Filing an insurance claim can be a stressful and overwhelming process. Whether you’re dealing with damage to your home, car, or business, you rely on your insurance provider to offer a fair settlement. However, before accepting any offer, you must be prepared to ask the right crucial questions to ask an insurance adjuster to ensure you receive the compensation you deserve.

An insurance adjuster is responsible for assessing your claim and determining how much the insurance company will pay. While they might appear helpful, their primary duty is to protect the company’s bottom line. This is why knowing what to ask—and how to ask it—is essential.

In this guide, we’ll discuss 11 crucial questions to ask an insurance adjuster, explaining their significance and how they can impact your claim. Whether you’re handling a car accident claim, a homeowner’s insurance case, or a personal injury settlement, these questions will help you navigate the process with confidence.

Why It’s Important to Ask the Right Questions?

Navigating the insurance claims process can be daunting, but being informed about the crucial questions to ask an insurance adjuster can significantly impact your settlement outcome.

Adjusters work on behalf of the insurance company, and without the right inquiries, you may not receive the full compensation you’re entitled to. By understanding their role and knowing what to ask, you can protect your financial interests and ensure a fair claims process.

Understanding the Role of an Insurance Adjuster

An insurance adjuster is a professional who investigates claims on behalf of an insurance company. Their job is to:

- Assess the damage

- Review policy details

- Estimate repair costs

- Negotiate settlements

While they may seem impartial, insurance adjusters work for the company, not for you. Their primary goal is to minimize the payout.

How Asking the Right Questions Impacts Your Claim

Before you accept a settlement or proceed with the claims process, it’s essential to understand how the right inquiries can make a difference. Asking crucial questions to ask an insurance adjuster not only helps you gain clarity on your policy and settlement but also ensures you are not being shortchanged.

With the right approach, you can uncover hidden details, strengthen your case, and improve your chances of a favorable payout.

By asking crucial questions to ask an insurance adjuster, you can:

- Ensure transparency in the claims process

- Identify errors in their assessment

- Negotiate a better settlement

- Avoid unfair denials or delays

Common Mistakes to Avoid When Speaking with an Adjuster

- Accepting the first settlement offer without negotiation

- Giving recorded statements without legal advice

- Signing documents without reviewing the terms

- Failing to document damage properly

Essential Questions to Ask an Insurance Adjuster

Before diving into negotiations or agreeing to a settlement, it’s important to be well-prepared. Asking the right crucial questions to ask an insurance adjuster can significantly impact the outcome of your claim. These questions will help ensure you understand the process, avoid common pitfalls, and receive a fair evaluation of your damages.

1. What Is Your Role in the Claims Process?

Before proceeding with your claim, it is essential to understand the adjuster’s position and responsibilities. Asking this question ensures that you know who you are dealing with and whether their role may affect your settlement. Many claimants assume all adjusters work the same way, but there are key differences in their duties and affiliations.

This question helps clarify whether the adjuster is:

- A company-employed adjuster (works directly for the insurance company)

- An independent adjuster (contracted by insurers but not a direct employee)

- A public adjuster (hired by policyholders to negotiate on their behalf)

| Type of Adjuster | Works For | Bias Level |

| Company Adjuster | Insurance Company | High |

| Independent Adjuster | Contracted by Insurance | Moderate |

| Public Adjuster | Policyholder | Low |

Why It Matters:

Understanding their role can give you insight into their potential biases and help you prepare for negotiations.

2. Can You Provide a Copy of My Insurance Policy Details?

Before discussing settlement details, it’s crucial to have a clear understanding of your policy. Many claimants assume their coverage includes all damages, but policies often contain exclusions and limitations. Reviewing the fine print can help you determine whether you’re getting the compensation you deserve.

Insurance policies contain complex terms and exclusions that may not be clear at first glance.

Why It Matters:

- Helps you confirm coverage details

- Ensures you understand your rights

- Allows you to challenge any misinterpretation by the adjuster

Example:

Some homeowners assume flood damage is covered, but many policies exclude it unless explicitly stated.

3. How Did You Calculate the Settlement Offer?

Understanding how the adjuster determined the settlement amount is crucial for ensuring fairness. Many factors contribute to this calculation, and being aware of them helps you challenge any undervaluation. If you don’t ask this question, you may miss out on compensation you’re entitled to.

Requesting a detailed breakdown of how the adjuster arrived at the offer can help identify discrepancies.

| Key Factor | Importance |

| Repair Cost Estimates | Determines base compensation amount |

| Depreciation | May lower payout based on item age |

| Policy Limits | Caps the maximum claim amount |

Why It Matters:

Understanding their calculations allows you to dispute undervaluation and request a reassessment.

4. What Documentation Do You Need from Me?

Before your claim can be processed efficiently, the insurance adjuster will require specific documents to assess the extent of damage and validate your request. Knowing exactly what to provide helps avoid unnecessary back-and-forth and speeds up the claims process.

Providing complete documentation speeds up claim processing and prevents delays.

