Choosing the right crypto exchange can be tricky. With so many options, it’s hard to know which one fits your needs best. You might be wondering about fees, security, or supported cryptocurrencies.

These are all key factors when deciding where to trade.

Did you know some exchanges offer better safety features like two-factor authentication and cold wallets? Others may have lower fees or more coins to choose from. Picking the right platform depends on what matters most to you.

This guide will help clear up your doubts. It explains how to find an exchange that matches your goals and experience level. Keep reading—you’ll want these tips!

Identify Your Trading Goals

Think about why you want to trade crypto. Decide if you’re investing for the long run or trading often for quick gains.

Long-term investment vs. short-term trading

Long-term investment focuses on holding crypto assets like Bitcoin (BTC) or Ethereum (ETH) for years. This approach benefits from the growth of digital currencies over time. It works best for people with patience and a belief in blockchain technology.

Short-term trading involves quick buying and selling to profit from price changes. Traders often use platforms like Binance or Kraken due to their high liquidity. This method requires constant monitoring of market data and higher risk tolerance.

Focus on specific cryptocurrencies or diversification

Choosing between specific cryptocurrencies or a mix depends on your goals. Investing in top coins like Bitcoin (BTC) and Ethereum (ETH) can be safer due to their popularity and large market caps.

For higher risk but bigger rewards, explore newer tokens or altcoins.

Diversification is key if you want to spread risks. Many platforms like Binance or Coinbase offer wide cryptocurrency selections, from major cryptos to lesser-known ones. “Don’t put all your eggs in one basket” applies here—spreading assets helps balance gains and losses over time.

Evaluate Security Features

Strong security keeps your assets safe from threats. Check for features that protect accounts and funds, like authentication tools or secure storage methods.

Two-factor authentication (2FA)

Two-factor authentication (2FA) adds an extra layer of protection. It requires two steps to access your cryptocurrency account. First, you log in with your password. Then, a code is sent to your phone or email for confirmation.

This makes it harder for hackers to break in, even if they steal your password. Many top crypto exchanges like Crypto.com and Coinbase Wallet use 2FA as a safety feature. Always enable it on any trading platform you use to keep your digital assets safe.

Cold storage and insurance policies

Cold storage keeps your cryptocurrency safe by storing it offline. It protects funds from hacking and online theft. Top exchanges, like Crypto.com, use cold wallets for most of their assets.

This ensures added safety for users’ digital currency.

Insurance policies cover losses from cyberattacks or system failures. For example, Coinbase insures user funds against breaches. Choosing an exchange with both features adds layers of protection to your investments.

“Cold storage is the gold standard for securing digital assets.”

Assess Fees and Costs

Check the costs linked to trades, deposits, or withdrawals. High fees can eat into your profits fast—so compare wisely!

Trading fees

Trading fees can eat into your profits. Many cryptocurrency exchanges charge a percentage per trade, often between 0.1% and 0.5%. Binance offers low trading fees of 0.1%, making it popular with active traders.

Some platforms like Robinhood Crypto advertise zero fees but may have higher spreads.

Always check deposit and withdrawal costs too. Some exchanges, like Coinbase, charge up to 3% for credit card transactions or fiat deposits through PayPal. Look for transparent pricing to avoid hidden charges that hurt your returns on investment.

Deposit and withdrawal fees

Deposit and withdrawal fees differ across cryptocurrency exchanges. Some platforms, like Crypto.com and Binance, offer low costs or free deposits for certain payment methods. Others charge flat rates or percentages based on the amount you’re transferring.

Bank transfers may have smaller fees compared to credit cards or PayPal payments. Fiat currency withdrawals often cost more than crypto withdrawals, depending on the exchange. Check these details before choosing an exchange to avoid surprise charges.

Consider Available Cryptocurrencies

Check which coins the exchange supports. Make sure it fits your portfolio needs and goals.

Supported altcoins and tokens

Crypto exchanges differ in the coins and tokens they offer. Some platforms, like Binance and Coinbase, support hundreds of options. Others may only list major ones like Bitcoin (BTC) or Ethereum (ETH).

Bigger selections help traders diversify their portfolios easily.

Fiat-to-crypto trading is another factor to weigh. Many exchanges let you buy digital assets with currencies like USD or EUR. This feature simplifies starting your crypto journey without using other tools.

Always ensure your preferred cryptocurrencies are available on the platform before signing up.

Fiat-to-crypto options

Fiat-to-crypto options let you exchange traditional money for digital currency. Many platforms, like Coinbase and Crypto.com, support major fiat currencies such as USD, EUR, and GBP.

These exchanges provide quick deposits through bank transfers, debit cards, or even credit cards in some cases.

Some crypto apps also offer features like peer-to-peer trading or over-the-counter services for larger transactions. Fees may vary depending on the method used. Choose an exchange that supports your local currency to avoid conversion charges during deposits or withdrawals.

