Do you hate high tax bills and rising energy costs? Many homeowners feel the pinch, especially with utility bills that climb every year. They search for ways to cut expenses, but overlook how green homes can help.

Imagine turning your house into a money-saver, not just a place to live. It’s like killing two birds with one stone, saving cash while helping the planet.

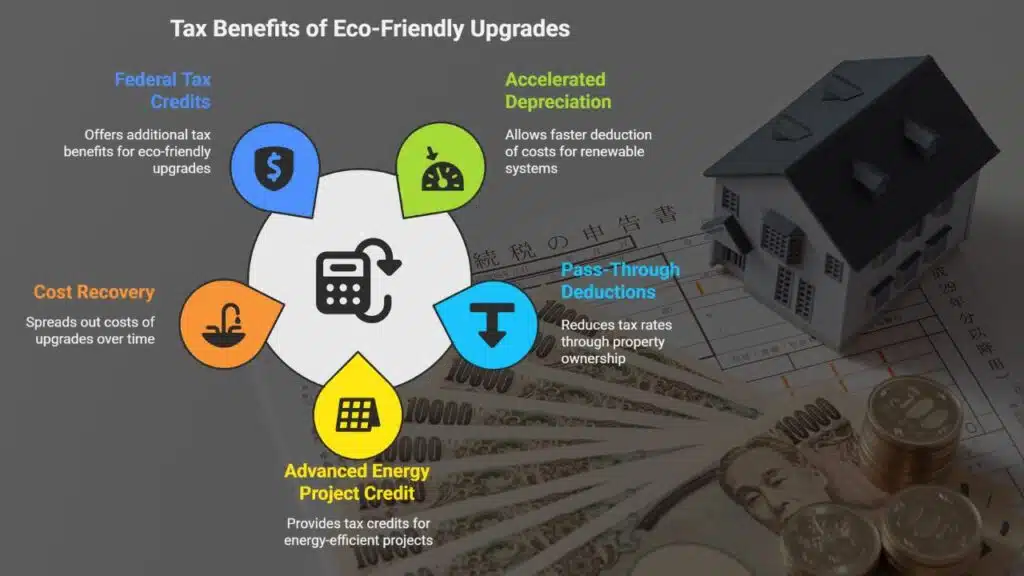

Homeowners can grab tax credits up to $1,200 for energy-efficient updates like insulation, plus 30% off solar panels through the Inflation Reduction Act. This blog post breaks down six key tax benefits, from renewable energy tax credits to depreciation perks for eco-friendly features.

You’ll learn how to slash your tax return and boost energy savings with simple steps, like installing heat pumps or energy-efficient windows.

Stick around to see how these tax breaks can pad your wallet.

Key Takeaways

- Homeowners get 30% federal tax credit on solar panel costs under the Inflation Reduction Act.

- Claim up to $1,200 in tax credits for insulation and energy-efficient windows.

- Wind energy systems qualify for 30% Residential Clean Energy Credit.

- Heat pumps offer up to $2,000 in rebates through home energy programs.

- Solar setups provide depreciation benefits and cut utility bills.

Renewable Energy Tax Credits

You know, installing those shiny photovoltaic modules on your roof can slash your federal tax bill through hefty credits under the Inflation Reduction Act. If you switch to turbine setups for wind power, suddenly your tax liability drops while you pocket savings on utility bills, making green living feel like a smart win.

Solar panel installation

Install solar panels on your home, and you grab big tax perks right away. The federal Residential Clean Energy Credit gives you 30% back on costs, slashing your tax liability like a sharp knife through butter.

Imagine turning sunlight into savings, folks, that’s the magic here. This credit, part of the Inflation Reduction Act, covers renewable energy setups that cut your utility bill savings and boost energy efficiency.

Homeowners love it because it fights climate change while padding your wallet, no strings attached.

Picture this: you add those shiny solar panels, and suddenly your energy consumption drops, thanks to clean energy power. The U.S. Department of Energy backs these moves with federal tax credits that make the switch affordable.

Pair it with home energy upgrades, like efficient water heaters or heat pumps, and stack those benefits. Real estate investors, listen up, this counts as a smart play for investment property, offering depreciation over time and even capital gains tax edges when you sell.

It’s like hitting the jackpot on sunny days, reducing your tax bill while going green.

Wind energy systems

You know that feeling when a strong breeze powers your home, like nature’s own gift? Wind energy systems let you capture that power with small turbines on your property. They cut your utility bills big time, and here’s the sweet part, they qualify for hefty tax credits.

Under the Inflation Reduction Act, grab the Residential Clean Energy Credit for 30% of the install costs. Homeowners love this, as it slashes tax liability while boosting energy savings.

Picture your roof with a turbine spinning away, turning wind into real cash back through federal tax credits.

