You might feel lost when prices jump and the crypto market shifts without warning. Donald Trump’s return to the presidency led to a Strategic Bitcoin Reserve, and a fresh set of crypto guidelines from the SEC.

This post will show five key factors that will guide your crypto moves in 2025, from decentralized finance (defi) growth to AI in blockchain technology. Keep reading.

Key Takeaways

- Big firms bought 3.3 times more Bitcoin than miners in 2025. They drove Bitcoin to $112,000 in May and a $2.2 trillion market cap.

- BlackRock and Fidelity now hold $15 billion and $9 billion in Bitcoin through new spot ETFs. Venture capitalists poured $4.8 billion into blockchain startups in Q1 2025.

- Trump’s team scrapped the IRS DeFi broker rule (2023), set a U.S. Strategic Bitcoin Reserve, and FASB updated Bitcoin fair-value accounting in December 2023.

- The EU’s MiCAR law (mid-2024) covers token issuance, trading venues, and anti-money laundering checks in 27 states. India taxes crypto at 30% plus 1% TDS, and China tests the digital yuan at its borders.

- VanEck says tokenized real-world assets will hit $50 billion by end 2025 and $10 trillion by 2030. Central banks in Hong Kong, Singapore, the UAE, and India run digital currency pilots like the e-Rupee to speed cross-border payments.

Institutional Investments and Market Maturity

Big firms buy bitcoin as a treasury asset. Public companies acquired 3.3 times more bitcoin in 2025 than miners dug up. Bitcoin hit 112,000 dollars in May 2025, and it now ranks among the five top global assets with a 2.2 trillion dollar market cap.

Investors treat this crypto asset like a blue chip stock.

Spot exchange traded funds won SEC approval, led by asset managers BlackRock and Fidelity. They hold 15 billion and 9 billion dollars in bitcoin, respectively. Venture capitalists poured 4.8 billion dollars into blockchain startups in Q1 2025.

This flood of funding powers digital assets and decentralized finance.

Regulatory Changes and Global Policies

Donald Trump set a pro-crypto agenda after his return. He plans a U.S. Strategic Bitcoin Reserve this spring. His administration scrapped the IRS’s decentralized finance broker rule in 2023.

The Office of the Comptroller of the Currency now lets banks earn transaction fees on stablecoin activity. FASB updated Bitcoin fair value accounting in December 2023. SEC chair Gary Gensler still calls for stronger investor protection.

These shifts hit digital assets and blockchain technology hard. They reshape the crypto market.

The EU rolled out MiCAR crypto regulation in mid 2024 across 27 states. This law covers token issuance, trading venues and anti-money laundering measures. India slapped a 30% levy on crypto profits plus 1% TDS on transactions.

Traders now face high tax and extra paperwork. China pushes the digital yuan in border tests with partners. Such moves remind venture capital firms that global policies can vary wildly.

This patchwork shapes blockchain startups too.

