In the quiet corridors of the world’s central banks and the bustling trading floors of New York and London, a realization has settled in: the rules of the game have changed. As of mid-December 2025, the financial world is digesting a reality that few mainstream economists predicted two years ago. Gold Price has not just broken records; it has smashed through the psychological barrier of $4,300 per ounce.

Silver, the volatile younger sibling of the precious metals family, has awakened from a decade-long slumber to trade near $64 per ounce, outperforming virtually every major asset class this year. Headlines are calling it a “rally,” but seasoned analysts are using a different word: repricing.

This is not a standard market fluctuation. It is the result of a structural shift in the global financial architecture—a “supercycle” driven by the convergence of loose monetary policy, geopolitical fracturing, and a physical shortage of the metals needed to power the AI and green energy revolutions.

As we look toward 2026, the question for investors is no longer “Why is this happening?” but rather, “How much higher can this go?”

Key takeaways

- This isn’t a one-factor rally: Record highs in gold and silver are being driven by a mix of Fed policy shifts, real-rate expectations, and “uncertainty hedging,” not just headlines.

- Fed “path” matters more than the last cut: Markets are reacting to what comes next—especially signs of debate and potential pauses—because that changes real-yield expectations.

- Central banks are a structural pillar: Reported 2025 official-sector buying has stayed strong, reinforcing demand beyond short-term speculation.

- Silver is not just “gold, but cheaper”: Its record surge is also tied to industrial demand narratives and supply-tightness/deficit framing, which makes it more volatile.

- Watch signals, not hype: The next key cues are Fed communication, inflation/growth data, the dollar/real yields, and whether silver’s industrial story stays supported.

The Macro Catalyst: The Fed’s Pivot and the Death of “Real Yields”

To understand the Silver and Gold price trajectory for 2026, we must first dissect the engine that powered the breakout of late 2025. That engine is the Federal Reserve. Gold has been trading near record territory in December, with spot prices around the low-$4,200s to $4,300s in key reports around and after the Fed’s December decision. Silver pushed into record highs as well, repeatedly described by major wires as a record-high market and widely reported above $60/oz in early/mid-December.

For much of 2024, the narrative was “higher for longer.” That narrative collapsed in 2025. With the Federal Reserve delivering its third consecutive interest rate cut this December—bringing the target range down to 3.50%-3.75%—the central bank has explicitly signaled that supporting the labor market is now more important than fighting the last mile of inflation.

Why Does This Matter for Gold?

Gold is a non-yielding asset. It pays no dividends or interest. Historically, it struggles when interest rates are high because investors prefer the “risk-free” return of US Treasury bonds. But as the Fed cuts rates, yields on bonds fall.

When you adjust for inflation (which remains sticky around 3%), the “real yield” on cash is approaching zero. In a world where cash loses purchasing power and bonds offer meager returns, gold becomes the ultimate competitor.

- The 2026 Outlook: With the Fed’s “dot plot” signaling further easing into early 2026, the dollar is expected to face continued headwinds. A weaker dollar is mathematical rocket fuel for commodities priced in that currency. As the Dollar Index (DXY) flirts with breaking below key support levels, gold is simply repricing higher to reflect the currency’s debasement.

Silver’s Perfect Storm: The Industrial Squeeze

While gold is rising on fear and monetary debasement, silver is rising on something far more tangible: scarcity.

Silver is unique. It is a monetary metal, yes, but it is also an irreplaceable industrial metal. It is the most conductive element on the periodic table, making it essential for the two technologies defining our era: Solar Energy (Photovoltaics) and Artificial Intelligence (AI).

The AI Factor

The explosion of AI data centers in 2025 has created a surprise demand shock. High-performance computing chips and the complex electrical connectors required for AI infrastructure use significantly more silver than traditional electronics.

The Solar “Gulp”

Simultaneously, the solar industry has moved to more efficient “TOPCon” and “HJT” cells, which require vastly more silver paste per unit than older models.

The Deficit Reality

According to recent data, the silver market is in its fifth consecutive year of a structural supply deficit. In 2025 alone, demand outstripped supply by hundreds of millions of ounces. Above-ground stockpiles in London and New York vaults have been drawn down to critical levels to fill this gap.