Eco-friendly property owners, listen up, these systems also tie into depreciation benefits if you rent out space. Think of it as a smart real estate investment that offsets taxes over time.

No specific deductions for buying the home itself, but green tax credits make a huge difference. They help low-income communities too, per the U.S. Department of Energy guidelines.

Pair this with energy-efficient windows or heat pumps for even more rebates, up to $1200 on home improvement tax credits. Your tax return on Form 1040 could look a lot brighter, cutting energy costs and aiding the fight against climate change.

Insulation upgrades

Insulation upgrades boost your home’s energy efficiency, and they come with sweet tax perks. Homeowners grab tax credits up to $1200 for these energy-efficient updates under home improvement tax credits.

Think of it like wrapping your house in a cozy blanket, achieving utility bill savings while cutting energy costs. Green tax credits make a real difference, helping the environment and your wallet.

No specific deductions exist for buying eco-friendly homes or installing systems in residential spots, but these credits still trim your tax liability.

Imagine your attic getting a fresh layer of insulation, like armor against high energy bills. Energy star-rated materials qualify for rebates on retrofits and improvements. Owners of eco-friendly property reduce tax bills through such tax deductions and credits.

This move supports action on climate change, offering long-term energy savings. Rental property owners even tap depreciation costs over time for these upgrades.

Energy-efficient windows and doors

You install energy-efficient windows and doors to cut down on drafts and heat loss. These upgrades qualify for home improvement tax credits under federal programs. Homeowners claim up to $1200 in tax credits for such energy-efficient updates, slashing your tax liability right away.

Imagine your house like a tight ship, sailing through winter without wasting cash on utility bills. This move boosts energy savings and helps the environment, all while padding your wallet with green tax credits.

Rental property owners deduct costs for these improvements too, thanks to depreciation over time. Think of it as a slow burn on your tax bill, recovering expenses bit by bit. Energy-efficient doors and windows lead to long-term utility bill savings, making your investment pay off fast.

Pair them with heat pumps for even more perks, like the $2000 credit for heating upgrades. You cut energy costs and grab those tax deductions, turning eco choices into smart money plays.

Property Tax Incentives

Imagine slashing your property taxes just by going green, like getting a lower assessment on that eco-home you built. Cities often hand out rebates for sustainable builds, so picture the savings adding up while you help the planet.

Green building tax assessments

Green building tax assessments offer real perks for eco-friendly property owners. They lower your property taxes based on sustainable features, like energy-efficient designs that cut down on waste.

Imagine you install better insulation or solar panels, and local rules reward you with a reduced tax bill. Homeowners love how these assessments tie into tax credits, slashing energy costs while helping the planet.

Think of it as a high-five from the government for going green.

States often give these breaks to encourage renewable energy setups. You might snag federal tax credits too, up to 30% for solar installations or $1200 for energy-efficient windows and doors.

Rental property owners, listen up, you can claim depreciation on those upgrades, turning eco moves into smart tax deductions. Energy savings add up fast, trimming utility bills and your tax liability.

It’s like planting a money tree in your backyard.

Local rebates for sustainable construction

Cities and towns often give rebates for building with green methods. These perks cut your costs on eco-friendly projects. Think of it as a high-five from your local government for going green.

Homeowners can snag these rebates for sustainable construction, like adding insulation or using recycled materials. This ties into energy-efficient updates that offer tax credits up to $1200.

You save on utility bills too, and it helps the environment. Picture your home as a smart fortress against high energy costs.

Local rebates boost those long-term savings from green building. They work with federal tax credits, such as 30% off for solar panels. No specific deductions exist for buying eco-friendly homes, but these rebates make a real difference.

Rental property owners benefit too, through depreciation costs over time. Energy-efficient construction slashes your tax liability and energy savings add up fast. It’s like finding money in your pocket while doing good for the planet.

Depreciation Benefits for Eco-Friendly Features

Homeowners spread out costs on green upgrades like photovoltaic arrays through faster write-offs, slashing their tax bills quicker than a hot knife through butter. For example, you install a geothermal heat pump and recover expenses over fewer years, keeping more cash in your pocket while the planet thanks you.

Accelerated depreciation for renewable systems

Rental property owners, you get a big win with accelerated depreciation on renewable systems. Think solar panels or wind setups. They let you deduct costs faster than usual. This cuts your tax bill right away.

Imagine writing off a chunk of that investment in year one, like a quick cash back from Uncle Sam. Depreciation costs over time add up, and this speeds it all up for eco-friendly features.

Pair it with pass-through deductions, and your tax rate drops. Real estate professionals, this fits your strategy to reduce taxes through property ownership.

