Many people feel stuck with slow bank transfers and high fees every day. Crypto assets cut fees and speed up cross-border payments thanks to blockchain technology. This post will show ten ways peer-to-peer transactions and smart contracts shake up traditional banking and help you find new options.

Keep reading.

Key Takeaways

- Crypto cuts fees and speeds up payments: banks often charge over $20 per wire transfer, while blockchain networks settle peer-to-peer transactions in seconds for under $1.

- DeFi platforms use smart contracts to lend and borrow without banks, offering 8 – 12% interest rates versus about 1% on traditional savings accounts.

- Blockchain’s open ledger boosts transparency and security: auditors and regulators like the FATF, IRS, and IMF can trace every trade in real time.

- Regulators face new challenges: the SEC approved altcoin ETFs in January 2024, yet KYC/AML rules still lag as peer-to-peer trades cross borders instantly.

- Asset tokenization and stablecoins (USDC, Tether) let investors buy slices of real estate or art 24/7 and use dollar-pegged tokens as cash alternatives.

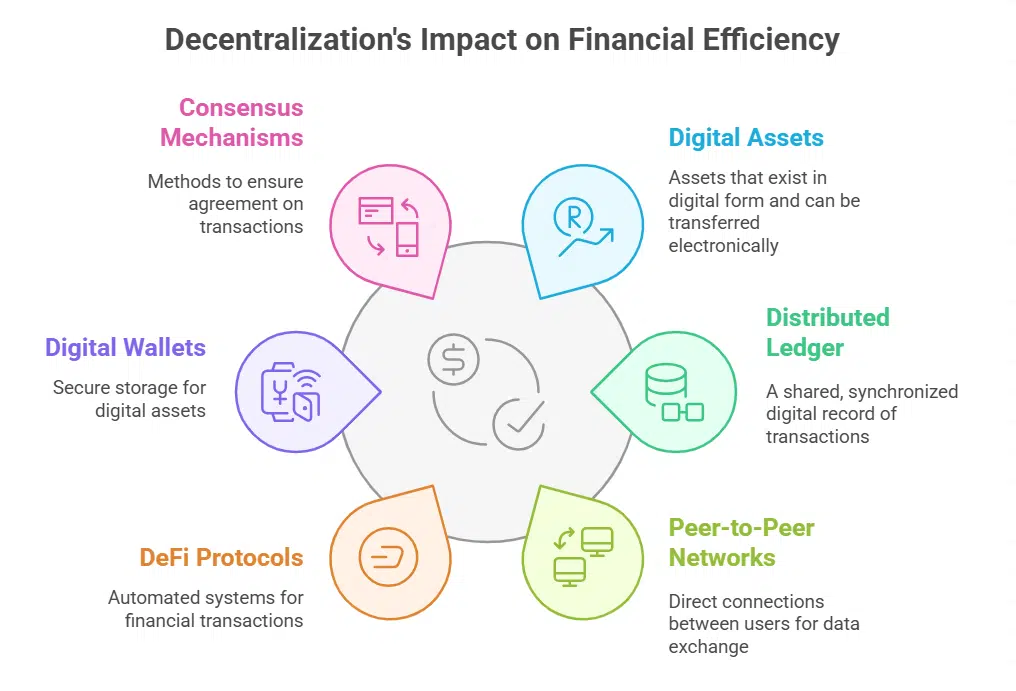

How does decentralization reduce reliance on intermediaries?

Decentralization cuts banks out of many deals. Digital assets move on a distributed ledger. This ledger runs on peer-to-peer networks. People trade value like sending a text or email.

No central bank or wire transfers slow the process. DeFi protocols let smart contracts do the work. They set rules and handle approval in seconds. That drops fees and thins out red tape.

Crypto adoption shakes up traditional banking. Fintech companies cannot match grant speed across borders. P2P payments cost a fraction of wire transfers. Users store funds in digital wallets with key pairs.

They skip account holds or middleman delays. Networks fend off double-spend with proof of work or other consensus. This path stacks speed and security. It shines light on old friction in the financial ecosystem.

Why are crypto transaction fees lower than traditional banking fees?

Crypto cuts out banks and middlemen. It runs on blockchain technology. That tech links nodes across the globe, so customers send digital assets without extra fees. Banks often charge over $20 per transfer, while crypto fees often stay under $1.

Digital wallets and crypto payment gateways match sender and receiver in peer-to-peer trades. That process slashes costs, compared to bank wires that use clearing houses and special networks.

Miners or validators settle each trade. That step costs a small network fee and a token tip. Tools like the layer two payment network speed transactions and lower costs even more. DeFi lenders skip bank overhead and offer fair rates on loans.