Unlike gold, which is hoarded, silver is consumed. Once it is used in a solar panel or a cruise missile, it is effectively gone from the market for decades.

- The 2026 Outlook: Miners cannot simply “turn on” more supply. It takes 10+ years to permit and build a new mine. This “inelasticity” of supply means that if demand from green energy and AI continues to grow in 2026, the only mechanism left to balance the market is price. We are seeing the early stages of a classic “short squeeze” in physical silver.

The “Scorecard” (Current Market Snapshot)

| Asset Class | Current Price | YTD Gain (%) | 52-Week High | Analysis |

| Gold | ~$4,355 / oz | +63.9% | $4,383 | Driven by Central Bank buying & Safe Haven demand. |

| Silver | ~$63.89 / oz | +109.4% | $64.66 | Outperforming Gold due to AI/Solar supply squeeze. |

| Bitcoin | $142,000 | +45.2% | $148,500 | Strong, but acted more like a tech stock than a hedge. |

| S&P 500 | 6,150 | +12.5% | 6,210 | Lagging behind commodities as inflation fears return. |

The Geopolitical Shift: The Great “De-Dollarization”

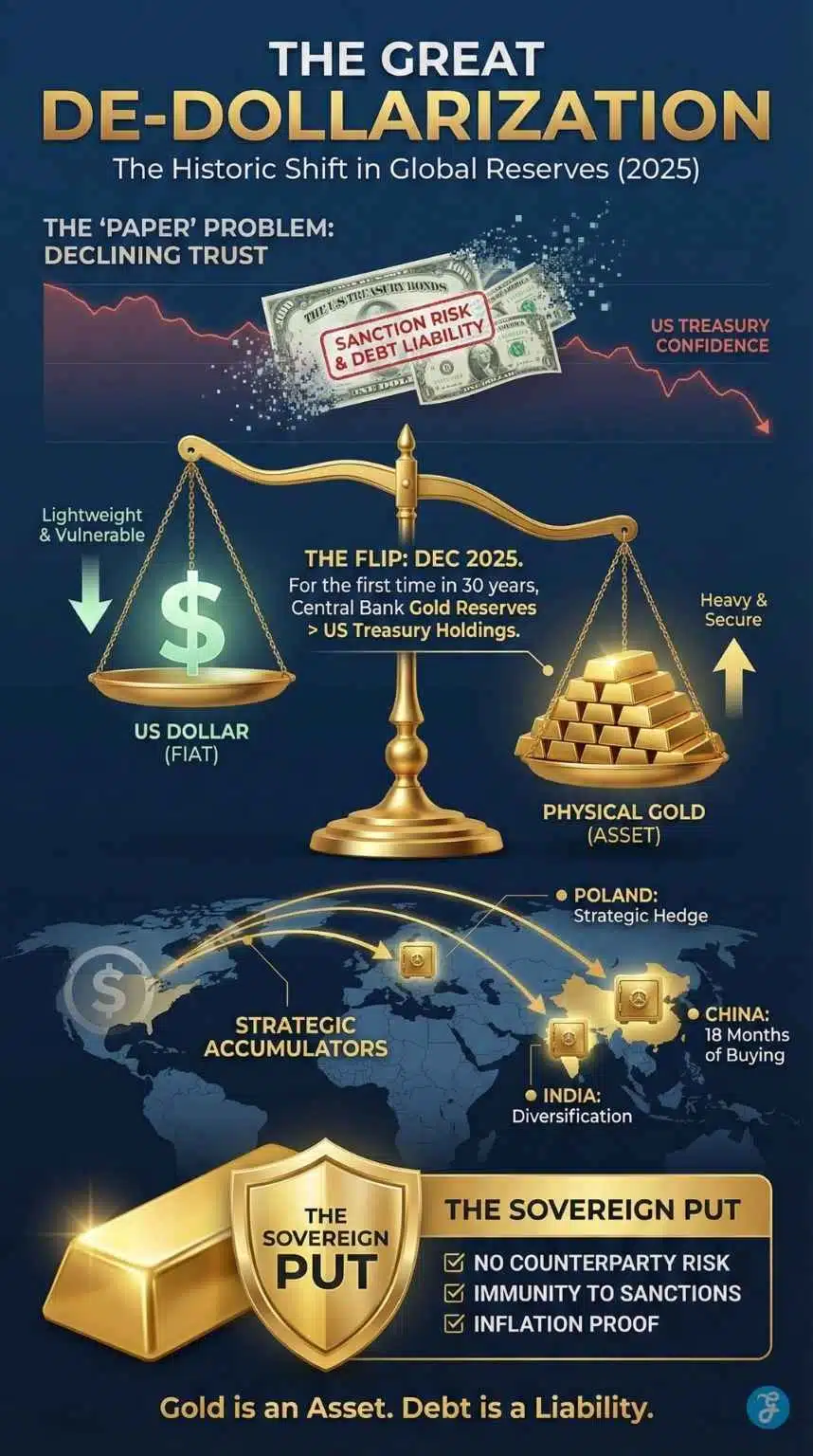

If the Fed provided the fuel, global central banks provided the spark. Perhaps the most underreported story of the last two years is the quiet but massive accumulation of gold by sovereign nations. For the first time in nearly three decades, global central banks collectively hold more gold reserves than US Treasury bonds. This is a watershed moment in financial history.

Led by China, India, Poland, and Singapore, nations are diversifying their reserves. The aggressive freezing of Russian assets in 2022 sent a chill through emerging markets, teaching a harsh lesson:

If your reserves are in dollars, they are someone else’s liability. If they are in gold, they are your asset.

The “Sovereign Put”

This buying has created what analysts call a “sovereign put” under the gold price. In the past, when Western investors sold gold ETFs, the price would crash. In 2025, we saw a new phenomenon: when Western investors sold, Eastern central banks bought.

This floor is higher than anyone expected. It suggests that even if retail demand softens in 2026, the geopolitical bid will remain. As long as global tensions persist—and with trade fragmentation accelerating—central banks will likely continue to view gold as a strategic imperative, not just a trade.

