Planning for the future is essential, especially when it comes to ensuring financial stability for your loved ones. Funeral insurance has become an increasingly vital part of financial planning in India.

As funeral costs continue to rise, having a reliable funeral insurance plan can provide much-needed peace of mind and alleviate the financial burden during emotional times.

This guide explores the top 5 funeral insurance providers in India, their policies, and what makes them stand out in 2025.

What is Funeral Insurance and Why is it Important?

Funeral insurance, also known as final expense insurance, is a specialized policy designed to cover the costs associated with funerals and related expenses. Unlike standard life insurance, which typically provides a large lump sum to beneficiaries, funeral insurance focuses specifically on smaller amounts to cover funeral arrangements, cremation, burial, and related services.

Key Features of Funeral Insurance:

- Affordable premiums tailored for smaller coverage amounts.

- Quick and hassle-free claim processes.

- Coverage for a wide range of funeral expenses, including services, transportation, and memorials.

Why Indians are Opting for Funeral Insurance in 2025?

India has seen a significant cultural and financial shift, making funeral insurance a popular choice for families.

Some of the driving factors include:

- Rising funeral costs: The average funeral expense in India has risen sharply due to inflation and the increasing costs of ceremonial requirements.

- Cultural significance: Funerals in India are elaborate and often involve religious rites, community gatherings, and rituals, which can be financially burdensome.

- Peace of mind: Knowing that funeral arrangements are taken care of ensures families can focus on grieving and healing without financial worries.

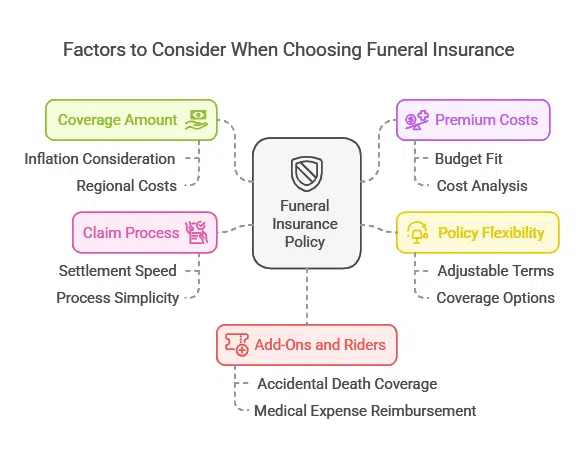

Factors to Consider When Choosing Funeral Insurance

When selecting a funeral insurance policy, it’s essential to evaluate your unique needs and the policy’s features. Here are some important factors to keep in mind:

- Coverage Amount: Choose a policy that provides sufficient funds to cover funeral expenses, considering inflation and regional costs.

- Premium Costs: Look for plans with affordable premiums that fit your budget.

- Policy Flexibility: Opt for policies offering adjustable terms and the option to increase or decrease coverage over time.

- Claim Process: Ensure the provider has a straightforward and quick claim settlement process.

- Add-Ons and Riders: Some policies offer additional benefits, such as accidental death coverage or medical expense reimbursement.

How to Compare Policies Effectively?

Comparing funeral insurance providers can be overwhelming. Use this table to evaluate policies based on essential criteria:

| Provider | Coverage Options | Premium Range (Monthly) | Claim Settlement Ratio | Unique Features |

| LIC Funeral Insurance | ₹50,000 – ₹2,00,000 | ₹100 – ₹500 | 98.2% | Extensive agent network |

| ICICI Prudential Life | ₹75,000 – ₹1,50,000 | ₹150 – ₹700 | 96.8% | Online policy management |

| SBI Life Insurance | ₹100,000 – ₹2,50,000 | ₹200 – ₹800 | 97.5% | Flexible policy terms |

| HDFC Life Insurance | ₹50,000 – ₹1,00,000 | ₹130 – ₹600 | 95.4% | Fast claim processing |

| Max Life Insurance | ₹75,000 – ₹2,00,000 | ₹150 – ₹750 | 94.7% | High customer satisfaction |

Top 5 Funeral Insurance Providers in India (2025)

Understanding which funeral insurance provider suits your needs can be challenging, but this guide simplifies the process by highlighting the most trusted options.

1. LIC Funeral Insurance

The Life Insurance Corporation of India (LIC) is a household name and remains the most trusted provider in India. With decades of experience, LIC has built a reputation for financial stability and reliability, making it a preferred choice for millions of Indian families.

Known for its robust customer support and vast network of agents, LIC ensures that policyholders have access to assistance whenever needed.

Its funeral insurance policies are carefully designed to cater to the diverse cultural and financial needs of Indian families, providing comprehensive coverage options that suit a range of budgets.

