Have you ever wondered how cool it would be to pay for a bus ticket or a parking spot with digital money? Many of us struggle with old-school payment methods, like carrying cash or digging for exact change, and it can be a real hassle.

Here’s a fun fact to chew on: only 16 percent of Germans prefer mobile payment methods, while a whopping 42 percent still stick to cash. Now, imagine a world where five German cities are shaking things up by testing cryptocurrency, a type of digital currency, for public services.

This blog will walk you through how Berlin, Munich, Hamburg, Frankfurt, and Stuttgart are jumping into the digital economy with crypto wallets and blockchain technology. Stick around, it’s gonna be neat!

Key Takeaways

- Berlin started accepting crypto for public transport payments since March 9, 2021.

- Munich tests cryptocurrency for utility bills like water and electricity.

- Hamburg experiments with crypto for government fees, despite 69% of Germans worrying about data security.

- Frankfurt uses digital wallets for parking and toll payments, even though only 20% of Germans understand “Internet of Things.”

- Stuttgart explores blockchain for tax payments, while 31% of Germans have faced data loss or fraud.

Berlin: Embracing Crypto for Public Transportation Payments

Berlin is jumping on the crypto train with open arms, folks. Since March 9, 2021, companies across Germany, including in this bustling capital, started accepting digital currencies.

Now, imagine hopping on a bus or tram and paying with your crypto wallet. That’s right, Berlin is testing cryptocurrency payments for public transportation. It’s a bold step to blend digital assets into everyday life.

This move makes getting around the city a breeze with modern tech. You just tap your mobile wallet at the ticket machine, and boom, you’re good to go. Even though cities like Essen and Hannover have many businesses and ATMs for crypto, Berlin is paving the way for public services.

Let’s see how Munich tackles crypto in their own style with utility bills.

Munich: Pilot Programs for Utility Bill Payments Using Cryptocurrency

Munich is jumping into the future with a cool trial run. They’re testing cryptocurrency for paying utility bills like water and electricity. Imagine settling your monthly dues with digital assets instead of cash.

This pilot program is part of a bigger push for digital transformation in the city. It’s like swapping out an old bike for a shiny electric scooter, fast and modern.

This effort ties into the smart city vibe Munich is building. With crypto wallets, payments could be quicker and safer. Think of it as mailing a letter versus sending a text, no waiting around.

Plus, data from Statista on May 29, 2024, shows growing interest in electronic money across Germany. Now, let’s see how Hamburg is tackling crypto in their own way.

Hamburg: Testing Crypto Integration in Government Fees

Moving north from Munich’s utility bill trials, let’s discuss Hamburg, a vibrant port city exploring crypto for government fees. They’re experimenting with digital assets as a method to pay for items like permits and fines.

Picture settling a parking ticket with a swift tap on your crypto wallet, no cash required. It’s a daring move to integrate tech into routine public finance.

Now, here’s the challenge, folks. With 69% of Germans concerned about data security, Hamburg is putting in significant effort to foster confidence in these online payment systems.

Plus, since 59% of locals view cash as the most secure choice, far exceeding the global average of 36%, the city confronts a genuine hurdle. They’re implementing protections like two-factor authentication to guard against threats such as phishing or identity theft.

Hamburg aims to demonstrate that smart cities can securely utilize cryptocurrency exchanges for everyone.

Frankfurt: Digital Wallets for Parking and Toll Payments

Shifting gears from Hamburg’s push for crypto in government fees, let’s roll into Frankfurt’s cool new plan. This city is jumping on the digital bandwagon with digital wallets for parking and toll payments.

Imagine pulling up to a parking spot, whipping out your phone, and paying with cryptocurrency in a snap. No fumbling for coins or cards, just a quick tap using mobile wallets.

Frankfurt is making life easier with this digital transformation, and honestly, it’s like a breath of fresh air. They’re testing crypto payments to keep up with modern trends, even though only 20% of Germans know what “Internet of Things” means, and just 25% get the “smart city” idea.

