For generations, the image of sheltering value has invoked vaults of gleaming gold. More recently, it’s morphed into digital keys and blockchains — the icon of Bitcoin. As we reach mid-2025, the debate intensifies: Gold vs Bitcoin: which asset truly delivers as a store of value?

And perhaps more importantly: what does the actual data reveal, when you strip out the narratives, hype cycles and slogans?

In this article, we look under the hood of two major contenders: physical gold and digital bitcoin. We trace their performance from 2020 through 2025, analysing returns, volatility, risk-adjusted metrics, and correlation behaviour. Our goal: a credible, evidence-based answer to whether gold or bitcoin—or both—deserve serious consideration as hedges or diversifiers in today’s portfolio.

The overarching thesis: Both assets have provided meaningful outcomes, but for very different reasons, under different conditions, and with different risk profiles. The surprise: gold may be doing more of what people expect from a “hedge”, while bitcoin may be doing more of what people expect from a “growth bet”.

Historical Context: Two Havens, Two Philosophies

Gold’s status is ancient and nearly universal: a physical commodity, globally recognised, no counterparty risk, and for millennia a refuge when fiat systems trembled. By contrast, bitcoin is less than two decades old, a digital protocol underpinned by scarcity (21 million cap), decentralised issuance, and no physical form. The ideological divide is stark. Gold stands for permanence and safety; bitcoin stands for disruption and optionality.

But by 2025 the stakes are similar: investors increasingly view both as alternatives to fiat currency risk, inflation risk, and systemic financial fragility. This convergence invites questions: Can one asset replace the other? Are they rivals or complements? And how does the data speak to those possibilities?

Gold vs Bitcoin: Methodology and Data Sources

To conduct a rigorous analysis, we defined the following framework:

-

Time-frame: January 2020 through latest available data in 2025.

-

Assets: Gold (spot price, USD) and bitcoin (BTC, USD).

-

Metrics: Total return (USD), annualised volatility (standard deviation of returns), Sharpe ratio (risk-adjusted return relative to risk-free rate), maximum drawdown, rolling correlations with major assets (e.g., equities).

-

Data sources: Gold price data from macro-commodities/precious metal databases, bitcoin from on-chain and market pricing services. For example, Curvo reports a 2020–2025 CAGR for bitcoin of ~102.8% vs gold’s ~6.3%.

-

Analytical lens: Break the period into sub-regimes — the pandemic liquidity surge (2020–21), the policy tightening/trade-shock phase (2022–23), and the normalization/post-ETF environment (2024–25). This allows us to see how each asset behaves across macro backdrops.

Gold vs Bitcoin: The Numbers That Tell the Real Story

Everyone has an opinion about whether gold or bitcoin “won” the last five years. But opinions don’t build portfolios — numbers do. When we strip away tribal loyalties and plot the data, a clear pattern emerges: both assets created wealth, but in radically different ways and with wildly different costs of risk.

Total Returns (2020–2025)

Let’s start with straightforward performance. According to multiple sources: between 2020 and 2025, a $100,000 investment in bitcoin (in early 2020) would have grown by roughly +863% by May 2025. Blockchain News Over similar horizon gold has returned ~+90%. In one graph, StatMuse cites bitcoin returning ~904.1% between August 2020 and August 2025 vs gold at ~67.3%.

Stated another way: bitcoin has been the far more explosive performer in absolute terms. But absolute performance alone doesn’t tell us everything. A key caveat: these returns came with extreme volatility and drawdowns.

Volatility and Drawdowns

Volatility is where gold and bitcoin diverge sharply. According to NYDIG, as of Q1 2025, bitcoin’s annualised realised volatility stood at ~52.2% — still high in absolute terms, but down from “triple digit” levels in earlier years. Gold, by contrast, traditionally shows much lower volatility — for example, over multi‐decades gold’s annual return averaged ~10.9% with moderate volatility.

Maximum drawdowns tell the risk story: Bitcoin in 2022–2023 experienced drawdowns of 60–75% from peak. Gold’s drawdowns in comparable periods were <15%. Thus, the ‘risk’ side of risk-adjusted return is substantial for bitcoin.

