Cryptocurrency has evolved rapidly over the past decade, transforming from an experimental financial concept to a multi-trillion-dollar industry. Bitcoin, Ethereum, and thousands of altcoins have reshaped how we view money, investments, and digital ownership. But where is cryptocurrency headed next?

This article explores 10 key predictions for the future of cryptocurrency, including institutional adoption, blockchain innovation, government regulations, and more. Whether you are an investor, enthusiast, or newcomer, understanding these trends will help you stay ahead in the ever-changing world of crypto. These future of cryptocurrency predictions will guide you through the expected developments in digital assets.

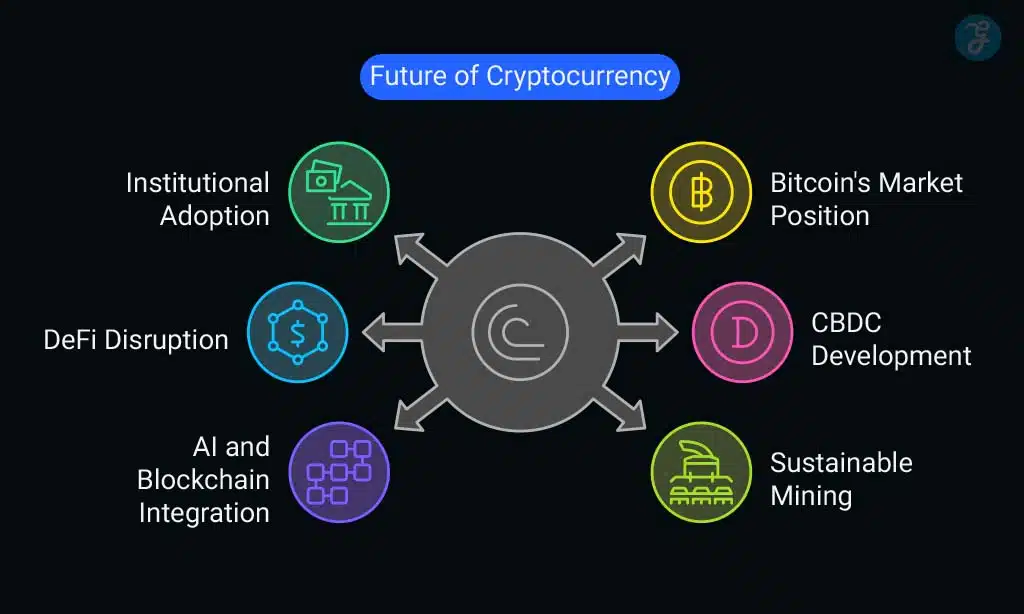

Future of Cryptocurrency Predictions: What’s Next?

The cryptocurrency industry is constantly evolving, with innovations and regulatory changes shaping its future. As blockchain technology advances, new opportunities and challenges arise. From institutional adoption to sustainability efforts, these predictions provide a glimpse into what lies ahead for digital assets.

1. Institutional Adoption Will Continue to Grow

Major banks, hedge funds, and corporations are increasingly investing in Bitcoin and other digital assets. Companies like Tesla, MicroStrategy, and even financial giants like JPMorgan have recognized the value of cryptocurrency.

| Key Trends | Implications |

| Bitcoin ETFs gaining approval | More retail and institutional investment |

| Banks offering crypto services | Increased accessibility and trust |

| Hedge funds diversifying into crypto | Market stability and growth |

Why This Matters

- Institutional investment increases liquidity and credibility.

- Regulatory clarity is improving, encouraging more firms to enter the market.

- Mass adoption by financial institutions could make crypto a mainstream asset class.

2. Bitcoin Will Remain the Market Leader, but Competitors Will Rise

Bitcoin remains the most dominant cryptocurrency, but competitors like Ethereum, Solana, and Polkadot are gaining ground. Innovations such as Ethereum 2.0 and Layer-2 scaling solutions will challenge Bitcoin’s position.

| Cryptocurrency | Strengths |

| Bitcoin | Store of value, scarcity, decentralization |

| Ethereum | Smart contracts, DeFi, NFT ecosystem |

| Solana | Fast transactions, low fees |

| Polkadot | Interoperability, cross-chain communication |

What to Expect

- Bitcoin will likely remain a store of value (digital gold).

- Ethereum and other smart contract platforms will continue to expand their use cases.

- New blockchain solutions will emerge to address scalability and efficiency.

