Hey there, are you feeling lost about picking the right health insurance in Vietnam? It’s a real headache, isn’t it, with so many choices and not enough clear info on who to trust for your medical expenses.

Here’s a quick fact to chew on: private health insurance is a top pick for many expats in Vietnam, mainly because it gets you faster care at top-notch private facilities. That’s a game-changer, right? In this blog, we’re breaking down 7 health insurance providers gaining trust across the country, from local giants to expat-friendly plans like Pacific Cross Vietnam.

We’ll help you sort through the mess of options, so you can find solid financial protection for your healthcare needs.

Stick with us to find out more!

Key Takeaways

- Bao Viet offers reliable health insurance in Vietnam with plans for inpatient and outpatient care, helping avoid long waits at public hospitals.

- Pacific Cross Vietnam provides adaptable plans with coverage up to USD $2,000,000 and maternity benefits of USD $6,250 for families.

- PVI Insurance collaborates with global names like Allianz Care, offering benefits up to $5,000,000 and a swift claims process.

- BIC Health Insurance presents cost-effective options in Vietnam, focusing on private care to bypass public hospital delays.

- Liberty Health Insurance has customized plans with limits like Silver at $1,000,000 and Gold at $2,000,000, plus 24/7 support.

Bao Viet: A Leading Local Health Insurance Provider

Bao Viet stands tall as a top health insurance company in Vietnam, earning trust among locals and expats alike. This provider offers a wide range of plans to cover medical expenses, from basic care to hospital stays.

If you’re in Hanoi or Ho Chi Minh City, where bed shortages hit hard, Bao Viet steps up with access to private medical services. Their plans help ease the stress of long wait times at public hospitals.

Got a need for solid financial protection? Bao Viet crafts health insurance options that fit both inpatient and outpatient care. They know the healthcare system in Vietnam, including the lack of English-speaking staff at public facilities, and work to bridge that gap.

With a focus on patient safety and quick service, they’re a go-to for many seeking reliable healthcare insurance.

Pacific Cross Vietnam: Flexible Plans for Expats and Locals

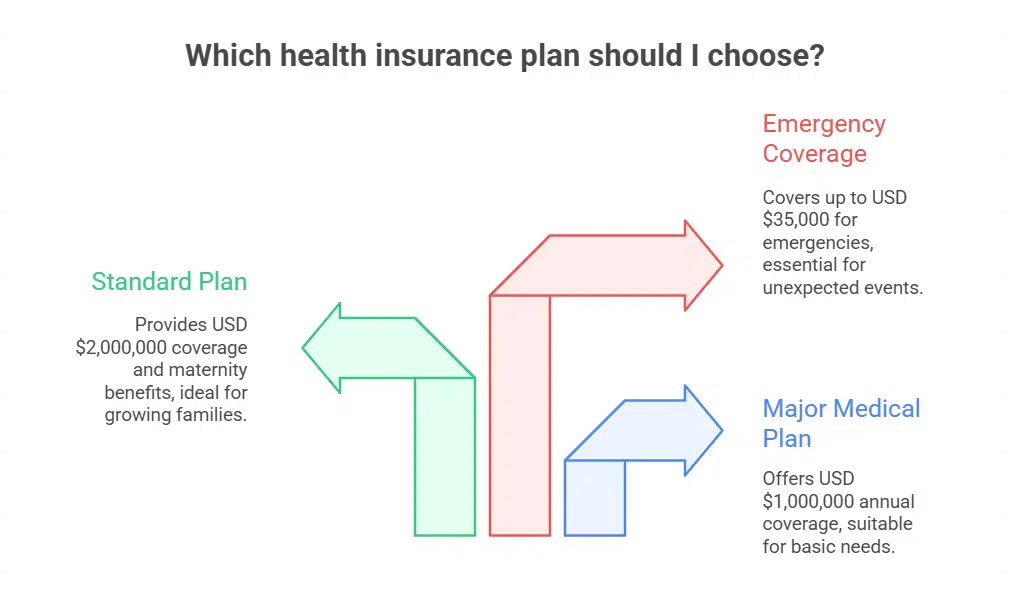

Pacific Cross Vietnam stands out with health insurance plans that fit both expats and locals. They offer a Major Medical Plan with a huge annual coverage of USD $1,000,000. Need more? Their Standard Plan bumps it up to USD $2,000,000, plus a maternity benefit of USD $6,250.