The Dollar Effect is Real — But It’s Not The Whole Story Anymore

A weaker dollar typically supports dollar-priced commodities. A credible source reported gold rising alongside a weaker U.S. dollar in mid-December, feeding into Canada-linked market moves too (TSX futures rising with precious metals).

But what’s new is how resilient metals look even when “risk assets” wobble. When a market can absorb bad headlines and still hold gains, it often signals that demand is broader than one variable.

In other words, the dollar can be a tailwind, but it doesn’t fully explain why investors stayed willing buyers at historically extreme price levels.

Miners vs. Metal: The “Catch-Up” Trade

For years, gold mining stocks (like those in the GDX ETF) lagged behind the price of gold. That relationship flipped in Q4 2025.

Mining companies have spent the last decade cleaning up their balance sheets. Now, with gold at $4,300, their profit margins are exploding.

- Cost to Mine: ~$1,600 per ounce.

- Selling Price: ~$4,350 per ounce.

- The Result: Free cash flow for miners is at record highs, leading to massive dividend hikes and stock buybacks.

What happens next: If you believe the rally continues, history suggests mining stocks could offer 2x to 3x the leverage of physical gold in 2026.

Investment Strategy (Physical vs. Miners)

| Feature | Physical Bullion (Gold/Silver Coins) | Mining Stocks (GDX/SIL ETFs) |

| Risk Level | Low (Safe Haven) | High (Volatile) |

| Primary Goal | Wealth Preservation (Insurance) | Growth & Dividends (Leverage) |

| 2026 Upside | 10% – 15% Potential | 30% – 50% Potential |

| Best For | Long-term savers worried about currency collapse. | Aggressive traders are chasing the “catch-up” trade. |

| Key Risk | Storage costs; Theft. | Operational costs, Poor management, and rising oil prices. |

Gold & Silver Through History: Lessons From Earlier Peaks

When precious metals break records, the most useful question isn’t “how high can it go?”—it’s what prior cycles looked like, what conditions were present, and which parts rhyme with today. Your referenced MarketMinute analysis leans on this framing, and it’s worth making it a dedicated section.