3. Decentralized Finance (DeFi) Will Disrupt Traditional Banking

DeFi is one of the fastest-growing sectors in cryptocurrency, offering lending, borrowing, staking, and yield farming without intermediaries.

| DeFi Trend | Impact |

| Decentralized lending platforms | Lower interest rates, fewer barriers |

| Automated market makers (AMMs) | Improved liquidity for traders |

| Yield farming & staking | Passive income opportunities |

What This Means for the Future

- Traditional banks may need to adopt blockchain technology or risk being left behind.

- DeFi protocols will become more secure and user-friendly.

- More institutional investors will participate in DeFi as regulations become clearer.

4. Central Bank Digital Currencies (CBDCs) Will Compete with Cryptocurrencies

Governments worldwide are exploring CBDCs, which are digital versions of their national currencies. Countries like China, the US, and the EU are actively researching and testing CBDC models.

| Country | CBDC Status |

| China | Digital Yuan in pilot phase |

| USA | Researching Digital Dollar |

| EU | Exploring Digital Euro |

What to Expect

- CBDCs could coexist with cryptocurrencies but may face resistance from privacy advocates.

- Government-backed digital currencies might increase financial inclusion.

- Stablecoins like USDT and USDC may be regulated or even replaced by CBDCs.

5. AI and Blockchain Integration Will Drive Innovation

Artificial intelligence (AI) and blockchain technology are merging to improve efficiency and security. AI-driven smart contracts, fraud detection, and automated trading are just the beginning.

| AI & Blockchain Use Case | Benefits |

| AI-powered smart contracts | More efficient and reliable transactions |

| Fraud detection | Better security for crypto transactions |

| Automated trading bots | Higher trading accuracy |

How This Affects Crypto

- More automation in trading and blockchain management.

- AI could help detect fraudulent transactions faster.

- Smart contracts will become even more sophisticated and self-executing.

6. Crypto Mining Will Shift Toward Sustainability

With concerns over Bitcoin’s energy consumption, the industry is moving toward eco-friendly solutions. Innovations in green mining and the adoption of proof-of-stake (PoS) models are changing how cryptocurrencies operate.

| Sustainable Crypto Trend | Impact |

| Renewable energy mining | Reduces carbon footprint |

| Proof-of-stake adoption | Less energy-intensive than proof-of-work |

| Carbon offset initiatives | Makes crypto more eco-friendly |

What This Means for Investors

- Regulators may push for more eco-friendly mining practices.

- Green energy projects may attract more investments.

- Proof-of-stake networks like Ethereum 2.0 will become more popular.

7. The Growth of Crypto Payment Adoption

What This Means for Investors

- Businesses accepting crypto could lead to higher adoption rates.

- Stablecoins may become the preferred payment method for cross-border transactions.

- Increased mainstream adoption could boost the overall value of crypto assets.

| Payment Trend | Impact |

| More businesses accepting crypto | Increased mainstream adoption |

| Stablecoins for payments | Reduced volatility concerns |

| Crypto debit cards | Easier everyday transactions |

8. Web3 and Decentralized Internet Expansion

What This Means for Investors

- Early investments in Web3 projects may yield significant returns.

- Decentralized applications (DApps) could reshape online security and privacy.

- Blockchain-based identity solutions could reduce fraud and improve trust in digital transactions.

| Web3 Trend | Impact |

| Decentralized applications | Reduced reliance on big tech |

| Blockchain-based identity | Enhanced security |

| Interoperability solutions | More seamless user experiences |

9. The Evolution of NFTs Beyond Art

What This Means for Investors

- NFTs will expand beyond art into real estate, gaming, and digital identity.

- Tokenized assets could revolutionize property ownership and verification.

- Investors should watch for new industries adopting NFT technology.

| NFT Trend | Impact |

| Real estate tokenization | Digital property ownership |

| NFTs in gaming | True asset ownership |

| Digital identity & credentials | Secure personal data control |

10. Increased Regulation and Compliance

What This Means for Investors

- Stricter regulations may create safer investment environments.

- Compliance with KYC/AML laws will be essential for crypto businesses.

- Greater legal clarity can boost institutional confidence in cryptocurrency markets.

| Regulation Trend | Impact |

| KYC/AML laws tightening | Less anonymity, more security |

| Tax regulations on crypto | Greater compliance requirements |

| More legal clarity | Increased investor confidence |

Takeaways

Cryptocurrency is constantly evolving, with new innovations, adoption trends, and regulations shaping its path. While challenges remain, the potential for financial inclusion, decentralized technology, and digital ownership is stronger than ever.

These future of cryptocurrency predictions highlight the major shifts happening in digital assets. From institutional adoption to sustainable crypto mining, the future looks promising for blockchain technology and digital currencies. Staying informed about these trends will help investors and enthusiasts navigate the complex crypto landscape.