Portugal has become a prime destination for property buyers, thanks to its picturesque coastlines, warm climate, and attractive lifestyle. While the country offers excellent opportunities for investment and relocation, many buyers—especially expats and first-time investors—are often caught off guard by the hidden expenses involved in the purchase process.

Beyond the listed price, several additional costs can significantly impact your budget and overall investment. From taxes and legal fees to renovation surprises and ongoing maintenance, this guide covers 12 hidden costs to consider when buying property in Portugal, so you can make a fully informed decision.

With real-world examples, up-to-date pricing insights, and expert tips, we’ll help you avoid budget-busting surprises and confidently navigate Portugal’s property market.

1. Property Transfer Tax (IMT)

The Imposto Municipal sobre Transmissões Onerosas de Imóveis (IMT) is a one-time property transfer tax paid by the buyer when purchasing real estate in Portugal. This tax is progressive and increases with the value of the property. Whether you’re buying a home for personal use or as an investment, IMT will be one of your largest upfront costs.

The percentage rate differs for primary residences versus secondary homes. Luxury properties exceeding €1 million fall under a flat tax rate. Understanding this tax is crucial to budgeting realistically for your home purchase.

Key IMT Rates:

| Property Type | Value Range | IMT Rate Range |

| Primary Residence | Up to €92,407 | Exempt |

| Primary Residence | €92,408 – €550,836 | 2% to 6% |

| Secondary Residence | Any amount | Up to 8% |

| Luxury Property | Over €1 million | Flat 7.5% |

Example: Buying a second home worth €600,000 could incur an IMT charge of around €38,000.

Tip: Calculate your estimated IMT on the Portuguese Tax Authority website using their online simulator.

2. Stamp Duty (Imposto de Selo)

Stamp Duty is another significant cost in Portugal’s property buying process. It applies to nearly all legal transactions, including real estate. Calculated at a fixed rate, the tax is based on the property’s declared value in the deed.

If you’re taking out a mortgage, Stamp Duty also applies to the loan amount. This is a one-time payment made during the deed signing. Failure to pay or underreporting the amount can result in hefty fines. Planning for this tax in advance helps you avoid surprises on closing day.

Stamp Duty Costs:

| Tax Basis | Rate | Amount on €300,000 Property |

| Property Transfer | 0.8% | €2,400 |

| Mortgage (if applicable) | 0.6% on loan value | €1,800 on €300,000 loan |

Note: This tax must be paid before or at the time of the final deed signing.

Tip: Ensure the declared value matches your purchase price to avoid underreporting fines.

3. Notary and Registration Fees

To finalize your property purchase in Portugal, you’ll need to pay for notary and registration services. These formalities ensure legal ownership is correctly documented and transferred. While fees vary depending on the property value and complexity of the transaction, they are unavoidable.

The notary validates the public deed, while registration updates ownership in official records. Together, they ensure legal protection for both buyer and seller. These fees, though often overlooked, should be included in your financial plan.

Estimated Cost Breakdown:

| Service | Typical Cost Range |

| Notary Fees | €500 – €700 |

| Land Registry | €250 – €500 |

| Admin Charges | €50 – €100 |

Tip: Some lawyers offer all-inclusive packages that cover notary and registration in one flat fee.

Example: Expect to pay about €1,000 in total for a mid-range property worth €250,000.

4. Legal and Solicitor Fees

Hiring a solicitor is highly recommended, especially for foreign buyers unfamiliar with local laws and language barriers. Your lawyer will verify that the seller holds a clean title, check for outstanding debts, and ensure all documentation is correct. Legal services offer peace of mind and can prevent costly mistakes.

Fees usually depend on the property’s value and complexity of the transaction. For long-term savings and legal protection, this is one of the most worthwhile hidden costs to include.

Legal Fees Overview:

| Service Provided | Estimated Cost (%) |

| Property Due Diligence | 1% – 2% of property value |

| Contract Review & Deed Preparation | Included |

| Tax and ID Registration Assistance | May be extra |

Tip: Always request a detailed breakdown before hiring a solicitor.

Case Study: An expat couple avoided purchasing a property with hidden tax debts thanks to their lawyer’s thorough background check.

5. Real Estate Agent Commission

Real estate agents play a central role in property transactions in Portugal. The commission they earn is usually paid by the seller, but buyers working with an independent agent may be charged separately.

Agent fees typically range between 3% and 5% of the property value. In off-plan developments, commissions are usually embedded in the price. Understanding who pays and how much ensures you know what’s included in the sale and avoids duplication of fees.

