Home Loan calculators have become popular among people planning to buy a house. Using three parameters, namely loan amount, interest rate, and tenure, they can get an approximate figure of the monthly instalments within a few seconds.

However, are they as accurate as they appear to be? Can you trust them to help you make one of the most important decisions that you will ever make in your life, that is, in the financial aspect? Let’s find out.

How do Home Loan calculators work?

There are many Home Loan calculators based on a formula that calculates your monthly payment of both the principal and the interest based on the loan details.

The formula typically used is:

Q = [P x R x (1+R)^N]/[(1+R)^N-1]

Where:

- Q = Monthly Payment

- P = Principal Loan Amount

- r = Monthly Interest Rate (Annual Rate / 12)

- n = Number of Monthly Payments (Loan Term in Months)

This will help you determine your monthly instalment payments. Nevertheless, some factors influence the calculator.

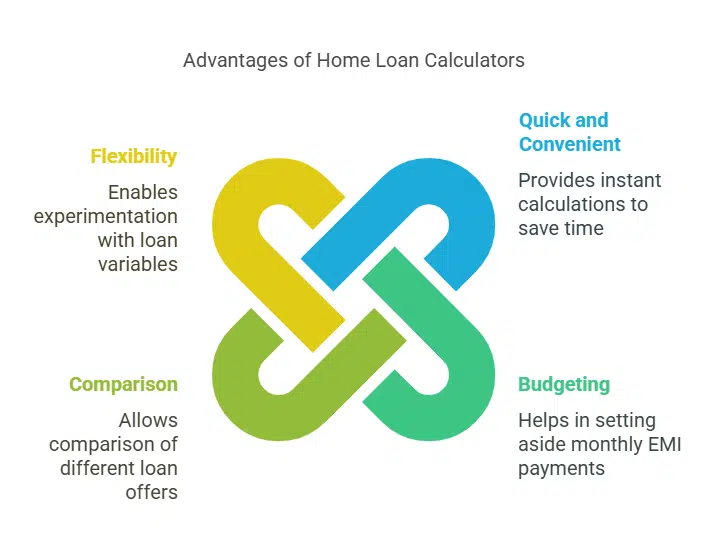

Benefits of Home Loan calculators

- Quick and convenient: Home Loan calculators instantly calculate your monthly EMIs, interest payable, and total loan cost, thus, saving time and effort.

- Budgeting: They provide clarity on how much you need to set aside each month for EMI payments. This helps you manage your finances better.

- Comparison: You can compare different loan offers from various lenders based on interest rates, loan terms, and EMIs.

- Flexibility: You can experiment with different loan amounts, tenures, and interest rates to see how changes will impact your EMIs and total repayment

Limitations of Home Loan calculators

They don’t include all fees

Most of the Home Loan calculators available on the internet are principal and interest only and do not include all fees, such as processing charges, legal fees, administrative costs, or stamp duty. If these costs are not taken into account, the total mortgage cost may be higher than the one that the calculator shows.

Interest rates can change

Home Loan calculators employ a fixed interest rate in the computation. However, these rates vary in the following ways:

- Market conditions

- Your credit score

- The fixed or variable interest rate of the loan

If you meet the requirements for a lower rate than the one you entered in the calculator, your actual payments will be lower than the calculated ones. On the other hand, if the interest rates go up, you may be charged more than expected.

Taxes and additional costs vary

Property taxes and other associated costs vary depending on the property’s area and the property’s value. Some calculators give estimates but are not the actual costs you are likely to pay in your region. If the estimates are too low, you will be forced to pay more than you planned in monthly payments.

Do not consider prepayment and foreclosure

These calculators generally do not account for prepayment or foreclosure penalties, which could affect the final repayment amount if the loan is closed early.

Conclusion: How Effective Are Home Loan Calculators?

While Home Loan calculators help plan a Home Loan, they should not be the only source of information for budgeting. They indicate what one can afford, but the actual cost of the mortgage is determined by credit score, type of loan, and other fees charged by the lender.

To get the most accurate figures, it is recommended to consult an expert and check the rates of various lenders.