Car accidents can be stressful and overwhelming, and while we often focus on the immediate damage to our vehicles or injuries, the financial impact of a car accident in the UK can last far longer. From repair bills to rising insurance premiums, the costs of an accident can quickly add up, leaving you facing financial strain when you least expect it. Let’s go through the financial impact of a car accident and what you need to consider to protect yourself financially.

The Immediate Costs of a Car Accident

Vehicle Damage

The first thing that comes to mind after a car accident is often the damage to your vehicle. The cost of repairs can vary significantly, depending on the severity of the accident and the type of car you drive. Minor fender-benders might only require small repairs, while more serious collisions could mean a total loss of your vehicle. If you don’t have comprehensive insurance, the cost of repairs will fall entirely on you, which can be a hefty sum. If you want to know the duration of a car accident on your insurance record, click on the link.

Medical Bills

Even in low-speed accidents, injuries can occur. Whether it’s whiplash, a sprained ankle, or something more serious, medical bills can quickly stack up. While the NHS offers free treatment, depending on your situation, you might need private medical care for quicker treatment or more specialised services. From physiotherapy to surgeries, the long-term medical costs following an accident can leave a significant dent in your finances if you’re not fully covered.

Legal Fees

If the accident leads to legal disputes—especially if there’s a question of liability or if you’re pursuing compensation for injuries—you might find yourself facing legal fees. Whether you’re hiring a solicitor to help with an injury claim or defending yourself in court, legal costs can quickly add up, further contributing to the financial strain after an accident.