They slash fees for borrowing and transfers.

How do cryptocurrencies enable faster cross-border payments?

XRP ledger moves funds for cross-border payments in seconds. It cuts costs and friction with blockchain technology. Users skip banks and high foreign exchange market fees. Peer-to-peer transactions clear in minutes instead of days.

Cryptocurrency exchange services let people send digital assets instantly. Digital wallets link bank accounts to the XRP ledger. This setup boosts cryptocurrency adoption in developing economies.

Regulators note greater traceability reduces money laundering risks. Faster payments support global trade and financial inclusion.

How does crypto increase financial inclusion for the unbanked?

Zero-fee crypto cards let unbanked people spend digital assets like cash, straight from electronic wallets. They link to smartphone apps and support peer-to-peer transactions. Users skip banks, cut fees, and send value in minutes.

They tap DeFi tools instead of bank branches.

Blockchain technology gives underbanked folks a new way to save money. They stash crypto coins in apps, not under a mattress. Cryptocurrency adoption lets them build credit and control budgets.

Digital wallets open global trade without central banks or physical ID.

How is crypto challenging traditional lending models?

Decentralized finance platforms, or DeFi, let people borrow and lend outside traditional banking. These platforms use blockchain technology and smart contracts, not big banks. Smart contracts hold digital assets in code until the deal ends.

They free borrowers from strict credit checks and long forms. Users tap peer-to-peer transactions for fast access to funds. Instant loans let traders execute loans without any collateral, all in seconds.

Code guards each step, so no bank officer can slow things down.

Access to loans now costs less than bank credit. Some services pay 8 to 12 percent, far above typical bank savings rates. Peer-to-peer channels cut fees, so savers earn higher returns on digital assets.

Financial inclusion grows as unbanked users tap loans for business or study, with no credit history. Crypto exchange protocols tap worldwide demand, so funds flow without strict borders.

Regulatory frameworks adapt to cover peer lending, while they curb illicit financing. Consumer protection bots scan code for scams before users click. DeFi lending trims middlemen out of the process and speeds up cash flows.

How does blockchain technology improve transparency?

Blockchain technology logs every transaction in a shared ledger that anyone can check. It secures records with hashing and cryptographic systems so no one can alter them. Fraud risks drop in peer-to-peer transactions.

It also boosts consumer protection in cross-border payments and digital assets trading.

Immutable transaction records improve accountability for banks like JPM and exchanges like Coinbase. Auditors use smart contracts on Hyperledger Fabric to verify hundreds of transactions in seconds.

Regulators from FATF and IRS can audit ledgers for anti-money laundering. This opens a clearer view into money transfers and financial ecosystem flows. It builds trust in cryptocurrencies and shakes up traditional banking.

How are banks pressured to innovate due to crypto?

Banks face fierce pressure to innovate as crypto gobbles market share. Many rely on aging mainframes that choke on digital assets and peer-to-peer transactions. Institutions update systems to roll out blockchain technology and smart contracts that trim fees and speed cross-border payments.

Tight know-your-customer and AML rules test banks as they juggle regulatory frameworks and innovation. Risk-averse policies block fintech startups from basic banking services, yet clients demand DeFi-style experiences.

Some banks build crypto custody services and shore up consumer protection to keep pace.

Decentralized Finance (DeFi) platforms overview

DeFi apps use public ledgers and self-executing code to cut out banks. They power peer-to-peer swaps, liquidity pools, flash loans and yield farming via price feeds and automated market makers, with no middleman in sight.

What are DeFi platforms and how do they differ from traditional finance?

Decentralized finance (DeFi) platforms let users trade digital assets without banks. They work on blockchain technology and use smart contracts to cut fees, speed up cross-border payments, and fight money laundering.

Smart contracts automate loans and trades, so no branch lobby or loan officer stands in the way. Peer-to-peer transfers run on a public ledger that anyone can view.

Traditional banking relies on layers of intermediaries to clear each payment. It follows strict regulatory frameworks, requires know-your-customer checks, and depends on central banks for monetary policy.

These networks skip those steps and move funds directly between wallets, boosting financial inclusion for the unbanked. The code on distributed ledgers brings more transparency, security, and control to users.

How do DeFi platforms provide new financial opportunities?

Users tap decentralized finance to lend and borrow without a bank. It runs on smart contracts in blockchains, so we skip middlemen. A liquidity protocol such as Compound lets you supply digital assets and earn interest.