Examine User Interface and Experience

A simple, clear platform makes trading smoother for everyone. Check if the app works well on your phone and feels easy to use.

Mobile app availability

Crypto exchanges with mobile apps make trading easy. Apps like Crypto.com and Binance offer strong tools for users. Google Play and the App Store provide access to these crypto apps.

They support both Android and iOS devices, letting you trade anytime.

A good app should load quickly and be simple to use. Beginners need clear layouts, while experts may want advanced features like margin accounts or staking options. Many top cryptocurrency exchanges ensure their apps have secure login methods like two-factor authentication (OTP).

Choose an app that fits your investing goals easily through your smartphone or tablet.

Ease of navigation for beginners

Simple layouts and clear tools make crypto trading easier for beginners. The best cryptocurrency exchanges, like Coinbase or Crypto.com, focus on user-friendly design. Large buttons, simple charts, and guided steps help new users avoid confusion while buying Bitcoin (BTC) or Ethereum (ETH).

Mobile app options also let you trade on the go without feeling lost.

Educational resources are helpful too. Many trading apps include tutorials or FAQs to explain terms like fiat currency or decentralized finance (DeFi). These features guide first-time traders through key actions like wallet setup, identity verification, or completing their first transaction.

Check Liquidity and Volume

High liquidity ensures quick trades without big price changes. Choose platforms with strong market activity for smoother transactions.

High trading volume for seamless transactions

Large trading volume ensures quick buying and selling of digital assets. Exchanges like Binance, with high liquidity, match buyers and sellers fast. This reduces delays and avoids price changes during trades.

Popular platforms such as Crypto.com handle huge transactions daily. Traders benefit from smooth operations, especially for top coins like Bitcoin (BTC) or Ethereum (ETH). High activity also attracts market makers, keeping prices fair.

Research Reputation and Reviews

Check the exchange’s track record and user feedback—this can reveal trustworthiness and past issues.

Track record of the exchange

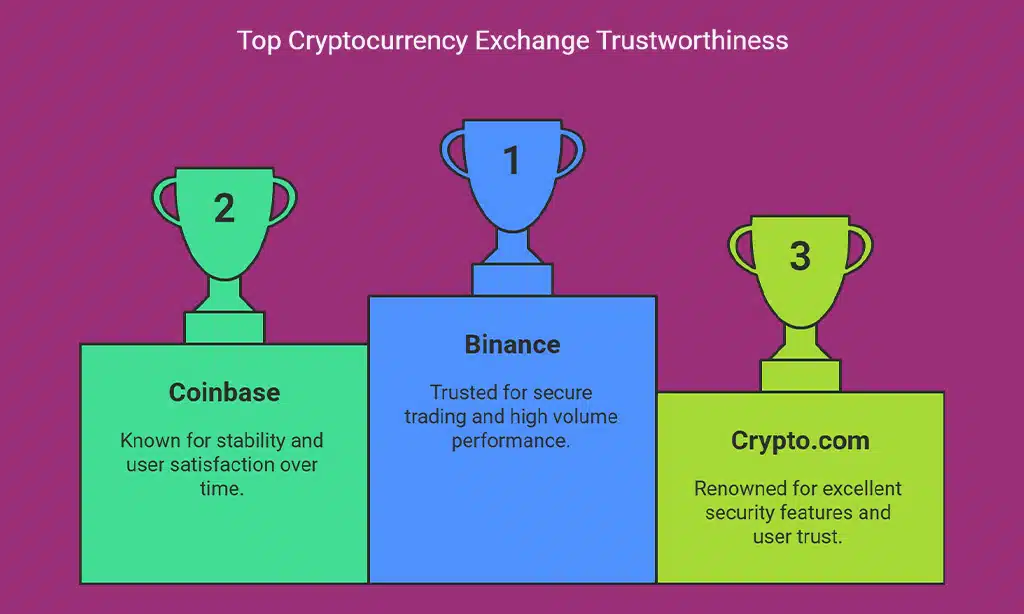

A crypto exchange’s history shows its reliability. For example, Binance is trusted by many investors due to high trading volume and solid performance. Meanwhile, Crypto.com ranks as one of the best for security features.

Past issues can reveal risks. Mt. Gox collapsed in 2014, losing millions in Bitcoin (BTC), which damaged trust. Research reviews and feedback from users online to learn how exchanges handle problems.

Choose platforms known for stability and good service over time like Coinbase or Kraken.

User feedback and community trust

User reviews show how reliable a cryptocurrency exchange truly is. Platforms like Binance are highly trusted by crypto investors for their secure trading tools and reputation. Coinbase also ranks well due to its long track record and user satisfaction.

A strong community and good feedback mean the crypto exchange delivers what it promises. Check online forums, ratings, or social media discussions about exchanges like Crypto.com or Kraken to see if users trust them.

