If you’ve tried to find an open teller window in January 2026, you’ve likely noticed the shift. The “End of the Branch” isn’t a prediction anymore; it’s a statistic. But while the neighborhood bank as we knew it—rows of tellers, slip-writing stations, and 9-to-5 hours—is gone, the physical branch hasn’t died. It has mutated to alternatives in Digital Banking.

In 2026, banking has bifurcated into two distinct realities: the invisible transactional layer that lives in our pockets, and the high-touch advisory hubs that have replaced the corner bank. With bank closures stabilizing after the massive waves of 2024–2025, the dust has settled on a new “Phygital” era. Here is the reality of digital banking in 2026, from the rise of Agentic AI to the final days of the teller window.

Key Takeaways

- The “Phygital” Shift: By 2026, bank branches have not disappeared but have stabilized as “Advisory Hubs” for high-value consulting, while routine transactions are 100% digital.

- Agentic AI Revolution: The era of passive chatbots is over. “Agentic AI” now autonomously manages finances—moving funds, refinancing loans, and optimizing savings without constant user input.

- The End of the Teller: The traditional bank teller role is effectively extinct, replaced by “Universal Bankers” who focus on tech support and financial strategy rather than counting cash.

- Biometrics Over Passwords: Due to the prevalence of deepfakes, security has shifted to behavioral biometrics (identifying you by how you type or hold your phone) rather than static passwords.

- Neobanks vs. Incumbents: The gap has closed. Traditional banks now offer the same speed as fintechs, while Neobanks are introducing subscription models and chasing “trust” signals.

The State of the Branch in 2026: By the Numbers

The narrative that “all branches are closing” is false. The reality is more nuanced: branches are becoming luxury showrooms for complex financial products.

- The “Long Tail” Stabilization: After a precipitous drop in branch counts between 2021 and 2025 (approx. 15-20% global reduction), closures have slowed in early 2026. Banks have identified their “skeleton crew” of essential locations.

- The Rural-Urban Divide: Major metros like New York, London, and Singapore are effectively 95% digital-first. However, rural areas rely on hybrid models, where “micro-branches” share space with retail outlets or community centers.

- The “Advisory Hub” Shift: 80% of remaining branches have removed traditional teller counters entirely. They are now staffed by “Universal Bankers” armed with tablets, working in consultation pods designed for privacy and advisory services rather than cash handling.

Top Digital Banking Trends Defining 2026

The technology driving this shift has moved beyond simple apps. The buzzword for 2026 is autonomy.