Documents Typically Required:

- Photos/videos of damage

- Police or accident reports

- Medical bills (for injury claims)

- Repair invoices or contractor estimates

Why It Matters:

Having the correct documents ensures a smoother process and prevents unnecessary denials.

5. Will My Claim Cover All Damages and Expenses?

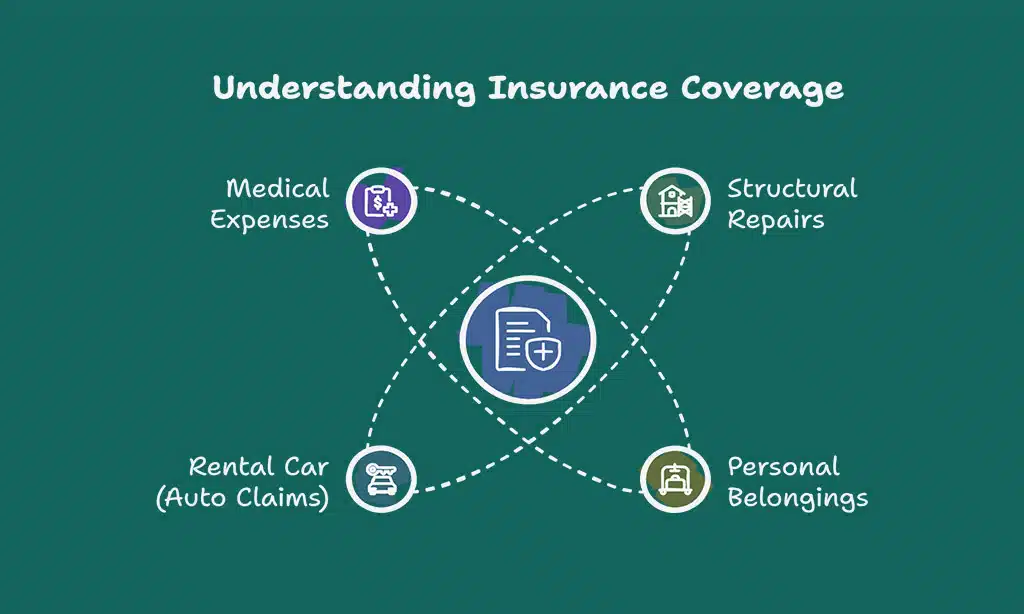

One of the most crucial questions to ask an insurance adjuster is whether your claim will cover all damages and associated costs. Policies often contain exclusions or limitations that might leave you paying out-of-pocket expenses. It’s important to clarify what is included in your coverage and whether additional endorsements are needed to fully protect your interests.

Insurance claims often have hidden exclusions or partial coverage clauses.

| Expense Type | Typically Covered? |

| Structural Repairs | Yes, if included in policy |

| Personal Belongings | Depends on policy terms |

| Rental Car (Auto Claims) | Often requires add-on coverage |

| Medical Expenses | Depends on liability coverage |

Why It Matters:

Knowing what’s covered prevents unpleasant surprises when you receive your payout.

6. How Long Will It Take to Process My Claim?

One of the most crucial questions to ask an insurance adjuster is about the timeline of your claim. Delays in processing can cause financial strain, especially if you’re waiting for funds to cover repairs or medical bills. Understanding the factors that influence processing time helps set realistic expectations and allows you to follow up proactively.

Claim processing time varies based on complexity, policy terms, and adjuster workload.

Factors That Influence Processing Time:

- The severity of damage

- Adjuster workload and availability

- The completeness of documentation provided

Why It Matters:

Understanding timelines helps you set realistic expectations and take necessary follow-ups.

Insurance claims have strict filing deadlines that vary by policy and state regulations. Missing these deadlines can result in claim denial, leaving you responsible for expenses that should have been covered.

Common Deadlines to Ask About:

- Time limit for filing a claim: Most policies require claims to be filed within a specific period after an incident.

- Deadline for submitting additional documentation: Insurers may have strict timelines for submitting medical bills, repair estimates, or supporting evidence.

- Statute of limitations for legal action: If your claim is unfairly denied, states have a limited period within which you can take legal action against the insurer.

Why It Matters:

Knowing and tracking these deadlines ensures that your claim is processed without unnecessary delays or denials. Consider keeping a record of all submission dates to avoid missing critical deadlines.

7. Can I Hire a Public Adjuster for a Second Opinion?

If you feel that the insurance adjuster’s assessment is unfair or inadequate, hiring a public adjuster can be a smart move. A public adjuster works on behalf of the policyholder, ensuring that the claim is properly evaluated and that you receive the compensation you’re entitled to.

They can help review the damage, negotiate a higher settlement, and provide an unbiased second opinion on the insurance company’s offer.

A public adjuster is an independent professional who represents policyholders, not insurers.