With tools like crypto wallets, plus neat tricks like smart contracts for secure deals, this could be a game-changer. Hey, paying tolls might finally feel less like a punch to the gut!

Stuttgart: Exploring Blockchain-Based Tax Payments

Hey there, folks, let’s chat about something pretty cool happening in Stuttgart. This city is stepping into the future by testing blockchain for tax payments. Imagine paying your taxes with digital assets, not just old-school cash.

Stuttgart wants to make this process fast and safe using crypto wallets. It’s like sending a quick text, but for your taxes.

Now, here’s a bit of a wake-up call. Did you know 31% of Germans have faced data loss or online fraud? Plus, 16% aren’t even sure if they’ve been hit. On top of that, 39% don’t know what info digital services collect from them.

That’s way above the global average of 27%. So, while blockchain could boost security in taxation, protecting data is a big deal. Stuttgart is on the case, mixing financial innovation with consumer protection to keep your details safe.

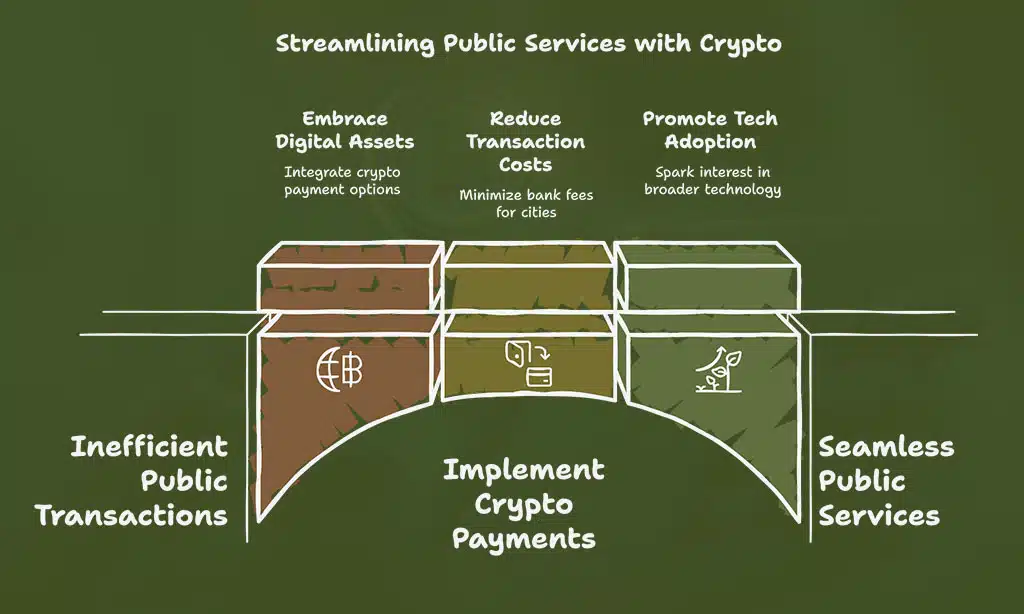

Benefits of Crypto Adoption in Public Services

Let’s talk about why crypto payments in public services are significant for Germans like you. Envision paying for a bus ticket in Berlin with a simple tap of your crypto wallet. It’s quick, reduces paperwork, and saves time for everyone.

With 93% of Germans using the Internet, adopting digital assets seems like a logical progression. This shift can make transactions run smoother than a well-oiled machine, especially for tech-savvy individuals who already welcome digital transformation.

Now, imagine this as a major gain for convenience everywhere. Crypto isn’t just fast; it can also cut costs for cities by minimizing bank fees linked to fiat currency. Even if only 30% of Germans own smart home devices, below the global average of 38%, embracing digital payments might ignite broader interest in technology.

It’s like sowing a seed for greater innovation in everyday life. So, let’s look into the obstacles these cities encounter in making this a reality in the next section on challenges.

