Feeling the squeeze when rent is due but sales are slow? Cash flow gaps can hit your startup like a brick wall. That leaves you scrambling for cash, fast.

Working capital loans can fill that gap in a few days. Many online lenders offer fast business loans with funds in 1 to 3 days. This post shows 9 loan types that bring quick cash, from a revolving line of credit to gear loans.

We also cover loan application tips, interest rates, and smart cash use. Read on.

Key Takeaways

- Online working capital loans let startups borrow $5,000–$2 million. Lenders like Lendio or Bank of America fund in 1–3 days. Term loans start at 6 % APR and OnDeck rates reach 31.3 %.

- SBA-backed loans fuel growth with lower cost. 7(a) loans run $200,000–$5 million over 10–25 years. CAPLINES offer up to $5 million, under 15 % APR for loans below $50,000. Funds clear in 5–10 workdays.

- Equipment financing uses new gear as collateral. Startups with six months of revenue get same-day or four-hour funding. Section 179 can cut taxes on qualifying purchases.

- Business credit lines and cards boost cash flow fast. American Express offers $2,000–$250,000 with same-day funding, 3–9 % rates, and no application fees. You need 12 months in business, $36,000 annual revenue, and a 660+ credit score.

- Revenue-based financing gives funds in as little as two hours. You repay via a fixed sales percentage until a 1.11 factor rate returns the cash. You need six months in business, $15,000 average monthly deposits, and a 500+ credit score.

What are business bank loans and how do they work?

Business bank loans let a company borrow money for operations. Banks such as Lendio or Bank of America set loan amounts from $5,000 to $2 million or $10,000 to $100,000. The lender checks a borrower’s FICO score and at least one year in business.

Approval hinges on that score plus a business plan or checking account details. Founders can use funds for payroll, rent, utilities, inventory, or marketing. Some loans demand collateral; many working capital loans ask for little, so entrepreneurs risk fewer assets.

Lenders set fixed repayment terms that aid cash flow management and help plan budgets. Interest rates can start at 6 percent APR on term loans and climb to 31.30 percent with OnDeck.

Banks disperse money in 24 hours or within five business days. A business line of credit offers revolving credit, like a credit card with a larger credit limit and lower APR. Access feels flexible and fast for urgent expenses.

Can startups use personal loans to fund their business?

Some startups turn to personal loans to fill cash flow gaps. Lenders may accept a FICO score as low as 500 for a working capital boost. New companies under one year often lack the six to twelve months of operating history that most banks want.

A strong credit history can earn better loan terms, yet personal credit dependence may hike interest rates. You can tap fast business loans through an online lender. They ask only for recent bank statements and a photo ID.

Some ask for an average of fifteen thousand dollars in monthly deposits.

Personal funding can expose owners to extra risk. Missing payments can hurt your credit history. You might pay higher interest than you would on a business loan. Crowdfunding or small business grants may suit you better if personal funds fall short.

Government-backed startup loans overview

Small Business Administration credit lines give startups a safety net for working capital, and you can plug in numbers on an online loan calculator, so keep reading.

Which government loans are available for startups?

Government loans can fuel startup growth fast. They offer solid working capital options.

- SBA 7(a) loans range from $200,000 to $5,000,000 through lenders like Bank of America. SBA backs each loan, so they carry lower interest rates. Borrowers can spread payments over 10 to 25 years. Funds often arrive in about five to ten workdays.

- SBA CAPLINES provide up to $5,000,000 in working capital loans. They cover Seasonal, Contract, Builder, and Working Capital lines. These lines act like revolving credit for peak months or specific projects. APR tops 15% for loans under $50,000 and 11.5% for loans over $350,000. Funds clear in five to ten workdays.

- Business Advantage Term Loans from Bank of America demand a FICO score of 700 or higher. They do not need an SBA guarantee. The bank sets interest rates based on credit score. Loan funds arrive quickly to shore up cash flow.

How to qualify for government-backed startup loans?

Lenders expect clear cash flow plans. Loans hinge on strong credit history.

- Keep a credit score of at least 700 to qualify for Bank of America’s Business Advantage Term Loans.

- Operate for at least 12 months to meet SBA-backed loan rules.

- Show detailed cash flow projections to prove working capital needs.

- Gather profit and loss statements and tax returns from the past year.

- Draft a business plan that outlines growth forecasts and repayment terms.

- Consider SBA 7(a) loans for longer repayment periods and lower interest rates.

