In the fast-changing world of cryptocurrencies, learning how to build a balanced crypto portfolio is more important than ever. With thousands of cryptocurrencies and rapidly evolving technologies, the crypto market in 2025 presents exciting opportunities and significant risks.

A well-balanced crypto portfolio can help you navigate this volatile landscape, reduce risks, and maximize returns.

In this guide, we’ll explore the essential steps to build a balanced crypto portfolio, consider the trends shaping 2025, and provide practical tips to diversify and manage your investments. Whether you’re new to crypto or a seasoned investor, this article will equip you with actionable insights.

Understanding a Balanced Crypto Portfolio

What Is a Balanced Crypto Portfolio?

A balanced crypto portfolio refers to a well-diversified mix of cryptocurrencies and assets designed to minimize risk while achieving consistent growth. It involves investing in different types of cryptocurrencies, such as Bitcoin, altcoins, and stablecoins, to reduce exposure to any single asset’s volatility.

Benefits of a Balanced Portfolio

- Risk Reduction: Spreading investments across multiple assets lowers the impact of price swings in a single cryptocurrency.

- Long-Term Growth: A balanced portfolio ensures steady returns by leveraging various market opportunities.

- Adaptability: It allows investors to adjust quickly to market changes and emerging trends.

| Category | Example Assets | Purpose |

| Large-cap Cryptos | Bitcoin, Ethereum | Stability and long-term growth |

| Mid-cap Cryptos | Solana, Polygon | Higher growth potential |

| Stablecoins | USDT, USDC | Risk management and liquidity |

Key Factors to Consider in 2025

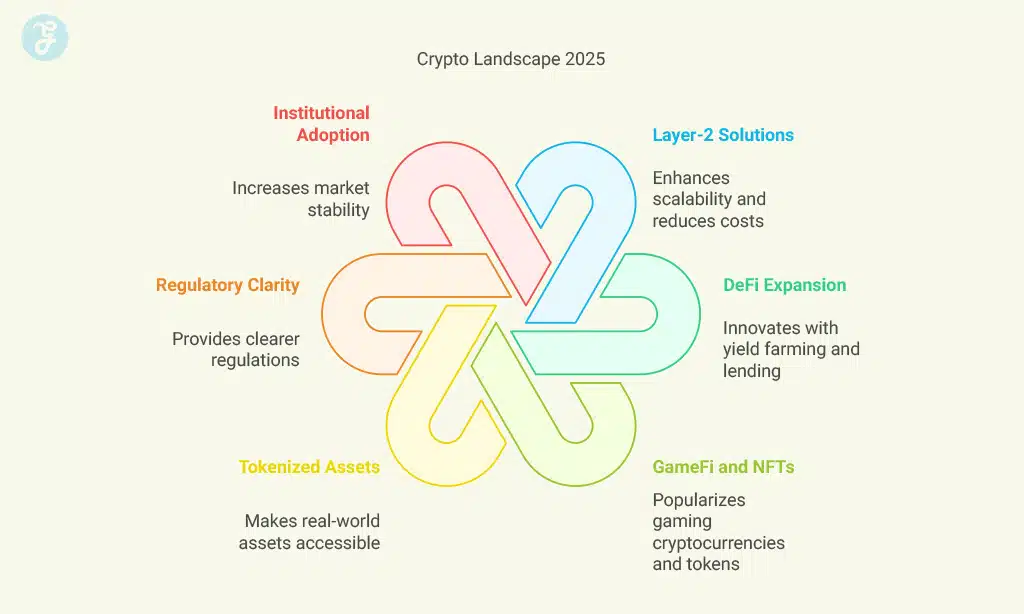

Market Trends Shaping 2025

- Layer-2 Solutions: Projects like Arbitrum and Optimism are gaining traction by enhancing scalability on major blockchains.

- DeFi Expansion: Decentralized finance (DeFi) platforms continue to innovate with advanced yield farming and lending options.

- GameFi and NFTs: Gaming-related cryptocurrencies and non-fungible tokens remain highly popular.

- Tokenized Assets: Real-world assets are increasingly tokenized, making them accessible via blockchain technology.

Regulatory and Adoption Updates

- Governments worldwide are implementing clearer crypto regulations, fostering safer investment environments.

- Institutional adoption is on the rise, with major companies and financial institutions entering the crypto space.

| Trend | Impact |

| Layer-2 Solutions | Reduced transaction costs and faster speeds |

| Institutional Adoption | Increased market stability |

| Regulatory Clarity | Improved investor confidence |

Diversification Strategies for Crypto Investments

Build a Balanced Crypto Portfolio Through Diversification

A balanced portfolio requires careful allocation among large-cap, mid-cap, and small-cap cryptocurrencies:

- Large-cap Cryptos: Represent the market’s most stable assets.

- Mid-cap and Small-cap Cryptos: Offer higher growth potential but come with increased risk.

- Stablecoins: Provide a hedge against market volatility.

Diversify by Use Cases

Invest in assets with different applications, such as:

- Layer-1 Blockchains: Ethereum, Cardano.

- DeFi Tokens: Uniswap, Aave.

- GameFi and NFTs: Axie Infinity, Decentraland.

| Asset Class | Percentage Allocation |

| Large-cap Cryptos | 40% |

| Mid-cap Cryptos | 30% |

| Stablecoins | 20% |

| High-risk Altcoins | 10% |

Risk Management in Crypto Investments

Setting Realistic Goals

Define your financial goals and align them with your risk tolerance. Ask yourself:

- How much can I afford to lose?