Challenges Faced by Cities in Implementing Crypto Payments

Hey there, folks, let’s chat about the hurdles German cities face with crypto payments for public services. It’s like trying to fit a square peg in a round hole, isn’t it? Many people just don’t trust digital assets yet.

In fact, 30% of non-users lack faith in smart devices, and that spills over to crypto wallets too. Plus, a whopping 51% see no need for such tech in their daily lives. That’s a big wall to climb when cities want to push digital transformation.

Now, security is another tough nut to crack. About 28% of folks have dealt with hacking, identity theft, or data loss. That’s scary stuff when you’re paying utility bills or taxes with bitcoins.

On top of that, 43% think manufacturers must step up device safety. Add in the wild price fluctuations and exchange rate risks of crypto, and you’ve got a real puzzle. Then there’s the worry about money laundering and keeping things safe from advanced persistent threats.

It’s a steep hill, but cities are working hard to make crypto a safe part of global finance.

The Future of Crypto in German Public Services

Moving from the hurdles cities face with crypto payments, let’s peek at what lies ahead for this tech in German public services. Could crypto become a regular part of daily life here? It’s an exciting thought, folks.

Imagine a day when digital assets are as common as debit cards for paying city fees across Germany. With Bitcoin ATMs already in 74 countries and territories as of May 2, 2025, the trend is growing fast.

Nations like Poland and Romania are jumping on board, exploring crypto use. So, German cities might soon lean on crypto wallets for smoother transactions. The push by the European Central Bank could speed this up, making digital transformation a real game-changer.

What’s next could be a whole new way to handle taxes or bills, right at your fingertips.

Takeaways

Hey there, folks, let’s wrap this up with a quick nod to the exciting crypto wave hitting German cities! Picture five big players, like Berlin and Munich, jumping into digital payments for stuff like bus fares and taxes.

It’s a bold step, showing how blockchain tech can shake up public services. Pretty neat, right? Stick around to see if this trend grows across Germany!

FAQs

1. What’s the big deal with German cities testing crypto payments for public services?

Hey, imagine paying for your bus ticket with digital assets! Five German cities are diving into this digital transformation, testing crypto wallets for everyday stuff like invoices and receipts at checkout. It’s a bold step to blend crypto into the global financial system, isn’t it?

2. Which cities are jumping on this crypto bandwagon?

Well, I won’t spill all the beans just yet, but let’s say these German spots are pioneering grounds. They’re working with ideas like a crypto strategic reserve, guided by rules from the European Central Bank (ECB) and ECB President insights. It’s like they’re planting seeds for a future where digital tender might rival legal tender!

3. How do folks pay with crypto in these cities?

It’s as easy as pie, my friend. Residents can use a Coinbase wallet or similar tools with two-factor authentication (2fa) to settle bills at public offices, almost like swiping a card at a supermarket chain in the UAE.

4. Are there any tax quirks with using crypto for payments?

Oh, you bet there are, pal! Using digital assets might bump into income tax or capital gains rules under tax laws, so a bit of tax planning is wise. Chat with a pro to dodge any surprises from asset seizures or funky exchange rates.

5. What’s the role of big players like central banks in this crypto test?

Central banks, like the Czech National Bank under Aleš Michl, are keeping a sharp eye on this. They’re juggling monetary policy and currency reserves, wondering how bitcoin reserves or a strategic bitcoin reserve fits into portfolio management. It’s like they’re chess masters plotting moves in equity markets and foreign reserves!

6. Will this crypto experiment affect regular money stuff?

Hey, that’s the million-dollar question, right? This trial could shake up market liquidity and portfolio diversification for institutional investors, maybe even sovereign wealth funds like the State of Wisconsin Investment Board. With governance nods from the Financial Conduct Authority (FCA) and the International Monetary Fund (IMF), it’s a test that might rewrite monetary frameworks!