Hey there, are you feeling lost with all the buzz about cryptocurrency? Maybe you’re curious about digital assets, but you’re not sure how to jump in safely with trusted banks.

Here’s a cool fact to chew on. Did you know that 10 major German banks are now offering crypto services, making it easier for folks like you to explore this new world? From giants like Deutsche Bank to others, they’re stepping up with options like crypto custody and trading.

Stick with me, and I’ll break it down super simple. This blog will guide you through these banks, showing how they’re embracing blockchain technology and helping with crypto adoption.

We’ll tackle the who, what, and why, so you can pick the best fit for your needs.

Keep reading, pals. Let’s explore!

Key Takeaways

- Commerzbank is the first German bank to get a crypto custody license, showing their commitment to digital assets.

- Landesbank Baden-Württemberg plans crypto custody services in late 2024, partnering with Bitpanda, which offers 300 cryptocurrencies.

- Deutsche Bank joined with Taurus in September 2023 for crypto custody and is preparing for trading under MiCA rules by December 2024.

- DZ Bank launched a digital asset custody platform in November 2023 and will test crypto trading in 2024.

- N26, a digital bank, supports crypto investments with multi-currency options and 24/7 customer help.

Commerzbank: The First Bank with a Crypto Custody License

Moving from our broad look at crypto trends in Germany, let’s focus on a key player making waves. Commerzbank stands out as the first bank in the country to secure a crypto custody license.

This significant step shows how committed they are to engaging with digital assets. It’s a clear sign that even traditional banks are prepared to adopt cryptocurrency.

Now, imagine this, folks, it’s like opening a vault for a new kind of treasure. With this license, Commerzbank can store and safeguard crypto for clients, creating a path for safer investments.

They’re also preparing for the Markets in Crypto-Assets regulation, or MiCA, set to begin by December 2024. This move isn’t just a victory for them; it inspires hope for more financial institutions to enter the crypto space with strong regulatory compliance.

Landesbank Baden-Württemberg: Offering Crypto Custody Solutions

Shifting from Commerzbank’s trailblazing move, let’s talk about another big player stepping into the crypto game. Landesbank Baden-Württemberg, a major name in Germany, is gearing up to offer crypto custody solutions.

They plan to roll out these services in the second half of 2024, and they’re not doing it alone. Teaming up with Bitpanda, a popular crypto platform, they’re set to make digital assets more accessible for institutional investors.

Here’s the scoop on this partnership, folks. Bitpanda brings a whopping 300 cryptocurrencies to the table, and they stick to strict European laws for regulatory compliance. Their fees? Just 1.49%, which isn’t too shabby.

Plus, they offer easy payment methods like bank transfers and cards. With Jürgen Harengel as the Managing Director steering the ship at Landesbank Baden-Württemberg, this venture into blockchain technology looks promising for those eyeing cryptocurrency adoption.

Stick around to see how this shapes up!

Deutsche Bank: Expanding into Crypto Trading and Custody

Deutsche Bank is jumping into the crypto game with bold moves. In September 2023, they teamed up with Taurus, a top player, to offer digital asset custody and tokenization. This step shows their drive to lead in cryptocurrency adoption for institutional clients.

Hey, it’s like they’re building a safe vault for digital gold!

They’re also eyeing crypto trading to serve big investors. With a focus on blockchain technology and regulatory compliance, Deutsche Bank is aligning with rules like MiCA, set to kick in by December 2024.

This law will shape how non-EU crypto services reach EU citizens. Pretty cool, right? Let’s see how other banks stack up next with DZ Bank.