Quick comparison table: then vs. now

| Episode | What sparked the move | What gold/silver were “pricing” | What’s the key lesson |

| Late 1970s → Jan 1980 peak | Inflation shock + geopolitical stress + declining trust in monetary stability | Gold as a hedge against inflation + systemic risk; silver as a high-volatility satellite trade | Metals can surge when confidence breaks—but volatility and reversals can be brutal (especially in silver). |

| 2008–2011 post-crisis rally | Financial crisis aftermath + ultra-loose policy + lingering systemic worries | Gold as a hedge against policy-driven currency debasement fears and financial fragility | Gold can stay elevated when easing meets uncertainty; flows and confidence matter as much as headlines. |

| 2025 record-high cycle | Rate-cut cycle + policy-path uncertainty + elevated official-sector demand; silver also pulled by industrial narratives | Gold as policy/uncertainty hedge; silver as monetary + industrial metal with tighter/less forgiving structure | This cycle is less “single-cause” and more “stacked drivers,”which can make the trend feel sturdier, while still leaving room for sharp corrections. |

What’s similar to past cycles

- Macro uncertainty is the common ingredient. In each episode, metals strengthened when investors questioned the stability of inflation, growth, or policy credibility.

- Policy expectations matter—especially real rates. Whether it’s inflation-era erosion (1970s) or post-crisis easing (2008–2011), gold tends to react to shifts in the opportunity cost of holding it.

What’s different this time (and why that matters)

- Gold demand looks more “institutional/official” in structure. Unlike some earlier cycles that were dominated by retail fear or crisis hedging, recent market framing emphasizes continued central bank buying alongside investment flows—demand that can be slower to reverse than fast money.

- Silver’s story is more industrial than most readers assume. Silver has always been volatile, but the current narrative gives more weight to industrial usage and supply-chain realities, which can add a fundamentally different layer to a momentum-driven move.

2026 Price Forecasts: Reading the Tea Leaves

Given this backdrop, where do the experts see prices going?

Gold: The Path to $5,000

Institutional analysts have been forced to upgrade their forecasts repeatedly this year.

- The Consensus: Most major banks now see gold stabilizing in the $4,500 – $4,600 range in early 2026 as the market digests recent gains.

- The Bull Case: However, strategists at firms like Goldman Sachs and J.P. Morgan have suggested that if the US enters a recession or if inflation reignites (a distinct possibility given loose fiscal policy), gold could target $5,000 per ounce by late 2026. This would represent a further 15% upside from current record levels.

Silver: The “Catch-Up” Trade

Silver is the asset to watch for aggressive growth. Historically, the “Gold-to-Silver Ratio” (how many ounces of silver it takes to buy one ounce of gold) averages around 60:1. At the peak of the 2025 rally, it was hovering near 70:1, suggesting silver was still cheap relative to gold.

- The Target: If silver simply reverts to its historical average ratio with gold at $4,500, silver prices would need to exceed $75 per ounce.

- Some analysts are even more bullish, pointing to the 1980 and 2011 peaks. Adjusted for inflation, silver’s 1980 high would be over $150 today. While $150 is a distant target, a move toward $80 – $85 in 2026 is becoming a consensus view among commodity specialists who track the depletion of physical vaults.

2026 Price Forecast Scenarios

| Scenario | Probability | Gold Target (2026) | Silver Target (2026) | The Catalyst |

| Bear Case | Low (15%) | $3,800 | $45.00 | Fed pauses rate cuts; Inflation drops to 2%; Geopolitical peace. |

| Base Case | High (50%) | $4,600 | $68 – $72 | Steady Fed cuts; Continued Central Bank buying; Solar demand stable. |

| Bull Case | Moderate (35%) | $5,000+ | $85.00+ | Recession hits; Fed prints money (QE); Silver deficit worsens (Squeeze). |

The Overlooked Ripple Effects: Winners, Losers, and Second-Order Signals

Record highs in gold and silver don’t stay confined to bullion charts. They spill into corporate earnings, consumer behavior, and even policy decisions — and those spillovers often become the next set of clues about whether a metals rally is rooted in fundamentals or dominated by flow and momentum.