- Check your credit score and average monthly revenue to prep for the approval process.

- Shop online lenders or national banks to compare loan interest rates.

- Plan for a 90 to 150 day span if you apply for a credit line program.

- Limit use of business credit cards for fast financing and repay balances on time.

What is equipment financing and who is it for?

Equipment financing uses the gear you buy as collateral. This cuts risk for lenders and speeds approval. No extra paperwork sits on your desk beyond the purchase agreement. You can get same-day funding for trucks, computers or factory tools.

Funding arrives as fast as four hours once you clear approval.

Startups need six months of steady revenue to apply. Section 179 brings possible tax savings on gear buys. This loan works for firms that want to buy vehicles or production lines. It frees up working capital for payroll or marketing and helps cash flow management.

Interest rates stay competitive among online lenders and banks. Applications run fast thanks to a streamlined process.

How can business credit cards help startups with cash flow?

Business credit cards let startups pay daily costs like supplies or rent. They act like a revolving line of credit, with flexible draws up to a set limit. You only pay interest on what you charge, making cash flow more predictable.

American Express Business Line of Credit offers draws from $2,000 to $250,000 with same-day funding, no application fees, and 3 to 9% rates for six-month terms.

Eligibility hits after 12 months in business, $36,000 in annual revenue, and a credit score of 660 or higher. This payment tool covers payroll, ad spends, or inventory when monthly revenue falls short.

It bridges short-term cash flow gaps so you can invest in growth without a working capital crunch.

How does crowdfunding work for startup funding?

Startups often skip banks when they lack one-year operations. Crowdfunding gives them cash from many backers online. No credit score or revenue check stops them. Platforms such as Kickstarter and Indiegogo host reward-based campaigns.

Campaigns let founders set a funding target and perks. Backers pledge small sums; if the goal hits, the site sends the money.

Funds suit any working capital or equipment needs. Teams sell tokens or products instead of shares. Crowdfunding avoids interest rates or loan fees. Marketing buzz drives public interest and funding speed.

Creators track cash flow management as money arrives. Success ties to how they pitch their idea.

What should you know about loans from friends and family?

Loans from friends and family can save a cash-strapped small business when banks decline a fast business loan. These flexible financing deals skip credit score checks and skip long operating history demands.

You can haggle interest rates down to zero or pick a minimal rate that suits your cash flow management plan. Funds often arrive within days to boost working capital and spare you bank lending delays.

Clear paperwork helps protect both sides and keeps business growth on track. A simple promissory note or email can outline repayment terms, dates, and amounts; it also shields friendships.

Missing formal underwriting raises the risk of blurred lines in personal bonds. Careful loan repayment keeps relationships intact.

What is revenue-based financing and how does it differ?

Revenue-based financing lets startups trade a slice of sales for cash. This option works like a merchant cash advance. Lenders ask for a 500+ credit score, at least six months in business, and $15,000 average monthly revenue.

They collect a fixed percentage of each sale until a factor rate, often 1.11, returns the funding. This setup ties payments to your cash flow management.

Many small businesses love its speed. Applications finish in minutes and funding can hit accounts in two hours. You can spend funds anywhere and avoid collateral demands. Your remittance dips during slow months.

This flexible plan differs from term loans and lines of credit that demand fixed repayment terms.

Are there grants available for startups?

Startups can apply for grants as an alternative to loans. They work like cash advances without interest rates or repayment terms. These lump sums can fund working capital or equipment financing.

Grant sources include government, nonprofit, and private groups. The U.S. Small Business Administration and SBIR programs list open calls in grant databases. Application processes take weeks and require detailed proposals.

Delays can hit cash flow management, unlike fast business loans from online lenders.

No credit score or business history can block a grant bid. Funds arrive without loan defaults or high loan interest rates. Grant funds often come with strings on how they can be spent.

Equipment financing or community projects can match grantor goals. Minority-owned firms and tech startups may get priority. A clear business plan and strong loan applications for other funds can boost credibility.

Most awards stay below $50,000, so lean term loans or revolving credit may fill gaps.

How can I prepare a strong loan application?

Gather key records before you apply. Show lenders solid stats on revenue and credit.

- Prepare a thorough business plan that shows revenue forecasts, cash flow management strategies, and working capital needs for term loans or revolving credit.

- Pull your credit report early, aim for a personal FICO score of at least 500, note that higher scores lower loan interest rates on small business loans.