Business owners, explore accelerated depreciation for renewable energy systems on your commercial spots. Use Schedule C to claim it if you’re self-employed. It covers things like heat pumps or energy-efficient upgrades.

No specific deductions exist for buying eco-friendly homes, but this method recovers costs fast. Eco-friendly businesses grab the Advanced Energy Project Credit too. That means lower tax liability and energy savings.

Capital gains tax advantages come in when you sell, avoiding depreciation recapture pitfalls. It’s like turning green choices into gold for your wallet.

Cost recovery for energy-efficient upgrades

Homeowners love slashing tax bills with smart moves. Cost recovery lets you deduct costs of energy-efficient upgrades over time. Think of it as a slow drip of savings, like money trickling back into your pocket each year.

You spread out the expense of items like insulation or heat pumps through depreciation. This cuts your tax liability bit by bit. Folks with rental properties gain even more. They claim depreciation costs over time as business expenses.

Eco-friendly tweaks qualify for this perk. Imagine turning your home into a green machine and watching your utility bill savings grow while taxes shrink. The U.S. Department of Energy backs these incentives.

You might snag up to $1200 in home improvement tax credits for updates. Energy-efficient windows and doors fit right in. Pair that with 30% off for solar panels under the Inflation Reduction Act.

Property owners, you spread recovery across years for lasting benefits. Accelerated depreciation speeds up deductions for renewable systems. This means faster tax relief on energy efficiency investments.

Businesses tap into advanced energy project credits too. Homeowners, no direct deductions exist for buying eco-friendly homes. Yet green tax credits provide real savings. Imagine installing a heat pump water heater and recovering costs while cutting energy costs.

Low-income communities often get extra rebates for retrofits. Real estate investors use these to reduce taxes like pros dodging raindrops in a storm. Energy-efficient construction leads to long-term savings on bills.

Federal tax credits make it all sweeter.

Federal Incentives for Sustainable Properties

The government offers sweet deals, like credits that slash your tax bill for going green at home. Imagine turning your roof into a power plant and getting cash back from Uncle Sam – now that’s a win-win for your wallet and the planet.

Residential Clean Energy Credit

Homeowners, you can grab the Residential Clean Energy Credit to slash your tax bill. This federal tax credit covers 30% of costs for solar panels and other renewable energy setups.

It’s like planting money trees in your yard that pay off at tax time. Folks install wind systems or heat pumps and watch energy savings pile up. The U.S. Department of Energy backs these moves, helping you cut utility bills while aiding the planet.

Rental property owners, take advantage of this too for real estate perks. Claim up to $2000 on heat pump water heaters or $1200 for energy-efficient windows and doors. These credits come from the Inflation Reduction Act, offering rebates for home improvements.

You reduce tax liability, boost property value, and enjoy depreciation benefits over time. Imagine chatting with neighbors about lower energy costs, all thanks to smart tax strategies.

Home Energy Rebate Programs

Home energy rebate programs give you cash back for smart upgrades. Think of them as a high-five from the government for going green. They come from the U.S. Department of Energy, and tie into the Inflation Reduction Act.

You can snag rebates for retrofits that cut your utility bill savings. For example, install heat pumps or heat pump water heaters, and pocket up to $2,000. These perks help slash energy costs, like trimming a wild hedge back into shape.

Imagine: you fix up your place with energy-efficient windows or doors, and rebates flow in like rain on a dry day. Home improvement tax credits reach $1,200 for such updates. Pair them with 30% off on solar panels through federal tax credits.

This setup reduces your tax liability while boosting energy efficiency. Low-income communities get extra boosts here. Owning eco-friendly property means real tax deductions and refunds, turning your home into a money-saving machine.

Capital Gains Tax Advantages

Selling your eco-friendly home can cut your capital gains tax, thanks to exclusions tied to green features

Tax exclusions for eco-friendly property sales

Own eco-friendly property, and you might skip some capital gains taxes on the sale. Imagine: you sell your green home with solar panels, and the government lets you exclude part of the profit from taxes.

Homeowners love this break because it cuts their tax liability big time. It works like finding extra cash in an old coat pocket, rewarding your smart choices for the planet. Federal rules often give these exclusions if your upgrades boost energy efficiency, think solar or heat pumps.

Rental property owners get even sweeter deals here. They claim capital gains tax advantages on sales of sustainable buildings. You deduct costs from energy-efficient windows or insulation upgrades first, slashing what you owe.

It’s like the tax code high-fives you for going green. Pair this with depreciation benefits, and your tax bill shrinks. Real estate professionals use these tricks to reduce taxes through property ownership, turning eco features into real money savers.

Reduced capital gains for energy-efficient upgrades

You sell your eco-friendly home after those smart energy-efficient upgrades, and guess what? Capital gains taxes drop lower than you expect. It’s like finding extra cash in an old coat pocket.

