In a clear sign that the cryptocurrency market is heating up again, Dogecoin (DOGE) surged nearly 27% this past week, climbing to a high of $0.23 on Saturday morning—its strongest performance in over two months. The move coincides with broader bullish momentum across the digital asset landscape, as Bitcoin flirts with its own all-time high, and Ethereum rallies off the back of a major network upgrade.

Let’s break down what’s behind the sudden meme coin revival, how it connects to overall market sentiment, and where major cryptocurrencies stand as we head deeper into Q2 2025.

Dogecoin Climbs to Multi-Month Highs

Dogecoin, the once light-hearted meme token backed by figures like Elon Musk, is no joke this week. As of early Saturday, the price of DOGE reached $0.23, the highest level since March 2, according to data from CoinGecko. It has gained:

- +27% over the past 7 days

- +9% in the last 24 hours alone

The renewed interest in DOGE has also pushed open interest in its futures contracts to $3.01 billion, based on current figures from CoinGlass—the highest since mid-February. Open interest refers to the total value of futures contracts that haven’t yet been settled, and a rise in this number often suggests increasing speculation and trading activity.

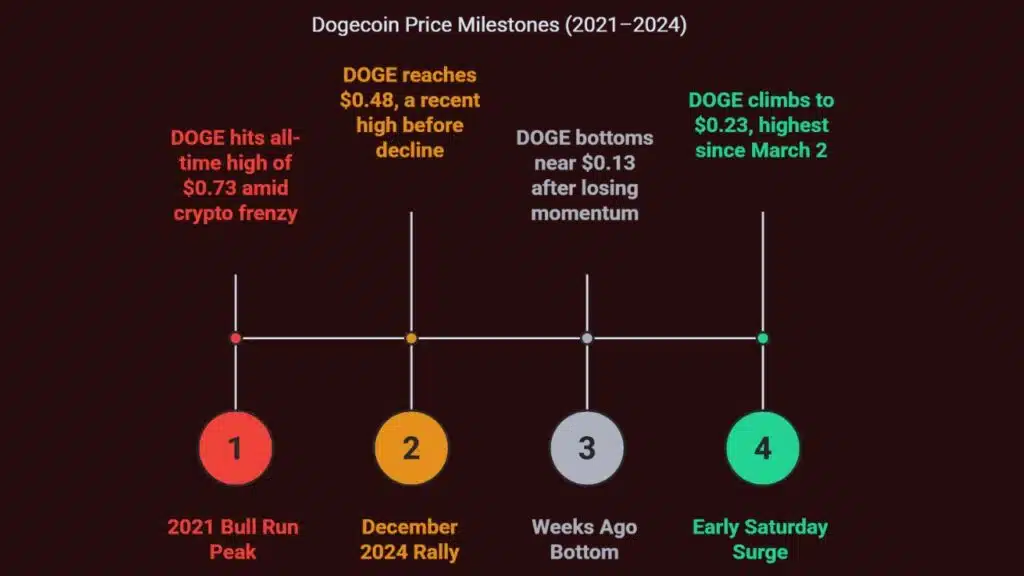

While these gains are notable, they still pale in comparison to Dogecoin’s peak during the 2021 bull run, when it hit an all-time high of $0.73. In more recent memory, DOGE reached $0.48 in December 2024, before losing steam earlier this year and bottoming near $0.13 just weeks ago.

Meme Coins Regain Momentum Across the Board

Dogecoin isn’t the only meme coin enjoying a resurgence. A new generation of internet-driven tokens is gaining traction among retail investors, especially on social media.

- Moo Deng (MOODENG) — a meme coin that went viral on TikTok last year — has nearly tripled in value this week.

- Peanut the Squirrel (PNUT), another meme-based token, is also up significantly.

These meme tokens often benefit from high community engagement, viral promotion, and speculative trading on decentralized exchanges. Although they are considered high-risk assets with no intrinsic value or major utility, they continue to attract short-term traders looking for explosive gains.

Bitcoin Inches Closer to Record Levels

While DOGE is stealing some spotlight, Bitcoin (BTC) remains the market’s centerpiece. The world’s most valuable cryptocurrency surpassed $100,000 earlier this week and currently trades at around $103,700—just 5% shy of its all-time high of $108,786, set in January 2025 on President Donald Trump’s inauguration day.

Bitcoin’s rally is fueled by multiple factors:

- Institutional inflows into Bitcoin ETFs and spot funds

- Federal Reserve’s pause on interest rate hikes

- Improving sentiment on Wall Street, with tech stocks also rising

The milestone marks a massive comeback for Bitcoin, which dipped below $65,000 in March due to investor concerns over geopolitical tensions and slowing economic growth. Now, with renewed confidence in risk assets, analysts are predicting new highs before mid-year.

According to Investopedia, some analysts forecast Bitcoin may hit $150,000 to $200,000 by late 2025, assuming current momentum holds and global adoption continues to expand.

Ethereum Sees 32% Weekly Gain After ‘Pectra’ Upgrade

Meanwhile, Ethereum (ETH) posted an even more impressive 32% gain over the week, now trading above $2,500. The rally follows the successful rollout of Ethereum’s “Pectra” upgrade, the largest since the Merge in 2022.

The Pectra update:

- Implemented 11 Ethereum Improvement Proposals (EIPs)

- Increased staking caps to improve decentralization

- Enhanced transaction speeds and reduced gas fees

These changes were well-received by developers and institutional investors alike, with Ethereum ETFs gaining nearly 26% in value over just two trading days following the upgrade.

According to CoinDesk, the upgrade helps position Ethereum as a more scalable and efficient platform for decentralized applications (dApps), particularly in the areas of DeFi (Decentralized Finance) and NFT transactions.

Crypto Market Liquidations Exceed $1.1 Billion

One of the side effects of this bullish momentum has been a significant increase in liquidations, especially for traders betting against the market.

As of Friday morning:

- Total crypto liquidations surpassed $1.1 billion

- Ethereum led in liquidation volume

- Short sellers bore the brunt, as prices surged unexpectedly

Liquidation occurs when leveraged positions are automatically closed due to price movements, often amplifying volatility. This level of liquidation is a clear sign that many traders were caught off guard by the market’s sharp rebound.

Expert Take and Market Outlook

The current rally across Bitcoin, Ethereum, and Dogecoin has some experts cautiously optimistic. Many believe that 2025 could mirror the 2021 cycle, particularly if macroeconomic indicators continue to favor risk assets.

However, caution is still warranted. The crypto market remains notoriously volatile, and the gains in meme coins especially could evaporate just as quickly as they appeared.

“While the recent momentum is encouraging, traders should be mindful of the risks involved,” says digital asset strategist James Butterfill of CoinShares. “These kinds of surges often come with steep corrections, especially in high-beta tokens like DOGE.”

Dogecoin’s 27% surge is part of a broader crypto market revival that has seen leading coins approach — or surpass — key resistance levels. With Bitcoin nearing its all-time high, Ethereum benefiting from network upgrades, and meme tokens surging on social media hype, the market is showing signs of renewed strength.

Still, history teaches that such excitement can be fleeting. Whether this is the beginning of a sustained bull run or just a temporary spike will depend on macroeconomic trends, institutional interest, and market sentiment in the weeks ahead.

The Information is Collected from Binance and Yahoo Finance.