Agriculture is the backbone of India, employing millions and contributing significantly to the economy. However, it remains one of the most vulnerable sectors, susceptible to unpredictable weather patterns, natural disasters, and market fluctuations.

Crop insurance acts as a safety net for farmers, protecting them from financial losses due to crop failure. Understanding how to apply for crop insurance in India can empower farmers to secure their livelihoods and focus on agricultural productivity without fear of unforeseen risks.

This guide provides a step-by-step explanation of crop insurance in India, eligibility criteria, schemes, and the application process, ensuring farmers have the information needed to make informed decisions.

By learning how to apply for crop insurance in India, farmers can access financial protection and mitigate the risks associated with agriculture.

Understanding Crop Insurance in India

What Is Crop Insurance?

Crop insurance is a financial tool designed to safeguard farmers against losses resulting from crop failure caused by natural calamities, pests, or diseases. It ensures that farmers receive compensation, enabling them to recover their investment and sustain agricultural operations. This scheme is critical for Indian farmers, who often face climate-related challenges that threaten their livelihoods.

Knowing how to apply for crop insurance in India can make this process seamless for farmers.

Key Benefits of Crop Insurance

| Benefit | Description |

| Financial Security | Protects farmers from unpredictable financial losses |

| Risk Mitigation | Reduces the impact of natural disasters on agriculture |

| Promotes Agricultural Growth | Encourages farmers to adopt better practices without fear |

Types of Crop Insurance Schemes in India

Pradhan Mantri Fasal Bima Yojana (PMFBY)

Launched in 2016, PMFBY is a flagship scheme aimed at providing comprehensive insurance coverage to farmers. It covers:

- Food crops: Cereals, millets, and pulses

- Commercial crops: Cotton, sugarcane, etc.

- Horticultural crops: Fruits and vegetables

Key Features:

| Feature | Details |

| Low Premium Rates | 2% for Kharif crops, 1.5% for Rabi crops, 5% for commercial crops |

| Comprehensive Coverage | Pre-sowing to post-harvest losses |

| Technology-Driven Processes | Simplified claims process for faster settlements |

Example Insight: A farmer in Punjab insuring 5 acres of wheat under PMFBY only needs to pay ₹900 as a premium, with the rest subsidized by the government. This demonstrates the simplicity of how to apply for crop insurance in India under PMFBY.

Restructured Weather-Based Crop Insurance Scheme (RWBCIS)

This scheme focuses on mitigating weather-related risks such as rainfall, temperature, and humidity deviations. It provides payouts based on weather parameters rather than actual yield losses.

Key Features:

| Aspect | Details |

| Weather Risk Coverage | Includes deviations in rainfall, temperature, and humidity |

| Faster Claims | Payouts based on predefined weather triggers |

| Regional Suitability | Designed for weather-sensitive regions |

Practical Example: A farmer in Tamil Nadu growing groundnuts might receive compensation under RWBCIS if rainfall falls below the critical threshold during the growing season. Farmers need to know how to apply for crop insurance in India under schemes like RWBCIS to ensure timely benefits.

State-Specific Crop Insurance Schemes

Several states have launched tailored crop insurance schemes to address regional agricultural challenges. For example:

- Maharashtra: Mahatma Phule Karj Mafi Yojana offers additional coverage for state farmers.

- Tamil Nadu: Tamil Nadu’s Crop Insurance Scheme prioritizes localized weather and crop-specific risks.

State-Specific Data:

| State | Key Scheme | Focus Area |

| Maharashtra | Mahatma Phule Karj Mafi Yojana | Loan waivers and crop insurance |

