The Silent Impact of Late Payments

Revenue looks great on paper—until you realize it hasn’t landed in your bank account. That’s the challenge many businesses face when cash gets tied up in receivables. Everything seems fine until you need to pay staff, order stock, or invest in growth, and suddenly the money isn’t there.

Late payments don’t just inconvenience your finance team. They create ripple effects across your entire business: missed opportunities, stalled operations, and reactive decisions. It’s a subtle drain, but over time, it compounds.

When Predictable Income Becomes a Guessing Game

Cash flow is supposed to be rhythmic. Revenue comes in, expenses go out, and the business keeps humming. But that rhythm gets disrupted when invoices aren’t paid on time. Suddenly, a confident monthly forecast turns into a shaky estimate.

That’s exactly what happened at Aline Services, Australia’s largest supplier of pumps and pumping systems. As the business scaled, so did their receivables. Their AR officer was stretched thin, manually chasing payments. Eventually, the stress led to burnout and resignation. The team was left without a handle on collections, and financial planning became a guessing game.

From Short-Term Delay to Long-Term Strain

A few late invoices might not seem like a big deal. But when delays become the norm, the financial strain builds. You might delay your own vendor payments, dip into reserves, or hold off on a new hire you were counting on.

At Sunnylife, a company with operations across three continents, manual follow-ups were no match for their scale. The AR process was slowing everything down. With receivables overdue by 76 days on average, cash flow couldn’t keep pace with operational needs.

After automating their process, overdue days dropped to 17. Suddenly, planning became possible again. The finance team wasn’t guessing anymore—they were leading.

The Domino Effect on Decision-Making

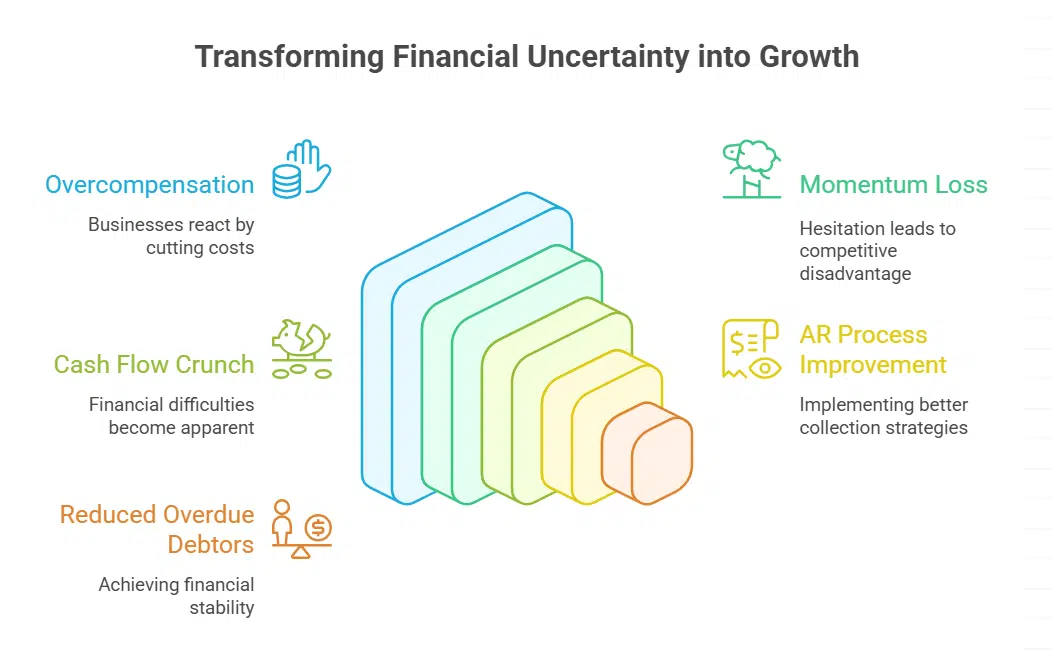

When income is unpredictable, businesses tend to overcompensate. You might hold back on marketing spend or delay product development just to preserve liquidity. But that hesitation can cost you momentum in a competitive market.

Bruce at Web Ninja saw this firsthand. Collections were inconsistent, and he didn’t realize how much it was hurting until the cash flow crunch hit. Once they tightened up their AR process, not only did they halve their overdue debtors, but they also freed up cash to reinvest in growth.

How the Right Tools Change the Game

There’s a reason many businesses are turning to an account receivable automation tool. It’s not just about reminders—it’s about restoring rhythm and predictability to cash flow. These tools give finance teams a dashboard view of what’s owed, by whom, and how to act on it. They remove the guesswork and manual drag that holds teams back.

Instead of tracking down dozens of overdue clients each week, your team sees exactly who needs a nudge—and automation handles the rest. It’s about working smarter, not harder.

The Confidence to Make Bold Moves

When you can count on your receivables to convert to cash reliably, you gain the confidence to plan. That’s what Christian at CW Systems discovered. Their overdue days dropped from 12 to just 4. With cash flowing steadily, they didn’t need to dip into reserves to pay suppliers. They could finally operate from a position of strength.

That reliability isn’t just a financial win—it’s a leadership win. When finance can forecast with confidence, the whole business benefits.

Closing the Gap Before It Widens

Receivables delays are like slow leaks. They rarely cause immediate disaster, but they quietly erode your ability to act. The good news is that the solution doesn’t have to be dramatic. It starts with clarity, consistency, and the right processes.

When you stop chasing cash and start directing it, everything changes. Financial decisions become proactive. Teams feel empowered. And business growth becomes less about hope—and more about planning.

That’s what happens when cash starts moving again.