Have you tried to check Egrag Crypto’s latest XRP chart and hit a broken link? This respected blockchain analyst uses a 12-hour time frame and Fibonacci levels to spot key breakout zones.

In this guide, we will break down his trend analysis, map support and resistance, and set a clear XRP price target. Stay tuned.

Key Takeaways

- Egrag Crypto spots firm support at $0.52 on the 12-hour chart and flags a tight Fibonacci cluster at $0.62 as key resistance zones.

- XRP trades above $2.26 support, forms a bullish flag above an accumulation area, and may break out on a clean 12-hour close above $2.30.

- Charts mark resistance near $0.75, $0.80, and $0.90; a decisive close above $0.80 could spark a run to $1, $5 in 2024–2025, and $22 by early 2025.

- Elliott Wave counts paint a path to the $37 all-time high and up to $46 if XRP breaks clear of its consolidation zone.

- The total crypto market cap sits at $3.47 trillion with $60.16 billion in 24-hour volume, and easing U.S. legal risks may fuel a bullish surge around June 4–6.

Egrag Crypto’s Key Observations on XRP in the 12-Hour Time Frame

Egrag spots a firm support line at $0.52 on the 12-hour chart, with moving average guardrails in place. He flags a tight Fibonacci cluster at $0.62 as a key resistance zone that bulls must crack to break free from recent consolidation.

Current price action and support levels

XRP currently trades above 2.26 support, marking a key pivot. A bullish flag pattern sits above an accumulation zone that held firm. The crypto market saw four rejections at the Fib 0.5 level, like a stubborn mule.

Ethereum gas fees register 1.54 Gwei, a fun stat for on-chain fans.

Buying demand is quietly building around the 12-hour chart. Market sentiment lines up with chart signals. A respected crypto analyst, egragcrypto, spots higher lows that feed a potential breakout.

A clean close above 2.30 on the 12-hour chart could unleash a strong run. Price could hit $5 in 2024–2025, and the XRP community dreams of $22 by early 2025.

Potential breakout zones and resistance points

Charts mark a cluster of resistance levels around the 0.5 Fib zone near $0.75. Egrag Crypto says XRP has met sellers at $0.80 and $0.90 before. A decisive close on the 12-hour timeframe above $0.80 could spark bullish pressure.

Trendline pressure and consolidation signals set the path for a potential surge. This zone ties to the convergence of multiple resistance levels that XRP has previously faced.

A valid breakout from this consolidation zone may lead to a run at $1, then toward the $37 all-time high. Egrag’s wave count concept uses Elliott Wave Theory to paint a path up to $46.

Technical indicators such as higher lows and the Fibonacci retracement tool confirm a growing bullish structure. Breaking these barriers could spark the next moment for XRP in the broader market and lift ripple sentiment.

Technical Indicators Highlighted by Egrag Crypto

Egrag uses a ratio tool on a candlestick chart to map price swings. He then reads a momentum tool and directional guide to time a move past tight limits.

Fibonacci levels and trend analysis

XRP is currently trading under close watch on the 12-hour chart. According to egrag crypto, it faced four historical rejections at the Fib 0.5 level. A Fibonacci retracement tool shows that barrier, almost like a brick wall.

Trend lines highlight support near $0.94 and $1.02. This setup met higher buying at each dip, hinting at a shift in favor of buyers.

Price is hovering in a tight consolidation, forming a bullish flag above an accumulation zone. Wave count analysis points to a potential breakout, and XRP could head toward $5. That move could unlock the next wave of bullish momentum.

Chart patterns outline a strong stage for another decisive level if breakout gains full control.

Implications of higher lows and consolidation patterns

Higher lows shape a solid floor under XRP’s 12-hour chart. Respected technical analyst Egrag Crypto believes this structure hints at a big jump. A bullish bar on this time frame points to a $22 surge.

The ratio tool marks pullbacks at key support levels. New X readers track these signals in Bitcoin news and technical analysis.