Commission Details:

| Agent Type | Payer | Commission Rate |

| Seller’s Agent | Seller | 3% – 5% |

| Buyer’s Agent | Buyer (optional) | 1% – 2% |

Tip: Confirm commission structure upfront and review the terms in writing.

Note: For off-plan or new development properties, commissions are often built into the price.

6. Surveyor and Inspection Costs

A property inspection helps identify structural issues or hidden defects before you commit to the purchase. This is especially important for older or rural homes, which often have unregistered extensions or outdated wiring. Inspections are not legally required but can save thousands in post-sale repairs.

Costs vary based on the survey’s depth and property size. It’s wise to hire a certified professional to provide a detailed report that can be used in price negotiations.

Types of Surveys:

| Survey Type | Estimated Cost | Recommended For |

| Basic Structural Survey | €300 – €500 | Newer properties |

| Full Building Condition Survey | €600 – €1,000 | Older, rural, or historic homes |

Tip: Combine your property survey with a valuation if you’re taking out a mortgage.

Example: One buyer discovered €15,000 worth of hidden roof damage during a pre-purchase survey, leading to a successful price negotiation.

7. Mortgage Fees and Bank Charges

If you need financing, expect additional costs from Portuguese banks. Mortgage application processes involve multiple fees for opening the account, evaluating the property, and insurance requirements.

Lenders may also charge early repayment penalties. While rates are competitive, hidden charges can add up quickly. Shopping around and comparing Annual Percentage Rates (APR) from various banks will give you a clearer view of total borrowing costs. Plan these expenses carefully to avoid loan-related stress.

Typical Mortgage Costs:

| Fee Type | Typical Range |

| Arrangement/Opening Fee | 0.5% – 1% of loan amount |

| Property Valuation | €200 – €500 |

| Life Insurance (often required) | Varies by age/health |

| Early Repayment Fee | Up to 2% of outstanding loan |

Tip: Compare mortgage offers from multiple banks and request an APR (Annual Percentage Rate) comparison.

Note: Some Portuguese lenders offer special conditions for expats, but paperwork can take longer.

8. Currency Exchange Fees

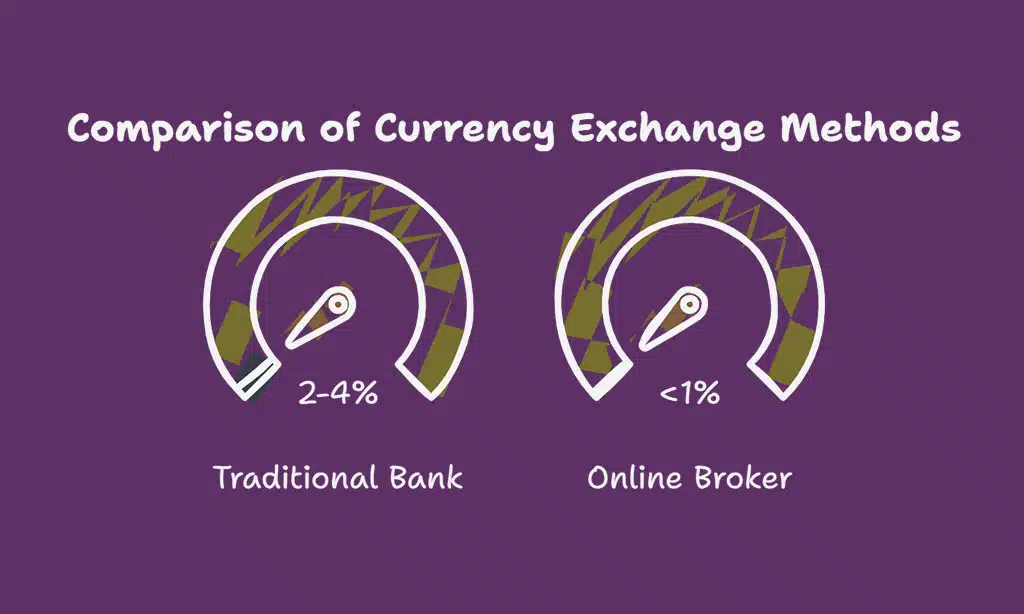

Foreign buyers converting their home currency into euros often lose out due to poor exchange rates and hidden bank charges. Over large property transfers, this can amount to thousands of euros in lost value. Using a specialized currency broker can help you lock in favorable rates and avoid unnecessary fees. Some brokers offer forward contracts to protect against market fluctuations. Managing this cost efficiently ensures you maximize the value of your funds in Portugal.