- Compile recent account summaries and a valid ID card to meet minimal paperwork demands for fast business loans or same-day funding.

- Show six to twelve months of sales records with $15,000 or more in monthly revenue so banks and online lenders trust your repayment capacity.

- Attach complete financial statements like profit and loss reports and cash flow statements to strengthen your SBA 7(a) loan or bank loan application.

- Clarify the intended use of funds whether for merchant cash advance, equipment financing, or commercial real estate loans to speed approval.

- Compare offers from online lenders, work with a Lendio match, or reach out to microlenders to increase access to flexible financing.

- Outline a clear repayment plan with payment dates, term details, and projected cash flow to handle loan repayment terms and compounding interest.

- Highlight collateral options or propose a secured loan to reduce interest rates and borrow higher loan amounts under a standard repayment or refinancing plan.

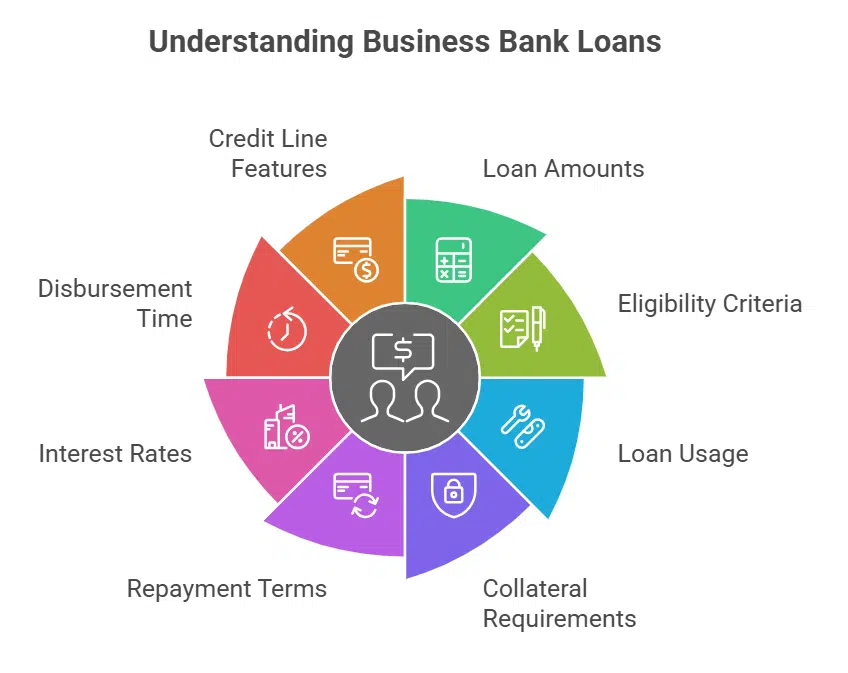

What factors should I consider when choosing a loan?

Picking the right loan shapes your cash flow future. Each deal can make or break your business growth.

- Interest Rates: Compare lenders like Lendio at 6% and OnDeck at up to 31%, to spot low rates that lower your cost of capital.

- Repayment Terms: Look at working capital loans with 6 to 36 month schedules and SBA 7(a) loans that stretch beyond five years, to match your business plan.

- Speed of Funding: Decide if same-day funding matters, since some online lenders approve and release cash in 1–3 days to keep you moving.

- Collateral Requirements: Check whether the deal asks for collateral or if you can get unsecured loans, so you protect your assets.

- Eligibility Criteria: Inspect credit score minimums, monthly revenue benchmarks, and time in business needs for each lender’s approval process.

- Loan Amounts: Review ranges from Fundbox at $100 to $150,000, Bank of America at $10,000 to $100,000+, and Lendio up to $2 million, to fit your funding gap.

- Fee Structures: Ask about application fees, factor rates starting at 1.11 on merchant cash advances, and any hidden charges before you sign.

- Repayment Flexibility: Pick a business line of credit or revolving credit for variable needs, or choose a term loan for fixed repayment plans.

- Cash Flow Impact: Gauge how each repayment schedule aligns with your monthly revenue to avoid a cash crunch and keep growth on track.

How do I manage loan repayment effectively?

Good cash flow starts with a clear plan. Smart schedules can ease stress.

- Track each due date on a digital calendar, set reminders, guard against late fees.

- Match your repayment terms to monthly revenue, avoid 6 to 36 month strains.

- Pick a working capital loan with fixed schedules, keep cash flow steady.