Price swings settle into tight bands as bulls catch a breath. Egrag stated that XRP has held above $1.3 after consolidation. That rest sets the stage for another potential breakout toward $46.

Long-term chart models signal a run to the $37 all-time high. Volume tracer in charting platforms confirms rising demand. Connectivity issues noted on some nodes may blur parts of the data.

Predicted Price Targets and Market Sentiment

XRP eyes a jump to 2.50, as bulls break through a key resistance on the chart. Sentiment heats up around the digital asset, and the momentum gauge hints at a fresh rush—don’t snooze on this move.

Short-term trajectory and potential bullish momentum

Analysts see XRP forming a bullish flag pattern above an accumulation zone. This shape echoes the 2017 market rally. Wave count analysis with Elliott Wave Theory suggests a breakout around June 4-6.

XRP is currently trading near a resistance point at 2.30, and a confirmed 12-hour close there could validate a decisive move.

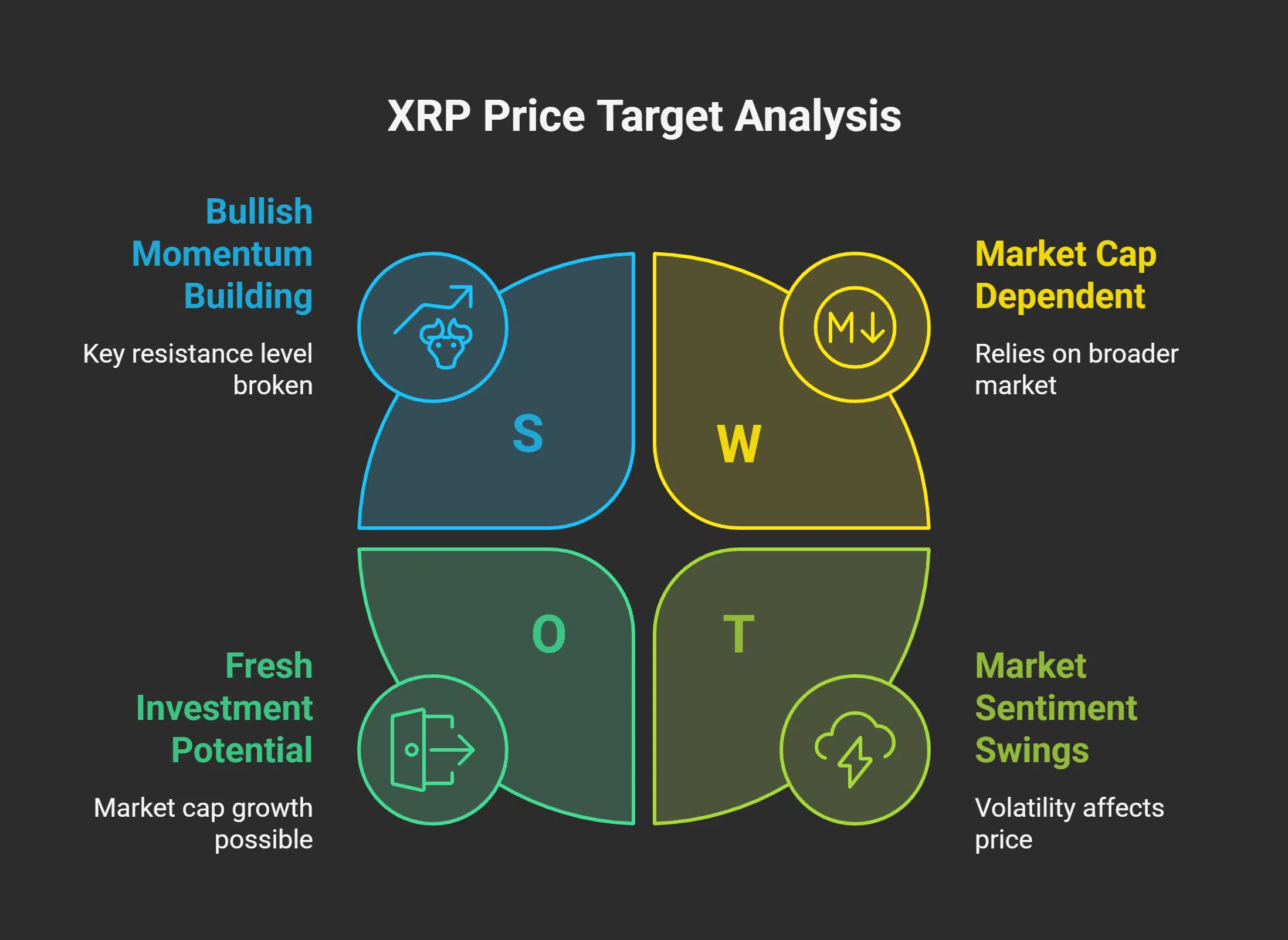

This short-term trajectory could unleash strong momentum. Market cap growth may draw fresh investment. Legal uncertainty in United States courts has eased, boosting sentiment. A recent post on X notes that XRP surged after chart structure showed higher lows.

This crypto asset sits on the verge of a major breakout.

Broader market impact on XRP’s movement

The total crypto market cap sits at $3.47 trillion, down 0.89%, but 24-hour spot volume jumped 6.39% to $60.16 billion. Cryptocurrency investors weigh Bitcoin’s 60.95% dominance, up 0.39%, against Ethereum’s 8.94% share, down 1.17%.

This broad selloff opens space for XRP to shine, with a path to a $1.5 trillion market cap prediction. Egrag emphasizes how these swings can shift momentum.

Ripple (payment protocol) power shines; XRP is showing life as price action follows market tides. The assets’ legal clarity could spark higher demand, potentially unleashing strong bulls.

A move past the 2.30 barrier could validate a fresh rally, gaining full control of short-term trends. Crypto traders apply Fibonacci trend analysis, and the analysis remains firmly rooted in past swings to gauge consolidation.

