulatory approvals.

Lack of compliance can mean illegal activities such as money laundering. Fake platforms often skip audits to hide fraud risks. Avoid any project that dodges transparency in this area.

A proper Web3 project should stick to rules and protect new investors from scams.

4. Avoid Pressure Tactics and Quick Investments

Scammers push hard for quick decisions. They use fear of missing out [FOMO] to trap new investors. The deal might sound too good, but acting fast can lead to losses. Crypto scams often offer huge returns and ask you to invest right away.

Take your time before investing in digital assets or blockchain technology projects. Research the project’s details, like its whitepaper and goals. If someone pressures you or promises risk-free profits, it’s likely a Ponzi scheme or pump-and-dump scam.

Stay calm, dig deeper, and always think twice about rushed offers.

Takeaways

Spotting a Web3 Ponzi scheme is key to staying safe in crypto. Always question promises of high returns with no risk. Check if the project has a real product or clear business goals.

Avoid schemes that only reward recruiting more people. Take time to verify whitepapers and team credentials before investing your money. Learn about scams like rug pulls, phishing, or fake mining platforms to protect yourself better.

Stay alert and keep your digital assets secure—your wallet will thank you later!

FAQs on How to Spot and Avoid Web3 Ponzi Schemes

1. What is a Web3 Ponzi scheme?

A Web3 Ponzi scheme is a scam where early investors get paid with the money from new investors, not actual profits. It often uses crypto or digital assets to trick people.

2. How can I spot signs of crypto scams like Ponzi schemes?

Watch out for promises of high returns, pressure to invest quickly [FOMO], and difficulty withdrawing funds. Scams may also use terms like blockchain technology or cloud mining but offer no real product.

3. What are common types of Web3 scams besides Ponzi schemes?

Other scams include phishing attacks that steal private keys, rug pulls where projects vanish after collecting money, and pump-and-dump schemes that manipulate valuations.

4. How does social engineering play into cryptocurrency scams?

Scammers use tricks like catfishing or sim swapping to gain access to personal data or wallets. They exploit trust through fake profiles, inbox messages, and misleading claims.

5. Can government agencies help protect against crypto ponzi schemes?

Yes, organizations like the SEC [Securities and Exchange Commission] and Federal Trade Commission work on consumer protections by investigating fraud in the crypto ecosystem.

6. What steps can I take for scam prevention in Web3 investments?

Do research before investing capital funds, avoid sharing private information online, verify sources carefully, and stay updated on web3 security practices for better protection against risks.