Homeowners cut tax liability on profits from the sale, thanks to green features that boost property value without the full tax hit. Energy-efficient windows and heat pumps qualify for this perk, tying into federal tax credits under the Inflation Reduction Act.

Real estate professionals love it too, as they slash taxes through savvy strategies, much like investors dodging loopholes with rental properties.

Depreciation costs over time play a role here, letting you recover expenses for solar panels or insulation upgrades before the sale. Pass-through deductions help rental property owners, turning eco-investments into real savings on capital gains.

Homeowners save big, with credits up to $1,200 for updates and 30% for renewable energy systems, all while trimming utility bill savings. Think of it as Mother Nature giving you a high-five, plus a tax break, for going green.

Real estate agents use these write-offs to reduce taxes, proving property ownership packs a punch for your wallet.

Rainwater harvesting credits

Homeowners love cutting costs, and rainwater harvesting systems deliver big on that front. These setups collect roof runoff in barrels or tanks, slashing your water bills like a pro.

You install a simple cistern, and suddenly your garden thrives without tapping the municipal supply. The U.S. Department of Energy backs such moves with green tax credits that trim your tax liability.

You get up to $1,200 in home improvement tax credits for these water-saving upgrades, turning eco-smart choices into real energy savings.

Think of it as Mother Nature’s rebate program. Rental property owners, listen up, you can claim depreciation costs over time on these systems, plus pass-through deductions if you run it as a business.

No specific deductions exist for buying eco-friendly homes, but these credits still knock down your tax bills. Pair it with solar panels or heat pumps, and watch utility bill savings stack up, all while helping the environment.

Real estate professionals, you snag tax write-offs too, making water conservation a win-win for your wallet.

Wastewater recycling tax benefits

You install a wastewater recycling system in your home. This setup turns used water into something reusable, like for irrigation. Guess what? It qualifies for green tax credits under federal programs.

These credits cut your tax liability by up to 30 percent on costs, much like solar panels do. Homeowners love this because it slashes utility bill savings and helps the planet. Think of it as hitting two birds with one stone, saving cash while going green.

Business owners get even more perks with wastewater recycling. They claim tax deductions for eco-friendly practices, including the Alternative Fuel Vehicle Refueling Property Credit if it ties into sustainable fuel.

Rental property owners deduct depreciation costs over time too. Eco-friendly businesses tap into environmental tax credits from the U.S. Department of Energy. This leads to big energy savings and lower tax bills, no joke.

Takeaways

You’ve learned about tax credits for solar panels and wind systems, plus rebates for energy-efficient windows and insulation. These perks make owning green property a smart move, easy to claim with simple forms like those from the U.S. Department of Energy.

Picture slashing your tax liability while cutting utility bills, that’s real impact on your wallet and the planet. Check out Intuit TurboTax for help filing those federal tax credits, or visit energy.gov for more on heat pumps and rebates.

Go ahead, grab these benefits to build a brighter future. Heck, I once installed solar panels and watched my tax refund grow, what a win.

FAQs

1. What tax credits can I get for installing solar panels on my eco-friendly home?

You can claim federal tax credits under the Inflation Reduction Act for solar panels, which cut your tax liability by a chunk of the cost. Think of it as the government high-fiving you for going green, and saving on utility bill savings too. Plus, if you’re in low-income communities, extra bonuses might apply through the U.S. Department of Energy programs.

2. How do energy-efficient windows and doors help with tax deductions?

Installing energy-efficient windows and doors qualifies for home improvement tax credits, slashing your tax bill while boosting energy savings. It’s like giving your house a cozy hug that pays you back, come tax time.

3. Can owning an eco-friendly property with heat pumps reduce my taxes?

Yes, heat pumps and heat pump water heaters earn you tax credits for energy efficiency. Pair them with renewable energy sources, and watch your tax refund grow; it’s a smart move that funds Social Security and Medicare indirectly through lower FICA tax worries.

4. What about tax benefits for electric vehicles if I own green property?

Charging your electric vehicle at an eco-friendly home can snag federal tax credits, especially if you refinance with low interest rates or use HELOCs. Imagine zipping around town, saving on gas, and getting a nod from Uncle Sam on your tax returns.

5. Are there deductions for alternative energy like wind or geothermal in eco-friendly homes?

Alternative energy setups offer tax deductions and credits, depreciated over time to ease your tax liability. For pass-through entities, it’s even sweeter, like a like-kind exchange but for your energy bills; check with Intuit TurboTax for the details.

6. How does the child tax credit tie into owning eco-friendly property?

While not directly linked, energy savings from eco-friendly features free up cash for family needs, boosting your earned income and possibly your child tax credit. It’s a win-win, like turning solar power into more playground time, without hiking your state and local tax deductions.