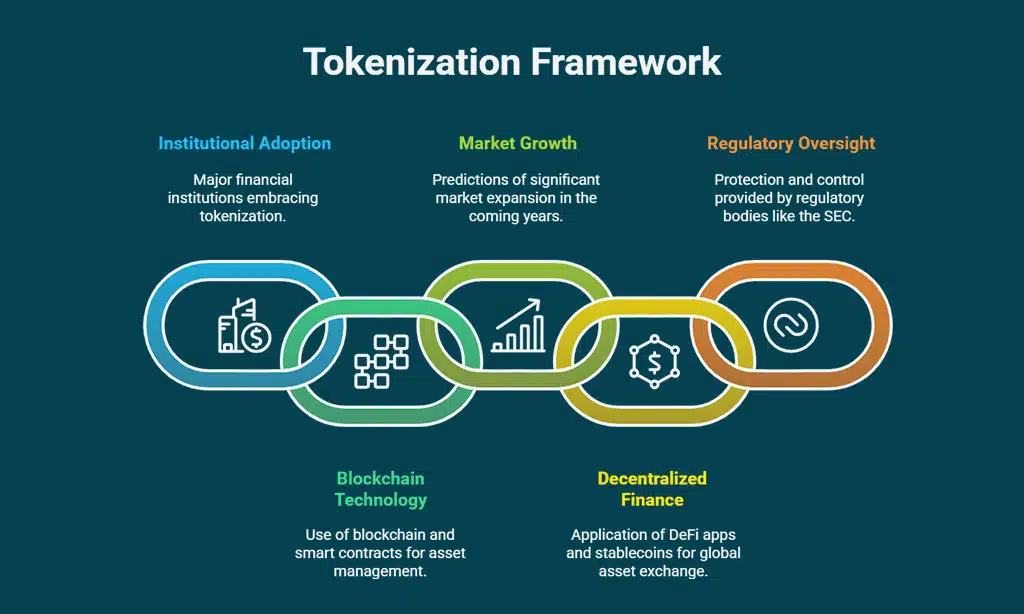

Tokenization of Real-World Assets

Big institutions like BlackRock, Goldman Sachs, and JP Morgan adopt tokenization of real-world assets. Real estate tokenization splits a million dollar building into tiny digital assets.

It feels like slicing a pizza into many tiny pieces so more friends can join. This method uses blockchain technology and smart contracts on Ethereum network. VanEck predicts the RWA market will exceed 50 billion by end of 2025 and could grow to 10 trillion by 2030.

Many use decentralized finance (defi) apps and stablecoins to swap asset tokens across borders. The tool cuts transaction fees and speeds trades. Code uses anti-money laundering (aml) checks to block bad actors.

Investors gain better control and strong protection under u.s. securities and exchange commission’s watch. Public adoption rises in property share tokens and other digital currencies.

The Rise of Central Bank Digital Currencies (CBDCs)

Central banks around the world test central bank digital currency (CBDC) models to reshape the crypto market. Hong Kong, Singapore and the UAE adopt pro-crypto licensing rules to speed up crypto adoption and digital asset growth.

India plans an e-Rupee pilot to boost cross-border transactions, like a travel pass for money. Public ledger networks, a type of blockchain technology, add AML checks and KYC tools for safety.

Donald Trump’s team aims to make the U.S. a global crypto hub, by tweaking SEC rules. Clear crypto regulation can curb wild swings, and help decentralized finance (DeFi) projects grow.

People will use crypto trading apps to swap USDT, bitcoin and AI tokens in low-fee digital wallets, as markets mature. This shift could bring financial inclusion, real estate tokenization, and faster currency conversions.

Takeaways

New pro-crypto rules revive digital assets on distributed ledgers. Big banks and VCs pour cash into stablecoins. AI tokens on the Ambient network spark smart DeFi apps. Digital national money gains support in bank trials.

Real estate fraction shares sell fast via tokenization. ETFs and crypto funds chase bitcoin halving gains. These factors hint at a wild crypto ride in 2025.

FAQs

1. What are the main factors that will drive the crypto market in 2025?

The bitcoin halving will cut new coins in half. It often sparks price moves. The ethereum network upgrade may speed up trades. They shape the digital assets you own. Inflationary pressures and an economic downturn could shake market value. This makes the crypto market more volatile.

2. How will crypto regulation shape cryptocurrency adoption next year?

The securities and exchange commission will roll out new rules. Anti-money laundering checks will grow. Stronger crypto regulations will protect investors and pave the way for wider cryptocurrency adoption. They also help ease systemic risks in global financial systems. They act like guardrails on a wild ride.

3. What role will decentralized finance and central bank digital currency play?

DeFi will keep power in users’ hands, pushing a decentralised ecosystem. A central bank digital currency, or CBDC, could add a safe hoop for cross-border transactions. This may boost financial inclusion, like a key to new doors.

4. How will artificial intelligence and ai tokens affect crypto trading?

Artificial intelligence will spot trends fast. It may power ai tokens that trade on their own. Blockchain startups and fintech companies will tap this tech for sharper moves. Think of bots that never sleep.

5. Will venture capital and acquisitions boost blockchain startups?

VCs and venture capital firms will pour fresh cash into emerging blockchains, they hunt for rising stars. Smart acquisitions can fuel growth, helping startups scale in tight markets.

6. How will transaction fees and energy use impact crypto mining and sustainability?

High transaction fees will push users to cheap chains. Proof of work crypto mining may face heat over electricity consumption. Carbon emissions and fossil fuels use will meet tight climate goals. The sector must seek a sustainable future. That will make miners sweat over power bills.