- Plan batch payments with Wise Business, it shifts funds automatically.

- Pull extra sales data for merchant cash advance, it adjusts remittances to daily sales.

- Use a business line of credit for variable needs, interest only hits drawn sums.

- Build a buffer for small business loans, hedge against slow cycles.

- Make timely repayments to boost your credit score, get better loan interest rates later.

- Negotiate flexible financing early, ask online lenders or Bank of America for lower variable rates.

- Update your business plan monthly, track loan amounts and working capital needs.

- Seek advice from the Better Business Bureau, compare SBA 7(a) loans terms.

- Avoid over-borrowing on unsecured loans, it can stall growth and strain working capital.

What common mistakes should I avoid when applying for loans?

Loan errors can wreck your plans. Steer clear of these pitfalls before you ask for funds.

- Fail to compare interest rates and fees before you apply. Factor rates can start at 1.11, so you could pay more than you budgeted.

- Over-borrow and you can squeeze your cash flow management. It’s like biting off more than you can chew, and it ramps up your default risk.

- Skip the approval process details and you risk surprises. You could miss a clause in your repayment terms that trips you up.

- Ignore eligibility criteria and lenders will toss your form. That wastes time and stalls your growth plan.

- Use fast business loans like same-day funding without a solid business plan. You might ignore cash flow management and dig a deeper hole.

- Neglect your credit score check before you apply. A low grade can bump your interest rates into high tiers.

- Forget to prep docs like your monthly revenue report. Missing bank statements or tax returns can delay approval.

- Assume every offer on peer-to-peer sites matches. Some online lenders market working capital loans, but they hide fees or restrict how you use funds.

- Treat a revolving credit line as a free gift. Unpaid balances can balloon under compounding interest.

- Choose machinery leasing without weighing term loans or secured loans. That equipment financing can come with strict repayment terms.

What are best practices for using loan funds wisely?

Keep a tight eye on each dollar. Target every cent to payroll, rent, inventory, or marketing.

- Record each transaction in a billing app or spreadsheet.

- Allocate proceeds to payroll, rent, inventory, equipment financing, or marketing.

- Avoid using funds on non-business or speculative purchases.

- Schedule repayments to match monthly revenue for solid cash flow management.

- Leverage BatchTransfer by Wise Business to pay vendors or staff in bulk.

- Use Wise Business for international payouts to avoid hidden fees and exchange rate markups.

- Employ free invoicing apps to send bills fast and chase payments.

- Pair a working capital line of credit with a term loan for flexible financing.

- Check loan interest rates and repayment terms before making outlays.

- Focus on activities that boost revenue or improve operational efficiency.

Takeaways

You now have a nine-point map to fuel your venture, from a fast working capital loan to a simple equipment loan. You can tap a merchant cash advance or crowd raise to cover rent, payroll, and stock.

Invoice factoring and a credit line also help smooth out your cash flow. Pick one, line it up with your monthly revenue, then watch funds land fast. Act now, track your score, and steer toward real growth.

FAQs on Fast Capital Loans for Startups

1. What fast business loans can a startup grab for quick cash?

You can pick a merchant cash advance, working capital loan, or business line of credit. You may also tap invoice factoring or revolving credit. Online lenders and big banks, like Bank of America or Citizens Bank, offer same-day funding.

2. How do loan interest rates and repayment terms work?

Rates hinge on your credit score, monthly revenue, and loan amounts. Merchant cash advance fees beat standard rates. Term loans or SBA 7(a) loans bring set rates. Repayment terms stretch from six months to ten years.

3. What do I need for loan approval?

You need a solid business plan, proof of monthly revenue, and a fair credit score. Lenders check your cash flow management and working capital needs. Online lenders move faster, banks stick to a strict approval process.

4. How can a startup use its loan?

Use the cash for equipment financing, inventory boosts, or marketing spikes. You might refinance old debt or back long-term investments. Think of the loan as a shot of adrenaline for your day-to-day operations.

5. Should I pick a secured loan or an unsecured loan?

Secured loans ask for collateral, like real estate or equipment, and carry lower rates. Unsecured loans need no collateral, but the interest rates may climb. Weigh your assets, risk comfort, and business growth plans.

6. How do I stay on top of loan repayment?

Set up automated payments, track due dates on a calendar. Use a cash back business credit card or revolving credit to ease cash crunches. Keep an eye on your growth forecast, and stick to your repayment terms.