Most platforms pay 5 to 10 percent, while banks top out at one. People in remote areas need only a wallet, like MetaMask, to join. This step moves millions closer to real financial inclusion.

DeFi throws a lifeline beyond just loans. Traders use peer-to-peer transactions in pools and farms, chasing yield. Users swap virtual currencies in seconds, around the globe, with no broker.

Some hold stablecoins pegged to the U.S. dollar to cut risk. Regulators at the SEC and IMF watch DeFi. Officials fear money laundering and policy gaps. Big names in banking feel pressure to adapt or lose customers.

What risks and benefits do DeFi platforms present?

Platforms slash transaction costs and boost payment speed. They use blockchain technology, smart contracts, and liquidity pools for peer-to-peer transactions. These systems secure digital assets and reward users with high interest rates, sometimes over 8 percent.

Financial inclusion grows as virtual currency can reach people outside banks.

Security flaws in code can lead to hacks that drain funds fast. They exploit gaps in regulatory frameworks, inviting fraud and money laundering. Policymakers and the FATF urge stricter KYC checks in decentralized finance.

Investors face risks from untested protocols and hot wallets that lack insurance.

How do cryptocurrencies challenge existing regulatory frameworks?

Regulators chase crypto like shoppers in a flash sale. Crypto trades cross borders in seconds, so banks struggle with KYC and AML checks. Fintech startups spend months filling out forms to satisfy the financial action task force rules.

SEC green lit altcoin ETFs in January 2024, and that breaks old molds. Scammers still abuse peer-to-peer transactions for money laundering, so lawmakers add more fines. This tug of war shows gaps in existing regulatory frameworks.

Blockchain ledgers run on cryptographic techniques and smart agreements that auto execute terms. Central banks can draft policy, but they lack tools to track all digital asset flows.

DeFi platforms let users lend and borrow without banks, sidestepping KYC walls. IMF reports that regulators need new legal tender definitions for tokens. Retail investors push for clear guides on taxes, capital gains, and custody.

Clean rules could curb fraud and boost consumer protection across the global ecosystem.

How does cryptography enhance security and prevent fraud?

Strong ciphers guard digital assets with private key access. AES-256 and Rivest Shamir Adleman codes scramble transaction details in blockchain technology. Cryptocurrency exchanges adopt these protocols to shield user data from hackers.

Tamper proof seals appear when wallets use digital signatures. Identity tools attach real names to wallets, tightening know your customer checks under FATF rules.

Immutable records on open ledgers expose fraud attempts quickly. IRS or IMF auditors trace shady flows in peer-to-peer transfers with clear timestamps. Consumer protection gains ground as every transfer links to a verified source under strict regulatory frameworks.

This audit friendly design cuts money laundering risks and shores up financial stability.

What is asset tokenization and how does it open new markets?

Asset tokenization turns real items like art, real estate, or stocks into digital assets on a blockchain network. Each token represents a small share of the underlying asset. That lets investors buy tiny slices of a $1 million property or a famous painting.

Investors trade these shares in peer-to-peer transactions secured by smart contracts. Blockchain technology logs each sale in a public ledger, cutting out layers of middlemen and high fees.

Global traders can buy these tokens on secondary markets 24 hours a day, without any geographic limits. Extra liquidity fuels cryptocurrency adoption in sectors once bound by traditional banking rules.

Companies can offer tokenized bonds or securitized loans, tapping a wider investor pool. Regulators like the FATF demand clear regulatory frameworks and know-your-customer checks to curb money laundering.

Investors and issuers now mix DeFi tools with fiscal policies to reshape financial inclusion and monetary policy.

How does crypto reduce dependence on central banks?

People use peer-to-peer transactions on blockchain technology secured by encryption algorithms. They send digital assets through digital wallets. These wallets link individuals, not banks.

They let users hold bitcoins or USDC and Tether without a bank account. They take away seigniorage that normally goes to central banks.

DeFi apps like Aave run smart contracts for loans, savings and trades. They skip monetary authorities and slash fees. Users tap them on smartphones, not in bank branches. USDC and Tether tie to currency of the United States and blend into everyday spending.

This setup trims central bank influence on monetary policy.

What are stablecoins and how do they serve as fiat alternatives?

Stablecoins peg crypto tokens to the US dollar. Issuers lock a dollar in a custodian bank. They mint a matching token on the Ethereum network. Such digital assets tap blockchain technology as a reliable store of value.

These coins curb wild swings in cryptocurrency values and bolster the digital financial ecosystem outside traditional banking.

Traders swap stablecoins in peer-to-peer transactions, just like cash. Merchants add them as payment options to boost cryptocurrency adoption. Cross-border payments drop from days to minutes, with lower fees.