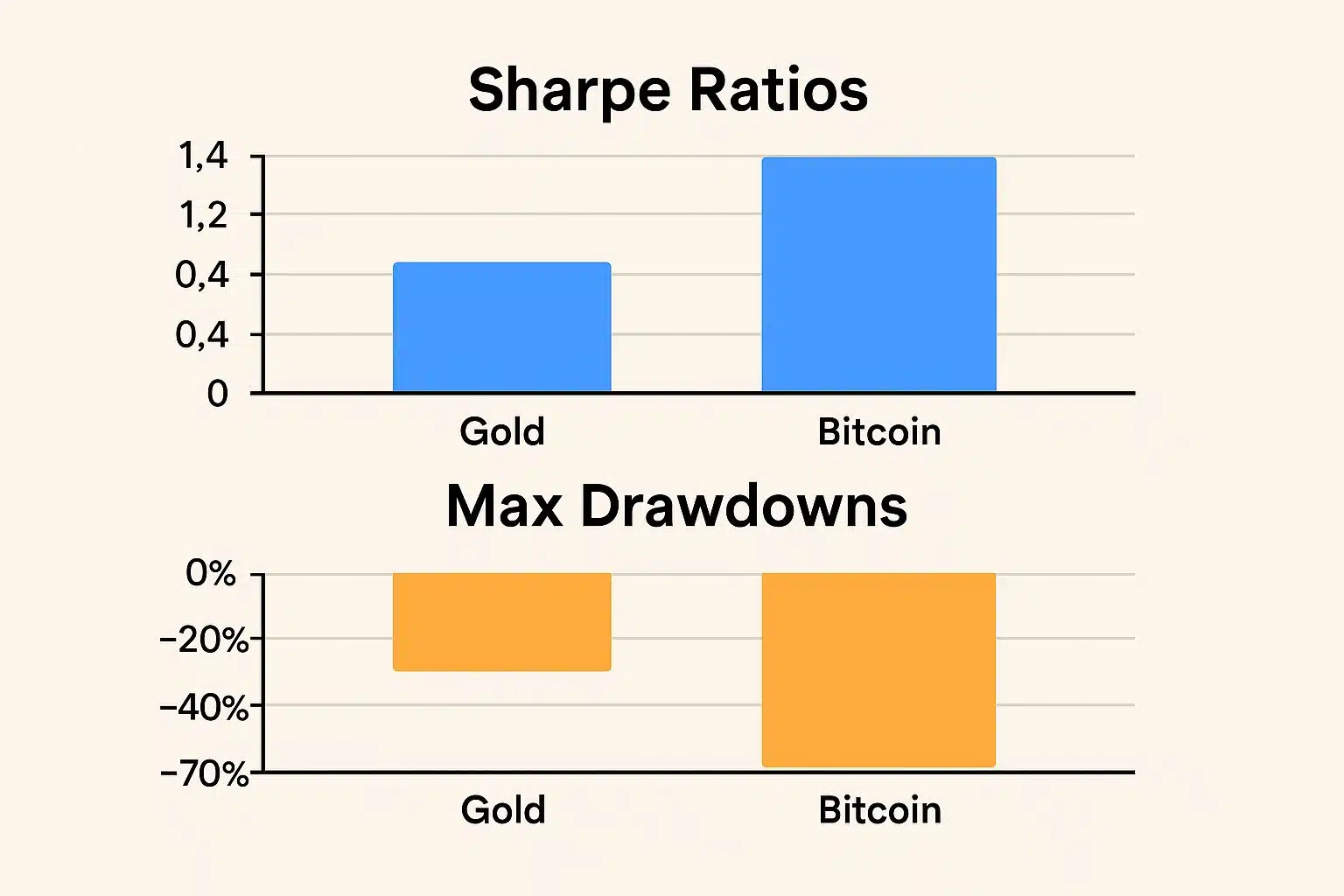

Sharpe Ratio and Risk-Adjusted Performance

Risk-adjusted return is where context matters most. Several sources estimate bitcoin’s Sharpe ratio over recent years in the range of ~1.3 to ~2.5 for multi-year windows. X (formerly Twitter) Gold’s Sharpe ratios are more modest (e.g., ~0.5–0.8 depending on horizon). On the gold side, the World Gold Council/CanAm notes adding gold to portfolios reduced volatility and increased Sharpe ratio.