Winners: miners, royalty firms, and “operational leverage”

When precious-metal prices rise sharply, the most obvious beneficiaries are gold and silver producers, because revenue can climb faster than many costs in the short run. That’s why mining equities often behave like leveraged versions of the underlying metal. Recent market coverage highlighted how large miners’ shares surged alongside the rally and how investors started treating miners as a high-beta expression of the metals move.

But the rally also tends to lift companies that don’t operate mines directly — like royalty/streaming businesses — because they may gain price exposure without the same day-to-day operating risks.

Losers: manufacturers and consumers who can’t “hedge” easily

Silver’s industrial importance means higher prices can flow into electronics, solar components, and other manufacturing inputs. Even if silver is a small slice of a product’s total bill of materials, a rapid move to record highs can force procurement teams to make trade-offs: lock in contracts, redesign components, or accept margin pressure.

On the gold side, record prices often hit jewelry demand first. A credible source reported that gold jewelry fabrication fell sharply in Q3 as high prices discouraged consumption — an example of how a rally can be “bullish” for investment demand while simultaneously “bearish” for price-sensitive buying.

Second-order signals: what the rally reveals about the market’s real fears

Big rallies in precious metals often reveal what kind of uncertainty is dominating.

- If gold leads and stays resilient, the market may be emphasizing policy credibility, inflation risk, or systemic hedging.

- If silver dramatically outperforms, it can signal a blend of industrial optimism + supply tightness + momentum positioning, because silver tends to amplify moves once it breaks out.

These ripple effects matter because they’re observable. Rising miner equities, weaker jewelry demand, shifting inventories, and policy attention are not abstract theories — they’re the secondary data points that often tell you what kind of rally you’re actually looking at.

What to watch next

A forward-looking analysis doesn’t require predicting $X by $Y date. It requires identifying the decision variables the market is using right now.

1) Fed communication: “cut” isn’t the headline — “path” is

The Fed has already cut to 3.50%–3.75%, but officials are openly debating what comes next, and Reuters reporting indicates caution about further moves. Metals traders will respond less to the fact of a past cut and more to whether the Fed sounds:

- confident about disinflation (less hedge demand), or

- worried about growth / financial conditions (more hedge demand).

2) Central bank demand cadence

WGC’s data show central banks remained a firm pillar of demand through Q3. If official buying stays steady, it can dampen selloffs; if it slows sharply, it can change the psychology of dips.

3) The silver “industrial vs. speculative” balance

Silver is likely to remain sensitive to two things:

- indicators tied to industrial activity and supply tightness, and

- investment flows that can amplify both rallies and pullbacks.

Frequently Asked Questions

Why are gold and silver prices rising in 2025?

Because several forces stacked together: Fed rate cuts and the policy outlook, safe-haven and hedging demand, and sustained official-sector demand, plus industrial and supply narratives boosting silver.

Did the Fed cut rates recently?

Yes. The Fed cut by 25 bps in December, taking the funds rate to 3.50%–3.75%, and policymakers have signaled caution and internal debate about the next steps.

Is silver moving for the same reasons as gold?

Partly, but silver is also being pulled by industrial demand and supply tightness narratives, making it more volatile and often more momentum-driven than gold.

Are central banks really buying that much gold?

The World Gold Council reported net 220 tonnes of central-bank purchases in Q3 2025 and 634 tonnes year-to-date through Q3.

Bottom Line: The Era of Hard Assets

The record-shattering rally of December 2025 is a signal, not a noise. It signals that the global economy is entering a new phase—one defined by higher volatility, persistent debt concerns, and a scramble for finite resources.

For the last decade, the winning strategy was to buy “growth” (tech stocks) and ignore “value” (commodities). The trends of late 2025 suggest a rotation is underway. Investors are waking up to the fact that you cannot print gold, and you cannot code silver.

As we head into 2026, the “FOMO” (Fear Of Missing Out) will tempt many to chase these prices blindly. Caution is always warranted after parabolic moves; corrections are healthy and inevitable. However, the fundamental floor has risen. The combination of the Federal Reserve’s easing cycle, the geopolitical “de-dollarization” of the East, and the undeniable industrial shortages in the West has created a trifecta of support that is unlikely to vanish soon.

The “Supercycle” has begun. The only question now is who is positioned for it.