Ethereum, the world’s second-largest cryptocurrency by market capitalization, has surged to a new all-time high, finally breaking a price barrier that had stood for nearly four years. On Sunday, Ethereum reached as high as $4,945 on CoinGecko, while CoinMarketCap recorded a slightly higher peak at $4,948. As of late trading, ETH was still hovering close to both marks, maintaining strength at around $4,935, a 4% increase for the day.

This new high surpasses the long-standing record of $4,878 first set in November 2021 during the previous crypto bull market. For many investors, this achievement represents a psychological breakthrough, signaling renewed institutional and retail confidence in Ethereum’s potential as a core digital asset.

Rally Fueled by Federal Reserve Policy Expectations

Ethereum’s latest breakout was preceded by a sharp rally on Friday after comments from U.S. Federal Reserve Chair Jerome Powell suggested the possibility of interest rate cuts later this year. Markets interpreted these remarks as a signal that liquidity conditions could ease, sparking enthusiasm across risk assets.

Ethereum responded dramatically, climbing almost 8% in a single hour and ending the day with gains of nearly 15%. The spike propelled ETH past its 2021 record for the first time, and momentum has carried through the weekend, pushing the cryptocurrency closer to the $5,000 threshold.

This connection between macroeconomic signals and crypto performance highlights the growing interdependence between digital assets and traditional financial markets. Lower interest rates tend to encourage greater investment in speculative and growth-oriented assets like Ethereum.

Spot Ethereum ETFs See Record Inflows

One of the biggest factors driving Ethereum’s upward momentum has been the explosive growth of U.S. spot Ethereum exchange-traded funds (ETFs). After their launch in 2024, these products have steadily attracted investor capital, but August marked a turning point.

In recent weeks, spot ETH ETFs recorded over $1 billion in inflows in a single trading day, the highest since launch. Cumulatively, these funds have amassed more than $7.9 billion in assets, briefly outpacing the performance of Bitcoin ETFs in terms of growth.

The availability of regulated ETF products has made Ethereum more accessible to institutional investors, retirement funds, and wealth managers who previously avoided direct cryptocurrency exposure. This mainstream adoption is a key reason ETH is now leading market performance relative to Bitcoin.

Corporate Accumulation Strengthens Demand

Beyond ETFs, corporate treasuries have begun accumulating Ethereum on a large scale, further tightening supply and increasing upward price pressure. Companies such as BitMine Immersion have disclosed holdings exceeding $7 billion in ETH, while SharpLink Gaming has acquired more than $3.5 billion worth of the asset.

These treasury allocations mirror the earlier Bitcoin strategy pioneered by companies like MicroStrategy but with a focus on Ethereum’s dual role as both a store of value and the backbone of decentralized applications (dApps). By committing billions in ETH holdings, corporations are signaling long-term faith in Ethereum’s ecosystem, particularly its role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based infrastructure.