Long-Term Financial Implications

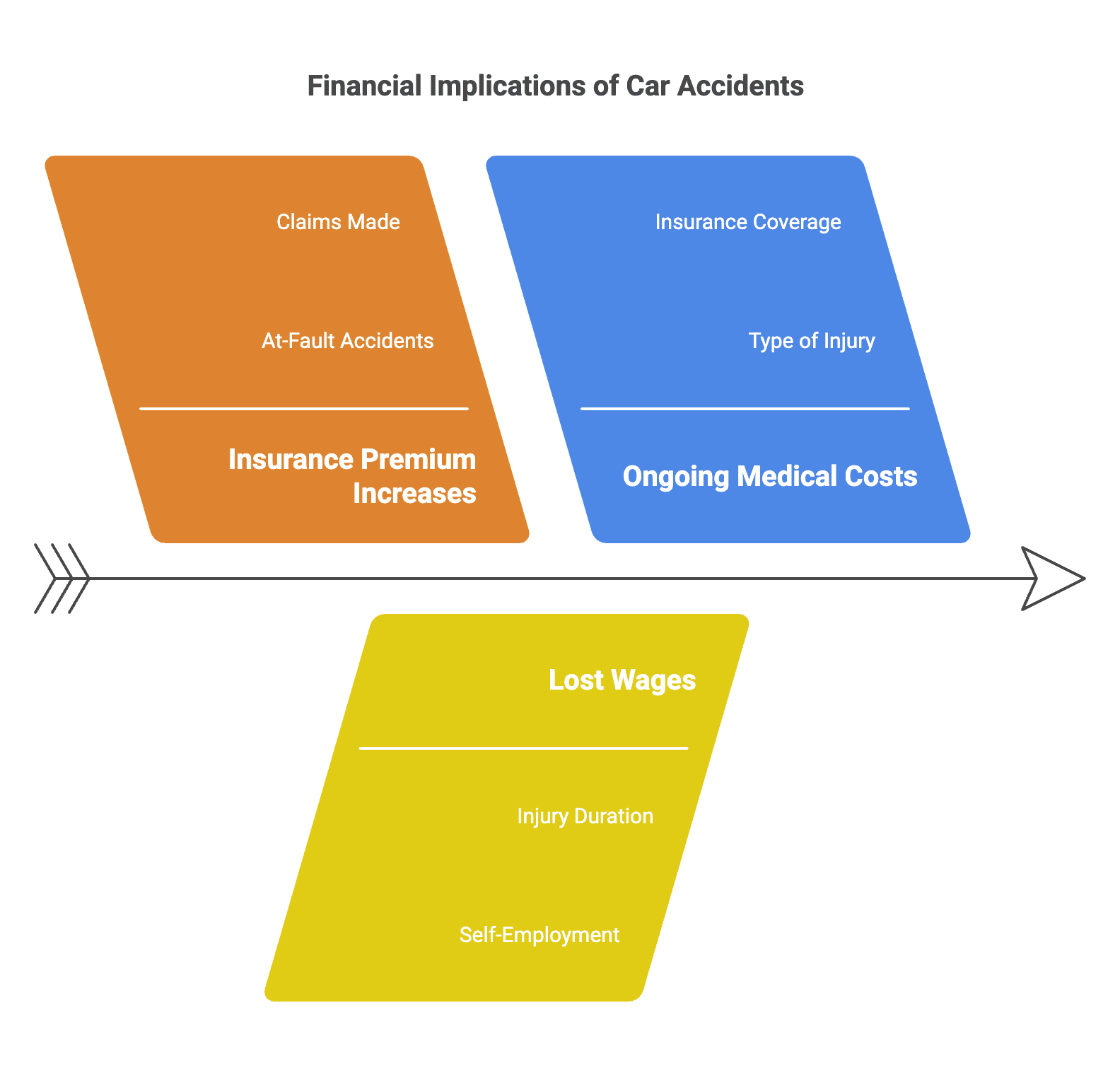

Insurance Premium Increases

One of the most noticeable long-term financial consequences of a car accident is the impact it can have on your insurance premiums. For at-fault drivers, insurance companies often raise premiums significantly after an accident, sometimes for several years. Even if you weren’t at fault, your premiums could still increase, especially if you’ve made a claim. While this can be a painful financial burden, shopping around for the best deal and maintaining a no-claims discount can help keep the costs down in the future.

Lost Wages

In addition to the costs of repairing your car and paying medical bills, a car accident can also impact your income. If you’re injured and need time off work, you could lose out on wages. This is especially true for those in self-employed roles or those who don’t have access to sick pay. If the accident causes long-term disabilities, the financial strain could stretch on for months or even years, making it essential to factor this into your accident planning.

Ongoing Medical Costs

Some injuries, such as broken bones or back pain, require long-term treatment. Physiotherapy, rehabilitation, and therapy are often necessary to fully recover after a serious accident. These medical costs can continue for months or even years, depending on the nature of the injury. Even with insurance, there may be some out-of-pocket costs for treatments not covered under your plan.

The Impact on Business and Self-Employed Individuals

Business Vehicle Costs

For businesses that rely on vehicles for deliveries, client visits, or other operations, a car accident can have a major impact. The repair costs, potential downtime, and the need to hire temporary vehicles can disrupt business and lead to financial losses. Additionally, if your staff are involved in accidents, you could face liability issues or lost productivity.

Loss of Business

If you’re self-employed and rely on your vehicle for work, a car accident can severely impact your income. Whether it’s a delivery service, a tradesperson, or a freelancer who relies on face-to-face meetings, the inability to work while waiting for repairs or recovering from an injury can result in a loss of clients and revenue.

Tips for Avoiding Distractions While Driving

Do you feel your mind starting to wander when you’re on long car journeys? While this can seem something that’s normal and innocent, it’s something that could lead to an accident. Distractions are a common way for people to have slower reactions and make mistakes they wouldn’t normally make. Therefore, it doesn’t matter whether you’re driving somewhere nearby or going on a road trip, you need to ensure that you avoid distractions. Here are a few simple ways you can do this.

Be Organised

First of all, you want to be organised before you hit the road. When you’re leaving late or don’t know where you’re going, you’re creating stress. This stress can become a distraction and stop you from making the right decisions. So, be organised with your trip, such as setting your maps and knowing where you’re going. If you’re driving hours, create a playlist so that you’re not continuously looking for a radio station. Don’t forget to leave the house in plenty of time to avoid stress.

Set the Temperature

The temperature inside your car can impact your concentration. For example, if it’s too hot, you’re going to get tired easily and it can mean that you’re changing the dials all the time, taking your eyes off the road. When it’s too cold, you’re focused on trying to keep yourself warm. So, set a comfortable temperature from the beginning before you head off.

Put the Phone Away

The biggest distraction in your daily life is your phone. You don’t want it to be somewhere that it’s easy to grab or see when you’re driving. Therefore, put it away in a bag in the backseat. This way, you won’t be tempted to call someone or answer a text message. You can do this when you get to your destination.

Conclusion

The financial impact of a car accident in the UK goes far beyond the initial repair costs. From medical bills to insurance premium hikes, the costs can accumulate quickly. By understanding these potential expenses and ensuring you have the right insurance coverage, you can minimise the financial burden of an accident. Be proactive about your insurance, and take steps to protect your finances both in the short and long term.