In today’s fast-paced world, having a savings account is essential for financial stability. But with so many options available, how do you choose the right savings account for your lifestyle? Let’s explore the key factors to consider when selecting a savings account that fits your needs.

Understanding Your Financial Goals

Before choosing a savings account, take the time to understand your financial goals. Are you saving for a specific purchase, such as a car or a house? Or are you looking to build an emergency fund for unexpected expenses? By identifying your goals, you can choose a savings account that aligns with your objectives.

Types of Savings Accounts

There are several types of savings accounts to choose from, including traditional savings accounts and digital savings accounts. Traditional savings accounts are offered by brick-and-mortar banks and credit unions, while digital savings accounts are provided by online banks.

Benefits of Digital Savings Accounts

Digital savings accounts have become increasingly popular due to their convenience and higher interest rates. With a digital savings account, you can manage your money online or through a mobile app, making it easy to track your savings goals. Additionally, digital savings accounts often offer competitive interest rates, allowing your money to grow faster compared to traditional savings accounts.

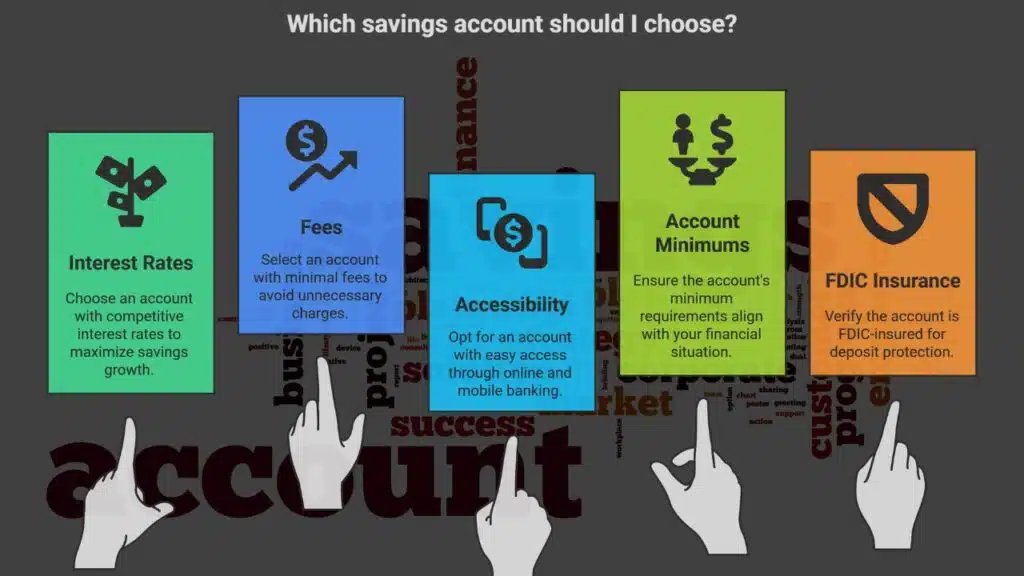

Key Factors to Consider

When choosing a savings account, consider the following factors:

Interest Rates

Interest rates play a critical role in how quickly your savings grow. Look for a savings account with a competitive interest rate to maximize your earnings over time.

Fees

Some savings accounts may come with fees, such as monthly maintenance fees or ATM fees. Be sure to read the fine print and choose an account with minimal fees to avoid unnecessary charges.

Accessibility

Consider how easy it is to access your savings account. Digital savings accounts typically offer 24/7 access to your funds through online and mobile banking, making it convenient to manage your savings anytime, anywhere.

Account Minimums

Some savings accounts may require a minimum deposit to open the account or maintain a minimum balance. Make sure you choose an account with minimum requirements that align with your financial situation.

FDIC Insurance

Ensure that your savings account is FDIC-insured, which means your deposits are protected up to $250,000 per depositor, per insured bank. This insurance provides peace of mind knowing that your money is safe and secure.

Making the Right Choice

Selecting the right savings account is a crucial step in achieving your financial goals. By considering factors such as interest rates, fees, accessibility, account minimums, and FDIC insurance, you can choose a savings account that fits your lifestyle and helps you save for the future.

In conclusion, choosing the right savings account is essential for financial success. By understanding your financial goals, exploring different types of savings accounts, and considering key factors, you can make an informed decision that aligns with your needs. Start comparing savings accounts today and take the first step towards a secure financial future.