Regulators like FATF push issuers to run strong KYC and AML checks. DeFi apps tap these tokens for loans and payments, expanding financial inclusion.

How is crypto increasing competition for traditional banking services?

Fintech startups choose crypto-friendly banks for digital assets and peer-to-peer transactions. Silvergate and Signature Bank support stablecoin trades and cash management for fintechs.

DeFi platforms like Aave and Compound use smart contracts to lend directly. These services spur traditional banks to cut fees and speed up cross-border payments. Banks build digital wallets, boost consumer protection, and use distributed ledgers.

Regulators such as the FATF, IMF, and IRS tighten KYC and anti-money laundering rules. Traditional lenders now revamp services amid rising cryptocurrency adoption.

What are digital wallets and how do crypto custody solutions work?

Digital wallets act as vaults for crypto. They lock private keys with strong cryptography. They let people manage bitcoin, ethereum and other digital assets. Users carry seed phrases in memory or on paper.

A good wallet uses software vaults or hardware storage. It sends peer-to-peer transactions in seconds. It makes cross-border payments almost instant. It runs on blockchain technology.

Custody solutions add an extra shield. Companies use hardware security modules or multi-party computation to hide keys offline. These services rival traditional banking vaults and tough audits.

They follow sec’s rules and FATF guidelines for consumer protection. Institutions gain clear regulatory frameworks and safe holds. Clients earn 4% or more in defi savings, far above money market funds.

That mix of tools cuts fraud risk and money laundering chances. This model drives financial inclusion by reaching unbanked users.

How is crypto disrupting traditional payment processing systems?

Crypto payment gateways cut fees by dropping middlemen. Wallet apps hold digital assets and slash processing charges. Blockchain technology clears batches in seconds, not hours. Peer-to-peer transactions offer cheap cross-border payments.

Smart contracts automate settlements and boost consumer protection. Chain validation tracks transfers, fights money laundering. Global transfers clear in minutes, not days. This shift reshapes the financial ecosystem.

What are the implications of crypto for global economic stability?

High volatility can shake global markets. A crash can wipe out billions overnight. Some states see rapid capital swings. Peer-to-peer transactions often sidestep central banks. Mining pools burn vast energy, spiking demand on power grids.

Loose regulatory frameworks invite tax evasion and money laundering. The IMF warned about offshore financial centers hosting heavy mining. The Financial Action Task Force urges strict know-your-customer rules.

The IRS hunts hidden income linked to blockchain technology. Shifts in monetary policy lag behind this fast pace. This mismatch can strain financial stability.

Migrant workers send remittances fast and cheap. Cross-border payments speed up on new rails. Smart contracts cut fees and clear transactions in minutes. Financial inclusion grows for millions of unbanked people.

DeFi platforms offer loans and savings without banks. Some rogue apps lack basic consumer protection though. SEC’s scrutiny follows frequent scams. Regulators chase shadow apps in a race without end.

Takeaways

Digital assets have shaken the vaults of old banks. Blockchain technology builds trust without vault doors. Smart contracts guard deals like a watchdog. A digital wallet helps people pay fast across borders.

DeFi apps cut fees and speed up loans. Banks face new rivals, and they must adapt or risk getting left in the dust.

FAQs on How Crypto Is Disrupting Traditional Banking

1. What makes crypto a challenge to traditional banking systems?

Crypto uses digital assets recorded on blockchain technology. It lets people make P2P deals, cut out middlemen, and speed up cross-border payments. Banks see a fast, low-cost rival.

2. How does decentralized finance (defi) boost financial inclusion?

Defi apps open doors for the unbanked. They use smart contracts to let anyone save, lend, or borrow. No branch visits, no heavy fees.

3. Can crypto fuel money laundering or terrorist financing?

Yes, bad actors can move funds on hidden sites or use regulatory arbitrage. That sparks work from regulators, the sec’s, the irs, and the financial action task force, plus strict know-your-customer checks.

4. Does crypto shake up monetary policy and fiscal policy?

Crypto’s rise cuts into central bank control of money supply and interest rates. It tests tools from the global fund and can shift how governments tax or subsidize funds.

5. Is energy consumption by crypto mining a threat to financial stability?

High energy use drives big power bills and eco concerns. If miners shut down, it can crash networks and unsettle the wider financial ecosystem.

6. How do smart contracts and defi affect consumer protection and investments?

Smart contracts automate deals without lawyers. Defi courts let you swap tokens or stake funds. But you lose bank-style safety nets and formal regulatory frameworks, so you need to watch your risk.