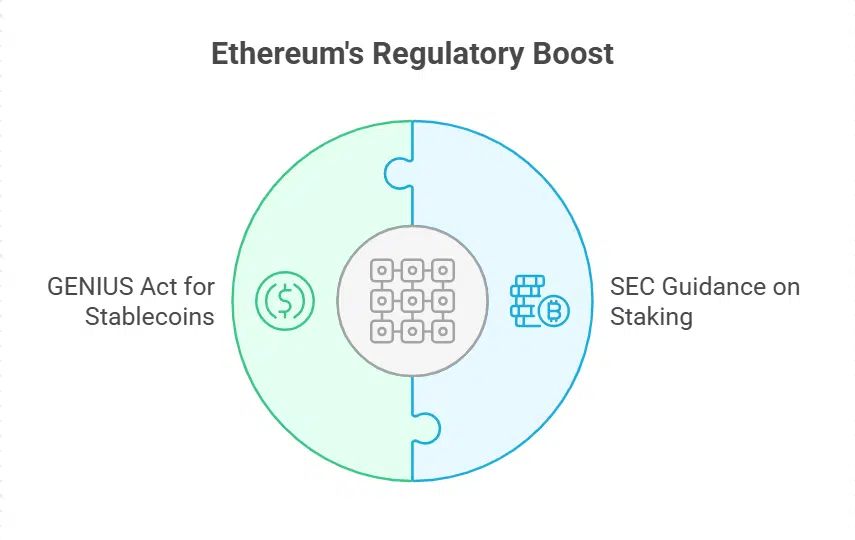

Regulatory Shifts Boost Ethereum’s Outlook

Ethereum’s recent strength is also tied to favorable regulatory developments in the United States. The Securities and Exchange Commission (SEC) issued new guidance on staking services, clarifying that liquid staking providers can continue offering yield-bearing products without registering as securities issuers.

This marks a significant shift from prior uncertainty under the previous administration. The clarification reduces legal risk for platforms offering Ethereum staking, which remains a major driver of ETH’s utility and demand.

At the same time, the passage of the GENIUS Act established a long-awaited federal framework for stablecoins. Since most stablecoins, such as USDT and USDC, are issued and transacted primarily on the Ethereum blockchain, this regulatory certainty enhances Ethereum’s credibility as the infrastructure for dollar-pegged digital assets.

Why Ethereum Is Outperforming Bitcoin

Ethereum has outpaced Bitcoin in performance throughout 2025, rising nearly 45% year-to-date compared to Bitcoin’s roughly 25% gains. Analysts attribute this outperformance to several structural advantages:

-

Smart Contract Ecosystem: Unlike Bitcoin, Ethereum supports a wide range of decentralized applications, including DeFi, NFTs, gaming, and real-world asset tokenization.

-

Staking Yield: ETH staking generates yields between 4%–6% annually, offering investors passive income alongside price appreciation.

-

Scarcity of Supply: Exchange reserves of ETH are at multi-year lows, reducing the volume available for trading and amplifying price moves.

-

Stablecoin Dominance: The majority of stablecoins, which underpin global crypto trading and DeFi liquidity, operate on Ethereum’s blockchain.

-

Institutional Interest: ETFs, treasury holdings, and hedge funds are increasingly allocating to ETH as a portfolio diversifier and yield-generating digital asset.

Market Sentiment: $5,000 Seen as Inevitable

Investor confidence is riding high, with polls showing 94% of Ethereum users and traders expect ETH to surpass $5,000 before the end of 2025. The milestone is viewed as not just a price target but also a symbolic confirmation of Ethereum’s transition into a fully mainstream financial asset.

With macroeconomic conditions favoring risk assets, regulatory clarity improving, and institutional inflows accelerating, analysts believe Ethereum is positioned to sustain momentum. However, they caution that volatility remains inherent in cryptocurrency markets, and sharp corrections are still possible even in a bullish cycle.

Key Facts at a Glance

| Metric | Details |

|---|---|

| New ATH | $4,945 on CoinGecko, $4,948 on CoinMarketCap |

| Previous Record | $4,878 in November 2021 |

| Year-to-Date Gain | +45% in 2025, compared to Bitcoin’s +25% |

| Spot ETF Inflows | Over $7.9B total; record $1B+ in single-day inflows |

| Corporate Treasuries | BitMine Immersion: $7B+, SharpLink Gaming: $3.5B ETH holdings |

| Regulatory Developments | SEC staking clarity; GENIUS Act establishes stablecoin regulation |

| Main Drivers | Institutional adoption, staking yields, stablecoin reliance, Fed rate outlook |

| Investor Sentiment | 94% of traders expect ETH to surpass $5,000 by end of 2025 |

Ethereum’s surge to new record highs reflects more than speculative hype. It illustrates a maturing market where institutional inflows, regulatory progress, and corporate adoption are aligning to create sustainable demand.

As Ethereum edges closer to $5,000, the question is no longer whether it will reach the milestone but how quickly it will establish new support levels. With macroeconomic and structural drivers in its favor, Ethereum is poised to remain at the center of the digital asset conversation for the foreseeable future.