- What are my short-term and long-term objectives?

Importance of Stop-loss Orders

Stop-loss orders automatically sell assets when they fall to a predetermined price, preventing significant losses.

Rebalancing Your Portfolio

Regularly review and adjust your portfolio to ensure it remains aligned with your goals and market conditions.

| Risk Management Strategy | Description |

| Stop-loss Orders | Limit losses during market downturns |

| Portfolio Rebalancing | Maintain desired allocation ratios |

| Hedging with Stablecoins | Preserve value during high volatility |

Tools and Platforms for Building a Crypto Portfolio

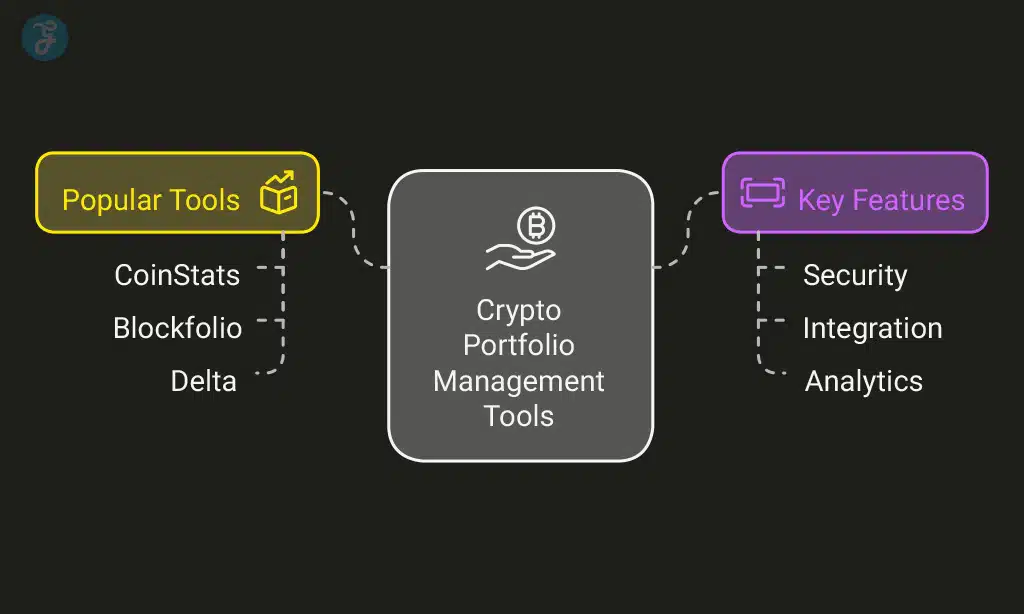

Popular Portfolio Management Tools

- CoinStats: Tracks your investments across multiple wallets and exchanges.

- Blockfolio: Offers portfolio tracking with real-time updates.

- Delta: Features advanced analytics and portfolio insights.

Features to Look For

- Security: Ensure the platform uses encryption and secure connections.

- Integration: Compatibility with major exchanges and wallets.

- Analytics: Detailed performance tracking and insights.

| Tool | Key Features |

| CoinStats | Multi-exchange integration |

| Blockfolio | Real-time portfolio tracking |

| Delta | In-depth analytics and insights |

Mistakes to Avoid While Building a Portfolio

Overconcentration in One Asset

Investing heavily in a single cryptocurrency increases risk. Diversify your investments to reduce exposure.

Ignoring Liquidity

Ensure you have access to liquid assets that can be easily converted to cash during emergencies.

Falling for FOMO

Avoid impulsive decisions based on market hype. Stick to your strategy and conduct thorough research.

| Mistake | Why It’s a Problem |

| Overconcentration | Increases vulnerability to market swings |

| Ignoring Liquidity | Limits flexibility in volatile markets |

| Acting on FOMO | Leads to poor investment decisions |

Case Study: Example of a Balanced Crypto Portfolio in 2025

Beginner’s Portfolio

- 50% Bitcoin (BTC)

- 30% Ethereum (ETH)

- 10% Stablecoins (USDT, USDC)

- 10% Emerging Altcoins (e.g., Polkadot, Avalanche)

Intermediate Portfolio

- 40% Large-cap (BTC, ETH)

- 30% Mid-cap (Solana, Polygon)

- 20% Stablecoins

- 10% High-risk Altcoins

Advanced Portfolio

- 30% Large-cap

- 30% Mid-cap

- 20% DeFi tokens

- 10% GameFi/NFT projects

- 10% Stablecoins

| Portfolio Level | Allocation Focus |

| Beginner | Stability and ease of management |

| Intermediate | Higher growth with moderate risk |

| Advanced | High diversification and risk |

Future Outlook for Crypto Portfolio Management

Market Predictions for 2025

- Continued growth in institutional investment.

- Increased adoption of blockchain technology in traditional industries.

- Expansion of tokenized real-world assets.

Adapting to Emerging Trends

Stay informed about new technologies and adjust your portfolio to include promising assets early.

Takeaways

Learning how to build a balanced crypto portfolio in 2025 requires a thoughtful approach, including diversification, risk management, and staying updated with market trends. Start small, focus on your goals, and use reliable tools to manage your investments.

By doing so, you’ll be well-positioned to navigate the crypto market’s exciting opportunities and challenges.