Talk about a safety net for growing families!

Got an emergency? Pacific Cross has your back with emergency medical expense coverage up to USD $35,000. Their plans also include inpatient and outpatient treatments, urgent care, medical evacuation, and even repatriation.

Whether you’re at public hospitals in Vietnam or a private medical center, their flexible options bring peace of mind. So, if you’re hunting for solid financial protection in the healthcare industry, this provider might just be your ticket!

Bao Minh: Comprehensive Health Coverage Options

Hey there, let’s chat about Bao Minh, a solid name in health insurance here in Vietnam. They’ve got a wide range of plans that cover medical expenses, from hospital stays to regular check-ups.

Think of them as a safety net, catching you when health troubles pop up. Their options fit both locals and expats, making sure everyone gets proper healthcare services.

Dig into their offerings, and you’ll see plans for in-patient and out-patient care, much like big players such as Bupa Global. They tackle hospital bills and even throw in mental health support or reconstructive surgery if needed.

With Bao Minh, financial protection against hefty medical bills is right at your fingertips, so you can focus on getting better, not stressing over costs.

PVI Insurance: Trusted Provider with Diverse Packages

PVI Insurance stands out as a solid choice for health insurance in Vietnam. They offer a wide range of packages that fit different needs, from basic plans to full coverage. Want protection for medical expenses or hospitalization? PVI has got your back with options that include preventive care and more.

Their plans are like a safety net, catching you when health troubles sneak up.

Dig into their offerings, and you’ll see why so many trust this provider. PVI works hard to keep premiums fair while linking with a broad network of medical professionals. They even team up with global names like Allianz Care, which boasts 1.9 million providers worldwide and benefits up to $5,000,000.

Plus, their claims process is fast, getting you financial protection without the long wait. Stick with PVI for reliable health care support!

BIC Health Insurance: Affordable and Reliable Solutions

Gosh, folks, let’s chat about BIC Health Insurance in Vietnam. They’re making waves with plans that won’t break the bank. If you’re hunting for solid health insurance, BIC offers reliable choices for both locals and expats.

Their coverage sticks to Vietnam, much like other local plans, keeping costs down. That’s a big win when medical expenses can pile up fast.

Now, think of BIC as your trusty sidekick against hefty hospital bills. While public hospitals in Vietnam are cheap, you might face long waits or language hiccups. BIC steps in with private medical insurance options to dodge those headaches.

Plus, their focus on financial protection means you’re covered without sweating the small stuff. Stick with a health insurer like BIC for peace of mind!

VietinBank Insurance: Health Plans Backed by a Strong Reputation

VietinBank Insurance stands tall as a trusted name in Vietnam’s health insurance scene. This provider, backed by a solid banking giant, offers plans that bring peace of mind. Their health benefits cover a wide range, from hospital stays to critical care needs.

If you’re looking for financial protection against medical expenses, their packages are worth a peek. Hey, who doesn’t want a safety net when life throws a curveball?

Dig into their offerings, and you’ll see why locals and expats alike lean on them. They provide options that rival even international health insurance plans. Need coverage for something urgent, like medical evacuation? They’ve got ties to top facilities, much like those in Thailand or Singapore.

Stick with VietinBank Insurance for a blend of local know-how and strong support in Vietnam’s growing insurance industry.

Liberty Health Insurance: Tailored Coverage for Various Needs

Liberty Health Insurance stands out in Vietnam for its custom-fit plans that match different lifestyles. They’ve got options that work for locals and expats alike, covering a wide range of medical expenses.