Positive feedback often reflects safe practices such as two-factor authentication (2FA) and cold storage security measures.

Look Into Customer Support

Good customer support matters—check if the exchange offers quick help through chat or email.

Availability of live chat or email support

Live chat and email support can make solving issues faster. The best cryptocurrency exchanges, like Crypto.com and Binance, offer these features to ensure smooth customer service. Quick responses are vital for beginners or traders facing urgent problems.

Some platforms provide 24/7 live chat for immediate help. Others may take a few hours to reply via email. Choose exchanges with reliable support systems to avoid delays in resolving concerns about trading fees or crypto wallets.

Responsiveness to issues

Good customer support matters in crypto exchanges. Fast answers can save you money during trades. The best exchanges, like Binance and Crypto.com, offer live chat or email help. They also solve problems quickly, like locked accounts or missing funds.

Check user reviews to learn about their service speed. Some platforms even have 24/7 support for urgent issues. Make sure the exchange values your time and helps fix problems fast.

Confirm Regulatory Compliance

Check if the exchange follows local laws and has proper licenses—this keeps your trading safe and legal.

Licensing in your country or region

Crypto exchanges must follow laws in your country. Many need a license to operate legally. For example, in the U.S., platforms must register with the Financial Crimes Enforcement Network (FinCEN).

They also have to obey anti-money laundering (AML) and know-your-customer (KYC) rules.

Always check if an exchange meets local regulations. Licensed exchanges are safer and more reliable for cryptocurrency trading. Some, like Kraken, comply with strict global standards while offering peace of mind for users.

Adherence to financial regulations

Exchanges should follow strict financial rules. Licensing ensures they operate legally in your country. For example, Kraken follows FinCEN guidelines in the U.S., providing added trust for users.

Adhering to Know Your Customer (KYC) and anti-money laundering laws protects against fraud.

Look for platforms with clear compliance details. Exchanges like Crypto.com and Coinbase often meet top standards like ISO 27001 certification. This shows strong security protocols and responsible practices while handling digital assets or fiat currency trades.

Test Additional Features

Explore tools like staking, lending, or earning rewards—they might add extra value to your crypto experience.

Staking, lending, or earning rewards

Staking lets users earn rewards for holding cryptocurrencies. Platforms like Binance and Crypto.com allow staking of coins like Ethereum (ETH) or BNB. The more you stake, the greater your potential earnings.

Some exchanges even offer flexible terms for withdrawing staked funds.

Lending digital assets is another way to make money. You loan your crypto to others through platforms such as Celsius or BlockFi. In return, you gain interest on these loans. Rates depend on the cryptocurrency and platform chosen.

Many exchanges also have cashback offers through rewards programs tied to their apps or debit cards, adding extra perks for users.

Advanced trading tools for experienced users

Experienced traders can use tools like margin trading, copy trading, and over-the-counter (OTC) options. These features help manage risks and offer more control during cryptocurrency trading.

Platforms like Binance or Kraken provide advanced charting tools with real-time data. They also support interactive brokers for stock trading alongside cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

Takeaways

Choosing the best crypto exchange depends on your needs. Focus on security, fees, and supported coins. Think about what features matter most to you—like ease of use or advanced tools.

Take time to research reviews and user feedback. The right exchange makes your crypto journey easier and safer!

FAQs

1. What is a crypto exchange, and why do I need one?

A crypto exchange is a platform where you can buy, sell, or trade digital assets like Bitcoin (BTC) and Ethereum (ETH). It helps users manage cryptocurrency investing by providing access to various cryptocurrencies and trading tools.

2. How do I choose the best crypto exchange for my needs?

Look at factors like cryptocurrency selection, trading fees, security protocols such as two-factor authentication (2FA), and whether they offer hot wallets or cold wallets. Also, check if it supports fiat currency deposits or withdrawals.

3. Are decentralized exchanges better than centralized ones?

Decentralized exchanges allow peer-to-peer trading without intermediaries but may lack features like FDIC insurance or customer support found in centralized platforms. Choose based on your comfort with risk and control over funds.

4. What should I know about security when using a crypto exchange?

Ensure the platform has strong security measures such as ISO 27001 certification, hardware wallet support, two-factor authentication (2FA), and safeguards against hacking risks to protect your digital assets.

5. Do all exchanges charge high fees for cryptocurrency trading?

No—trading fees vary across platforms like Kraken or Crypto.com. Some offer low-cost options for frequent traders while others might have higher rates but include perks like educational resources or cash back rewards.

6. Can beginners use apps for cryptocurrency investing easily?

Yes! Many crypto apps are beginner-friendly with simple interfaces and helpful guides on topics from initial coin offerings (ICOs) to blockchains. Platforms like Robinhood also provide extra tools such as credit score insights alongside investment options in equities or ETFs.