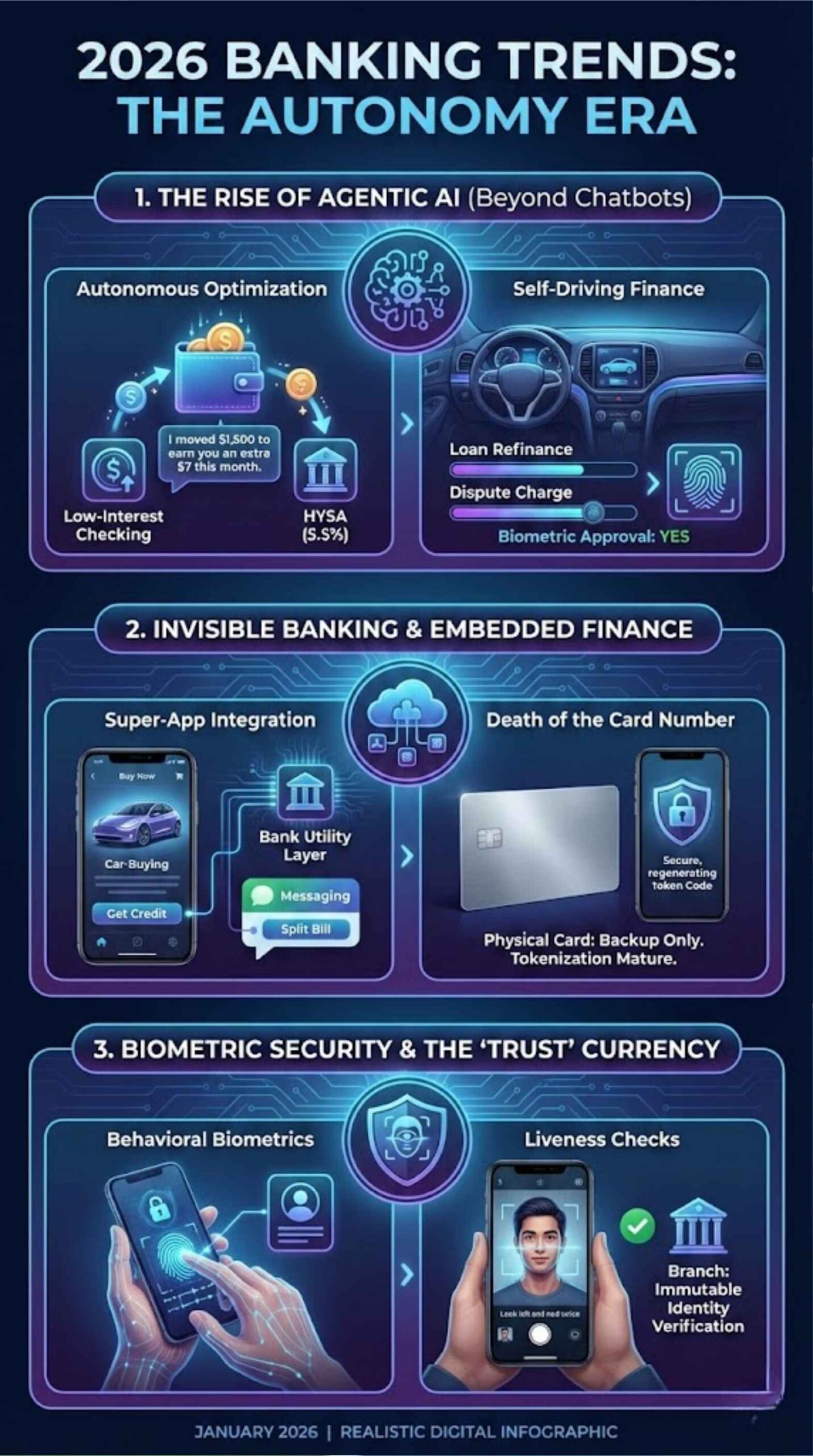

1. The Rise of Agentic AI (Beyond Chatbots)

In 2023, we had chatbots that could answer FAQ questions. In 2026, we have Agentic AI.

Unlike generative text tools, Agentic AI does things. It doesn’t just tell you how to save money; it executes the strategy for you.

- Autonomous Optimization: Your banking AI observes that you have $3,000 sitting idle in a low-interest checking account. Without asking, it moves the “safe” portion to a 5.5% High-Yield Savings Account (HYSA) and notifies you: “I moved $1,500 to earn you an extra $7 this month.”

- Self-Driving Finance: Complex tasks like refinancing a loan or disputing a charge are now handled by agents that navigate the bank’s internal systems on your behalf, requiring only a final “Yes” from you via biometric approval.

2. Invisible Banking & Embedded Finance

Banking has become less of a destination and more of a utility layer.

- Super-App Integration: You rarely log into a dedicated “Bank App” anymore. You apply for credit directly inside a car-buying app, or split bills inside a messaging platform. The bank provides the rails, but the brand interface is owned by tech giants.

- The Death of the Card Number: Tokenization has reached maturity. Physical cards are blank pieces of metal or recycled plastic with no printed numbers, used only as a backup hardware key.

3. Biometric Security & The “Trust” Currency

With the explosion of Deepfake voice and video fraud in 2025, passwords and SMS codes are obsolete.

- Behavioral Biometrics: Banks now authenticate you based on how you hold your phone, your typing cadence, and your swipe patterns.

- Liveness Checks: To authorize high-value transfers, users must perform specific, randomized actions on camera (e.g., “Look left and nod twice”) to prove they aren’t an AI avatar. The physical branch is finding a niche here as the only place to establish an “immutable identity” in person before going fully digital.

Neobanks vs. Traditional Banks: The Gap Narrows

In the early 2020s, Neobanks (like Chime, Monzo, Revolut) were seen as disruptors. By 2026, the lines have blurred. Incumbents have bought the tech, and Neobanks are buying the “trust.”

| Feature | Neobanks (2026) | Traditional Incumbents (2026) |

| Primary Interface | 100% App-based with Agentic AI. | Hybrid “Phygital” (App + Advisory Hubs). |

| Fees | Near-zero for basic use; subscription models for “Pro” features. | Fees waived for high-balance customers; emphasis on relationship pricing. |

| Fraud Protection | AI-driven, instant freeze; faster but sometimes trigger-happy. | Slower, human-verified restoration; higher trust for large disputes. |

| Target User | Digital natives, freelancers, gig economy workers. | Families, mortgage holders, small business owners requiring complex lending. |

Will Cash Survive the Digital Shift?

The “Cashless Society” is closer, but not absolute.

- CBDCs (Central Bank Digital Currencies): Pilot programs in the US and EU have moved to limited public rollouts in 2026, offering a “digital cash” alternative that settles instantly without fees.

- ATM Evolution: The standalone ATM is disappearing. It is being replaced by ITMs (Interactive Teller Machines), which allow you to video chat with a human teller for withdrawals, check cashing, and even loan payments 24/7.

The Human Cost: What Happens to Tellers?

The role of the “Bank Teller” is effectively extinct. The surviving workforce has been upskilled into “Universal Bankers.“ These employees are part tech-support, part financial therapist. They don’t count cash; they help customers navigate the complex digital tools, set up estate plans, or resolve identity theft issues that the AI can’t handle.

The Branch of the Future is a “Help Desk”

The physical branch isn’t dead, but its purpose has inverted. It used to be the place you went for routine tasks (deposits, withdrawals). Now, it is the place you go for exceptions—the messy, complex, high-stakes moments of financial life that require a human handshake.

For the day-to-day, 2026 belongs to the algorithms. The “bank” is no longer a place you go, but a service that happens in the background, optimized by AI, and secured by your own biology.