DZ Bank: Integrating Blockchain Technology for Crypto Services

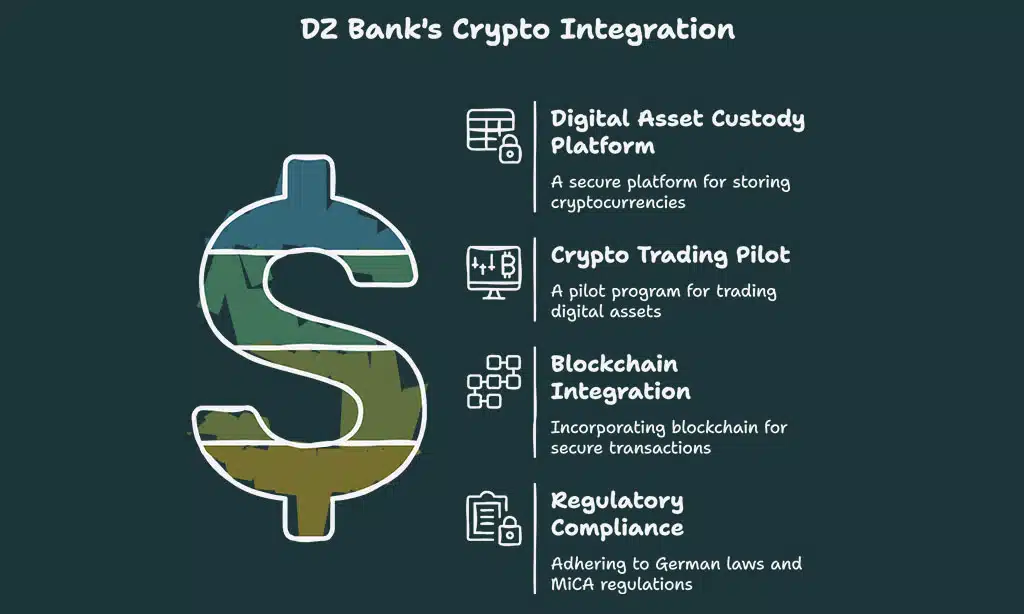

Hey there, let’s chat about DZ Bank and their exciting jump into the crypto world. They rolled out a digital asset custody platform in November 2023, which is a big deal for keeping your cryptocurrencies safe.

Plus, they’re planning a crypto trading pilot for 2024, so you might soon trade digital assets with ease.

Now, get this, they’re weaving blockchain technology into their system to make things secure and smooth for institutional clients. With Germany’s laws allowing crypto trading, and under the MiCA regulation for clear guidelines, DZ Bank is stepping up to meet the growing crypto adoption.

Stick with me as we explore N26 and how this digital bank is embracing crypto investments next!

N26: Digital Bank Embracing Crypto Investments

N26 is making waves as a digital bank jumping into crypto investments. This modern platform offers personal and business plans, fitting all kinds of users. Want to mix fiat and crypto? Their OneSafe feature supports multi-currency options, making it a breeze to handle digital assets.

Plus, with 24/7 support, you’re never left hanging if issues pop up. It’s like having a buddy on speed dial, day or night.

What’s cool is how N26 taps into digital banking trends with mobile banking at the forefront. Their app is user-friendly, boosted by AI-driven services for smarter choices. Security? It’s top-notch, keeping your funds safe in this wild world of cryptocurrency adoption.

They’re also riding the wave of blockchain technology, blending it into their system. Now, let’s check out how Sparkasse is stepping into crypto for everyday folks.

Sparkasse: Exploring Crypto Services for Retail Customers

Moving from N26’s exploration of crypto investments, let’s talk about another major player making moves. Sparkasse, a familiar name in Germany, is now venturing into crypto services for everyday people like you and me.

They’re aiming to make digital assets simple to manage for retail customers. How exciting is that?

This bank is set on rivaling major cryptocurrency exchanges like Coinbase and Kraken. Their focus is to provide secure asset management while adhering to local crypto regulations. With the growing interest in cryptocurrency adoption among retail investors in Germany, Sparkasse is stepping up to meet that need.

Think about handling your altcoins directly through your reliable bank app, with no added trouble!

Takeaways

Well, folks, it’s clear that German banks are jumping on the crypto train with gusto! From giants like Deutsche Bank to digital players like N26, they’re paving the way for digital assets in finance.

Isn’t it wild to think blockchain technology is now part of everyday banking? So, whether you’re an investor or just curious, keep an eye on this exciting shift. Got thoughts on crypto adoption? Drop a comment, and let’s chat!

FAQs on German Banks Now Embracing Crypto Services

1. Which big German banks are jumping into crypto services now?

Hey, guess what, folks, Deutsche Bank and DZ Bank, along with Germany’s largest federal bank, are leading the charge with crypto custody and cryptocurrency trading. It’s like watching old-school finance put on a shiny new blockchain technology jacket.

2. Why are these banks offering digital assets all of a sudden?

Well, my friend, cryptocurrency adoption is soaring, and these financial institutions don’t wanna miss the boat. With institutional investors and asset managers hungry for crypto assets, banks see a golden opportunity to cater to this growing crowd. Plus, regulatory compliance under frameworks like Markets in Crypto-Assets (MiCA) is paving a smoother path.

3. What kind of crypto services can I expect from these banks?

Picture this, you’re managing crypto staking or trading crypto currency right from your mobile banking app. Pretty neat, right?

4. Are these services just for the big shots or for regular folks too?

Listen up, while institutional clients are a huge focus for cryptoasset offerings, many banks are also rolling out wallets and mobile money options for everyday users. Think of it as tossing a lifeline to financial inclusion, letting more people dip their toes into decentralized finance (DeFi). Even cool features like Apple Pay or Google Pay might tie into this crypto wave soon.

5. How do regulations play into this crypto boom in Germany?

Ahh, regulations are the guardrails here, keeping things from going off the rails with crypto regulations set by heavyweights like the European Securities and Markets Authority. German banks are working hard to align with rules from bodies like the UK Financial Conduct Authority, dodging risks tied to financial crimes or terrorist funding. It’s all about building trust while diving into blockchain technologies and decentralized applications.

6. Can I trade on platforms like Binance through these banks?

Here’s the scoop, some banks are linking up with crypto exchange platforms like Börse Stuttgart, also known as Boerse Stuttgart, to offer trading perks. You might even stumble upon copy trading or derivatives down the line. It’s like having a financial buddy who’s got your back for money transfers or direct debits in this wild crypto world.