Think of it as a safety net, catching you when health troubles strike. Their plans draw inspiration from global models like the Cigna Global Insurance Plan, offering worldwide protection, though not in the US.

Dig into their offerings, and you’ll find multiple deductible choices plus 24/7 customer support to help anytime. Liberty mirrors top-tier annual benefit limits seen elsewhere, with levels like Silver at $1,000,000, Gold at $2,000,000, Platinum with no cap, and Close Care at $500,000.

Whether you’re after basic hospital care or full-on health insurance, they’ve got a package for you. Stick around, let’s chat about what fits your needs!

Key Factors to Consider When Choosing a Health Insurance Provider

Picking the right health insurance in Vietnam can feel like finding a needle in a haystack, but don’t worry, I’ve got your back. Let’s break it down into simple bites. First, check what the plan covers for medical expenses.

Many plans skip pre-existing conditions, aesthetic treatments, or non-emergency care outside their areas. Imagine needing help, only to find out it’s not included, ouch! Next, look for direct billing options.

Tools like the LUMA Care Mobile App make this easy, letting you skip upfront payments at hospitals. It’s a lifesaver for quick claims too.

Dig deeper into extras that fit your life, especially if you’re an expat or travel often. Does the plan offer medical evacuation for emergencies? How about hospital locators via apps for public hospitals in Vietnam? Also, peek at future updates, like the Asia Care Plans rolling out on April 21, 2025, for fresh options.

And hey, travel safety tips matter, so drink bottled water, slap on mosquito repellent, and dodge tap water or ice from public spots. These little tricks, paired with solid financial protection from health insurers, keep you safe and smiling.

Takeaways

Hey there, folks, choosing the right health insurance in Vietnam can feel like finding a needle in a haystack, but it’s worth the hunt! These seven providers, from Bao Viet to Liberty, offer solid plans to keep you covered, no matter your needs.

Got a question about medical expenses or direct billing? Chat with these companies to find your best fit. Stick with a plan that gives you peace of mind, and you’ll sleep like a baby!

FAQs on Health Insurance Providers in Vietnam

1. What’s the big deal with health insurance in Vietnam right now?

Hey, let me tell you, health insurance in Vietnam is becoming a hot topic as folks seek financial protection from rising medical expenses. With economic growth boosting the gross domestic product, more people are investing in plans from brands like Pacific Cross Vietnam. It’s like having a safety net when life throws you a curveball, especially with hospitalisation costs climbing!

2. Which companies are leading the pack for expat health insurance?

Well, if you’re an expat, listen up, because names like April International and William Russell are gaining ground fast. They offer international health insurance with perks like medical evacuation and direct billing, making life easier when you’re far from home.

3. How do public hospitals in Vietnam tie into insurance plans?

Public hospitals in Vietnam often work hand in glove with health insurance companies. Many plans, including those from MyHealth Vietnam, cover treatments there, though you might still face deductibles or out-of-pocket costs. It’s not a perfect system, but it’s a start toward universal coverage, don’t you think?

4. Are there cool innovations happening with insurance in Vietnam?

Oh, absolutely, the digital transformation is shaking things up! Health insurance companies are using machine learning algorithms for stuff like deepfake detection to spot fraudulent activities, and they’re boosting operational efficiency. It’s like watching a sci-fi flick, only it’s real, and it’s helping with compliance and disease management.

5. What’s the role of regulatory reforms in building trust?

Let me paint a picture, regulatory reforms are like a sturdy bridge connecting insureds to reliable coverage. These changes help insurance in Vietnam align with consumer price index trends and exchange rates, giving folks confidence in life insurance and car insurance alike. Plus, they keep companies honest, which is a win for everyone.

6. How do these providers handle behavioral health or rehabilitation?

Hey, got a minute to chat about something vital? Behavioral health and rehabilitation are getting more attention, with some health care system plans covering these alongside general liability or professional liability needs. Providers are stepping up, using market research to tailor offerings for demographic shifts, almost like they’re reading your mind!