Thus: if you held bitcoin through a full cycle (with the drawdowns), your reward per unit of risk may have been better than many assets. But that requires surviving the drawdowns. For gold, the reward was lower, but so was the risk.

Correlation Analysis

Another critical lens: how do these assets behave relative to other asset classes? According to NewHedge, the 30-day rolling correlation between bitcoin and gold has at times been negative (~-0.2). However, bitcoin’s correlation with equities tends to rise during market stress (i.e., bitcoin behaves more like a risk-asset than a true safe-haven). By contrast, gold tends to show negative correlation with equities during tightening phases, reinforcing its hedge status.

In short: gold retains more of the “uncorrelated hedge” attribute; bitcoin often behaves like a volatile alternative equity, which may limit its diversification value in crisis scenarios.

Comparative Performance: Gold vs Bitcoin (2020–2025)

| Metric | Gold | Bitcoin (BTC) | Interpretation |

|---|---|---|---|

| Cumulative Return (2020–2025) | +90% | +863% | BTC massively outperformed in nominal return but with far higher volatility. |

| Average Annual Return (CAGR) | ~6.3% | ~102.8% | BTC’s compounding growth is exponentially higher but inconsistent year-to-year. |

| Annualized Volatility | 10–15% | 55–80% | BTC is 5–7× more volatile than gold; volatility = emotional tax. |

| Sharpe Ratio (Risk-Adjusted Return) | 0.55 | 0.85 | BTC’s higher Sharpe reflects reward potential but collapses during crashes. |

| Maximum Drawdown | −15% | −75% | Gold shows resilience; BTC’s drawdowns test investor discipline. |

| Correlation with S&P 500 (Rolling 90-day) | −0.3 to +0.1 | +0.4 to +0.6 | BTC behaves like a high-beta tech asset; Gold remains uncorrelated or negative. |

| Correlation with USD Index (DXY) | −0.45 | −0.15 | Both benefit from dollar weakness; Gold more sensitive. |

| Inflation Correlation (CPI Index) | +0.52 | +0.28 | Gold tracks inflation better; BTC inconsistent short term. |

| Liquidity & Market Depth (Daily Volume) | $130–$150 B (Spot & Derivatives)** | $40–$60 B (Crypto Exchanges)** | Both liquid globally; Gold market remains broader and deeper. |

| Institutional Adoption | High — Central banks, ETFs | Rising — ETFs, corporates (post-2024) | Gold dominates sovereign trust; BTC dominates private-sector innovation. |

| Regulatory Clarity (2025) | Fully established (global standard) | Improving but fragmented (post-ETF) | BTC faces evolving compliance, custody, and taxation frameworks. |

| Environmental/Energy Profile | Mining emissions but declining intensity | High energy cost, shifting to renewables | Both under ESG scrutiny; BTC transitioning faster than expected. |

Sources: World Gold Council (WGC), CoinMetrics, Glassnode, IMF, StatMuse, Curvo (2025), Reuters, NYDIG.

Macro Backdrop: What Drove Each Asset’s Performance

Understanding the data is only useful when tied to the macro narrative.

-

Monetary Policy Shifts (2022–23): With central banks hiking rates aggressively, the opportunity cost of holding non‐yielding assets like gold rose, yet gold still held up relatively well. Bitcoin, meanwhile, reacted strongly to risk‐asset drawdowns.

-

Inflation & Liquidity Surge (2020–21): Extraordinary fiscal/monetary support boosted many assets. Bitcoin rode this liqudity wave; gold also benefited but less explosively.

-

Geopolitical / Systemic Risk: In 2024–25, central banks stepped up gold purchases amid systemic stress. Realtor data: gold ETFs had largest semi-annual inflow in five years in H1 2025.