- Key Features: Comprehensive coverage options ranging from basic to premium plans.

- Premium Range: Affordable monthly premiums starting at ₹100.

- Claim Settlement: LIC boasts a claim settlement ratio of 98.2%, ensuring quick and reliable payouts.

| Feature | Details |

| Coverage Options | ₹50,000 – ₹2,00,000 |

| Claim Settlement Ratio | 98.2% |

| Unique Selling Point | Extensive agent network |

2. ICICI Prudential Life Insurance

ICICI Prudential is known for its innovative and user-friendly policies. This provider offers a seamless online experience, making it ideal for tech-savvy customers who value convenience. ICICI Prudential has consistently ranked among the top insurance companies in India for its reliability and customer satisfaction.

Its funeral insurance plans are designed to provide flexible coverage and additional benefits, such as riders for accidental death and critical illness, ensuring comprehensive financial security for policyholders.

- Unique Benefits: Includes additional riders for accidental death and medical expenses.

- Claim Settlement: High claim settlement ratio ensures peace of mind.

- Customer Perks: Offers an easy online policy management system.

| Feature | Details |

| Coverage Options | ₹75,000 – ₹1,50,000 |

| Claim Settlement Ratio | 96.8% |

| Unique Selling Point | Online policy management |

3. SBI Life Insurance

SBI Life Insurance combines affordability with extensive coverage options, making it a highly sought-after choice for Indian families. Backed by the credibility and trustworthiness of the State Bank of India, this provider ensures reliability and stability.

Its funeral insurance plans are specifically designed to offer flexible terms and comprehensive benefits, making them suitable for diverse financial and cultural needs across the country.

- Highlights: Flexible terms, making it suitable for diverse needs.

- Affordability: Premiums start at just ₹200 per month.

- Claim Support: Offers excellent customer support and fast claim settlement.

| Feature | Details |

| Coverage Options | ₹100,000 – ₹2,50,000 |

| Claim Settlement Ratio | 97.5% |

| Unique Selling Point | Flexible policy terms |

4. HDFC Life Insurance

HDFC Life provides highly customizable funeral insurance policies that cater to a variety of customer needs. With a reputation for strong customer support and a focus on transparency, HDFC Life stands out for its commitment to ensuring that claims are processed efficiently and policies are easy to understand.

Their plans offer flexibility, allowing policyholders to select options that best fit their financial goals and cultural preferences.

- Standout Feature: Known for its streamlined claim processing system.

- Policy Benefits: Offers flexible plans with optional riders.

- Customer Reviews: Praised for its responsiveness and transparency.

| Feature | Details |

| Coverage Options | ₹50,000 – ₹1,00,000 |

| Claim Settlement Ratio | 95.4% |

| Unique Selling Point | Fast claim processing |

5. Max Life Insurance

Max Life focuses on customer satisfaction and robust policy options, making it a reliable choice for individuals seeking financial security for their families. With a commitment to providing affordable premiums and comprehensive coverage, Max Life ensures that customers can plan for unforeseen expenses without financial strain.

Their funeral insurance policies also include flexible payment options, catering to diverse budgets and preferences, and are supported by a strong reputation for customer service excellence.

- Coverage Options: Offers up to ₹2,00,000 in funeral insurance coverage.

- Premium Structure: Competitive pricing with flexible payment terms.

- Why It’s Popular: Strong focus on customer service and satisfaction.

| Feature | Details |

| Coverage Options | ₹75,000 – ₹2,00,000 |

| Claim Settlement Ratio | 94.7% |

| Unique Selling Point | High customer satisfaction |

How to Apply for Funeral Insurance in India: Step-by-Step Application Process?

- Research Policies: Compare the top providers to identify the best fit for your needs.

- Online or Offline Application: Most providers offer both options. Online applications are faster and more convenient.

- Provide Documentation: Submit required documents, such as identity proof, age proof, and income details.

- Pay the Premium: Choose a payment frequency—monthly, quarterly, or yearly.

- Policy Issuance: Once approved, the policy will be issued, and coverage begins immediately or after a short waiting period.

Common Mistakes to Avoid When Applying

- Ignoring the policy’s fine print.

- Opting for insufficient coverage to save costs.

- Not comparing providers based on claim settlement ratios.

Takeaways

Choosing the right funeral insurance provider in India ensures financial security and peace of mind during challenging times. The top 5 funeral insurance providers in India listed here offer reliable policies with competitive premiums and excellent customer support.

Take the first step towards securing your family’s future by comparing these providers and selecting a plan that suits your needs. Ensure that your loved ones are cared for, even in your absence.