Why It Matters:

- They can assess whether you’re being lowballed

- They negotiate on your behalf to maximize your settlement

8. Are There Any Deadlines I Need to Be Aware Of?

Insurance claims have strict filing deadlines that vary by policy and state regulations. Missing these deadlines can result in claim denial, leaving you responsible for expenses that should have been covered.

Common Deadlines to Ask About:

- Time limit for filing a claim: Most policies require claims to be filed within a specific period after an incident.

- Deadline for submitting additional documentation: Insurers may have strict timelines for submitting medical bills, repair estimates, or supporting evidence.

- Statute of limitations for legal action: If your claim is unfairly denied, states have a limited period within which you can take legal action against the insurer.

Why It Matters:

Knowing and tracking these deadlines ensures that your claim is processed without unnecessary delays or denials. Consider keeping a record of all submission dates to avoid missing critical deadlines.

Would you like further expansion or additional real-world examples?

9. What Happens If My Claim Is Denied?

Facing a claim denial can be frustrating, but it’s not necessarily the end of the road. Insurance companies may deny claims for several reasons, including missing documents, policy exclusions, or disputes over liability. Understanding why your claim was denied and taking the right steps to challenge the decision can help you secure the compensation you deserve.

Common Reasons for Claim Denials:

- Policy exclusions (e.g., flood damage not covered under standard home insurance)

- Incomplete or incorrect documentation

- Delays in filing the claim

- Disputes over fault or liability

- Insufficient evidence to support the claim

Steps to Take If Denied:

- Request a Written Explanation: Insurers must provide a reason for denying your claim. Obtain a detailed explanation to identify any gaps or errors.

- Gather Supporting Evidence: Provide additional documentation, such as photos, expert opinions, or receipts, to strengthen your case.

- File an Appeal: Many insurance companies have an internal appeals process where you can challenge the decision with new evidence.

- Seek Legal Assistance: If your appeal is unsuccessful, consulting an insurance lawyer or a public adjuster may be necessary to escalate the case.

Why It Matters:

A denied claim doesn’t mean you have to accept the insurer’s decision. Understanding your rights and taking the proper steps can improve your chances of overturning the denial and securing a fair settlement. Claim denials can occur for several reasons, such as policy exclusions or missing documents.

Steps to Take If Denied:

- Request a written explanation

- Gather supporting evidence

- File an appeal

10. How Will This Claim Affect My Future Premiums?

Many policyholders don’t realize that filing a claim can impact their future insurance premiums. Insurance companies evaluate risk based on past claims history, and frequent claims can lead to higher renewal rates.

Factors That Influence Premium Increases:

- Type of Claim: Minor claims (e.g., a small home repair) may have less impact than large claims (e.g., total vehicle loss).

- Claim Frequency: Multiple claims in a short period may label you as high-risk.

- Who’s at Fault: If you were at fault (in auto claims), your premium is more likely to increase.

- Claim Amount: Higher claim payouts could lead to more significant premium hikes.

How to Minimize Premium Increases:

- Consider paying out-of-pocket for minor damages rather than filing a claim.

- Ask your insurer about claim forgiveness programs, which prevent premium hikes after the first claim.

- Bundle policies (e.g., home and auto) to receive discounts that offset potential increases.

Why It Matters:

Understanding how a claim affects your premiums helps you make informed decisions about whether to file and how to manage future insurance costs. Filing a claim can lead to increased insurance premiums.

Why It Matters:

Knowing potential rate increases can help you decide whether to proceed with the claim.

11. Can I Negotiate a Better Settlement Offer?

Insurance companies often start with a lower settlement offer, expecting negotiations. Many policyholders accept these initial offers without question, but with the right approach, you can often secure a higher payout.

Steps to Negotiate Effectively:

- Review the Offer Thoroughly: Compare the settlement to your actual damages and repair estimates.

- Request a Breakdown: Ask the adjuster how they arrived at the amount and challenge any discrepancies.

- Provide Counter-Estimates: Obtain independent repair estimates or medical evaluations to support a higher settlement.

- Highlight Policy Terms: Point out any clauses in your policy that justify a better offer.

- Remain Professional and Persistent: Stay calm, present your case clearly, and be prepared to counter multiple times.

- Escalate If Necessary: If negotiations stall, ask to speak to a higher-level adjuster or consider legal assistance.

Why It Matters:

Negotiating can significantly increase your settlement, ensuring that you receive fair compensation rather than an undervalued payout. Being proactive and well-informed is key to maximizing your claim amount. Most insurance adjusters offer a lower initial settlement, expecting negotiations.

Negotiation Strategies:

- Provide counter-estimates from professionals

- Highlight discrepancies in their evaluation

- Request written justification for the offer

Takeaways

Filing an insurance claim is a complex process, but knowing the crucial questions to ask an insurance adjuster can make all the difference in securing a fair settlement.

By being proactive, informed, and assertive, you can navigate the claims process with confidence and maximize your payout.

If your claim is undervalued or denied, consider seeking professional help from a public adjuster or attorney. Remember, your financial recovery depends on the questions you ask and the actions you take.