| Tamil Nadu | Tamil Nadu Crop Insurance Scheme | Region-specific crops |

| Rajasthan | Weather-Based Crop Insurance Scheme | Rainfall variability |

Eligibility and Requirements for Crop Insurance

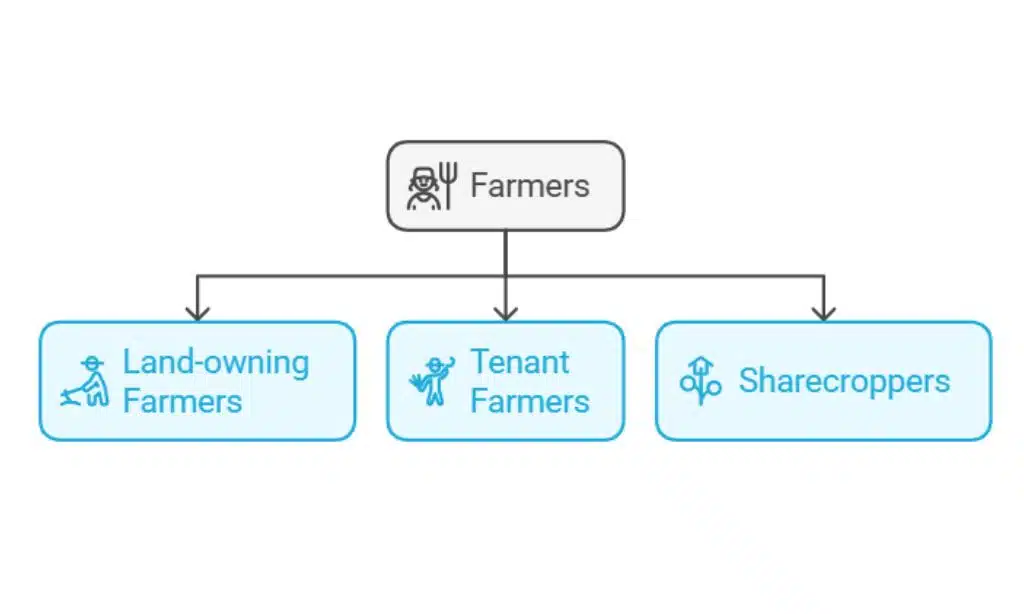

Who Can Apply for Crop Insurance?

Crop insurance schemes in India are designed to be inclusive, ensuring that all farmers, irrespective of their financial status, can access these benefits. Eligible applicants include:

- Land-owning farmers

- Tenant farmers

- Sharecroppers

Eligibility Matrix:

| Farmer Type | Eligibility |

| Landowners | Must have valid land ownership records |

| Tenant Farmers | Lease agreements or proof of tenancy required |

| Sharecroppers | Proof of farming activity |

Example Insight: Sharecroppers in Andhra Pradesh can access crop insurance under PMFBY by submitting a simple affidavit of farming activity along with an Aadhaar-linked bank account. This simplifies how to apply for crop insurance in India for non-landowning farmers.

Key Documents Required

To apply for crop insurance in India, farmers need to provide the following:

- Land ownership records: Title deeds, lease agreements, or revenue records

- Identity proof: Aadhaar card or voter ID

- Bank account details: Linked to Aadhaar for direct benefit transfer

- Crop sowing declaration: Proof of the type of crop sown and its acreage

Document Checklist Table:

| Document | Purpose |

| Land Records | Verifies ownership or tenancy rights |

| Aadhaar Card | Identity verification |

| Bank Account Details | Facilitates subsidy and claim transfers |

| Crop Declaration Form | Confirms type and area of crops sown |

Step-by-Step Guide: How to Apply for Crop Insurance

Online Application Process

### Step 1: Visit the Official Crop Insurance Portal

Farmers can start by accessing the official government website, such as the PMFBY portal. This portal offers an intuitive user interface designed to simplify the process of applying for crop insurance. Farmers can also access resources such as FAQs, scheme details, and premium calculators to understand their options.

Actionable Tip: Before starting, gather all necessary documents, including land records, Aadhaar card, and bank account details, in digital format. Understanding how to apply for crop insurance in India online ensures a smoother experience and prevents unnecessary delays.

Step 2: Registration and Login

- For New Users: Click on the “Register” option and enter your Aadhaar number, mobile number, and other basic details. A One-Time Password (OTP) will be sent to your registered mobile number for verification.

- For Existing Users: Log in using your username and password created during registration.

User-Friendly Insight: Once logged in, farmers can update their profiles, track the status of previous applications, view claim settlements, and download important documents like premium receipts. This central dashboard simplifies how to apply for crop insurance in India and manage related tasks.

Step 3: Submit Application

- Navigate to the “Apply for Insurance” section.

- Fill in details such as crop type, sowing area, and land records.