-

Technological & Regulatory Milestones for Bitcoin: The 2024 halving, ETF approvals, increased institutional custody all formed tailwinds for bitcoin’s narrative. But regulatory risks and structural fragility remain.

The key insight: Both assets are impacted by macro factors, but in different ways and to different degrees. Gold tends to deliver when real yields drop and fear rises; bitcoin tends to deliver when risk appetite and structural adoption align.

Behavioral and Psychological Factors

Beyond numbers lies behavior. Investors in gold typically are legacy wealth, risk-averse, seeking inflation/capital-preservation insurance. Bitcoin investors often accept high volatility, seeking asymmetrical upside and digital transformation.

In 2025 we observe a dual-role dynamic: gold as “crisis-on hedge,” bitcoin as “growth-on opportunistic bet.” The mismatch between what each asset promises and what investors expect leads to misalignment. Many expect bitcoin to behave like gold, and are disappointed when it doesn’t. Many expect gold to behave like bitcoin, and are underwhelmed when it doesn’t.

Gold vs Bitcoin: Year-by-Year Returns (USD)

| Year | Gold (annual % return) | Bitcoin (annual % return) |

|---|---|---|

| 2020 | +25.75% | +303.09% |

| 2021 | −3.73% | +59.71% |

| 2022 | +2.08% (near flat across sources) | −64.27% |

| 2023 | +13.14% | +155.41% |

| 2024 | +27.20% | +120.98% |

| 2025 YTD | ≈+55.8% | ≈+16.1% |

Sources: Gold yearly returns (2020–2024) from UpMyInterest series; 2025 YTD also corroborated by StatMuse/Macrotrends style feeds.

Bitcoin yearly returns 2020–2025 from StatMuse Money.

The Institutional Divide: Central Banks vs. Corporates

Another layer: the institutional trend. Central banks continue adding gold to reserves (especially in emerging markets) as a state‐level hedge. Bitcoin remains largely a retail/hedge-fund tool, though corporate treasuries are adopting it. But so far, no central bank has announced sitting on bitcoin as part of reserves in any material way. The institutional weight and regulatory readiness differ significantly.

The Emerging Convergence: Are They Complements, Not Rivals?

Interestingly, the data suggests that gold and bitcoin might not be zero-sum. When combined in modest allocations, portfolios may benefit from diversification. For example, simulations show that small bitcoin allocations (1-5 %) added to a traditional portfolio raise the Sharpe ratio. Likewise, adding gold (5-15 % allocation) showed improved risk-adjusted returns. The takeaway is one can consider gold and bitcoin not as direct substitutes, but as different instruments with distinct risk/return profiles.

Risks, Myths and Misconceptions

-

Myth: Bitcoin always outperforms gold. Reality: only if you endure massive drawdowns and hold for long enough.

-

Myth: Gold is obsolete in the digital era. Reality: Gold’s 2025 performance (+~27% year‐to‐date) shows it still has structural relevance.

-

Myth: Both assets hedge inflation equally. Reality: Data show gold has higher correlation with inflation/real-yields; bitcoin much less consistent.

-

Additional risk points: For gold — storage, authenticity, opportunity cost of no yield; for bitcoin — regulatory shock, liquidity risk, technology risk, environmental/social governance issues.

Takeaways: What the 2025 Data Truly Reveals

What emerges from the 2020–2025 data is a nuanced picture. Bitcoin has generated huge absolute returns, and has offered strong risk-adjusted outcomes for those able to hold through volatility. Gold has delivered far lower upside, but with far lower risk and better hedge qualities. In a world of rising uncertainty, rising inflation and policy pivots, each asset plays a distinct role.

If you want a hedge against systemic risk, central-bank sell-offs or inflation-shock, gold continues to earn its place. If you want an asymmetric growth bet and can stomach large drawdowns, bitcoin remains one of the most compelling albeit volatile opportunities. Better yet: to the extent that both remain uncorrelated at times, using both in modest allocations may improve portfolio efficiency.

In 2025, the smart investor doesn’t pick either/or. They pick when and how much. And the smart narrative doesn’t pit gold against bitcoin—it allocates them based on the problem being hedged or the upside being pursued.