Money Transfer Options:

| Method | Exchange Rate Markup | Fees |

| Traditional Bank | 2% – 4% | €25 – €50/transfer |

| Online Broker (e.g., Wise, OFX) | <1% | €0 – €10 |

Tip: Lock in exchange rates in advance with a forward contract to protect your budget.

Example: A U.K. buyer saved over €3,500 on a €300,000 transfer by using a specialist FX broker instead of a high-street bank.

9. Capital Gains Tax on Resale

Planning to resell your property in Portugal? Be prepared for Capital Gains Tax (CGT). This tax applies to any profits you make from selling your property. Non-residents pay a flat rate of 28%, while residents are taxed on 50% of the gain based on their income bracket.

Expenses such as renovation, legal fees, and real estate commissions can be deducted. Knowing how CGT is calculated helps you plan for tax-efficient exits and avoid unexpected bills.

CGT Overview:

| Seller Status | Tax Rate | Exemptions |

| Resident | 50% of gain taxed at income rate | Reinvestment into another primary home |

| Non-Resident | 28% flat | Limited |

Tip: Track all expenses like renovations and legal fees, as these can reduce your taxable gains.

Note: EU/EEA residents may be taxed under Portuguese rates if treaties apply.

10. IMI – Annual Municipal Property Tax

IMI is a recurring property tax charged by local municipalities and based on the property’s taxable value (VPT). It varies by region, property type, and location. For high-value or luxury properties, additional taxes may apply (AIMI). IMI is typically billed once a year or in three installments.

It’s one of the ongoing costs of ownership, so be sure to factor it into your long-term budget. Some municipalities offer discounts for energy-efficient buildings or permanent residents.

IMI Rates by Municipality:

| Property Type | IMI Rate | Notes |

| Urban Property | 0.3% – 0.45% | Depends on local council |

| Rural Property | 0.8% | Set nationally |

| Luxury/High Value | Additional AIMI | Extra tax if VPT > €600,000 |

Tip: Some municipalities offer reductions for energy-efficient or heritage properties.

Example: For a home with a VPT of €200,000, expect to pay €600/year at a 0.3% IMI rate.

11. Renovation and Maintenance Costs

Many older Portuguese properties, especially those in charming historic areas or rural regions, require significant upgrades. Renovation can involve everything from structural repairs to updating utilities.

Costs vary widely based on size, location, and property condition. Routine maintenance is also a necessary expense to keep your home in good shape. Budgeting for these needs helps protect your investment and ensures long-term livability and resale value.

Common Renovation Costs:

| Work Type | Average Cost (per sqm) |

| Roof Replacement | €80 – €150 |

| Plumbing & Wiring | €50 – €100 |

| Interior Renovation | €400 – €900 |

| Landscaping | €1,500 – €5,000 |

Tip: Always include a 10–15% contingency buffer in your renovation budget.

Case Study: A buyer in Coimbra spent €60,000 renovating a 100-year-old townhouse—20% above the initial estimate due to hidden structural damage.

12. Homeowners Insurance

Homeowners insurance is crucial for protecting your asset against unforeseen events like fire, floods, or theft. If you’re financing the purchase, insurance is usually mandatory. The cost depends on the property’s size, value, and location. Comprehensive plans offer more coverage but come at a higher premium.

Comparing quotes and bundling insurance services with your lender may help reduce costs. It’s a smart way to safeguard your home and peace of mind.

Home Insurance Options:

| Coverage Type | Estimated Annual Premium |

| Basic Fire & Theft | €100 – €300 |

| Comprehensive Policy | €300 – €600 |

| Premium (high-value homes) | €600+ |

Tip: Compare quotes online and check if your bank or mortgage provider offers discounted insurance packages.

Note: Some providers offer combined home + life insurance deals for mortgage applicants.

Takeaways

Buying a home in Portugal is an exciting venture, but it’s crucial to plan beyond the sale price. These 12 hidden costs to consider when buying property in Portugal can add up quickly if not accounted for early. From taxes and legal fees to insurance and maintenance, being fully informed ensures you stay within budget and avoid unpleasant surprises.

By understanding and budgeting for these expenses upfront, you’ll enjoy a smoother, more secure property ownership experience in one of Europe’s most desirable destinations. Whether you’re investing for lifestyle, relocation, or rental income, knowing these hidden costs will ensure a successful and stress-free property purchase in Portugal.

Ready to buy smart in Portugal? Make sure your budget includes every item on this list