- Upload scanned copies of required documents, including the sowing declaration and identity proof.

- Select the coverage scheme (e.g., PMFBY, RWBCIS) and calculate the premium.

- Pay the premium using secure payment methods like UPI, net banking, or debit/credit cards.

Example Process Insight: For instance, a farmer in Gujarat applying for cotton insurance under PMFBY can calculate their premium directly on the portal. The online process, from registration to payment, typically takes less than 30 minutes if all documents are ready.

Offline Application Process

Step 1: Visit the Nearest Agriculture Office

Farmers preferring offline applications can approach their local agriculture department office or Common Service Centers (CSCs), which act as facilitators for government services.

Step 2: Submit Your Application

- Collect the official crop insurance form available at the office or CSC.

- Fill out the required details, including personal information, land records, and crop details.

- Attach necessary documents, such as Aadhaar and proof of sowing, to support your application.

- Pay the premium via cash, demand draft, or other accepted offline methods.

Comparison of Online vs. Offline Application

| Aspect | Online | Offline |

| Accessibility | Anytime, anywhere | Limited to office hours |

| Process Speed | Faster | Relatively slower |

| Documentation Submission | Digital upload | Physical copies required |

| Payment Methods | UPI, net banking, cards | Cash or demand drafts |

Pro Tip for Offline Users: To save time, call your local agriculture office in advance to confirm required documents and office hours. This ensures you are well-prepared and can complete your application in one visit.

Premiums, Subsidies, and Coverage

How Are Premiums Calculated?

Crop insurance premiums depend on factors like:

- Type of crop

- Geographical area

- Coverage amount

For example, a farmer insuring one acre of paddy under PMFBY might pay a 2% premium on the sum insured. If the coverage is ₹10,000 per acre, the farmer pays ₹200, while the government subsidizes the rest.

Example Premium Table:

| Crop Type | Sum Insured (₹) | Farmer Premium Rate | Farmer Contribution (₹) |

| Paddy (Kharif) | 10,000 | 2% | 200 |

| Wheat (Rabi) | 12,000 | 1.5% | 180 |

| Cotton (Commercial) | 15,000 | 5% | 750 |

Government Subsidies on Crop Insurance

Both the central and state governments contribute significantly to premium subsidies, making crop insurance affordable for farmers. These subsidies ensure that farmers pay only a fraction of the actual premium cost.

Subsidy Breakdown:

| Entity | Contribution Percentage |

| Central Government | 50% for most schemes |

| State Government | Varies by state; typically ranges from 40% to 50% |

Coverage and Claims Process

What Losses Are Covered?

Crop insurance schemes typically cover:

- Natural calamities: Floods, droughts, cyclones

- Pest and disease outbreaks

- Post-harvest losses due to adverse weather

Filing a Claim: Step-by-Step Guide

- Notify the insurance provider or local agriculture officer within 72 hours of crop damage.

- Submit a claim form with details of the loss.

- Provide supporting documents, such as photographs of the damaged crop and yield records.

- Await claim settlement, which is processed after a field survey.

Claim Processing Timelines:

| Step | Timeframe |

| Damage Reporting | Within 72 hours |

| Field Survey | 7-10 days |

| Claim Settlement | 2-3 weeks |

Tips and Best Practices for Farmers

How to Choose the Right Crop Insurance Scheme

- Compare premiums, coverage, and claim processes of available schemes.

- Opt for schemes that provide comprehensive coverage for your crop and region.

Avoiding Common Mistakes in Applications

- Submit complete and accurate documentation.

- Ensure premium payments are made within the stipulated deadlines.

Practical Tip: Farmers can consult local agricultural extension officers to better understand the schemes most suited for their region. This can simplify how to apply for crop insurance in India for first-time applicants.

Takeaways

Crop insurance is a vital tool for safeguarding India’s farmers against financial losses due to unforeseen events. By understanding how to apply for crop insurance in India, farmers can secure their investments and contribute to the nation’s agricultural stability.

Whether through online portals or offline centers, the process is now more accessible than ever, thanks to government initiatives and technology integration. Farmers are encouraged to take full advantage of these schemes to protect their livelihoods and ensure a prosperous future.