The broader market mood holds the key.

Takeaways

Readers get a clear snapshot of XRP’s move in the 12-hour view. Egrag Crypto shows key support levels and price chart zones. Analysts flag trend lines and a crypto wallet trend tool.

They mark a surge if XRP clears $0.75. This point could set the stage for a push to $1.0. Sentiment shifts as a Fibonacci retracement holds firm. Market cap hopes grow with each buy signal.

Watch the next hours for volume spikes.

FAQs on Egrag Crypto

1. What is the current price action showing for XRP in a 12-hour view?

The current price action is following a continuation pattern. It marks the convergence of multiple forces. XRP has been moving in a tight band. Another resistance level stands at 2.30. Breaking through this barrier could set the stage for the next leg.

2. What main barrier is XRP facing right now?

XRP is on the verge of breaking a key hurdle. This barrier sits near 2.30. If it clears this mark and is met with higher buying, it could spark a fresh rally. Recent developments have improved sentiment, and legal uncertainty is helping push buyers in.

3. How do analysts see movement between November 2024 and early 2025?

Analysts see movement between November 2024 and early 2025 as make or break. It outlines a strong phase and sets the stage for the next upswing. They use a tech-driven approach and keep their finger on the pulse of market movements.

4. Do things like HTTP cookie rules or Internet privacy changes alter XRP charts?

No, updates to HTTP cookie rules or Internet privacy laws do not change chart lines. But they can sway trader emotion. Many use JavaScript trackers like bloodhounds to sniff out price shifts. They also read the terms of service and disclaimer on each data feed.

5. What could a potential breakout mean for XRP?

A potential breakout that could lift XRP past 2.30 might spark fresh demand. It can shift overall market mood. It would confirm the current structure and pave the way for a new rally.